88E Found Oil. Does it Flow? We will Soon Find Out.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 32,164,590 88E shares and 6,296,297 88E options at the time of publishing this article. The Company has been engaged by 88E to share our commentary on the progress of our Investment in 88E over time.

Big binary oil investing events don't come around often.

Years and years of work and tens of millions of dollars go into getting there.

And then over the space of a few short weeks, material re-rates to company share prices can occur - up or down...

If a commercial oil discovery is made, the rewards can be big, especially for small cap companies.

The best (and most obvious) way to make an oil discovery is to drill an expensive hole into the ground, and see if there is any oil down there.

But after that, a company needs to prove that the oil it found can flow up to the surface at commercial rates via flow testing.

Successful new oil discoveries that ALSO deliver commercial flow rates are hard to come across, so are highly valued by the market.

Last year one of our Investments drilled a successful oil well that hit ~ 137m of net pay across multiple reservoirs.

In aggregate, it’s a multi-hundred million barrel prospective resource (mean, unrisked)...

... and it is now just a few weeks away from running tests to see if the oil flows to surface.

88E’s mantra every year is to drill giant targets, chasing a giant discovery - the type of drilling events we like to Invest in when it comes to oil & gas.

This is “swing for the fence” style exploration - where if successful, the share price re-rates and the company’s market cap can go into the hundreds of millions or even billions of dollars.

And if unsuccessful, the company goes back to the drawing board.

88E is currently capped at A$98M, and held A$18.1M in the bank at December 31st.

88E is fully funded for its imminent flow testing - lets see what it can deliver over the coming weeks...

Earlier this morning, 88E confirmed rig commissioning and ice pad construction for its upcoming flow tests is underway.

Mobilisation of the drill rig to the site is due to start in about 2 weeks time.

Likely by next month, we will know if 88E’s reservoirs flow commercial quantities of oil.

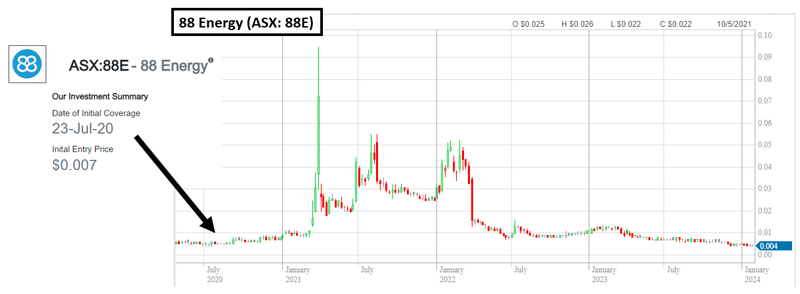

We anticipate that news of a successful flow rate could deliver an immediate re-rate to 88E’s share price from its current 0.4c.

We also expect an increase in interest in the stock BEFORE the flow test results - mainly in anticipation of what 88E might be able to deliver.

We think the market is placing very low expectations on 88E at present, and that positive results could catch it by surprise.

Each of 88E’s two planned flow tests are scheduled to take approximately ten days to complete - so 20 days of flow testing in total.

In this note, we unpack:

- 88E’s imminent catalyst - flow testing across multiple reservoirs

- What we view success or failure to be - what kind of flow rates we are looking for

- A detailed review of 88E’s other key assets

- Oil macro thematic - could current geopolitical instability lead to another oil price surge?

- What 88E investors might be in for over the coming months and years ahead.

Will it flow?

So, 88E is just a few weeks away from starting fully funded flow testing in a well it drilled last year.

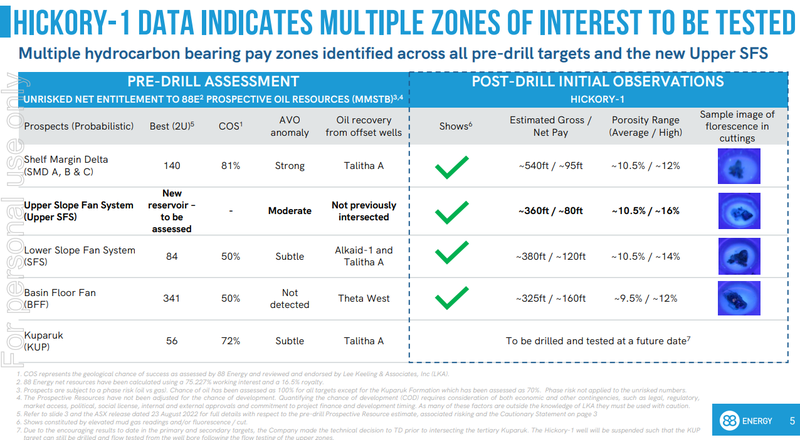

Last year 88E’s Hickory-1 well:

- Hit ~137m of net pay across multiple reservoirs,

- Made a completely unexpected new reservoir discovery, and

- Confirmed high porosity levels of up to ~16%

What is still unknown at this point is what kind of flow rates 88E can pull out of its reservoirs.

Following the successful drilling of Hickory-1, 88E has reviewed all the data and has planned flow tests that are optimised for success - bringing in expert consultants to help with the design.

After ~12 months of planning, 88E is finally about to start its flow test.

Results for the flow tests will be due a few weeks after they begin.

At that point we will know if 88E has been able to make a commercial oil discovery.

