How two big updates from Pantheon Resources affect 88E

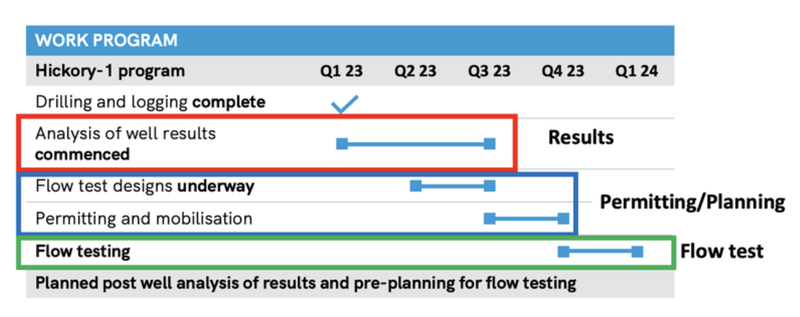

Our oil & gas exploration Investment 88 Energy (ASX:88E) is gearing up for a flow test at its Hickory-1 well scheduled for later this year/early 2024.

88E drilled the well earlier this year testing a 647 million barrel prospective mean unrisked resource (net to 88E) on the North Slope of Alaska, in the USA.

88E’s project sits adjacent to key infrastructure on the North Slope including the Dalton Highway and the Trans Alaska Pipeline (which sends oil down to the lower 48 states of the USA).

The project also neighbours London listed Pantheon Resources which we have mentioned several times in the past.

Pantheon is capped at ~$325M, whereas 88E is capped at ~$124M.

The latest from Pantheon Resources

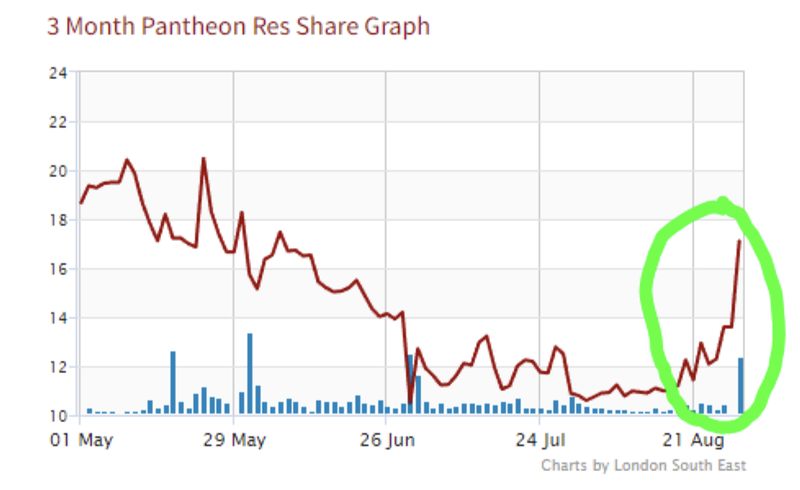

Earlier this week Pantheon put out news which has led to a ~50% move higher in its share price.

Here are the two announcements put out by Pantheon and how we think it relates to 88E:

- 29 August 2023 - Independent Expert Report confirms Best Estimate Contingent Resource estimates totalling 962 million barrels for Kodiak Field

- 28 July 2023 - Operational update

1) Pantheon is gearing up for a flow test at its Alkaid-2 well later this year.

Pantheon has now contracted a rig for re-entry into its Alkaid-2 well.

Pantheon expects rig mobilisation for the flow test to start in September.

How it relates to 88E:

The Alkaid-2 well isn't really a mirror of 88E’s Hickory-1 well BUT any activity in the region could spark investor interest in companies close to Pantheon.

If Pantheon can deliver strong results from the Alkaid-2 flow test there is a chance investors start to take an interest again in 88E which has a much lower market cap.

2) Pantheon discussed potential economics of developing the project:

This was an interesting one…

Pantheon’s management decided to provide some commentary on development modelling for its project.

The modelling was done based on 20 different well pads reading a peak production rate of ~8,000 barrels per day of liquids.

The results showed Net Present Values (NPV’s) of:

- US$103M at a US$70/barrel oil price.

- US$150M at a US$80/barrel oil price.

