GLV: Our New Energy Pick of the Year 2023

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 40,500,000 GLV shares and 6,750,000 GLV options at the time of publishing this article. The Company has been engaged by GLV to share our commentary on the progress of our Investment in GLV over time. 20M shares and 5M options are escrowed for 2 years and subject to final approval.

Today we announce our Next Investors Energy Pick of the Year for 2023.

In 2019 we chose EXR.

In 2020 we chose IVZ.

(We didn’t find any early stage energy explorers that fit the bill in 2021 or in 2022.)

Introducing our Next Investors 2023 Energy Pick of the Year: Global Oil & Gas (ASX:GLV)

A few months ago, GLV acquired a new project - a GIANT offshore oil & gas exploration block in Peru.

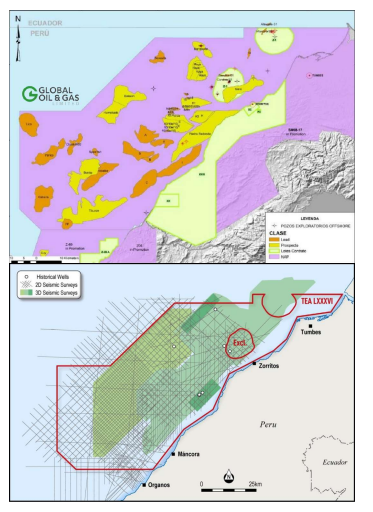

GLV has 4,858km2 of prospective licences.

Surrounded by historical hydrocarbon discoveries with numerous excellent leads.

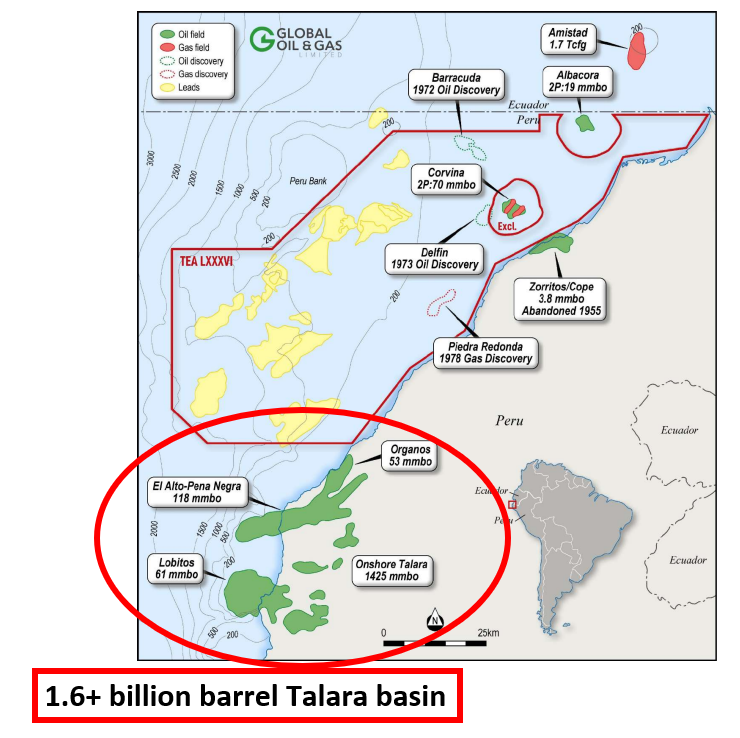

GLV’s acreage sits inside an oil producing basin with historical production of ~1.6 billion barrels of oil.

GLV’s block comes with ~17,935 km in 2D and 3,878 Km2 of 3D seismic data, a solid start and ripe for reprocessing and analysis.

At yesterday's close price, GLV had a market cap of less than $10M.

Yesterday, Scott Macmillan, founder and managing director of IVZ joined the GLV board.

(a big tick for us).

The reason we like GLV is because it is early stage, with a relatively small market cap (sub $10M) that can grow as the company executes on large amounts of pre-drill work to be done.

By the time GLV is ready to drill a high impact oil & gas exploration well, we expect to see its market cap a lot higher than where it is today.