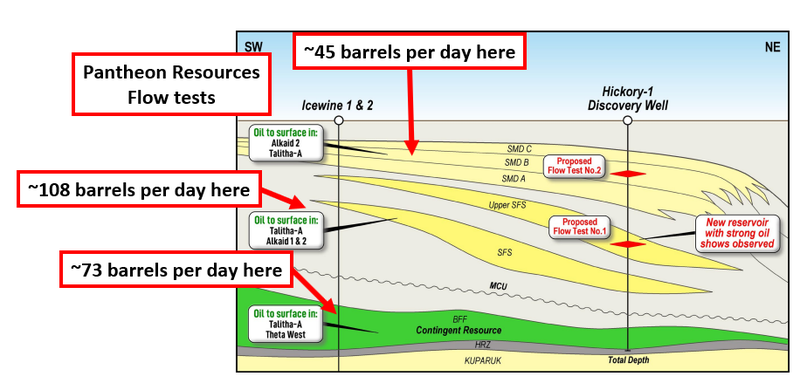

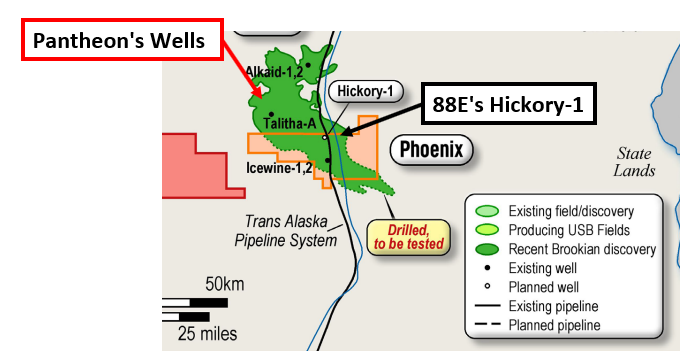

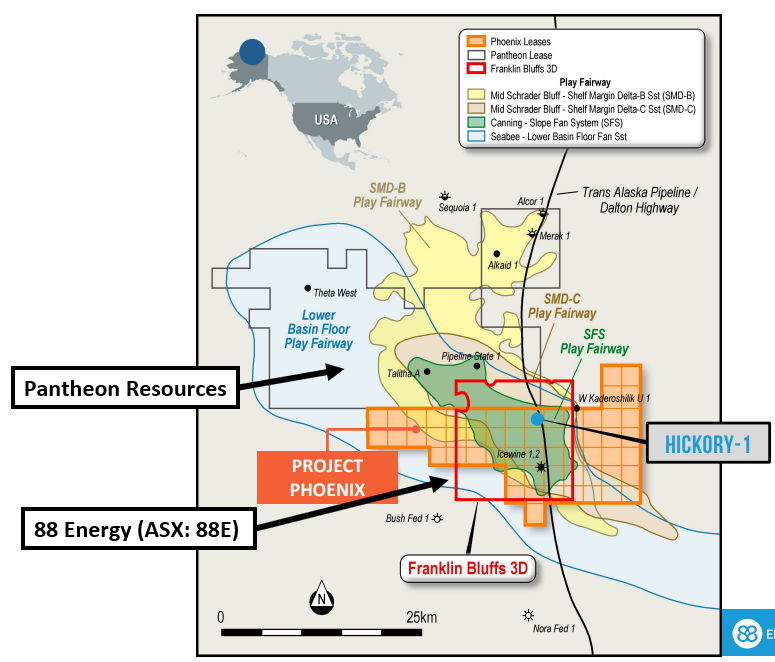

We have some idea of what flow rates are possible from 88E’s neighbour, the UK listed Pantheon Resources.

Pantheon is capped at £236M following its flow tests on ground next door to 88E, while 88E is capped at less than £50M.

Pantheon’s flow tests (on some of the same reservoirs 88E has on its ground) hit flow rates of up to 108 barrels of oil per day in vertical wells.

Pantheon’s vertical wells flowed:

- ~45 barrels of oil per day from the SMD-B reservoir.

- ~108 barrels of oil per day from the SFS reservoir,

- Up to ~73 barrels of oil per day from the much lower BFF reservoir

As a result, 88E’s upcoming flow tests will focus on the flow rate relative to Pantheon’s results.

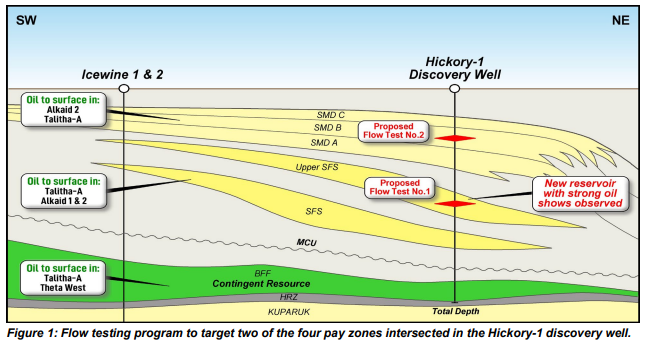

88E’s flow testing operations will focus on the two primary targets, the Upper SFS and the SMD zones.

The Upper SFS has never been flow tested before - it hasn't been found on Pantheon’s ground.

Expectations are more variable here - given the reservoir has strong porosities (up to 16%) we are hoping it can deliver an outsized result for 88E.

Together, both of 88E’s target zones hold, in aggregate, a multi-hundred million barrel oil prospective resource (mean, unrisked).

Anything above the 100 barrel per day mark would be a green light to come back, drill a horizontal well and to commercialise the project with likely 6-12x higher flow rates.

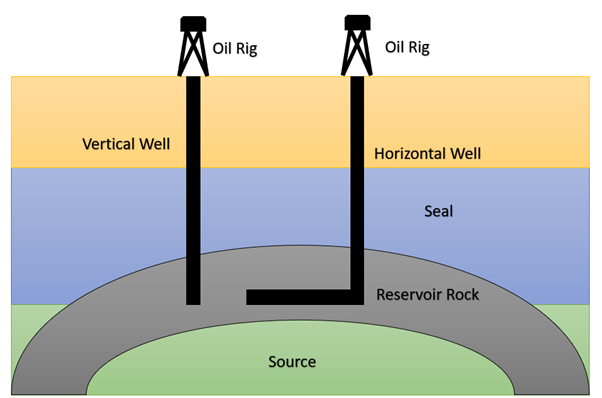

Horizontal wells can deliver higher flow rates because compared to a vertical well, a horizontal well can travel horizontally through the oil filled target reservoir, and pull oil out from multiple points of extraction.

With more points to pull oil from the reservoir, this means a much higher total flow rate to surface.

For example, a flow rate of 100 barrels of oil per day could mean 88E can increase that to 600-1,200 barrels of oil per day with a horizontal well.

This kind of result in the coming weeks would be enough for 88E to explore development options, and justify continued investment in the asset - hopeful at a much higher market cap.

With oil currently fetching almost US$80 a barrel, the numbers could start to really stack up.

However it is too early to put any revenue or cost figures on the project as it is so early stage (there may be multiple wells drilled, flow rates can vary, etc).

With geopolitical instability threatening to add more volatility to oil markets, a new USA located oil development could be welcomed.

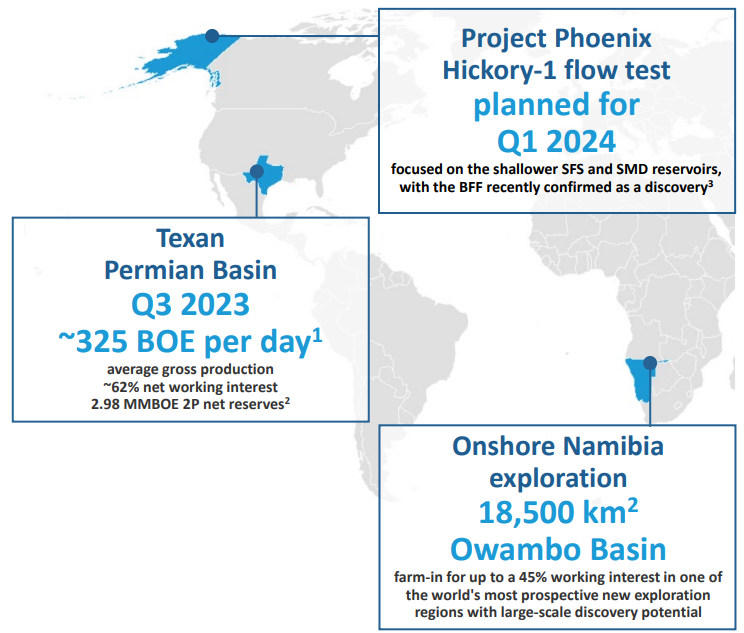

88E’s key oil and gas projects are found in:

- The North Slope Of Alaska, USA - In the next few weeks 88E will be flow testing Project Phoenix where it made a 250M barrel of oil equivalent discovery last year. At the same time it is preparing to announce a prospective resource estimate at its Project Leonis, immediately to the south of USA’s biggest oil field Prudhoe Bay.

- Onshore Namibia - 88E is farming into a 45% interest in ~18,500km2 of ground in a country where majors like Shell and Total Energies have made discoveries offshore. 88E’s ground is right next door to $261M capped Recon Africa.

- Producing assets in Texas, USA - Here 88E is producing ~355 barrels of oil equivalent per day on a gross basis.

More on 88E’s near term catalyst - Flow Test at Project Phoenix

The next major catalyst for 88E is coming from its North Slope assets.

