Free flowing gas well, two clarifications and a Zimbabwe gas discovery

Published 09-DEC-2023 10:05 A.M.

|

10 minute read

This was the most busy week of major announcements we have seen in our Portfolio in a long time.

Results of long awaited drilling events that have in some cases, been years in the making.

All happened in the same week.

Two of them on the same day.

IVZ declared Zimbabwe’s first ever gas discovery - a decade in the making and it has now been featured in global mainstream and industry news.

There is still more news to come from IVZ’s current drill as soon as next week... with IVZ still drilling towards their deeper primary target...

We just added early stage oil & gas explorer GLV as our Energy Pick of the Year after IVZ’s Scott Macmillan joined GLV’s board.

GLV has a giant oil exploration permit in offshore Peru.

With a fair bit of pre-drill work to do, we think GLV (under Scott’s watchful eye) should re-rate higher from its current sub $10M market cap as the pre-drill work is executed.

EXR announced a surprise drill result, where they were expecting to hit ~500m of tight gas, in a basin known for tight gas discoveries...

The deeper part of their well surprisingly delivered FREE FLOWING gas... which is easier to commercialise than tight gas.

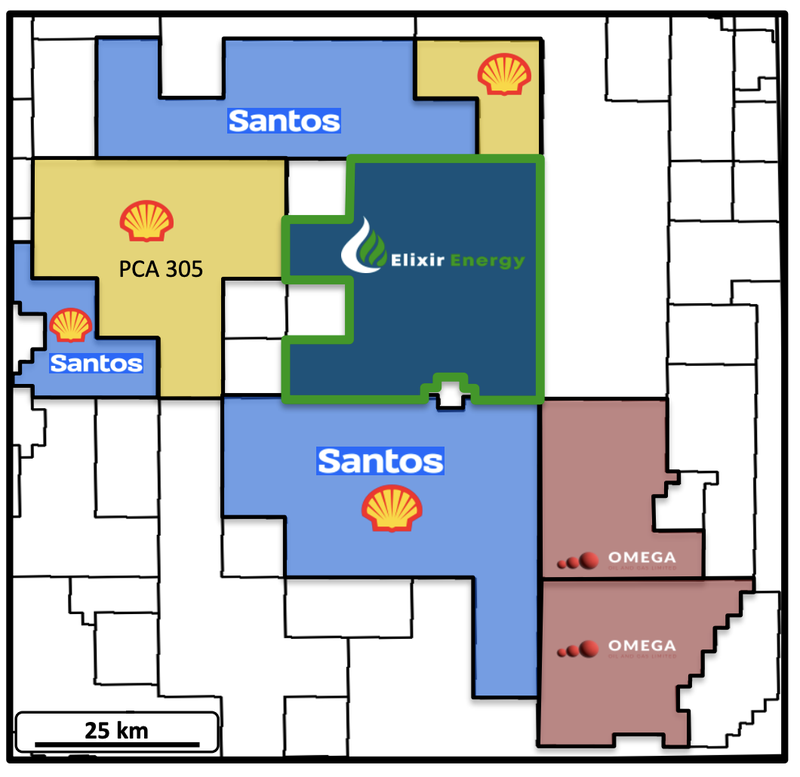

This has massive implications for the entire basin, where Santos, Shell and Omega all have neighbouring landholdings and have been drilling wells looking for tight gas.

Plus EXR found 607m of reservoir instead of the expected 500m in total...

NHE released an announcement saying that their drill “results point to prolific new helium province” -

Woohoo! Time to celebrate... right?

The market initially responded well, then appeared to get confused on what the announcement was actually saying, which caused a sell off.

The market hates confusion.

For the second time in recent weeks, NHE had to release a clarification of a confusing drill results announcement.

The clarification confirmed that YES, NHE’s upcoming lab results could potentially confirm a FREE GAS helium discovery in the coming weeks.

But the damage was already done and the share price had irreparably fallen during the 48 hours of confusion before the clarification.

NHE is currently in a trading halt for a placement and possibly an SPP (we’ll be bidding on both).

Hopefully NHE can deliver a bounce back over the next few weeks once the confusion effects have cleared, and recover from the “confusion discount” like they did following their last “announcement + clarification” combo on October 31st.

And then fingers crossed NHE announce a discovery after the lab testing results are completed.