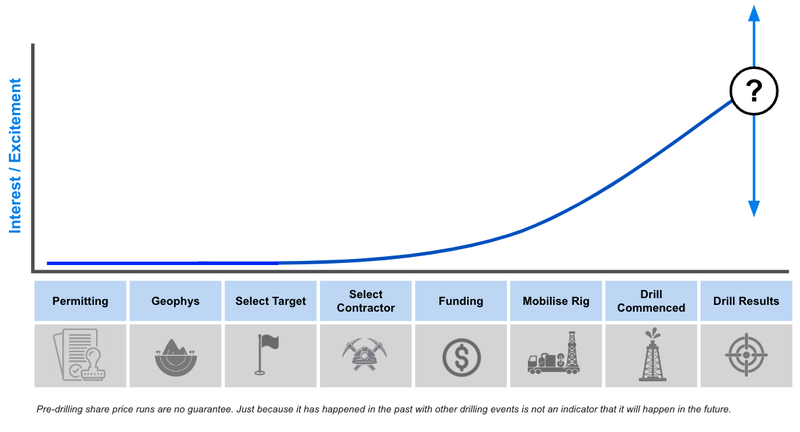

Small cap exploration companies with big drilling events often see a run in share price in the lead up to drilling (but obviously not always).

As drilling and results approach, interest and excitement build in the lead up to drilling results, and speculators may enter the stock expecting a positive result - it usually looks something like this:

It’s important to note that increased excitement/interest shown on our chart below does NOT necessarily correlate to share price increases, which depends on many other factors and broader market conditions.

Patience is required.

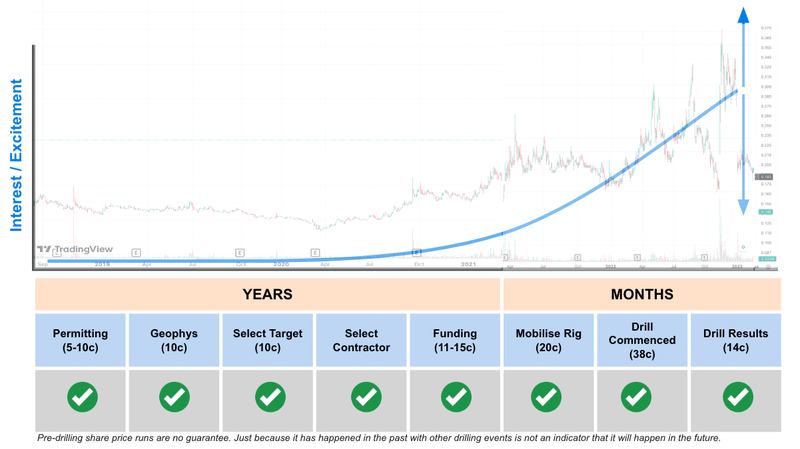

We Invested in IVZ back in 2020, when it had a $20M market cap (3.5c)

At the time, IVZ had a lot of work to do before their drilling event - IVZ’s first drill event was still a couple of years away.

But the early Investment and patient wait saw the IVZ share price gradually rerate from $20M to $134M BEFORE their first drill rig was mobilised.

IVZ’s share price during their first drill went as high as ~41c per share - more than 11x our Initial Entry Price.

During the first drill program IVZ’s market cap hit ~$360M.

Here is the list of work IVZ completed from when we Invested at $20M market cap, to just before its first drill rig was mobilised at $134M market cap:

- Field operations

- Historical seismic analysis and reprocessing (the old Mobil data)

- Government engagement

- Community engagement

- New seismic acquisition

- Increased land holding

- Identify prospects and targets

- Release initial prospective resource

- More analysis

- Upgrade prospective resource

- Environmental and other approvals

- Order long lead items

- Drill rig mobilised

And then we finally got to watch IVZ’s first big drilling event, which is a whole different experience to the gradual pre-drill work rise.

GLV is in a similar stage to where we first invested in IVZ.

(and IVZ Managing Director Scott Macmillan has just joined the GLV board, he has “been there” and “done that” when it comes to all the prep work required to get to a big drill event)

Note: We are not saying GLV will do the same as IVZ or any other early stage explorers, lots can go wrong and small cap investing is high risk. Past performance of other companies is not an indicator of the future performance of GLV

Over the next 2 years, we want to see GLV execute a pre-drill work program, including reprocessing seismic, new seismic, government approvals, prospect and target selection and release a prospective resource.

...and then eventually mobilise a drill rig for its first drill campaign.