Today, 88E started site preparations for a flow test at its Hickory-1 well.

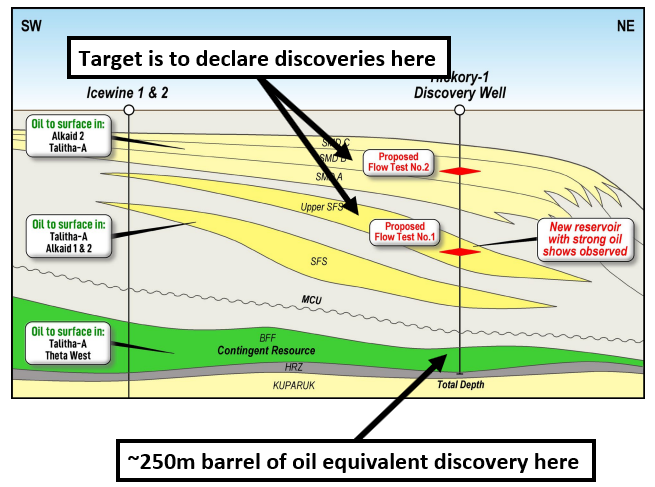

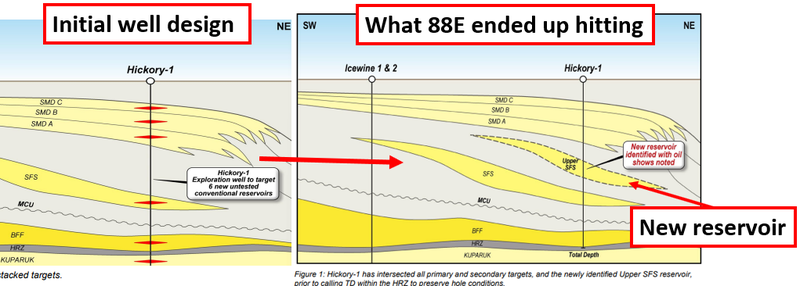

For those who are new to the story, last year 88E drilled the Hickory-1 well, targeting a ~647m barrel prospective resource.

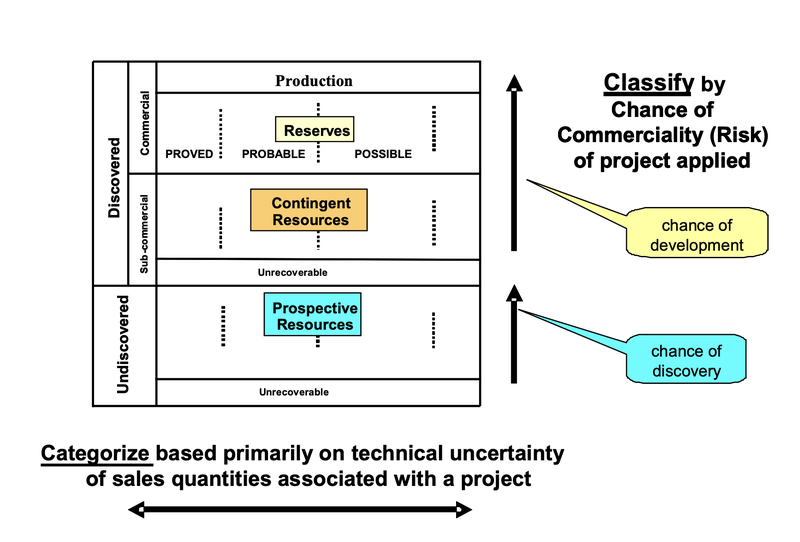

In November, 88E was able to declare a discovery from one of the six reservoirs intercepted - declaring a ~250m barrel contingent resource in the lower BFF reservoir on the project.

Now over the next 8 weeks, 88E will be flow testing the well in shallower reservoirs - a key phase of work and proof point to determine whether or not 88E’s project can be commercialised.

88E’s goal is to try and declare official discoveries and book contingent resources across more of the reservoirs.

What do we know about 88E’s Hickory-1 well so far?

Before flow testing, here is what the Hickory-1 well was able to find:

- ✅ Fluorescence (an indicator of oil presence) - Fluorescence across multiple reservoir units.

- ✅ Oil in samples - Oil shows from multiple reservoir units.

- ✅ Mud gas readings - Elevated mud gas readings across multiple reservoir units.

- ✅ New reservoir unit identified (unexpected) - 88E hit a new reservoir (Upper SFS) unit that sits outside of its current prospective resource estimate.

- ✅ ~450 feet in net pay - 88E hit over 2,000 feet in gross pay and ~450 feet (~137m) of net pay across multiple reservoir units.

- ✅ Average porosity of ~9-12% across all zones - At a high level, porosity measures how much oil and or gas sits inside the rocks. Highlight results came from the Upper SFS and Lower SFS where porosity was between 10.5-16%.

- ✅ Existing discovery across one of the six reservoirs - 88E has already declared a discovery across the Basin Floor Fan (BFF) reservoir booking a 250M barrel of oil equivalent contingent resource.

What we are looking forward to with the flow test

So, Hickory-1 delivered:

- ~137m of net pay,

- An unexpected reservoir discovery (Upper SFS), and

- High porosity levels up to ~16%

The key takeaways from the well were the porosity levels and the unexpected discovery of a whole new reservoir - the Upper SFS reservoir.

Across the multiple different reservoirs, 88E had average porosity levels of ~9-12%.

Porosity is important when it comes to oil & gas because it measures how much oil and or gas sits inside the rocks.

For context on how high that is - ConocoPhillips’ ~600 million barrel Willow oil field in Alaska had porosity levels averaging ~17% in its discovery wells.

(Conoco is one of the oil supermajors, capped at $202BN and is investing over US$6BN on its Willow project to get it into production.)

But back to 88E’s Hickory-1 well - the biggest surprise was 88E intercepting the Upper SFS reservoir.

The Upper SFS was an unexpected surprise to 88E and interestingly, also showed the strongest reservoir characteristics with the highest porosity levels of any of the reservoirs 88E hit.

AND given its a new find - the Upper SFS has never been flow tested before.

It's no surprise that 88E is prioritising a flow test across that Upper SFS reservoir and in one of the SMD reservoirs.

Post flow test, 88E will be in a position where it has data across all six reservoirs and we hope a position where it can book a contingent resource/maiden reserve number across all six of the targets at the same time.

At the moment, as we noted above, the contingent resource for the project currently sits at ~250 million barrels of oil equivalent.

🎓To learn more about oil & gas resources check out our educational article here: How to Read Oil & Gas Resources

What Success Looks like - 88E’s Pathway to Commercialisation

For the upcoming Hickory-1 flow test, the success scenario would be to see flow rates that confirm the project could eventually be developed and put into production.

