ARN drilling to define a maiden JORC rubidium/lithium resource

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 845,000 ARN shares and 220,000 Options at the time of publication. S3 Consortium Pty Ltd has been engaged by ARN to share our commentary and opinion on the progress of our investment in ARN over time.

Long time readers would know that a major theme across our portfolios is backing junior explorers who are chasing metals that will drive the green energy revolution.

In particular, we like to back those who have projects targeting the highest impact commodities.

Our junior exploration investment Aldoro Resources (ASX:ARN) is chasing these metals - namely rubidium, lithium, nickel and copper.

With the lithium price up over 500% this year and trading at all time highs, ARN has picked the perfect time to go in and drill its WA rubidium/lithium projects.

It's been a while since we wrote about ARN but that doesn't mean the company has been quiet.

In the middle of January this year, ARN kicked off a 3,730m RC drill program across 66 drill holes at its Niobe rubidium/lithium project in WA.

This RC drilling followed up a rock chip sampling program where ARN returned sample grades of up to 0.93% rubidium and 0.86% lithium oxide.

A few weeks back, ARN announced that 45 of these holes had been completed and importantly ALL of the drill holes had intersected pegmatites - with the thickest to date being 26m.

At this stage, none of the assays are back from the lab, but we expect this news to start coming through over the coming weeks.

ARN is drilling this project with the ultimate aim of converting its exploration target into a maiden JORC resource - so all of the pegmatite intersections are encouraging.

With another ~21 holes left in the drilling program and all of the assays still pending, ARN has a busy few months coming up. Hopefully it is filled with rubidium/lithium mineralisation and a maiden JORC resource.

We have set out our expectations for the assays as follows:

- Excellent: Average rubidium grades at or above the 0.15% upper range ARN set for its exploration target, with the project also proving out a lithium resource at the same time.

- Good: Average rubidium grades above 0.07% and some indication of lithium mineralisation.

- Poor: Average grades <0.07% rubidium and no lithium mineralisation in the assays.

After the drilling is completed, the RC rig will move straight into ARN’s OTHER lithium pegmatite project (Wyemandoo).

Similarly to the Niobe project, ARN sampled rock chips here grading 1.82% rubidium and 0.66% lithium oxide.

When we first launched ARN in our portfolio we also mentioned that we wanted to see ARN drill its nickel project. With nickel prices also trading at 10 year highs ARN has a good balance of prospects exposed to the battery metals thematic.

In late July 2021, ARN also started a 5,000m drilling program at its nickel project — the first drill core intersected 1.7m massive and semi-massive sulphides.

For now, though, the focus with ARN is on its rubidium and lithium projects.

In summary, based on ARN’s announcements released to market so far, over the coming months we expect the following:

- Complete pegmatite drilling at the Niobe project (early/mid March)

- The drill rig to immediately to move to the Wyemandoo project for more pegmatite drilling (straight after Niobe drilling ends)

- Assay results from both projects, where we will be on the look out for large pegmatite intersections (next 3 months)

- JORC resource on Niobe (next 3 months).

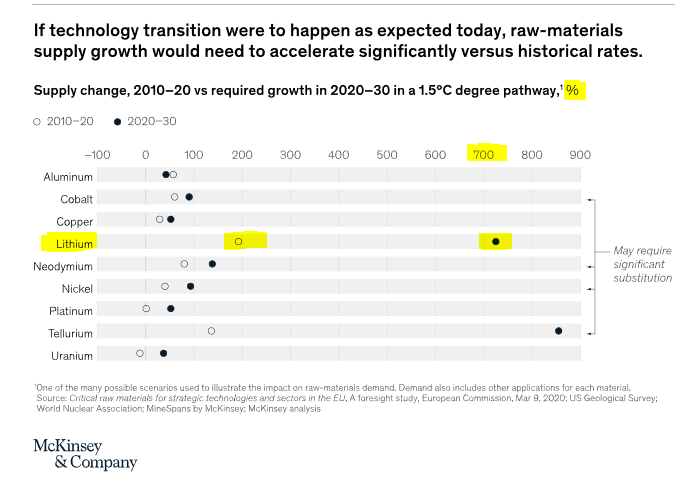

Global consulting group McKinsey in a recent note titled “The raw materials challenge: How the metals and mining sector will be at the core of enabling energy transition” listed lithium as one of the most critical and highlighting that the industry needs to ramp up production by over 7x its current output to meet expected demand in the next 10 years.

