Did EXR Just Unlock Another Australian Deep Gas Play?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,777,858 EXR shares and 1,071,429 EXR Options at the time of publishing this article. The Company has been engaged by EXR to share our commentary on the progress of our Investment in EXR over time.

Well, we did not expect that.

Neither did EXR...

Elixir Energy (ASX:EXR) just announced they have found FREE FLOWING gas in what was expected to be a “tight gas” well.

Up until now, the Taroom Trough in Queensland has largely been viewed as an “unconventional” (tight) gas region.

This means the other wells (Santos, Shell, Omega) in the region need to be stimulated (fracked) to flow gas...

Tight gas is what EXR was expecting to find with their well, but in the deeper part of their well, they encountered a zone of FREE FLOWING GAS,

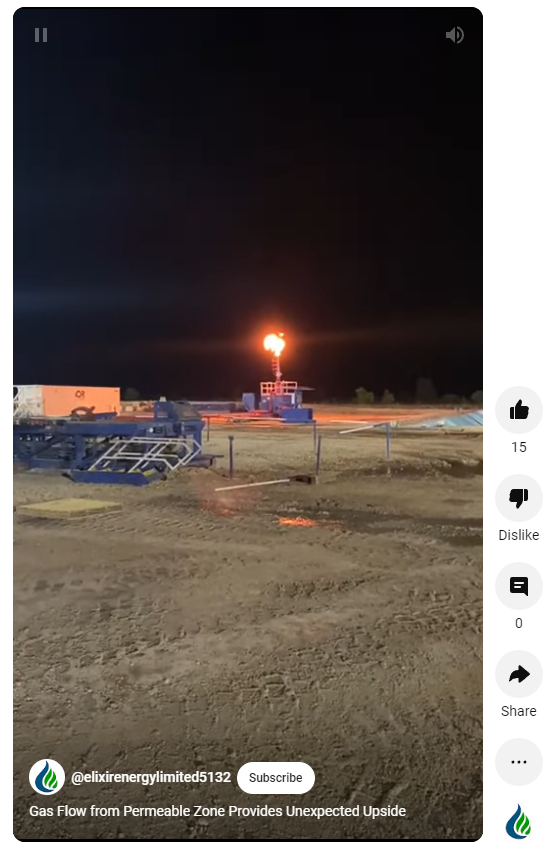

The gas also flowed - 50,000 cubic feet to the surface, and was flared off:

Free conventional gas is the easier type of gas to commercialise as it typically flows to surface naturally.

EXR was expecting to find an unconventional gas reservoir and then stimulate (frack) it to flow gas - like the other discoveries in the region.

Finding free flowing gas in deep sections has significant implications for the entire basin, and especially for EXR’s permit area where the free flowing gas was actually found.

The original EXR plan for the expected tight gas was to go back and design a stimulation program to unlock the gas and bring it up to the surface in a flow test next year.

EXR was able to flow gas from the deeper zones to surface WITHOUT stimulation work, from the deepest part of the well.

We look forward to the wireline results and how this unexpected development will alter EXR’s forward plans.

Again, finding free flowing gas in deep sections has significant implications for the entire basin, and especially for EXR’s permit area where the free flowing gas was actually found.

EXR’s Managing Director, Mr Neil Young, said: “Flowing gas without stimulation from a deep section is immensely exciting for Elixir. Although these are still early days, the unexpected intersection of a permeable gas zone this deep in the section may unlock another new Australian deep gas play and will be of interest to many parties. Furthermore, on almost every other front the well has exceeded expectations – in terms of geology, engineering, economics and project management.”

It's still very early days but the unexpected news today reminds us of the drilling in the Perth Basin by AWE which transformed the way explorers looked at gas projects across the entire basin.

AWE did something similar where they drilled deeper than usual and hit unexpected gas reservoirs with high natural flow rates.

In the years after its 2014 Waitsia discovery, AWE was taken over for ~$602M... (more on this further down).

Elixir Energy

ASX:EXR

A large part of today’s EXR announcement was broadly as expected (aside from a lazy 107m of EXTRA gross pay over the ~500m expected)

But there was one major unexpected bit of news...

Here is what happened:

- There are two different types of gas - (i) ‘conventional gas’ which flows to surface naturally, and (ii) ‘unconventional gas’ which needs to be stimulated to produce commercially viable flow rates.

- EXR was drilling an appraisal well targeting primarily an unconventional tight gas structure - EXR hit gross pay of ~607m of the unconventional gas structures.

- The unexpected news is that EXR hit a conventional section at the end of its well flowing free gas to surface. Field estimates were for ~50,000 cubic feet of gas - which had to be flared...

EXR has already uploaded a video of the gas flare onto Youtube here:

(Source)

So EXR hit everything it expected AND surprised to the upside at the deep part of its well with free conventional gas.

Why we think today’s news could be big...