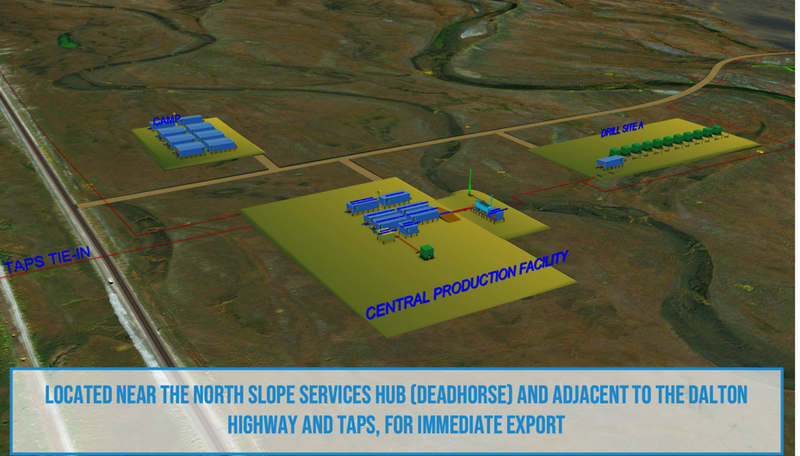

The project sits right next to the Dalton Highway and the Trans Alaska Pipeline, which sends oil down to the lower 48 states of the USA.

The proximity to infrastructure means that if proven commercial, the project could be tied into existing infrastructure in the region relatively quickly and without all of the CAPEX that would have come with building new infrastructure like pipelines and roads.

The video below is a good watch to get a quick overview of the project and how it could be commercialised:

(Source)

From a flow rate perspective, we will be looking for a result that mirrors or is higher than the flow rate of 88E’s neighbour Pantheon Resources from its wells to the north.

Since 2019, 88E’s neighbour Pantheon has run flow tests across three different vertical wells and one single horizontal well:

- Alkaid-1: A vertical well that flowed ~108 barrels of oil per day.

- Theta West-1: A vertical well that flowed an average of ~57 barrels of oil per day.

- Talitha-A: A vertical well that flowed ~73 barrels of oil per day.

- Alkaid-2: A horizontal well that delivered flow rates of ~505 barrels of oil equivalent per day.

Considering 88E’s Hickory-1 is flow testing a vertical well, we have set up our expectations as follows:

- Bull = 150+ barrels of oil per day

- Base = 50-100 barrels of oil per day

- Bear = <50 barrels of oil per day

Most of the market will be focused on the flow rate numbers in isolation, but we think it's worth considering the overall context...

88E will be flow testing a vertical well.

This means flow rates will naturally be lower than the horizontal wells drilled on the North Slope where flow rates can be >1,000 barrels of oil per day.

Vertical wells in the region on the other hand have flowed in the ~50-100 barrels of oil equivalent per day.

Anything above that 100 barrel per day mark would be a green light to come back, drill a horizontal well and commercialise the project with likely 6-12x higher flow rates.

For example, a flow rate of 100 barrels of oil per day could mean 88E can get that up to 600-1,200 barrels of oil per day with a horizontal well.

The basic schematic below shows why horizontal wells have stronger flow rates then vertical wells - primarily because they capture a bigger area of a reservoir:

Outside of the flow rates, we will also be looking at all of the technical data that comes from the flow test as well regarding reservoir quality and the types of oil/gas that are flowing to the surface.

The type of oil field 88E will be looking to prove up

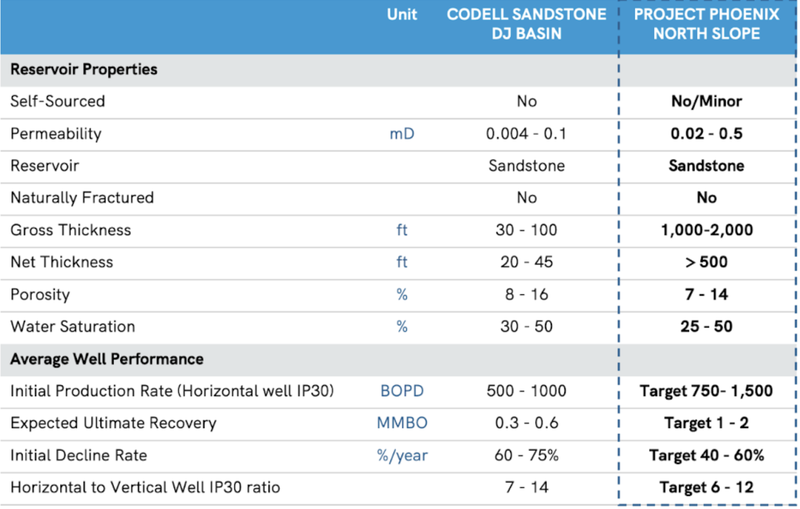

The type of success 88E is ultimately looking for is similar to the flow rates seen in the Codell oil field in the DJ basin, USA.

Wells drilled across the Codell field returned flow rates from horizontal production wells of ~500-1,000 barrels of oil per day from reservoirs that are seemingly weaker than 88E’s.

88E for example has a far bigger net thickness of >500ft compared to Codell at ~20-45ft.

88E also has higher porosity and permeability as seen below:

After the flow test is complete, we will compare the vertical flow rates and technical reservoir characteristics relative to the Codell field side by side.

88E neighbour Pantheon Resources briefly hit a ~$2BN market cap

88E is not exploring its project entirely alone. Its neighbour to the north, Pantheon Resources, is exploring and testing similar reservoir units to what 88E has on its ground.

Between 2019 and 2023 88E’s neighbour Pantheon ran multiple drilling/flow testing programs.

Throughout that period Pantheon’s share price went from ~£0.14 to a high in 2022 of ~£1.50 - an almost ~ 1,000% increase.

At its peak Pantheon’s market cap was nudging ~A$2BN.

That run up to just under A$2BN market cap was also when the company was drilling its Talitha-#A well - the closest well in terms of proximity to 88E’s acreage.

So Pantheon’s 10-bagger share price came when the company had success on the ground right next to 88E. Albeit that was in a different macro environment, with investors having more appetite for risk at the time.

The past performance of Pantheon Resources’ share price is not an indicator of 88E’s future performance. Many factors, like market conditions, share registry and sentiment all affect share price outcomes and there is no guarantee that 88E will go up on a result.

After a brief share price correction in 2023, Pantheon recently started running again after the company put out a maiden resource estimate for its project.

Following that news in late August last year, Pantheon’s share price went from ~£0.10 to ~£0.36 - up over 300%.

Pantheon is currently valued at $457M.

88E drilled Hickory-1 in Q1 2023 and has since declared a discovery with a 250M barrel oil equivalent contingent resource.

Since then, 88E’s share price has gone sideways and then lower...

88E has made progress at the project level but has not experienced a similar share price run to Pantheon's.

Our view is that off the back of the flow test results (assuming they are positive) 88E could have its run similar to Pantheon.

Especially considering the ~300%+ move in Pantheon’s share price in August last year...

That move for Pantheon came off the back of a resource estimate announcement - the same type of announcement we could see from 88E (IF the flow test is a success) where 88E books a bigger contingent resource number OR a maiden reserve number for its project.

It’s important to note however that results are only one factor that affect the share price. Many factors, like shares on issue, market conditions and project sentiment also make an impact.

There is no guarantee that 88E’s share price moves on this news, however we think that the company may be undervalued when compared to Pantheon Resources if a positive result is to be announced.

Right now 88E’s market cap is $98M - almost 4.5x lower than Pantheon Resources.

88E’s Funding Position

A few months back 88E raised $9.9M via a capital raise at 0.45c per share.

We Invested in the capital raise, increasing our position in 88E.

Following the capital raise, 88E held $18.1M cash in the bank (at 31 December 2023) - which fully funds 88E’s ~75% share of the upcoming flow test which 88E estimated at US$11M (on a 100% gross basis).

88E shouldn't have to do a capital raise before the flow test, meaning any investors wanting exposure to the flow test will need to step up and buy on the market.