We think ARN is rightly so focused on its rubidium/lithium project.

In today’s note, we will provide a snapshot of where ARN is right now and use this as an opportunity to launch our 2022 “Investment Memo” which will detail what we want to see ARN achieve in 2022.

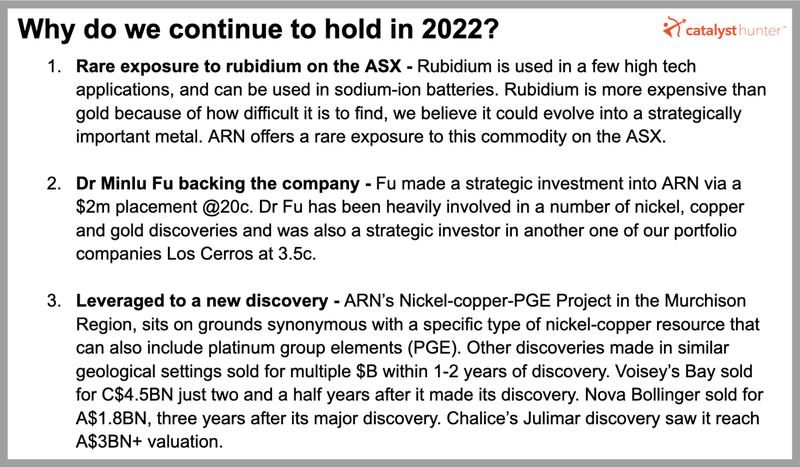

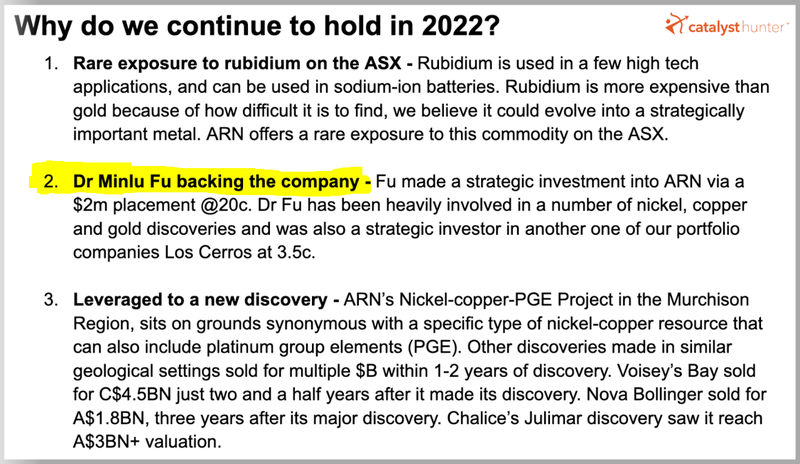

Here is a screenshot from our Investment Memo detailing why we continue to hold ARN in 2022:

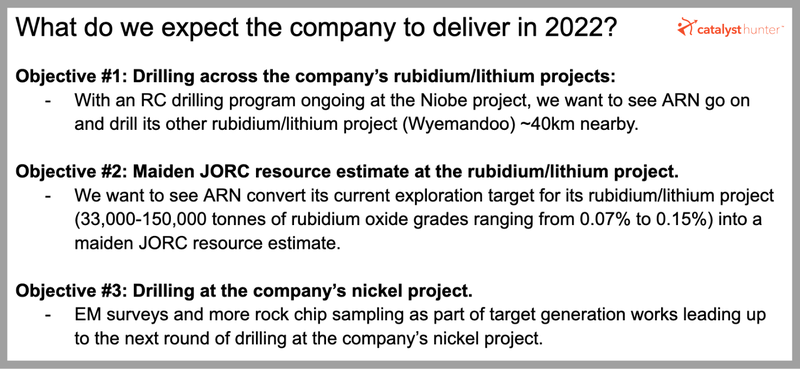

We have also attached a screenshot of the key objectives we want to see ARN achieve in 2022.