All under the watchful eye of GLV’s new board member, IVZ Managing Director Scott Macmillan.

Most early stage oil & gas explorers who are just about to start drilling a big target are usually sitting around the $70M to $200M market cap range (many multiples of GLV’s current market cap).

This is at the time they have all the pre-drill work in place.

Note: We are not saying GLV will perform the same as IVZ or any other early stage explorers. Lots can go wrong and small cap investing is high risk. Past performance of other companies is not an indicator of the future performance of GLV.

The plan with GLV is similar to our plan when we first Invested in IVZ - Invest at an early stage, patiently hold while the company executes the pre-drill work plan, and then hopefully Free Carry and Top Slice while holding a material position into the drill results.

The 10 key reasons we Invested in GLV -

- Connection to IVZ - IVZ’s Managing Director Scott Macmillan has agreed to join the GLV board. We have had success backing Scott before - our Initial Entry Price for IVZ was ~3.5c, and the company has traded as high as ~41c per share. We are Investing in GLV at a similar stage to when we first Invested in IVZ.

- Giant block - 4,858km2 with a portfolio of leads and prospects that can be followed up.

- Project has existing 2D & 3D seismic data - 17,935km2 2D seismic data and ~3,878km2 of 3D seismic data. As well as ‘well control’ and ‘geological’ data. This data would cost tens of millions of dollars if it were to be done again. GLV benefits from all of the old work done on the project.

- Surrounded by multi billion barrel oil fields - GLV’s project is spread across Tumbes/Talara basin. Talara was responsible for ~1.6 billion barrels of historical production. Nearby oil fields are producing at rates of ~3,000 barrels of oil per day.

- Already has existing discoveries - GLV’s block has three confirmed discoveries already sitting inside it. The three discoveries that sit inside GLV’s block were also a part of a project-sell down by Canadian explorer BPZ Energy worth ~US$335M back in 2012.

- Existing processing infrastructure - GLV’s project sits ~70km to the north of the Talara oil refinery. The refinery has been processing oil from the Talara basin for decades.

- Farm-in deals in offshore Peru signed for up to US$900M - Offshore Peru has attracted big ticket farm-ins before. KNOC (South Korean National Oil Corporation) and Ecopetrol (Colombian National Oil Company) in 2009 signed a deal worth US$900M for projects to the south of GLV’s block.

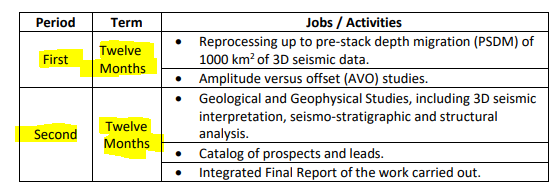

- Low-cost work program - GLV’s Technical Evaluation Agreement (TEA) means it will be doing mostly desktop work (identifying and ranking drill targets) for an initial two year period. There is no large capital commitment for any exploration wells which gives GLV two years to rank its highest priority drill targets and put together big prospective resource numbers.

- Low market cap leverage to re-rate - At its current share price (1.6c per share) GLV has a market cap of $7.4M. GLV had $2.4M in cash at the end of the September quarter giving it an enterprise value of ~$5M.

- High-risk, high-reward - We have had success in the past with “swing for the fences” style oil & gas drilling, and we like that GLV fits this type of investment.

While these are the key reasons we invested, we have also identified and accepted the risks, also keeping in mind that this is small cap explorations, and sometimes unexpected risks can materialise, we list known risks at the end of this note.

We have actually been GLV holders for some time, we are still holding all our shares from GLV’s failed Sasanof drilling event.

We have written about the mistake that we made with the Sasonof drilling investment - in particular that we invested “too close” to the drilling event and did not give ourselves enough time to watch the stock’s gradual re-rate while the company completed pre-drill work.

We still hold all those shares, and we also participated in the last GLV placement.

While many oil & gas drilling events don’t work out, occasionally they do - we are big fans of Investing in “swing for fences” type oil & gas drilling events.

We have been doing it for decades and have had some of our biggest wins in this space.

We Invested in:

- Invictus Energy - 1000%+ ($0.035 to a high point of $0.41)

- Africa Oil - 1000%+ ($1.20 to a high point of $12.50)

- 88 Energy - 1000%+ ($0.005 to a high point of $0.07)

- Elixir Energy - 1000%+ ($0.041 to a high point of $0.45)

Past performance should not be taken as an indication of future performance. Just because we have had successful oil and gas investments in the past does not guarantee that GLV will also be a successful investment.