Pantheon also mentioned the costs for the development could be ~US$350M and described it as a way to achieve “financial self-sufficiency”.

How it relates to 88E:

It's not always we see a company look to do development modelling on projects this early on and especially when the full extent of a project has not been identified.

What was interesting is that even a small scale development appears to produce a positive NPV project at a development model level.

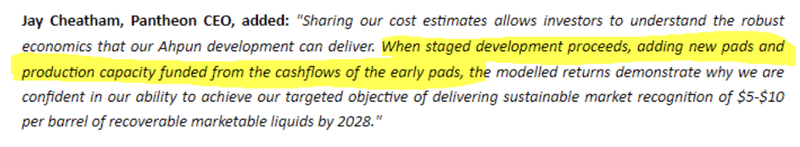

Clearly, Pantheon is trying to communicate to the market how these projects can be developed in stages - with low capital costs upfront and then additional developments to increase size/scale with project cash flows.

Here is a quote from Pantheon’s CEO Jay Cheatham touching on that point:

Depending on what 88E is able to find with its flow test this could have implications for the value investors/Pantheon see’s in 88E’s ground.

At this stage, we found the announcement insightful but nothing that warrants a deep-dive until after the Hickory-1 flow test results.

3) Pantheon put out an independent contingent resource estimate

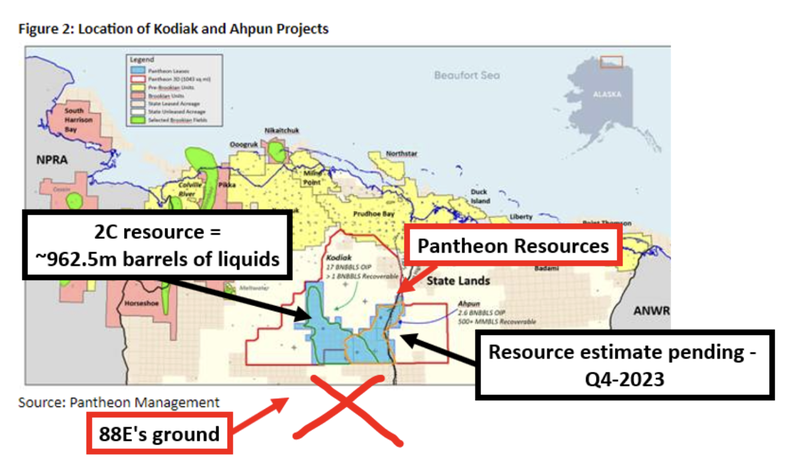

Pantheon put out an independent contingent resource estimate of ~962.5m barrels of liquids across its Kodiak project.

At the same time Pantheon said an independent resource estimate for its Ahpun project is also pending for Q4-2023.

We also noted the commentary on the company’s next well at Ahpun which would be Theta-West-2, this could have implications for 88E’s project and so we will be watching to see how Pantehon designs that well.

Kodiak and Ahpun both sit immediately to the north of 88E’s ground.

How it relates to 88E:

88E’s ground borders both projects and so any good news could be good for 88E.

Interestingly, Pantheon’s share price went up over 50% after the resource estimate was announced.

There is a chance (depending on the results from 88E’s flow test at Hickory-1) that 88E is able to convert its prospective resource estimate into a contingent resource or maybe even a reserve.

We think if 88E manages this then it could re-rate in a similar way to Pantheon.

What’s next for 88E:

Final results from the Hickory-1 well 🔄

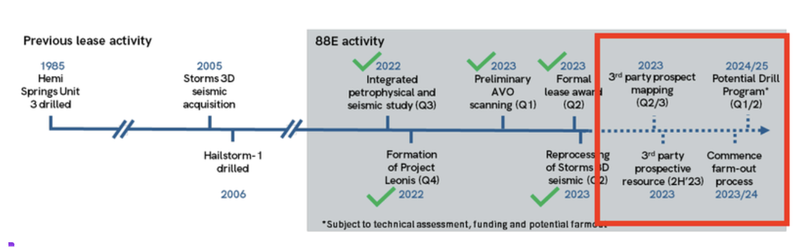

Maiden prospective resource estimate for Project Leonis 🔄