Free conventional gas had not been seen in the region where EXR is drilling.

Up until now, the Taroom Trough in Queensland has largely been viewed as an unconventional gas region.

Most of the operators who have drilled wells in the region have hit unconventional reservoirs, gone back, designed stimulation programs and tested the wells for flow rates that way.

No drilling explorer until today has hit conventional reservoirs that flow gas to surface naturally - until now...

It's a similar story to the one that has played out in the Perth Basin before - which defined Australia’s largest conventional onshore discovery in the last 30 years.

The AWE Story: Unlocking Gas in the Perth Basin - parallels to what EXR has just found?

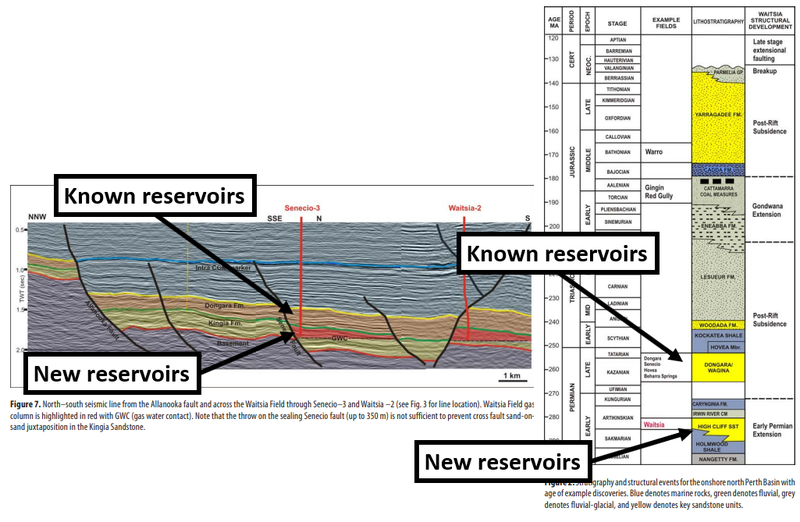

The first discovery in the Perth Basin was back in the early 1960s when the Dongara Reservoir was discovered.

For ~50 years, all of the gas explorers across the Perth Basin were chasing identical play types.

In 2014, the way companies look at the Perth Basin changed when AWE made the Waitsia discovery - Australia’s largest conventional onshore discovery in the last 30 years.

In September 2014, AWE started drilling what was originally an unconventional appraisal well.

Sounds familiar...

AWE was drilling to test known gas-bearing reservoirs (Dongara/Wagina), BUT the well was drilled deeper to test seismic targets at depth.

The well successfully tested the known reservoirs AND also hit gas pays in a tight reservoir in the lower reservoirs (Kingia and High Cliff reservoirs).

So in parallel to the EXR news today - AWE was drilling an appraisal well to test known reservoirs, it drilled deeper than initially intended and hit conventional gas at depth.

AWE’s Waitsia was the largest conventional onshore discovery in Australia for more than 30 years.

Waitsia changed the way everyone looked at the Perth Basin and also showed that bringing new geological modelling/exploration concepts to a mature basin could prove out new discoveries.

(Source)

Four years after the Waitsia discovery, AWE was taken over by a Japanese conglomerate for $602M.

(Source)

The Perth Basin also created other massive small cap success stories, including Norwest Energy, which went from ~0.3c per share to ~7c per share and got taken over by Mineral Resources in a deal worth ~$350M.

(Source)

We are hoping that by finding free flowing conventional gas at depth, EXR can follow AWE’s lead and unlock a new Australian deep gas play.

Like AWE, EXR drilled an appraisal well, hit everything it expected AND a tight conventional gas play at depth.

Until now, no other wells have been drilled into similar structures in the Taroom Trough.

It's very early days, but the signs are there that EXR may have hit something that changes the way everyone would look at the Taroom Trough region.

The overpressure and flaring of gas doesn't just happen for no reason - it is a good sign the well may have good flow potential.