Over the decades, we have fine tuned an Investment Strategy that works for us.

Our oil & gas Investment Strategy is to:

- Invest early, as the company is in the early exploration work stage.

- Increase our investment, as the company de-risks the project through permitting, geophysics and target generation.

- Top Slice, if the share price runs in anticipation of the drill results

- Free Carry, into the drill results while still maintaining a large position to be leveraged for a positive drilling outcome

- Evaluate our position post-drilling results

Usually as a company gets closer to drilling a giant target, market speculation about its chances of success and how much a discovery may be worth start to get priced in.

That is typically when interest in a drilling event is the highest.

We try to Invest well before that...

When a company has just picked up a project, put together an exploration concept OR has just started applying for new ground.

That way, we are Investing when the company is relatively unknown, drill targets are not clearly defined yet, and the market hasn't had time or information to start pricing in potential discovery scenarios.

It is a riskier time to Invest, BUT if it comes off, then we expect a company's share price to trade at many multiples higher than where we first made our Investment.

We think GLV is right at that earliest stage of a company’s lifecycle, probably two years away from its first big drilling event.

In May this year, Global Oil & Gas (ASX: GLV) picked up an 80% interest in an offshore oil & gas exploration project in Peru.

This asset is sitting in a 1.6 billion barrel producing basin.

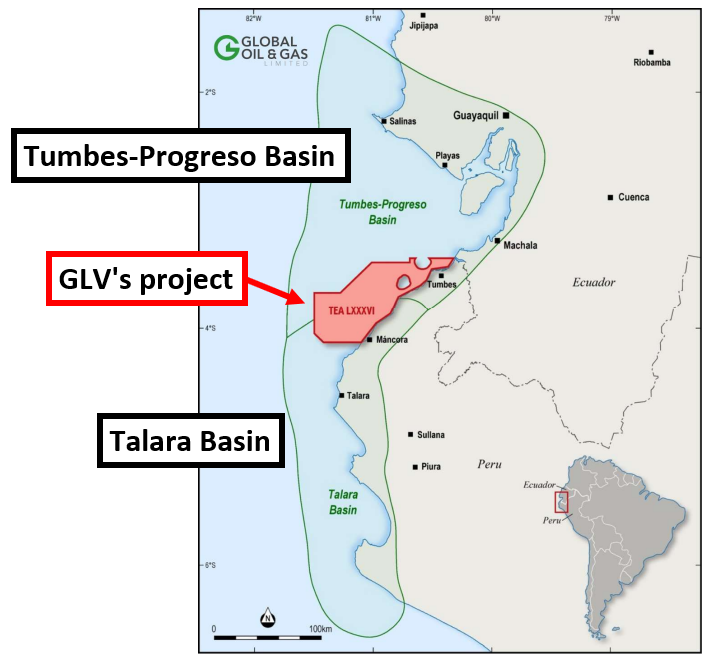

GLV’s current project covers ~4,858km2 across two basins in Peru - the Tumbes-Progreso and Talara basins.

The project has also had ~17,935km in 2D and 3,878km2 of 3D seismic data shot over it.

Despite all of that work, the project has only seen one well drilled for the last ~50 years.

The last one was drilled in February 2020 around the same time the oil price went negative but failed to make a discovery.