So a very busy week for our oil & gas explorers this week, here is more on what happened:

Invictus Energy (ASX: IVZ) made a gas discovery -

(Source)

(Source)

(Source)

(Source)

(Source)

(Source)

(Source)

The culmination of almost a decade's work for Scott and his team - Scott mentioned on a webinar after the discovery announcement that it had been “over 10 years” for some of his team.

The discovery officially opens up a whole new basin in East Africa and, in IVZ’s words, “The discovery represents one of the most significant developments in the onshore Southern Africa oil and gas industry for decades”.

IVZ is currently drilling into its second primary target, so we could see a second discovery & even more upside newsflow over the coming days.

On the day IVZ’s share price delivered a good rise from 16c to hit a high of 25.5c on big volumes.

IVZ has a large following on stock chatrooms, with many expecting a discovery and likely hoping to sell for a quick profit once it was announced.

Now that many of those will likely have exited, the heat of expectation has come out of the mood and the magnitude of what IVZ has achieved is hopefully starting to sink in with global investors, we are hoping to see the move upwards we have been waiting for.

Especially if IVZ can deliver some more good results in the coming days.

Scott held a webinar right after the result to explain the drill result to shareholders.

Elixir Energy (ASX:EXR) had a big unexpected surprise result...

EXR’s announcement caught us relatively off guard.

EXR’s drill at its QLD gas project was an appraisal well - meaning it was drilling known gas reservoirs.

We thought we had a pretty good handle on what to expect from the drill.

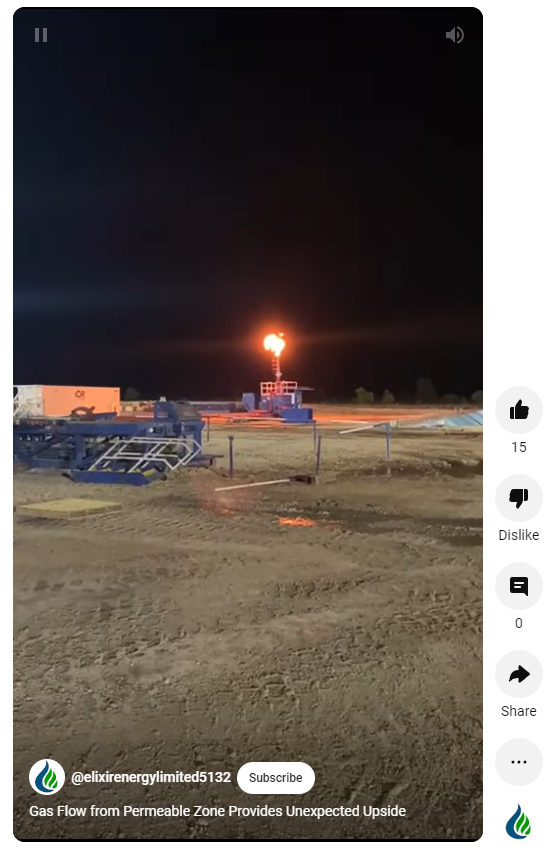

EXR delivered a big, unexpected win from a technical perspective, drilling through its primary targets and hitting free conventional gas that flowed to surface.

Below is the flare from the well.

(Source)

Free conventional gas is the easier type of gas to commercialise as it typically flows to surface naturally.

EXR was expecting to find an unconventional gas reservoir and then stimulate (frack) it to flow gas - like the other discoveries in the region.

Finding free flowing gas in deep sections has significant implications for the entire basin, and especially for EXR’s permit area where the free flowing gas was actually found.

And its neighbors Shell, Santos and Omega.

We have seen these types of unexpected surprises turn into big developments for other gas regions - like AWE’s Waitsia discovery in the Perth Basin.

Still early days for EXR but we will definitely be watching this a whole lot closer now.

EXR has a lot of work to do now given the unexpected positive result, and how it will alter their forward plans for the well.

Wireline logging results are still on the way and expected soon.

MD Neil Young summarised it pretty well saying;

“Although these are still early days, the unexpected intersection of a permeable gas zone this deep in the section may unlock another new Australian deep gas play and will be of interest to many parties”.