To see our full investment memo, which also gives a brief overview of what ARN does, why we are invested in ARN, and the key risks to our investment thesis, click the button below.

We'll use the Investment Memo to assess the company’s progress over 2022 and examine how our investment thesis plays out throughout the year.

Where is ARN currently at with its rubidium/lithium projects?

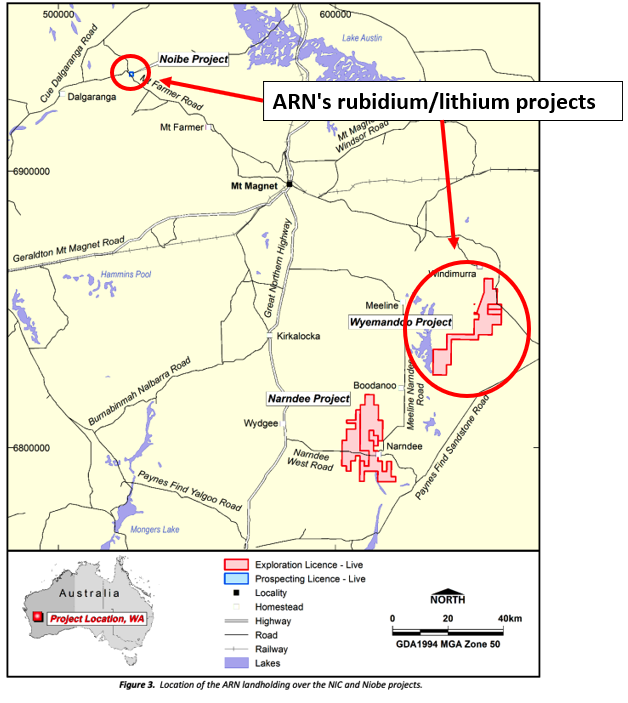

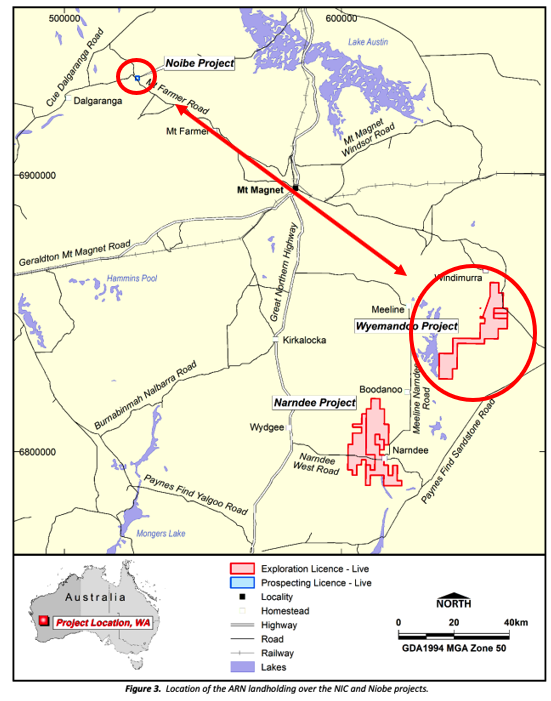

The focus for ARN right now is drilling its rubidium and lithium targets across the Niobe and Wyemandoo projects.

You can see each project on the map below, Niobe is a relatively small piece of land to the north west (shaded blue), while Wyemandoo is a larger block of land in red to the east:

The current round of drilling is for a planned 3,730m RC program across 66 drill holes at the Niobe Project (north west corner of the map above).

The drilling program was largely designed based on historical drilling results in the area and a recent round of sampling that returned average rock chip sample grades of up to 0.93% rubidium and 0.86% lithium oxide.

ARN has so far drilled out 45 of these holes.

Most importantly, every single drill hole has intersected pegmatite ranging from ~1m all the way up to the most recent round of results which showed 17m, 18m and 26m of pegmatite intercepts.

The significance of the intercepts to date is that pegmatites are often seen as the host rock for lithium mineralisation.

In the case of ARN, it is a combination of rubidium and lithium that is being targeted.

