MAN completes lithium sampling program in the USA

MAN completes lithium sampling program in the USA

Our US lithium Investment Mandrake Resources (ASX: MAN) just finished its first ever lithium sampling program.

MAN holds ~93,755 acres (~379km^2) of ground in Utah, USA prospective for lithium brines.

At its project, MAN is following a similar exploration strategy to Exxon Mobil and its regional peer Anson Resources:

To take lithium brine assets, apply Direct Lithium Extraction (DLE) technologies and then produce battery-grade lithium products.

MAN spent most of 2023 pegging ground and increasing the size of its project - now the company holds 93,755 acres (~379km^2).

Then MAN signed well access agreements with the owners of nearby old oil & gas wells.

Now it's all about sampling and flow testing the wells to see if a commercial discovery can be declared - and just how big the lithium discovery could be.

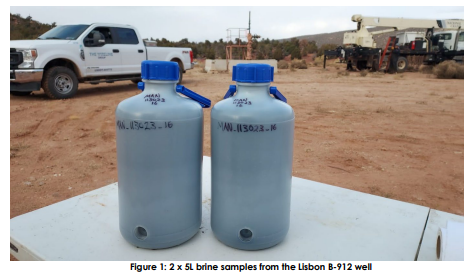

Today, MAN finished its first round of sampling on five wells across six different reservoir units.

The positives:

- MAN confirmed its brines were suitable for lithium brine exploration

- MAN sent samples for lab and DLE testing.

- MAN has started putting together its JORC exploration target.

That means we have three key bits of news to look forward to over the next few weeks…

Assays from the brine samples, the results from DLE testing and a JORC exploration target.

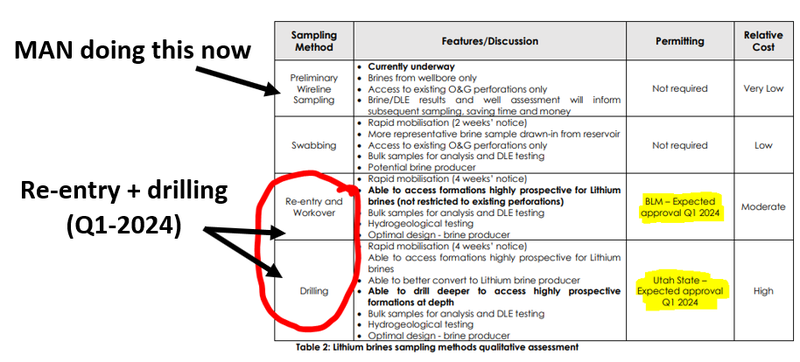

After that, MAN’s plan is to run re-entry/workover programs so it can put together the maiden resource estimate.

That work is scheduled for Q1-2024.

The three major catalysts we think could re-rate MAN:

Over the 3-6 months we think MAN could put out 3 key announcements that could re-rate its share price:

- Sampling results - MAN has seen grades of ~340mg/li in wells ~6km away from its ground. Anson’s resource has an average grade of ~127mg/li. If the sampling program returns grades higher than these across multiple reservoir intervals, the market may start to take an interest in MAN’s project.

- Maiden JORC resource - A maiden JORC resource estimate will give the market something to compare MAN’s project size/scale potential to other US lithium brine peers. Anson has a resource of ~1mt lithium carbonate equivalent and is capped at $186M.

- Direct Lithium Extraction (DLE) partnership - This was a major catalyst for Anson and was a key reason that led to its market cap reaching ~$490M in mid 2022. This was also the peak of the last bull market. Even so, Anson is currently capped at a fairly impressive $186M. After the sampling program is done, the $24M capped MAN can start sending samples to potential DLE partners for testing.

Our latest MAN note - USA lithium - MAN’s well sampling has begun

Just last week, we did a deep dive into MAN’s sampling program where we touched on the following:

- What are MAN’s lithium targets?

- $24M capped MAN following the lead of $186M capped Anson

- The pathway to a maiden JORC resource: Anson vs MAN

What’s next for MAN?

Sampling results from re-entered wells 🔄

MAN just finished wireline logging (sampling) five wells across three different reservoirs.

The main things we will be looking for from this program will be similar to the results we are used to seeing from oil & gas sampling programs.

Things like gross/net pay intervals and technical reservoir data.

Ideally, we will get some idea of the type of grades in the reservoirs and all of the above.