We announced our 2023 Energy Pick Of The Year:

A few days before the big IVZ discovery, IVZ’s Managing Director Scott Macmillan also joined the board of our latest portfolio Investment.

Scott joining the board was the trigger for us making Global Oil & Gas (ASX: GLV) our 2023 Energy Pick Of The Year.

Ironically, the pick came on the same week that two of our previous Energy Pick Of the Year’s delivered big news...

- In 2019, we chose EXR - we first Invested at 4.1c, and since then, it peaked at ~51c. EXR now trades at 10c per share.

- In 2020, we chose IVZ - we first Invested at 3.5c, and since then, it peaked at ~41c. Now IVZ trades at ~20c per share.

GLV holds 80% of an offshore oil & gas asset in Peru, which sits in a basin that has historically produced 1.6bn barrels of oil +.

The project sits on a giant 4,858km^2 of ground and already has existing 2D/3D seismic data.

The reason we like GLV is because it is early stage, with a relatively small market cap (sub $10M) that can grow as the company executes large amounts of pre-drill work to be done.

We think the company is in a similar position to where IVZ was when first Invested at 3.5c per share back in 2020.

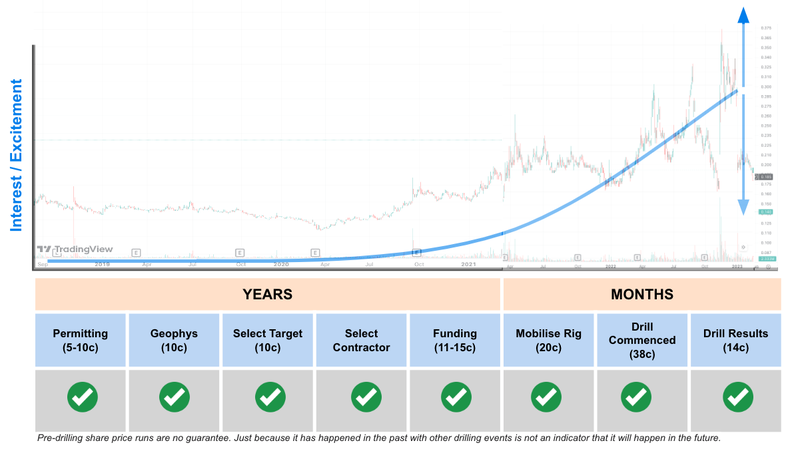

At the time, IVZ had a lot of work to do before their drilling event - IVZ’s first drill event was still a couple of years away, and its market cap was ~$20M (at 3.5c per share).

By the time IVZ was preparing to mobilise its rig for its first drill program, its market cap was ~$134M.

During the first drill program, IVZ’s market cap hit ~$360M - at its peak IVZ hit ~41c per share.

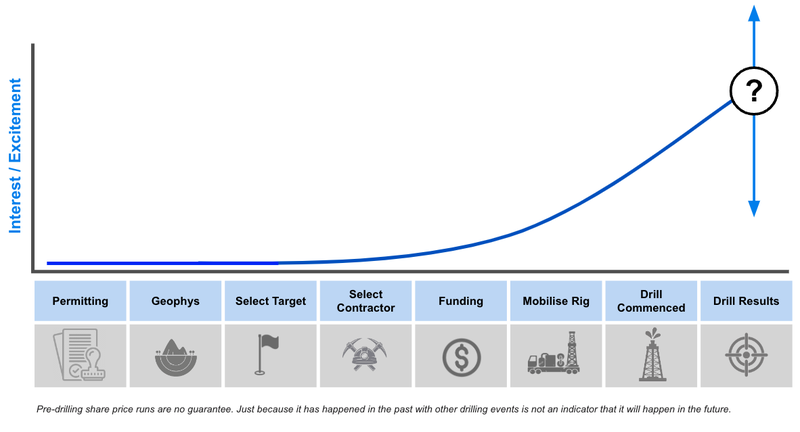

Usually (but not always), with these big “swing for the fences” oil & gas explorers, we see the share price creep higher as they get closer to a drilling.

As drilling and results approach, interest and excitement build in the lead up to drilling results, and speculators may enter the stock expecting a positive result - it usually looks something like this:

It’s important to note that increased excitement/interest shown on our chart below does NOT necessarily correlate to share price increases, which depends on many other factors and broader market conditions.