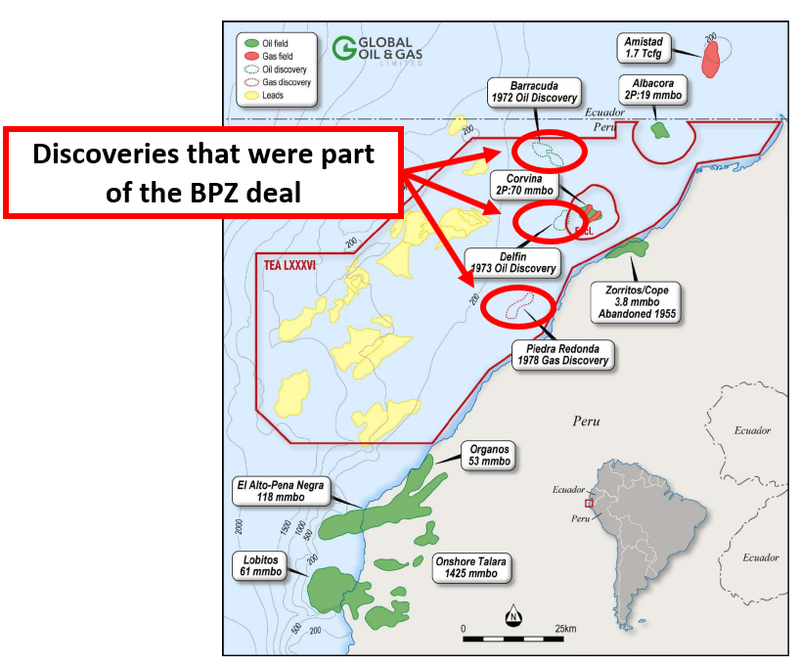

But there have been discoveries on GLV’s block in the past... three, in fact.

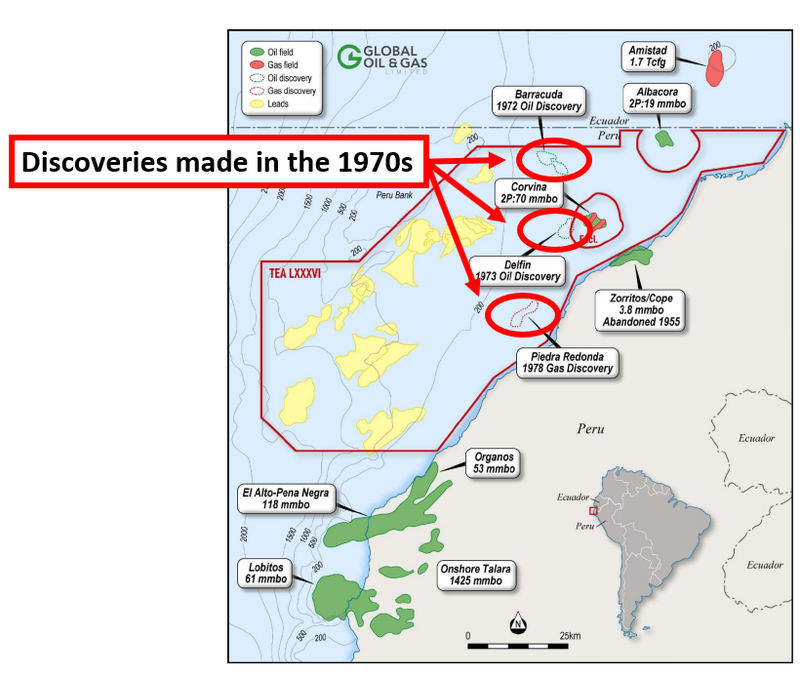

In the 1970s, three different discoveries were made - Delfin, Piedra Redonda and Barracuda.

All three were owned by Canadian explorer BPZ Energy who eventually sold a 49% interest in its block in a deal worth ~US$335M.

Three of the four main offshore targets BPZ owned now sit inside GLV’s current project.

GLV’s project also sits around some of Peru’s biggest oil fields, as well as existing processing infrastructure:

- The existing Corvina oil field is completely surrounded by GLV’s block. That field has a ~27.8 million barrel oil resource and was also one of the assets owned by the Canadian company BPZ Energy back in the early 2000s.

- GLV’s block is to the north of the Talara basin, which has produced ~1.6 billion barrels of oil in the past.

- GLV’s block is immediately to the south of Alto-Pena Negra oil field, which is currently producing at 3,000 barrels of oil per day and has historically produced ~143m barrels.

- GLV’s block sits ~70km away from the Talara crude oil refinery - responsible for processing some of the Talara basin production.

Our key takeaway from this comes down to what GLV is chasing at its project.

Given its project sits across both the Talara and Tumbes-Progreso basins, GLV is looking to replicate the success previous explorers have had in the Talara basin but this time in Tumbes basin.

While the Talara has seen over 1.6 billion barrels of oil production, the Tumbes hasn't been as widely explored/operated.

GLV’s theory will be to try and prove the same structures in the Talara extend up into the Tumbes.

Even though GLV’s ground holds historic discoveries that were included in project sell downs worth ~US$335M, the company’s market cap is ~$7.4M.