Rubidium has a wide range of industrial applications including specialty glasses in fibre optic cables, GPS systems, and night vision gear, while it also has potential to be applied in sodium-ion batteries. Check out our last note where we wrote all of this more extensively.

As for all of these intercepts, ARN hasn't received any of the assays yet.

Ultimately as with any drilling program, the proof is always in the assays, which will confirm how much lithium and how much rubidium are in those intercepts.

ARN’s ultimate goal for the drilling program, once all the assays are received, is to put together a JORC resource estimate for the project.

Also mentioned in our last note, was ARN’s exploration target (after reviewing all of the historic drill data from the 1980s) set at 33,000-150,000 tonnes of rubidium oxide grades ranging from 0.07% to 0.15%.

And that’s not even mentioning the lithium potential yet.

ARN proving out a lithium resource alongside the rubidium resource makes the deposit just that much more valuable.

This exploration target basically sets a benchmark for the type of grades we want to see from the drilling program. Anything below that 0.7% figure can be seen as below expectations and 1.5% or above will be seen at the upper range of expectations or above it.

Those who have been following the ARN story will know that we invested alongside renowned geologist Dr Minlu Fu and we highlighted that this was a reason we continue to hold ARN in our 2022 Investment Memo below.

With respect to this rubidium project, Dr Minlu Fu commented on the historical grades alone indicating commercial potential.

He noted that the current biggest discovery in the world was the Tiantangshan rubidium deposit in mainland China with a resource of ~100,000t at average grades of 0.109% rubidium.

This provides some context for what the $35M market capped ARN is going after — a project that could rank as one of the biggest in the world.

What about the other rubidium/lithium project?

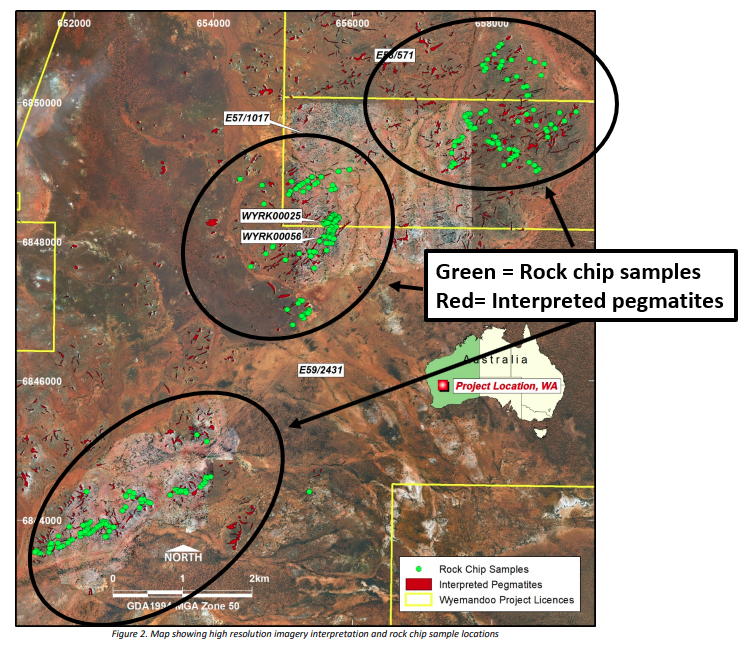

The second tenement package in ARN’s rubidium/lithium ambitions is the “Wyemandoo” project.

You can see how close this package of tenements is to the area ARN is currently drilling.

ARN picked up this ground in late 2021 and immediately went to work with a rock chip sampling program. It collected over ~275 samples during this period, adding to the previous ~53 rock chip samples collected.

Of these 275 samples, ARN has now received 188 of the results with average grades for all of the samples of 0.166% rubidium and lithium grades of 0.12% lithium oxide.

The stand out results so far have been ~1.82% rubidium and 1.05% lithium oxide.

ARN is now planning to move its RC rig directly from the Niobe project once the 66 hole RC drilling program is done, straight into the Wyemandoo project area.

The below map shows where all the sampling was done and where the pegmatite targets have been mapped to be targeted by RC drilling.

The drilling that will get done here is mostly greenfields, with no previous drilling to go by.