Here is how it looked for IVZ for the lead up to its first ever drill:

We think right now, GLV is in a similar position to where IVZ was when we first Invested.

GLV is at least ~2 years away from its first drill program and has heaps of pre-drilling work to do, including:

- Reprocessing existing seismic,

- Potentially, some new seismic,

- Government approvals,

- Prospect and target selection

- Prospective resource estimates

Our view is that as GLV runs through all of this work, the market will slowly start to get more and more interested and re-rate GLV’s market cap higher as the drilling approaches.

By the time GLV is ready to drill we would expect its valuation to be multiples of where it is today.

Note: We are not saying GLV will do the same as IVZ or any other early stage explorers, lots can go wrong and small cap investing is high risk. Past performance of other companies is not an indicator of the future performance of GLV

What we wrote about this week 🧬 🦉 🏹

The big one - and it came in just in time for the holidays. A great result for everyone following the story since we made it our 2020 Energy Pick of the Year.

GLV: Our New Energy Pick of the Year 2023

This week we made GLV our Energy Pick of the Year for 2023. GLV has 4,858km2 of prospective licences - surrounded by historical hydrocarbon discoveries with numerous excellent leads. The trigger to make it our Pick Of The Year was IVZ’s Managing Director Scott Macmillan joinING GLV’s board.

Did EXR Just Unlock Another Australian Deep Gas Play?

EXR announced on Thursday, that they have found free flowing gas in what was expected to be a “tight gas” well. So much that they had to flare - it certainly makes for a great picture. And a very pleasant surprise.

LNR farms into ground 400m from one of Australia’s largest lithium mines currently being built

On Wednesday, LNR farmed into a lithium exploration project ~400m away from the giant 189Mt @ 1.53% Li2O Earl Grey lithium deposit. A deposit where they are currently building one of Australia’s largest lithium mines, owned 50/50 by Wefarmers and SQM. It’s a bold acquisition, let’s see if it pays off.

A Globally Significant Helium Discovery? Bigger than anyone expected...

NHE’s hit net reservoir thickness’ above pre-drill expectations and air corrected helium grades of 2-3%. Now we wait for the lab results to see if NHE can declare an official discovery or not.

Quick Takes 🗣️

SLM hits pegmatites in Brazil, assays next

LCL has found multiple nickel sulphide outcrops

SGA achieves graphite thermal purification scale up

MAN completes lithium sampling program in the USA

TG1 completes sampling program at WA lithium project

GAL kicks off 1,500m drill program

NTI get HREC approval to extend Phase II/III ASD Trial to adults

GGE re-enters helium well in the US

IVZ Sidetrack well at 2,987m - Total Depth (TD) at ~3,400m

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc: The Future Money: https://future-money.co/

⏲️ Upcoming potential share price catalysts

Updates this week:

- EXR: Daydream-2 appraisal well, QLD

- EXR hit Total Depth (TD) and unexpectedly hit a reservoir that was flowing gas to surface. See our note on the news here.

- IVZ: Drilling oil & gas target in Zimbabwe, Mukuyu-2 (Q3, 2023)

- IVZ officially declared a discovery. See our note on the news here.

- NHE: Drilling two targets at its helium project in Tanzania (Q4, 2023)

- NHE put out preliminary results from its first two wells. See our note on the news here.

- MAN: Sampling program at its US lithium project in Utah.

- MAN completed its sampling program. See our Quick Take on the news here.

- TG1: Soil and rock chip sampling at its WA lithium project.

- No news from its project this week but we did see a TG1 feature on Ausbiz. Check that out here.

- HAR: 20,000m drill program at its uranium project in Senegal.

- No news from the drill program but HAR’s CEO Peter Batten did a mid week presentation. Check it out here.

- GGE: Re-entering its helium discovery in Utah, USA.

- GGE kicked off its re-entry on Monday. See our Quick Take on the news here.

- SLM: Assay results from drilling at its Brazilian Lithium project.

- SLM put out an update on its drill program. See our Quick Take here.

No material news this week:

- 88E: Flow test well, Alaska (Q1, 2024) & Government approvals for Namibia project (Q1, 2024)

- TYX: Second round of drilling at lithium project in Angola

- PUR: Drilling its Argentine lithium project in Q4-2023.

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (March 2024)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.