What is a JORC resource? How does a company define a resource?

Published 25-FEB-2022 16:42 P.M.

|

2 minute read

If you are new to investing in early stage mining companies you might have heard of the term ‘JORC resource’.

A JORC resource is the standard used for measuring the in-ground size of a mineral deposit that a company may have discovered.

After making a discovery, companies will do a bunch of exploration work to determine HOW BIG and WHAT GRADE the deposit is.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

Once enough drilling data has been collected, and the company hits what they think could be the ‘edge’ of a deposit, the company will announce a new (maiden) JORC resource estimate.

Companies with an existing JORC resource looking to improve the economics of their project will also undertake exploration work, collect data and then announce what is called a ‘JORC resource upgrade’.

Because JORC is the standardised method of evaluating the size and grade of a mineral deposit, it allows investors to compare and contrast other companies with a JORC resource of the same mineral.

A JORC resource can underpin a company's value, as it defines the in-ground mineralisation that has been discovered, and without a JORC resource, the company cannot undertake feasibility studies to evaluate the economics of the project.

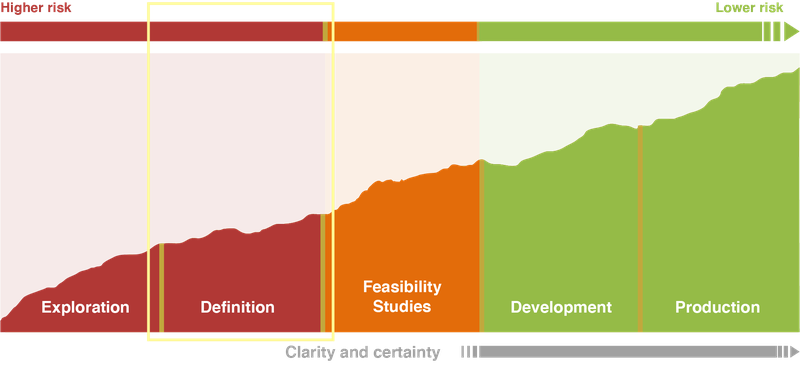

For a mining company to progress from exploration to development a JORC resource needs to be defined and eventually be upgraded into a reserve category.

This is called the definition phase:

Generally, whether or not a project is economic is dependent on the size of the JORC resource and its grade.

The size is important as mines are capital intensive and require economies of scale.

And the grades are important because they determine how much mining needs to happen to be able to extract that particular commodity.

Spot prices for respective metals also alter the value of the JORC resource.

A high copper spot price due to increased demand, may mean a relatively low grade JORC resource is still considered economically viable, and vice versa.

How to Read a JORC Resource

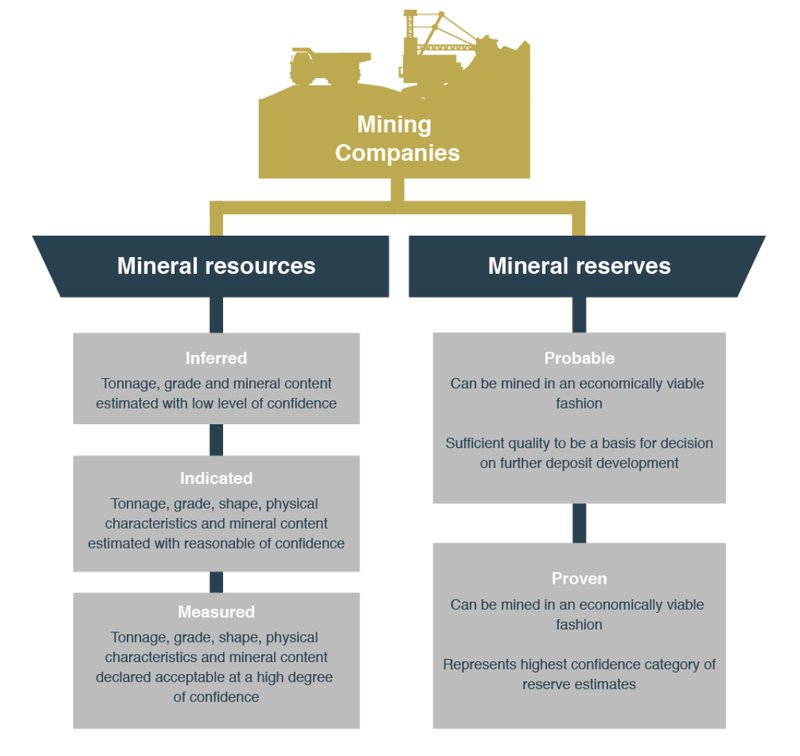

Discovered deposits can be classified as resources or reserves. The difference being how confident the company is that the deposit is valuable and extractable. In summary, reserves are better than resources... and here is why:

Resources are potentially valuable, with reasonable prospects for eventual economic extraction. Resources can be classified as inferred, indicated or measured for miners.

Reserves are valuable, and legally, economically and technically feasible to extract. Reserves can be classified as proven or probable for miners.

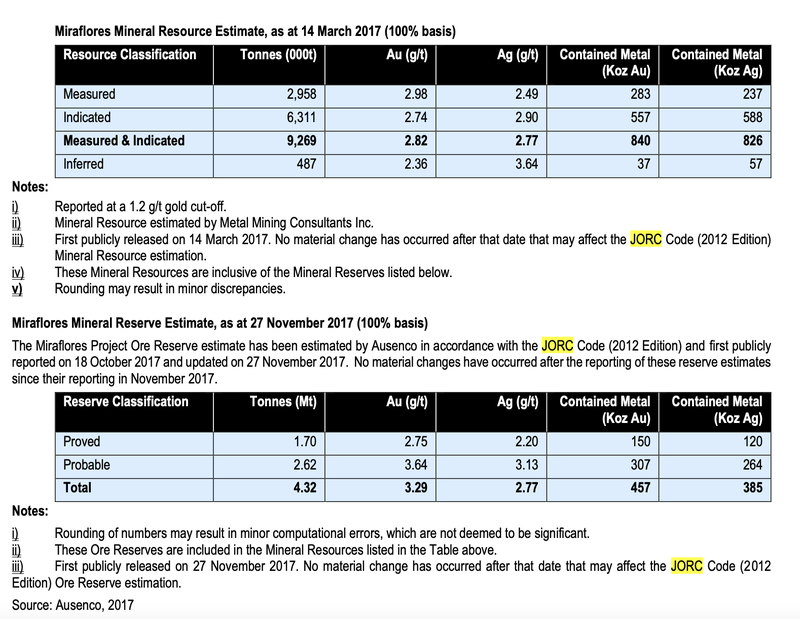

Here is an example of a JORC resource estimate from the Miraflores deposit for our gold Investment Los Cerros (ASX:LCL). As you can see, the classification is split into a ‘resource’ and a ‘reserve’ - with the reserve being the minerals that can be mined in an economic fashion.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.