88E to Drill 1.6BN Barrel Project in the Coming Days

88 Energy (ASX:88E) is set to drill the Merlin-1 well in the first week of March.

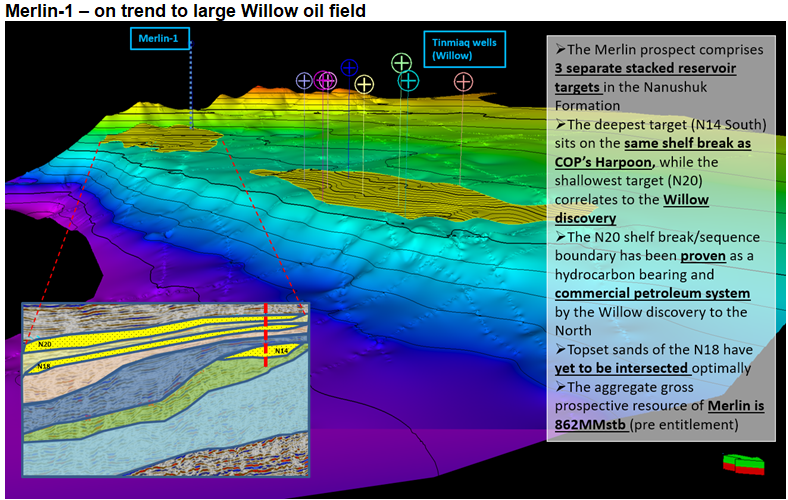

Merlin-1 targeting 645 million barrels of gross mean prospective resource, over three separate stacked reservoir targets, and is on trend to existing discoveries immediately to the north and south of the project area.

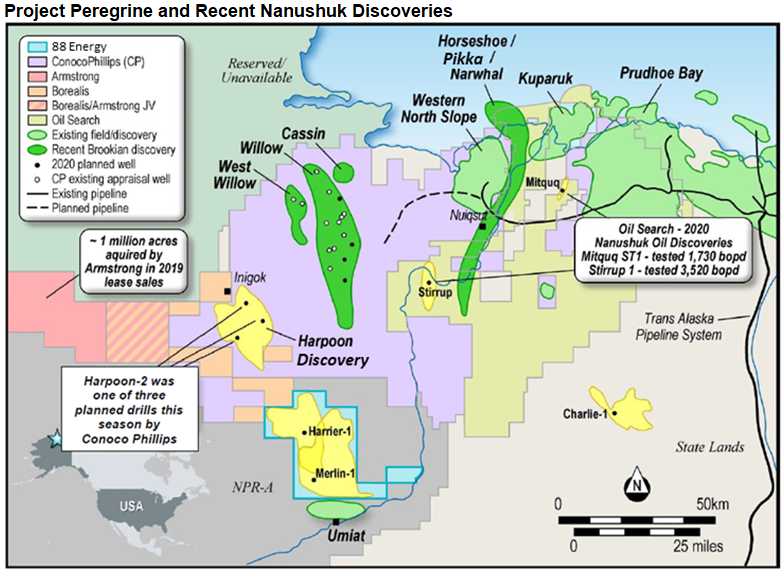

Merlin-1 is part of Project Peregrine, which is home to a total of 1.6 billion barrels of prospects (gross unrisked prospective oil resources).

This project encompasses nearly 200,000 contiguous acres and sits on the North Slope of Alaska - well known for a number of large oil resources.

This could be a company making well for 88E, and it looks like perfect timing to be drilling, given oil is in the spotlight on the back of the US deep freeze energy crisis.

Following a cap raise of $12M at $0.008 per share, adding to its existing cash reserves of AU$14.8M as at 31 Dec 2020, 88E has all the funding in place to drill-test a combined aggregate target of over 1 billion barrels of recoverable oil.

Beyond the imminent Merlin-1 well, a second well, Harrier-1, is due to be drilled in late March/early April subject to scheduling, permitting and related government approvals.

Harrier-1 is targeting a gross mean prospective resource of 417 million barrels.

It's also worth noting that Project Peregrine and the upcoming wells are not everything for 88E.