GLV had $2.4M cash in the bank at the end of the September quarter which means its enterprise value (EV) is ~$5M.

Most of the historic work focused on the eastern part of GLV’s acreage - the western portion of the project is still relatively underexplored.

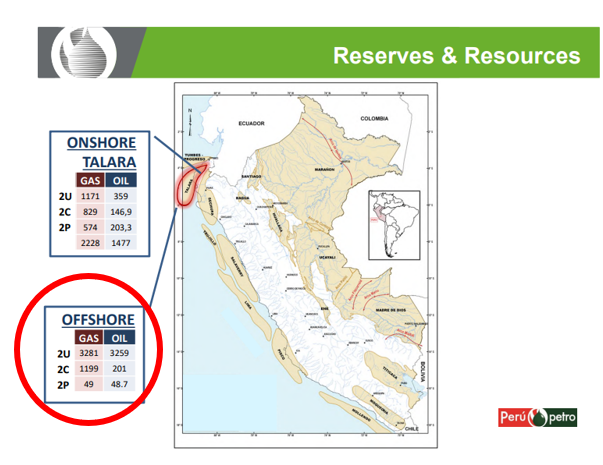

State owned PeruPetro has in the past said that across the offshore Talara/Tumbes basin projects have multi billion barrel exploration potential.

Below is a map of leads and prospects that GLV have already been mapped on GLV’s ground using all of the data from the old 2D/3D seismic campaigns:

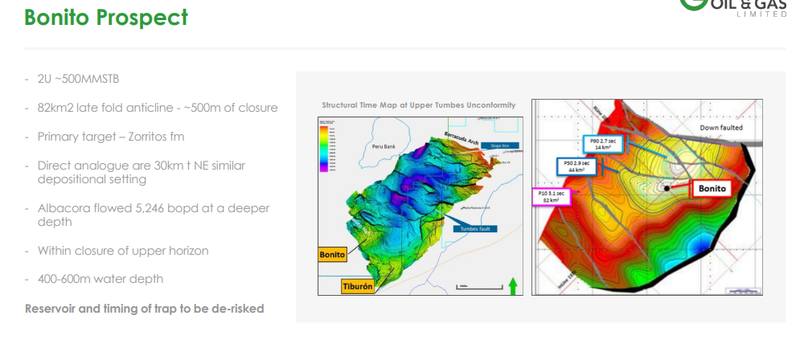

One of those prospects alone (Bonito) is estimated to hold ~500m barrels of oil...

At the moment, GLV’s project has no defined resource estimates, mostly because all of the old work was done too long ago and needs updating...

That’s where GLV comes in.

What will GLV be doing?

One of the key reasons we are holding GLV is because of the unique position its new projects are in.

As mentioned earlier, the project already has ~17,935km 2D and 3,878km2 of 3D seismic data, which would have cost tens of millions of dollars to run if it had to be done now.

That means GLV don't have to run any expensive seismic campaigns, shoot surveys or run through any major field exploration programs.

(unless they choose to)

Instead, GLV is in a position where it takes the projects and does all of the missing desktop work to put together a list of leads with the highest probabilities of success.

GLV has already locked in a two year work program with the regulators as follows:

- First 12 months - reprocess ~1,000km^2 of 3D seismic data & run amplitude versus offset studies.

- Second 12 months - Geological/Geophysical studies (interpreting all the 3D seismic and geological data). Finalise a catalogue of leads and put together a final report.

At the end of the two year program GLV will be in a position where it has a data room set up with a list of potential drill targets and the technical studies behind them.

By the end of the two year period we would hope to see the company’s valuation gradually grow from its current level at ~$7.4M.

At that point we think it will be more about shopping the project to potential farm in partners to try and get any drilling work funded by majors OR when the time comes looking to go it alone.

For us, this is the sweet spot for small cap companies like GLV.

Big companies are so focused on eking out 1-2% efficiency gains from giant oil fields which have hundred million dollar + implications for the company.

Working up exploration assets don't add much value to the company’s bottom line this or next quarter.

Instead they prefer to let the juniors do all the grunt work and then come in later and pay for the fence swing...

GLV gets to do the desktop work that a major might not be interested in doing at a relatively low cost.