We don't have any set expectations here but the ~10km long and 6.5km wide zone where ARN are looking for rubidium and lithium gives an idea of the size and scale of a potential discovery being made here.

If ARN can announce a resource at the Niobe project and then follow it up with a new discovery here at Wyemandoo we suspect the market might start to get seriously interested.

What’s next for the rubidium/lithium projects?

More drilling to get done 🔄

ARN is yet to finish the drilling at the Niobe project, with another ~21 holes to go; we expect this to take at least another 1-2 weeks.

The RC rig will then move onto the Wyemandoo project where ARN will continue doing rubidium/lithium targeted drilling.

Assays pending from all drill holes 🔄

ARN is still yet to receive all of the assays from the last round of drilling done towards the end of the year.

What do we want to see from the assays?

With the ultimate aim for the drilling program being to convert its exploration target into a JORC resource we have based our expectations off of the exploration target (33,000-150,000 tonnes of rubidium oxide grades ranging from 0.07% to 0.15%)

Below we have set out three scenarios for what we think would constitute excellent/good/poor results:

- Excellent: Average rubidium grades at or above the 0.15% upper range ARN set for its exploration target, with the project also proving out a lithium resource at the same time.

- Good: Average rubidium grades above 0.07% and some indication of lithium mineralisation.

- Poor: Average grades <0.07% rubidium and no lithium mineralisation in the assays.

A JORC resource estimate is in the works if the assays are strong.

If the drilling results are as expected by ARN, then the company has flagged that it will commission a resource estimate to try and convert the exploration target into a maiden JORC resource for the project.

You can read more about what a JORC resource is and why it's important here.

What about ARN’s Nickel, Copper and PGE project?

We mentioned earlier that ARN did some drilling at its 100% owned nickel, copper PGE project in WA.

Our primary reason for making our initial investment in ARN was for it to go on and make a large scale nickel discovery at this project, we liked that the project sat in a part of Australia considered to be the largest mafic-ultramafic complex.

This type of ground is seen as being consistent with a specific type of nickel/copper resource that can also include platinum group elements (PGE).

What did ARN do here?

In late July 2021, ARN started a 5,000m drilling program at its nickel project, which after the first drill core intersected 1.7m Massive and Semi-Massive sulphides.

ARN continued drilling the project all the way up to the end of the December quarter and has now received all but five of the assays from a round of diamond drilling that was done late in the year.

This is normal given the drilling was done around the new year and was unlikely to be submitted to the labs until mid January.

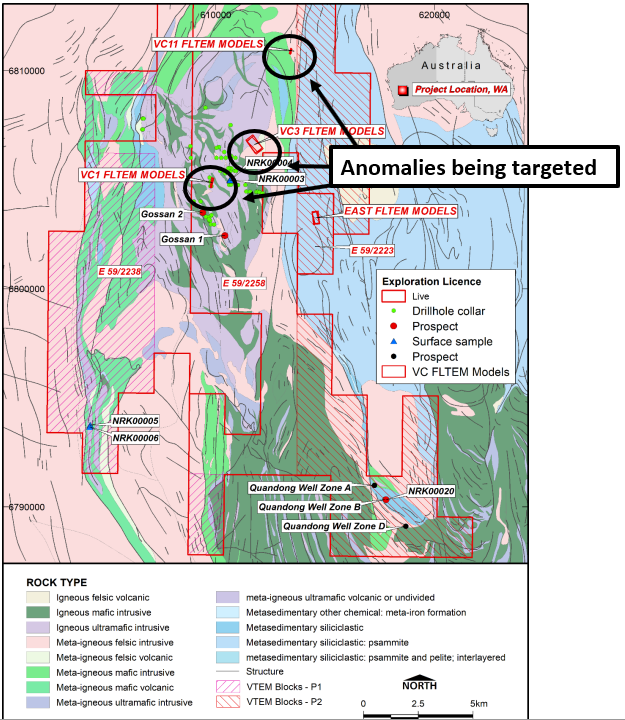

ARN at this project was primarily targeting three EM conductors it had located from previous EM surveys.

Drilling would initially focus on the VC1 and VC11 drill targets but as soon as drilling started and ARN intersected the massive and semi-Mmassive sulphides the VC3 target was added into the drilling program.