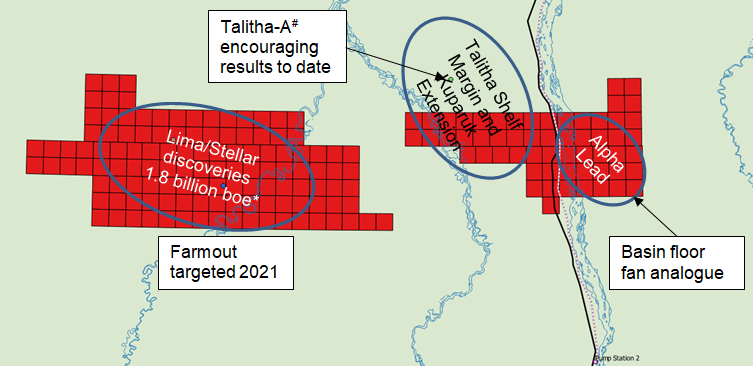

Most recently, 88E was buoyed by Pantheon Resources PLC’s (AIM:PANR) news that it had just completed drilling its Talitha-A well, situated close to the northern border of 88E’s central acreage position at Project Icewine.

Pantheon is scheduled to flow test Talitha-A over multiple horizons after receiving encouraging results.

Several of the prospective horizons in Talitha-A are interpreted to extend into 88 Energy’s acreage. Further positive results are likely to increase the value of Icewine, which is going to help the company proceed with a farm out on that project in the coming months.

With that in mind, let’s look at the immediate catalyst at hand.

The catalyst: 88E set to drill Merlin-1

The drilling of 88E’s Merlin-1 well, part of Project Peregrine, is now just a few weeks away, as the company looks to target the extension of the highly successful Nanushuk play.

88 Energy has a 50% working interest in Project Peregrine, off the back of a recent farm-in, whereby 88E is carried for the first US$10 million (of an estimated US$12.6 million total cost) for the Merlin-1 well.

Merlin-1 is scheduled for spud in early March 2021 and as stated is targeting 645 million barrels of gross mean prospective resource.

Flow testing of Merlin-1 is planned if wireline logging confirms a discovery.

A second well, Harrier-1, is intended to commence immediately following completion of operations at Merlin-1, subject to results from Merlin-1, schedule and permit approvals.

Harrier-1 is targeting gross mean prospective resource of 417 million barrels and is expected to cost ~US$7m.

88E’s Umiat Oil Field

Success here could be the start of a company-making development, with the proven resource at the recently acquired Umiat Oil Field contributing to additional value.

88E announced the acquisition of Umiat, an historic oil discovery, made in 1945 in shallow Brookian (Nanushuk) sandstones, in January.

Umiat is located immediately adjacent to the southern boundary of Project Peregrine.

The Umiat-23H well was flow tested at a sustained rate of 200 barrels per day with no water in 2014 by Linc Energy (max rate 800 barrels of oil per day).

Gross 2P reserves independently estimated at 123.7 million barrels of oil (94 million barrels attributable to 88E’s 76% net revenue interest) by Ryder Scott on 1 December 2015.

Project Icewine also on the radar

While Merlin-1 and Project Peregrine are the immediate focus, 88E is also buoyed by recent events occurring near Project Icewine.

Pantheon Resources PLC (AIM:PANR) has just completed drilling the Talitha-A well, situated close to the northern border of 88E’s central acreage position at Project Icewine as indicated below.

Pantheon is scheduled to flow test Talitha-A over multiple horizons after receiving encouraging lot results.

Several prospective horizons in Talitha-A are interpreted to extend into 88 Energy’s acreage as shown above.

Jay Cheatham, Pantheon’s chief executive said any one of the four zones at Talitha could be company makers.

Should Pantheon experience success with Talitha-A it could also be a game changer for 88 Energy as it should increase the value of the group’s territory at Project Icewine, as well as making it more attractive to potential joint venture partners with a view to sharing exploration costs in the future.

What's happening to the oil price?

This drilling event couldn’t come at a better time, with oil prices continuing to rise. The price of crude hit a new 12 month high of US$63.70 per barrel on Tuesday and continued growth is anticipated.

Also working in 88E’s favour is the adverse weather conditions being experienced by some of America’s most prominent shale oil-producing regions.

This has led to continuing supply constraints, as the Arctic blast spreads across America’s largest shale oil patch, which has caused crude flowing from wells to slow or halt completely.

Analysts and traders have hinted that several hundred barrels a day of output in the Permian Basin could be impacted by well shutdowns that began Thursday.

With the Texas shutdown in full swing, Alaska, which is unaffected by this weather, could be where America turns to for supply.

The final word

88E is just weeks away from spud at Merlin-1, in what could be a defining moment for the company.

Success here, would set the company up for fully funded planned work for the rest of the year.

It’s worth repeating that 88E has all the funding in place to drill-test a combined aggregate target of over 1 billion barrels of recoverable oil.

It all starts with Merlin-1’s target of 645 million barrels of gross mean prospective resource.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.