When it comes time to drill, GLV can hold onto a portion of the project and give shareholders a chance of owning a meaningful % in a large discovery.

Offshore Peru has seen US$900M dollar deals in the past...

Offshore Peru has seen big farm out deals in the past too...

In 2012, Pacific Rubiales Energy agreed to a 49% farm-in for BPZ’s assets with a total value of US$335M - that deal included a cash payment of US$150M.

As mentioned earlier, that deal included offshore blocks that are now inside GLV’s block.

One closer to home was the farm out by ASX listed Karoon Energy to Tullow Oil back in 2018.

In that deal, Tullow took a 43.75% interest in Karoon’s project in exchange for funding US$27.5M of the first well’s costs.

Again, a portion of the ground that Karoon farmed out to Tullow now sits inside GLV’s block.

Another big deal was the one between KNOC (South Korean National Oil Corporation) and Ecopetrol (Colombian National Oil Company) in 2009 in a deal worth US$900M.

(Source)

That deal was done for ground immediately to the south of GLV’s block.

(Source)

Clearly, if the opportunity is big enough and the technical data stacks up, the majors aren't afraid to commit to farm-in deals on drilling exploration wells that can cost 10s of millions of dollars to drill.

Right now GLV is capped at just $7.4M, and had $2.4M cash at the end of the September quarter giving it an enterprise value of ~$5M.

A large part of our Big Bet for GLV is to see it work up its asset to the point where it becomes an interesting target for a major.

By then we hope that the market would have recognised the potential of its project and the company’s market cap starts to reflect the potential upside from any discovery.

Our Big Bet for GLV is as follows:

“GLV defines a multi-billion barrel prospective resource and sees its market cap re-rate by 20x prior to drilling”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GLV Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Further down this note, we will publish our full GLV Investment Memo, which includes the objectives we want to see GLV achieve as well as the risks to our investment thesis.

But first, a quick summary on how much GLV is paying for the project and who its Joint Venture (JV) partner is:

Background on vendor/JV partner and what GLV is paying for the project

As mentioned earlier, GLV owns 80% of the offshore Peru asset, the other 20% is owned by “Jaguar”.

Jaguar knows the project area well having put together a library of data including all of the existing 2D & 3D seismic data as well as all of the historic well data for the entire project area.

As a result, GLV gets a 20% partner who understands the asset well and brings a lot of technical expertise to the table for the joint venture as a whole.

What is GLV paying for the project?

- US$265k in cash which has already been paid.

- ~25.4M GLV shares to Jaguar - worth ~$406k at GLV’s current share price (1.6c).

- GLV to fund all costs until one exploration well is drilled - Jaguar are free carried for their 20% interest.

Our GLV Investment Memo

Today, we will be launching our GLV Investment Memo, where you can find:

- Why we Invested in GLV

- Our Big Bet - what the long term upside Investment case is for GLV

- The key objectives we want to see GLV achieve

- The key risks to our Investment thesis

- Our Investment Plan

Investment Memo: Global Oil & Gas Ltd (ASX: GLV)

Memo Opened: 5-Dec-2023

Shares Held: 40,500,000

Options Held: 6,750,000

What does GLV do?

Global Oil and Gas (ASX: GLV) holds an 80% interest in an offshore oil & gas exploration project in Peru.

What is the macro theme?

Oil and gas demand continues to increase with oil prices trading near decade highs, whereas investment in new supply continues to fall below record lows year on year.

Underinvestment in new exploration means the world is heading towards a supply/demand shortfall in the medium term.

Our long term GLV Big Bet:

“GLV defines a multi-billion barrel prospective resource and sees its market cap re-rate by 20x prior to drilling”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GLV Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

The 10 key reasons we Invested in GLV -

- Connection to IVZ - IVZ’s Managing Director Scott Macmillan has agreed to join the GLV board. We have had success backing Scott before - our Initial Entry Price for IVZ was ~3.5c, and the company has traded as high as ~41c per share. We are Investing in GLV at a similar stage to when we first Invested in IVZ.

- Giant block - 4,858km2 with a portfolio of leads and prospects that can be followed up.

- Project has existing 2D & 3D seismic data - 17,935km2 2D seismic data and ~3,878km2 of 3D seismic data. As well as ‘well control’ and ‘geological’ data. This data would cost tens of millions of dollars if it were to be done again. GLV benefits from all of the old work done on the project.