The timing difference between 88E’s capital raise and when the flow test results are expected also plays a big role in how the share price might react to the news.

The more time that has passed, the more time the shareholder registry has to churn through any of the selling pressure from those who participated in the last capital raise.

It's not uncommon to see investors participate in a capital raise, and then sell a portion of their holdings before a major catalyst to de-risk some of that investment.

The more time that passes after the capital raise, the more time these investors have to get to a position level where they are comfortable holding on through to the the results of a major catalyst.

At a very high level, all of that means that when material news comes out, there is less selling pressure and more room for a share price to re-rate higher.

Of course, the news needs to be positive for this to happen...

Timeline of Hickory 1 flow test newsflow over the coming 6-8 weeks, results etc

After today’s news, below is a timeline of events we expect to see in the lead up to the flow test results:

- ✅ Rig contract signed

- ✅ Permitting for the flow test completed

- ✅ Ice pad and rig commissioning commenced

- 🔄 Rig mobilisation to commence mid-February.

- 🔲 Hickory-1 well re-entered. During this period, we expect to see 88E put out general updates on flowback/well clean up, progress on sampling, and maybe some early indicators on the types of fluids flowing up to the surface.

- 🔲 Flow tests completed

- 🔲 Preliminary flow test results

- 🔲 Final Results flow test results and forward plan.

Flow tests are typically relatively straightforward when it comes to timing.

Assuming there are no technical challenges encountered we expect to see final results from the well toward the end of this quarter/early Q2 2024.

When that time comes we are hoping 88E has proven its discovery is commercial and its share price is trading materially higher than where it is right now as per our 88E Big Bet which is as follows...

Our 88E Big Bet:

“88E makes a large oil discovery that is acquired by a major for over A$1BN”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our 88E Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

88E other key projects - beyond the imminent flow test

88E has a number of other key projects and assets both in the North Slope of Alaska and in Africa.

These projects could come into play over the coming years to add material value to the overall company portfolio.

The two key projects we want to look at today are:

- Project Leonis - Another North Slope Alaska project - where 88E is looking for a farm-out partner.

- Namibia asset - 88E has a 45% interest in an on-shore Namibian asset 70 times the size of its current Project Phoenix.

So, let’s look at each one in a little more detail...

Will 88E drill Project Leonis next? Watch for a farm-out

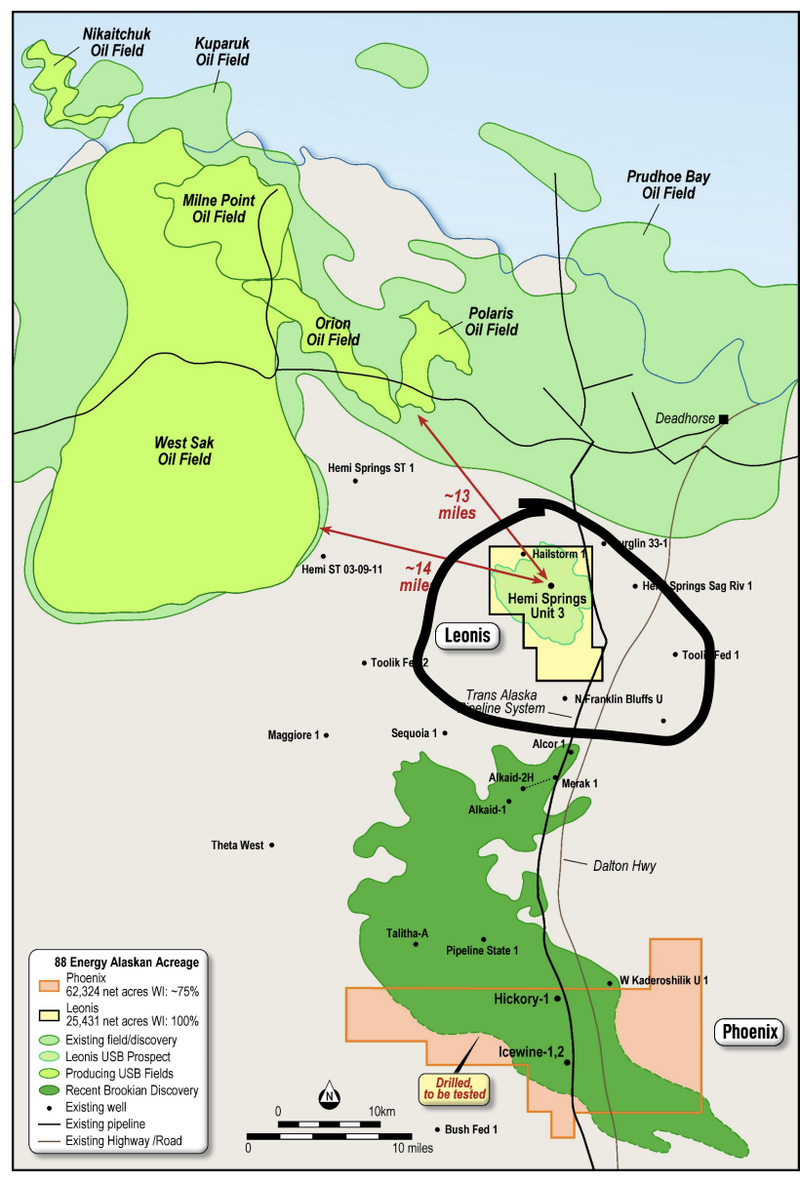

Alongside Project Phoenix, 88E is also working up its other project on the North Slope - Project Leonis.

88E picked up the project back in April last year.

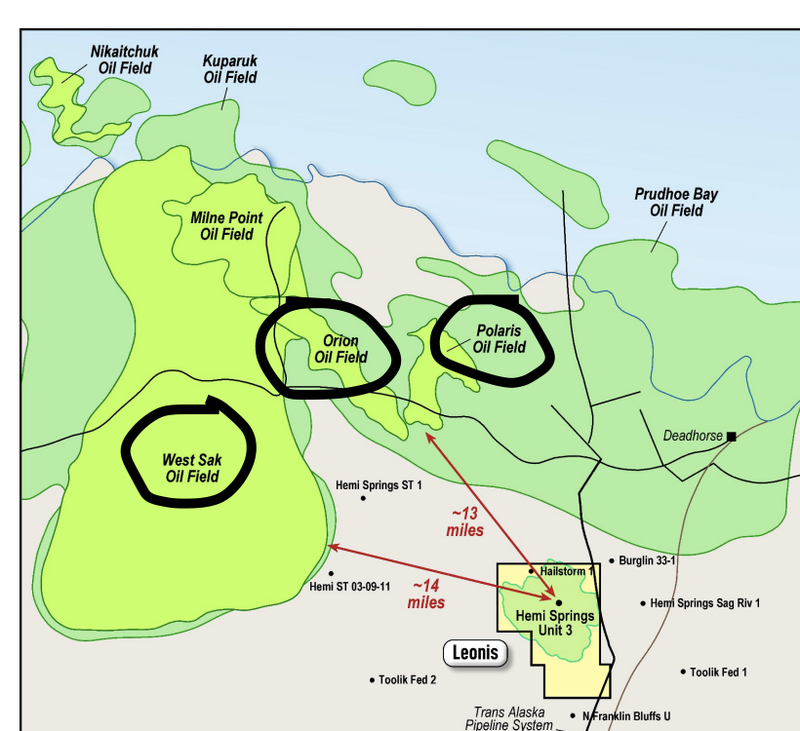

Leonis sits on ~25,600 contiguous acres immediately south of Prudhoe Bay - the USA’s biggest-ever oil discovery.