The project area had been previously explored by Maximus resources but drilling at the VC11 and VC3 structures had never been done.

Previous drilling at the VC1 target by Maximus had missed the EM conductor by ~40m.

Ultimately the aim for ARN was to try and work out whether or not the EM conductors were in fact nickel bearing sulphides or if they were just non economic/graphite based anomalies.

All three of these anomalies sit within 2.5-7.5km of one another, this was the reason the VC3 target was added to the drilling program. If anything was found at VC1 and VC11 then there could have been a good chance there was something in between at VC3.

Having established what ARN is looking for, let's take a look at what it has found.

So how were the results?

Based on the table below it looks to us like ARN has done ~4,700m of drilling at the end of the December quarter.

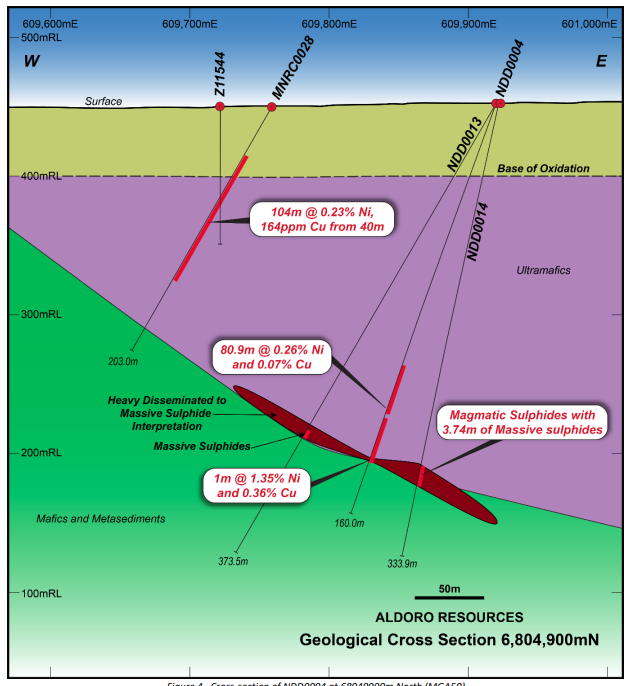

Some of the most notable interceptions from the drilling program were as follows:

- 2.05m @ 1% Nickel + 0.15% Copper from 112m.

- 80.9m @ 0.26% Nickel + 0.07% Copper from 192m. (Shown in the image below)

- 55.6m @ 0.19% Nickel + 0.06% Copper from 246m.

- 1m @ 1.35% Nickel + 0.36% Copper from 272m.

We think that despite the intercepts not containing anything that is really high grade or any indication of a major nickel discovery as yet, ARN got exactly what it was looking for from the drilling program.

The program was primarily designed to test the EM conductors and to see if there was any nickel in them. The assays proved that this is the case.

To us this looks like a good starting point for future drilling programs which can be targeted using the learning from this round of drilling.

Making large scale nickel discoveries can take a long time with several rounds of drilling before a discovery can be announced. ARN’s results are not indicative of a discovery as yet but would have increased ARN’s understanding of the grounds it is working with.

What’s next for the nickel, copper and PGE project?

More assays pending 🔄

Another batch of results were reported just last week and we can see that there are only two more assay results pending from the drilling program.

We expect these to come through within the next 2 to 4 weeks.

EM Surveys to define more drilling targets 🔄

With drilling completed, for now, ARN has now moved its focus away from further drill testing and back into EM surveys to refine the target areas.

Exactly what you would expect from an explorer after the results received from the program.

If the company had hit nothing then it would be back to the drawing board but the results ARN received are enough to warrant further target generation works in this part of its nickel project.

The results from these surveys should start to trickle through and we expect ARN to get back to the Nickel project to do some geochemical sampling as part of target generation works for the next round of drilling here.

Our 2022 ARN Investment Memo:

Below is our 2022 investment memo for ARN where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our ARN Investment Memo you’ll find:

- Key objectives for ARN in 2022 (shown above)

- Why we invested in ARN

- What the key risks to our investment thesis are

- Our investment plan

To access the ARN Investment Memo simply click on the button below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.