- Surrounded by multi billion barrel oil fields - GLV’s project is spread across Tumbes/Talara basin. Talara was responsible for ~1.6 billion barrels of historical production. Nearby oil fields are producing at rates of ~3,000 barrels of oil per day.

- Already has existing discoveries - GLV’s block has three confirmed discoveries already sitting inside it. The three discoveries that sit inside GLV’s block were also a part of a project-sell down by Canadian explorer BPZ Energy worth ~US$335M back in 2012.

- Existing processing infrastructure - GLV’s project sits ~70km to the north of the Talara oil refinery. The refinery has been processing oil from the Talara basin for decades.

- Farm-in deals in offshore Peru signed for up to US$900M - Offshore Peru has attracted big ticket farm-ins before. KNOC (South Korean National Oil Corporation) and Ecopetrol (Colombian National Oil Company) in 2009 signed a deal worth US$900M for projects to the south of GLV’s block.

- Low-cost work program - GLV’s Technical Evaluation Agreement (TEA) means it will be doing mostly desktop work (identifying and ranking drill targets) for an initial two year period. There is no large capital commitment for any exploration wells which gives GLV two years to rank its highest priority drill targets and put together big prospective resource numbers.

- Low market cap leverage to re-rate - At its current share price (1.6c per share) GLV has a market cap of $7.4M. GLV had $2.4M in cash at the end of the September quarter giving it an enterprise value of ~$5M.

- High-risk, high-reward - We have had success in the past with “swing for the fences” style oil & gas drilling, and we like that GLV fits this type of investment.

What we want to see GLV achieve

Objective #1: Reprocessing of 3D seismic data across the highest priority areas.

As part of its first year work program, GLV plans to process 1,000km^2 of 2D seismic data. We want to see GLV pick the highest priority areas of its block for this reprocessing work.

Milestones

🔄 Pick highest priority targets

🔲 Start reprocessing 3D seismic data

🔲 Results from the reprocessed data

Objective #2: Prospective/contingent resources for highest priority targets.

After the seismic data is reprocessed, we want to see GLV put out prospective resource numbers for leads that haven't been drilled yet, and/or contingent resources for the leads that have been drilled in the past.

Milestones

🔲 Prospective resource estimates

🔲 Contingent resource estimates

Objective #3: Progress funding for first exploration well.

At the end of the two year Technical Evaluation Agreement (TEA) we want to see GLV either progress a farm-in deal to fund its first exploration well and/or go it alone if the company’s market cap is high enough to sole fund the well.

Milestones

🔲 Prepare promoting data room

🔲 Signed non-binding farm out deal

🔲 Sign a binding farm out agreement for one well

🔲 Sole funding plan for first exploration well

What are the risks?

Geopolitical risk

The project is located in Peru which in the past has gone through periods of geopolitical instability. There is always a risk that geopolitical issues could lead to permitting issues. Any geopolitical instability in Peru is likely to impact GLV’s share price significantly.

Permitting risk

GLV’s project is currently permitted under a Technical Evaluation Agreement (TEA) for a period of two years. Eventually before any drilling work can happen GLV will have to convert it into an exploration licence. There is always a risk that the licence doesn't get granted and GLV is left with no claim over the asset.

Commodity risk

GLV’s project is leveraged to the price and demand for oil & gas. As the world looks to move away from fossil fuels, hydrocarbon projects may be phased out.

Funding risk

GLV does not generate any revenues and so is reliant on raising capital to fund its exploration programs. If the markets are unwilling to finance GLV’s exploration programs the company may need to go slow on its operations or offer large discounts to its share price when raising capital.

Market risk

If the broader market sells off, investors may shy away from high-risk investment opportunities like junior explorers. During market downturns, investors will look to pull capital away from the high risk investments. GLV is a junior explorer and may be impacted by these market wide sell offs.

Our Investment Plan

Our Oil and Gas Investment Strategy is to:

- Invest early, as the company is in the early exploration work stage.

- Increase our investment, as the company de-risks the project through permitting, geophysics and target generation.

- Top Slice, if the share price runs in anticipation of the drill results

- Free Carry, into the drill results while still maintaining a large position to be leveraged for a positive drilling outcome

- Evaluate our position post-drilling results

For GLV, we plan to hold the majority of our position for the next 2 years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.