At the time of acquiring the project 88E knew that:

- The project was fully covered by existing 3D seismic data, AND

- The project had historic exploration data from the Hemi Springs Unit #3 well drilled by ARCO in 1985.

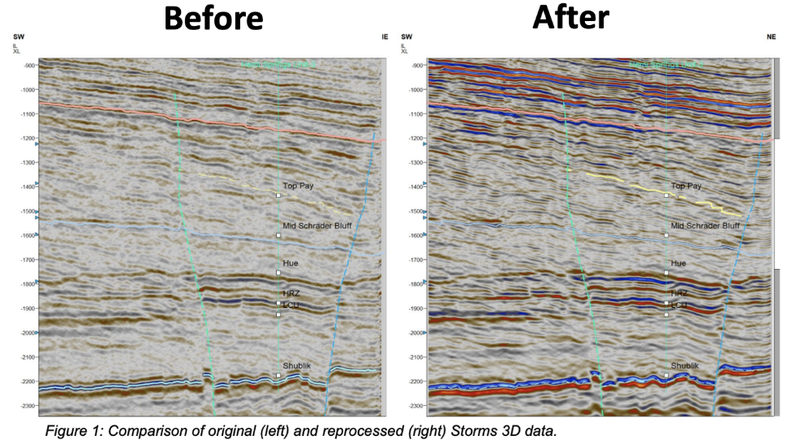

Since then, 88E has focused most of its efforts on modernising all the existing seismic data and re-analysing all the data from the Hemi Springs Unit #3 well.

Since April last year, 88E has:

1. Completed seismic reprocessing, improving the quality and resolution of the data.

The updated seismic data has also defined the extent of the prospective areas inside the project area and where 88E thinks a prospective resource estimate can be defined.

88E is now targeting an independent maiden prospective resource estimate in H1 2024.

2. Analysis has calculated >200ft of net pay across the USB Reservoir.

The well logs from the Hemi Springs Unit #3 well are showing ~200 feet of pay inside the main reservoir target (USB).

88E believes that the well data shows similar characteristics to the two oil fields to the north that are already producing oil (Polaris, West Sak, and Orion fields).

At Project Leonis we will be watching out for:

- Maiden prospective resource estimate (H1 2024).

- Farm out progress (2024) - 88E’s plan is to farm out the project ahead of a drill program in either 2025 or 2026.

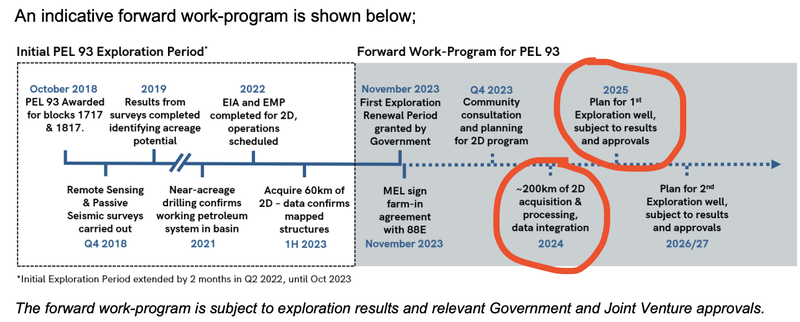

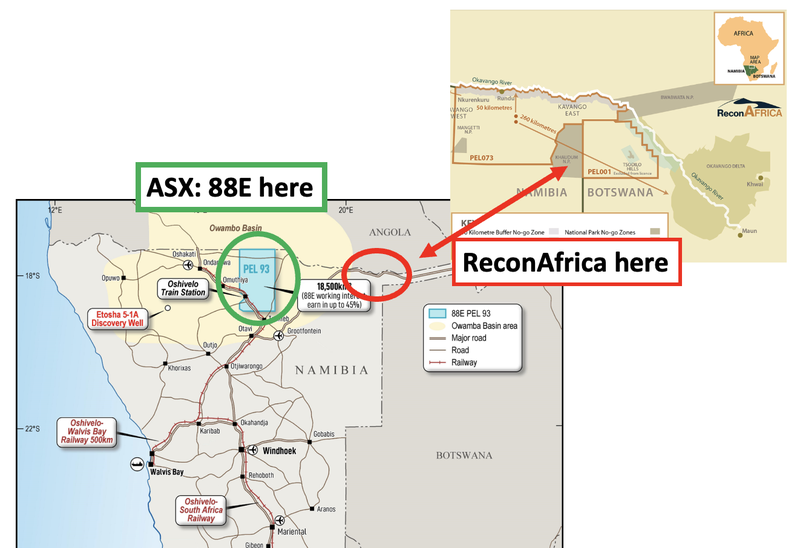

88E’s onshore Namibian asset - next in line

In November last year, 88E announced a farm-in deal for ~18,500km2 of onshore acreage in Namibia, Africa.

The deal, once completed, will see 88E farm-in a 45% stake in the project.

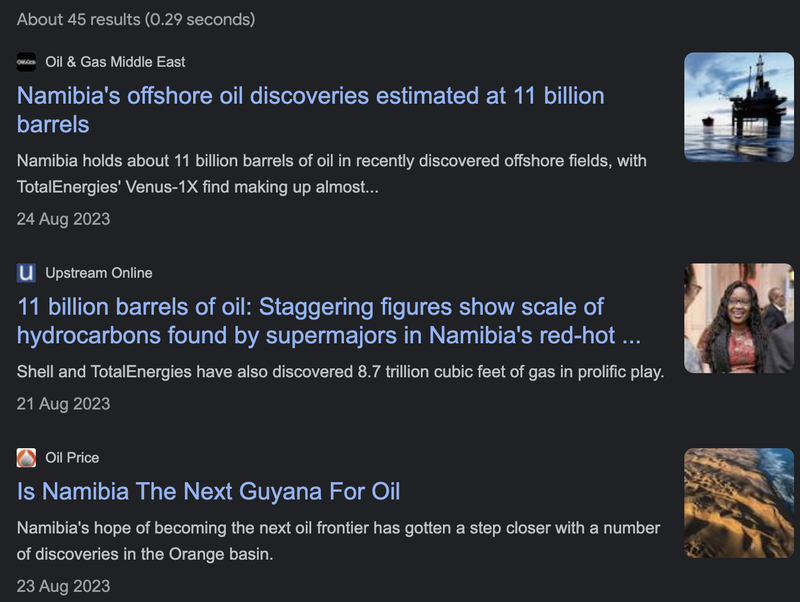

We wrote about 88E’s Namibian acquisition in a previous note here: 88E heading to Africa on frontier oil hunt - following Shell and Totals 11 billion barrel lead.

We like 88E’s Namibian project because:

- Huge ground position - ~70x the size of 88E’s Project Phoenix in the North Slope of Alaska, USA. The project is large enough to host a large resource base.

- Namibia’s fast developing oil and gas industry - recent giant discoveries offshore by TotalEnergies and Shell have put Namibia on the map. Namibia being touted as the next Guyana where US supermajors Exxon and Hess are making discovery after discovery.