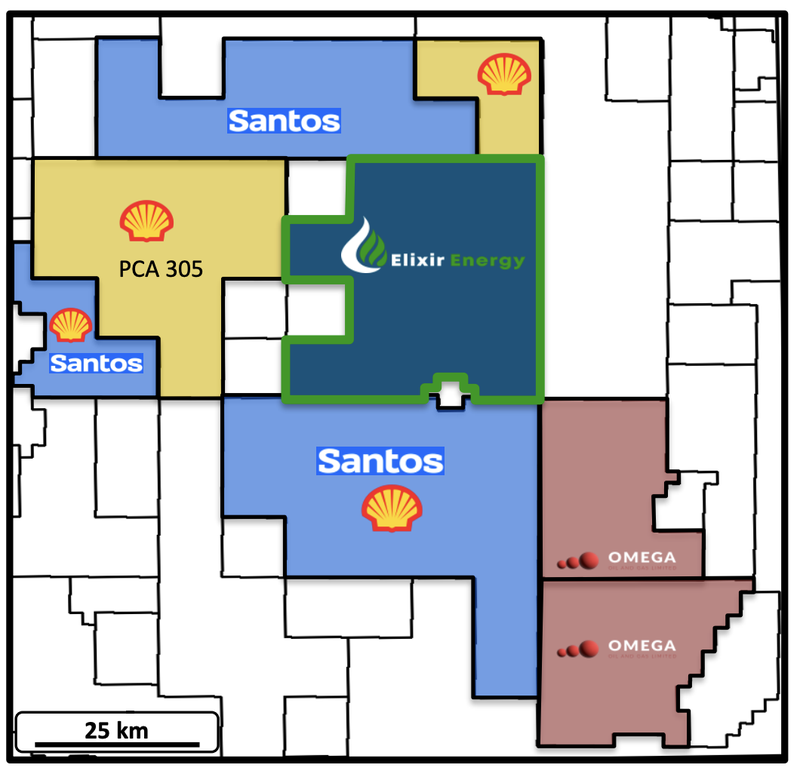

Another reason we think the news could be game changing for EXR is because of the companies that surround its project.

EXR’s acerage sits right next to ground owned by Shell, Santos and Origin.

EXR already has data sharing agreements with Santos and Origin so it's fair to say the two majors are both watching what EXR is doing.

Interestingly, the Santos data sharing agreement is centred around “exploring regional prospectivity” encouraging technical discussions about the deeper exploration plays in the region.

(Source)

We think Santos will definitely be one company that takes a keen interest in what EXR is doing...

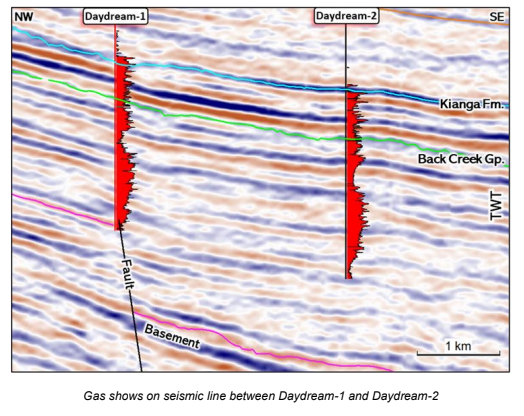

EXR also has Shell currently drilling a well right next door.

Shell is drilling right now AND is looking to emulate the success of a well previously drilled by BG Group (now Shell) ~10 years ago.

Remember Shell took over BG Group for £47bn - the same company that initially made the Daydream-1 discovery ~5km away from EXR’s well back in 2012.

EXR’s Chairman has built up and sold a gas company before...

One of the key reasons we Invested in EXR was for its management team.

With its Queensland gas project, EXR’s chairman’s experience is especially important.

EXR’s chairman Richard Cottee is seen as “the Godfather” of Coal Seam gas in Queensland.

Cottee took Queensland Gas Company from a $20M capped junior through to a $5.3BN takeover back in 2008 - the company doing the buying was BG Group (now Shell)...

(Source)

We also note EXR’s Managing Director Neil Young was ex-Santos management, and Director Stephen Kelemen ran Santos’ Coal Seam gas portfolio.

Overall, we think EXR has the right team in place to take its project forward.

What comes next?

🔄 Wireline logging and fracture injection testing

Next, EXR will run a wireline logging/fracture injection testing program.

The goal for that program is to test the permeability (flow potential) of the reservoirs drilled and to update EXR’s resource estimates.

Eventually, all of that information will feed into an optimised design for a stimulation/flow test in 2024.

EXR expects the first phase of work to start “before Christmas” and run for ~3 months.

Ultimately the flow test in 2024 will be the major catalyst to see if EXR can achieve our Big Bet, which is as follows:

Our Big Bet for EXR:

“EXR to achieve a $1BN market cap through successfully advancing one or more of its three projects: its Mongolia gas project, Mongolia green hydrogen project, and/or its Queensland gas project.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EXR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What are the risks?

The results from EXR’s Daydream-2 well are relatively strong so far but the main risk for EXR is still “commercial risk”.

EXR’s plan is to flow test the well early next year and we think that is when we will find out whether or not EXR’s project can produce oil/gas at commercially viable rates.

Uneconomic flow rates would mean EXR spends a lot of capital for very little return in terms of shareholder value, which we think would lead to a re-rate down in EXR’s share price.

EXR will also likely need to raise capital to fund its tests in 2024, so “funding risk” is still apparent for EXR.

To see all the risks to our EXR Investment thesis, check out our EXR Investment Memo here.

Our EXR Investment Memo

In our EXR Investment Memo, you can find the following:

- Our EXR Big Bet

- Key objectives for EXR

- Why we are Invested in EXR

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.