- Namibian onshore peer re-rated by over 40x - ReconAfrica drilled its first well at its onshore Namibian project back in 2021. Between 2020 and 2021 Recon’s share price went from CAD$0.30 to CAD$12.50+.

You can read all about ReconAfrica’s 2021 run in this IVZ article we wrote back in March 2021.

- Project vendors linked to Invictus Energy (ASX: IVZ) - IVZ director Robin Sutherland is a part of the team doing the deal with 88E. Robin was also involved in EnergyAfrica, which sold to Tullow Oil for $500M in 2004 and then again with Tullow Oil as it went onto make discoveries across East Africa.

- Early stage with plenty of upside - 88E is getting in on the project at a very early stage. There is scope for 88E to run the seismic surveys, define a large prospective resource and firm up a drill program over the next 12-24 months.

- Strategically located - Sits next to one of Africa’s largest economies, South Africa, which is looking to replace its retiring coal-fired energy generation fleet.

88E’s asset was picked up by its project partner, Monitor Exploration in 2018 - way before any of the major offshore discoveries were made in Namibia in 2022.

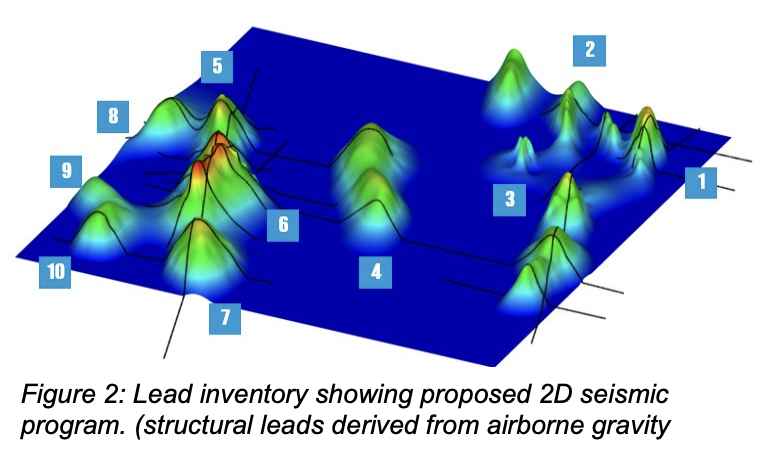

Since 2018, Monitor has run airborne geophysics and used existing 2D seismic data to map out 10 different leads worthy of further follow-up.

88E is now entering the project just before the ~200km of 2D seismic surveys, which we hope will lead to a large prospective resource estimate and lay the groundwork for a major drilling program in the future.

At the moment, 88E is waiting for the Namibian government to approve the farm-in deal.

Below is what we can expect to happen next for 88E’s Namibian project:

88E at 12 month lows - a fraction of its peer's $406M Pantheon Resources & $261M Recon Africa

Right now 88E’s market cap is ~$99M which puts it in a position where it is being valued lower than both its peers in the US and in Namibia.

On the North Slope in Alaska, 88E’s neighbour to the north of 88E is Pantheon Resources.

Pantheon’s market cap is almost 4x 88E’s at ~AU$406M.

In onshore Namibia, the direct comparison is ReconAfrica which holds ground immediately to the east of 88E.

Recon trades with a market cap of ~2.5x 88E’s at ~AU$261M.

We are Invested in 88E because we think that with some good news, the company could bridge the gap with its peers.

IF 88E is able to deliver a material positive result then we would hope that 88E achieves a valuation greater than its peers.

Oil and gas macro thematic getting stronger?

Even in a success scenario for 88E, a key variable for how the market reacts always comes down to how strong the macro thematic is.

🎓Check out our educational article to see how a company's macro thematic influences its share price: Why do shares prices go up?

Generally, there are four key drivers as to why share prices go up:

In particular, “Large Capital Inflows” comes when macro fundamentals for a sector/investment improve significantly and investors start to look for opportunities to capitalise on strength in that sector.

Right now we think that the oil & gas macro thematic could be about to get a lot more interesting.

First some context...

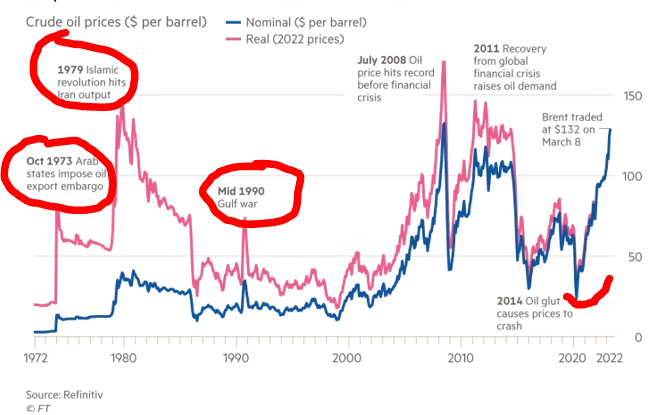

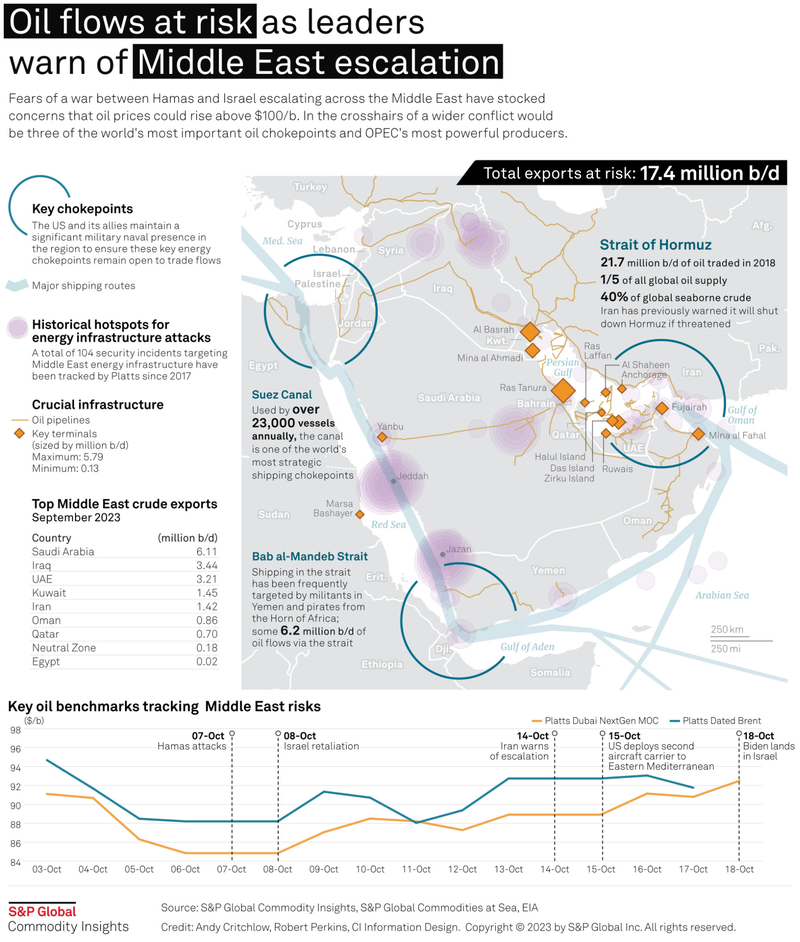

The biggest oil price runs happen when there is instability in oil & gas supply chains...

Back in the late 2000s supply concerns from instability in the Middle East took it from ~US$30 per barrel to US$140 per barrel.

An even bigger move was in the 1970s, when conflict in the Middle East raised the oil price from ~US$3 per barrel to ~US$40 per barrel.

(Source)

The simple fact of the matter is that oil and gas prices are prone to rallying when there is geopolitical instability - just like what we are seeing in the Middle East and in Russia/Ukraine right now.

When Russia/Ukraine conflict began, we saw a spike to ~US$120 per barrel.

Now with more unrest in the Middle East and shipping routes under threat there is a chance history repeats itself and prices rally to levels a lot higher than where they are now.

(Source)

Add on top of all of that the running down of the US strategic reserves and the US (as well as the rest of the world) could be faced with a situation where supply is genuinely at risk.

(Source)

All of this sets the scene for a confluence of events that could deliver big share price re-rates for oil & gas explorers that deliver big material drill results (like 88E) - especially if in the midst of a spike in the oil price.

Oil & Gas outlook

Whilst we are big believers in the electrification thematic and the switch to less carbon intensive energy sources, at a very high level, we think oil & gas is here to stay when it comes to the global energy mix.

Decarbonisation and renewable energy adoption was meant to spell the end for oil & gas demand but the reality couldn't be further from the truth.

Demand for oil is still rising...

(Source)

We expect to see this trend continue and prices to rise due to:

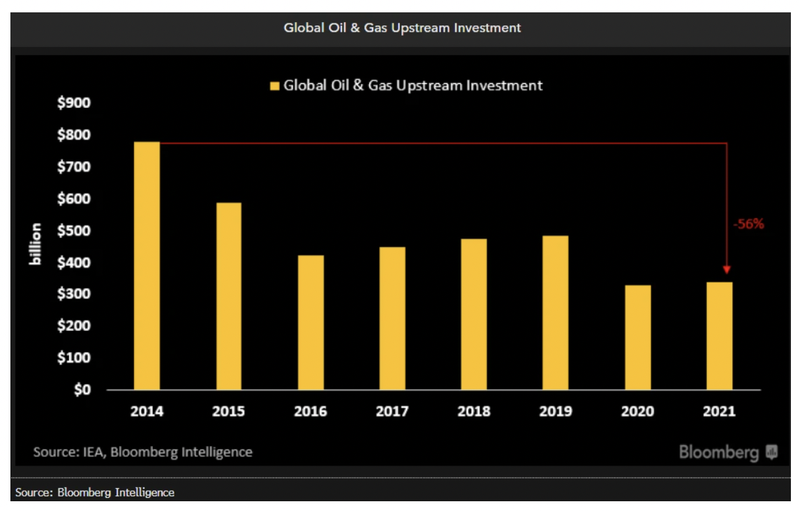

- Decades of underinvestment in new oil and gas supply

- The shift to electrification taking longer than expected, and

- The importance of energy independence for sovereigns.

Below is a summary of the reasons we like Oil and Gas as a macro thematic:

- 10+ years of underinvestment in new supply - The oil and gas markets have seen over 10+ years of underinvestment in new supply as the world focused on a shift towards electrification (source). For context, in 2021, global upstream oil and gas investment is down ~58% from 2014 levels.

- Energy security is now a real issue - The fallout from the Ukraine/Russia conflict hit oil and gas supply chains all over the world. Russia is one of the world's largest oil and gas producers and has become an “at risk supplier” with the European continent feeling the crunch the hardest. Now there is also the risk of supply disruptions from the Middle East. This means the world could need NEW supply to fill in the supply gap while also fulfilling increasing demand.

- Electrification of energy mix taking longer than expected - The rush to decarbonise has pushed capital towards more “green energy” technologies. The build out of new wind/solar/nuclear etc has been a lot slower than expected and so demand for oil and gas is still increasing.

Our 88E Investment history

We first started covering 88E as a portfolio position in July 2020.

Over the years, we have seen multiple big drill events and, at one point, saw the company’s share price rise by over 1,000%.

Over the years, we have executed our tried and tested Oil & Gas Investment Strategy, which is to:

- Invest early, as the company is in the early exploration work stage.

- Increase our Investment, as the company de-risks the project through permitting, geophysics and target generation.

- Top Slice, if the share price runs in anticipation of the drill results.

- Free Carry, into the drill results while still maintaining a large position to be leveraged for a positive drilling outcome.

- Evaluate our position post-drilling results.

It's a strategy that we have executed both successfully and unsuccessfully over the years but, over the long run, has worked well for us.

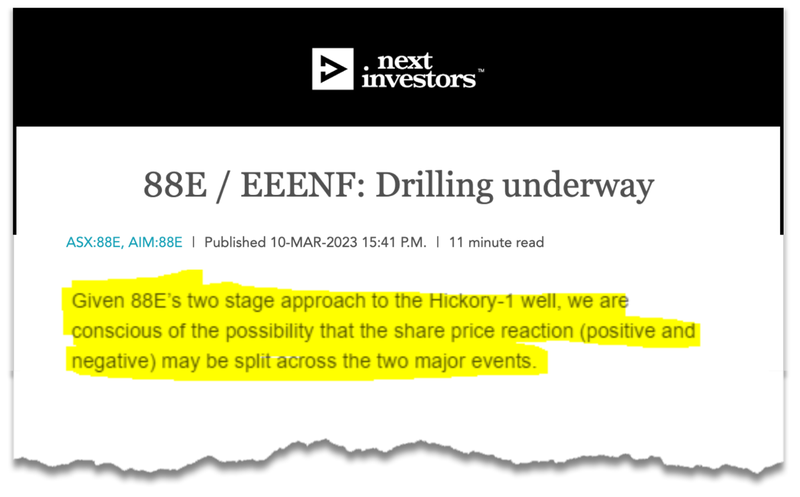

The difference with the Hickory-1 well was that 88E opted to take a two-stage approach to drilling and completing the well.

Instead of drilling and going straight into a flow test, 88E chose to break it up into a drill first, test later approach.

We mentioned in our notes in the lead-up to the Hickory-1 drill last year that the share price reaction could be split over two catalysts -

(Source)

We are hoping that the market reaction we failed to see after the drilling event last year, comes after the imminent flow test.

All we need is for 88E to deliver a materially positive result.

We increased our Investment in 88E in the most recent capital raise at 0.45c per share.

We haven't sold any of our holdings since our latest Investment.

Depending on how the share price moves between now and the final flow test results, we will be looking to implement our Oil & Gas Investment Strategy to the best of our ability.

What are the risks?

For 88E’s flow test, the primary risk is whether or not Hickory-1 can produce commercially viable flow rates.

As a result, the key risk for 88E is “commercial risk”.

As with any oil and gas project, making a discovery is just one part of the equation.

After a discovery is made companies need to be able to show that the oil flows to surface at rates that make the project worthwhile to develop.

If the flow rates are underwhelming then the project could be considered uneconomic by the market and could lead to a move lower in 88E’s share price.

Another key risk going into the flow test is “Funding risk”.

88E had $18.1M in cash at 31 December 2023, which should be enough to fund its 75% share of the flow test.

The funding risk comes AFTER the flow test is complete with 88E likely to spend most of its cash on the program.

88E already has ~24BN shares on issue. 88E is rightly considering a share consolidation, but obviously only if it's in the interests of its shareholders, and it would need to be done at the right time, which will be driven by results on the ground.

What you should read next

To help better understand this content here are some resources we recommend:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.