Surfing the commodities cycles

Published 27-JAN-2024 09:46 A.M.

|

15 minute read

How does a company go from an exploration junior to a profitable, producing mine?

It takes lots of money and lots of time.

And it usually takes multiple bull cycles for that particular commodity.

So how do bull cycles in particular commodities help progress mining hopefuls?

Mainly they allow the company to be able to raise enough money to lurch through another “mining company lifecycle” stage and finally get into production.

Anyone who has been in the small cap markets for over 10 years has seen multiple commodity bull cycles.

Iron ore, gold, lithium, uranium, nickel are examples of recent or current bull cycles.

Cycles come and go, come again and go again.

So how do we assess how well a particular mining junior “surfed” a bull cycle for a particular commodity?

The goal of a mining junior, who finds themselves in a bull cycle for their commodity, is to make as much progress as fast as possible, while the going is good.

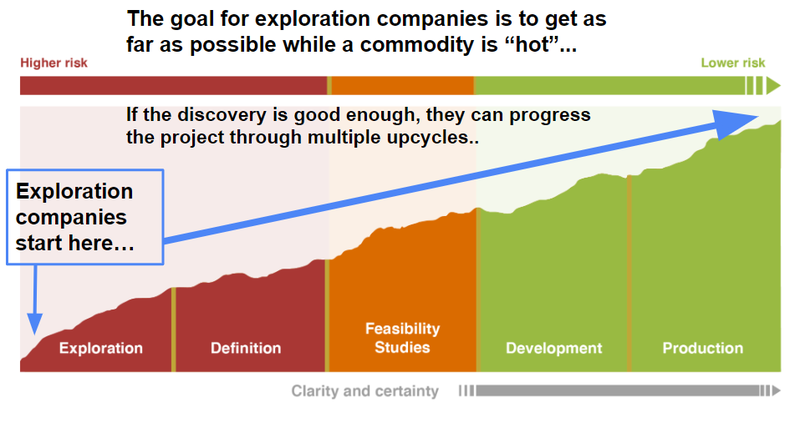

A mining hopeful trying to build a mine is gauged on how efficiently they move through these stages on the mining company lifecycle:

(and a bull cycle for their commodity is the time to accelerate)

Progressing through each stage is expensive, especially development and production (actually building the mine).

Exploration - need money to drill drill and drill some more, in the hope of making a discovery.

Definition - if or after a discovery is made, need money to drill around the discovery to understand its size.

Feasibility studies - need money to commission economic and engineering studies on building a profitable mine from the deposit.

Development - need money to actually build the mine.

Production - need money to run the mine... and hopefully start making some profit.

The most efficient and least dilutive way for a company to raise money to progress through the mining company lifecycle stages is to raise capital during the “upcycle” for a particular commodity.

This is when everyone is interested in buying shares on-market AND participating in cap raises.

Positive sentiment creates capital flows into a sector/commodity.

Capital flows come in two different forms:

- Capital flow into the company bank accounts - companies find it easier to raise capital because there is a wave of cash looking to invest in the sector

- Capital flows via on-market buying of shares - Company share prices go up as investors look to get exposure to companies already operating in the sector.

capital flows are always into sectors that have macro tailwinds, positive sentiment, and some momentum.

Next step is to use that cash to progress as quickly as possible through as many lifecycle stages as possible while sentiment is high.

...and ideally ending up with a good chunk of cash in the bank when the down cycle eventually starts, in order to still make some progress during the down cycle.

...while waiting for the upcycle to return.

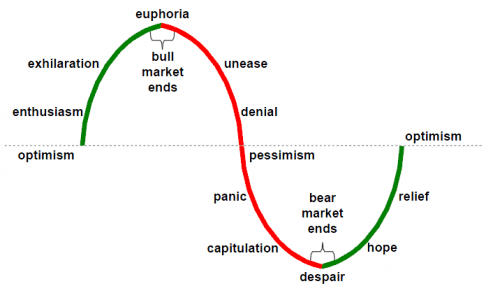

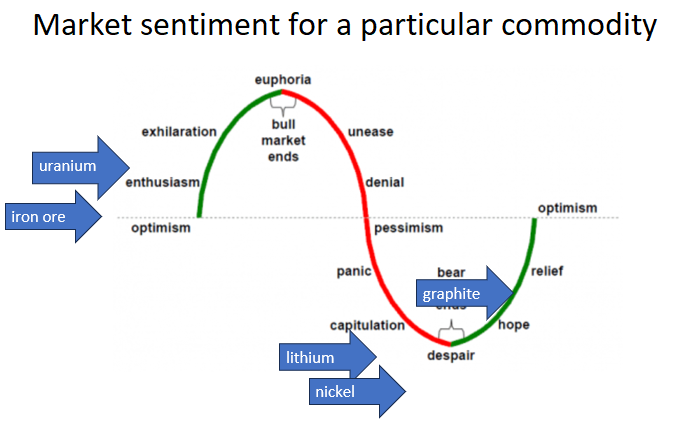

A up or down “cycle” for a particular commodity is the same as a broader stock market bull/bear cycle shown below:

Here is where we think a few commodities sit on the cycle, uranium is definitely on the upswing, and after a woeful 2023, lithium feels like it finally hit a “capitulation” point last week:

Exploration companies versus later stage companies during commodity cycles

An “exploration” company is “pre discovery”, meaning they have a couple of exploration projects, possibly in different commodities, and their objective is to drill one of the projects and make a discovery.

A “later stage” company is already sitting on a discovery and needs money to progress through the stages to build a mine.

When a commodity starts to cycle into favour:

- Exploration companies will switch focus to OR acquire a project in that commodity

- Later stage companies will use the renewed interest to raise money and accelerate progress.

If a company already made a discovery and some progress in the previous bull cycle for a commodity, their goal for any new cycle will be to raise money and try to progress through as many lifecycle stages as quickly as possible before the commodity cycles down again.

Later stage company’s share prices usually run first when a new commodity bull cycle starts, because they already have a project and are closer to possible production.

Many exploration companies will likely try to acquire an exploration project in the in-favour commodity during the upcycle for that commodity.

...in the hope of making a discovery and progressing the project as fast as possible during the upcycle.

A material new discovery in an upcycling commodity can really move an explorer's share price.

The job of a pre-discovery small cap board is to deliver value for shareholders.

And the best way to do that is to make a discovery during a bull cycle for a particular in-favour commodity.

If a discovery is made, the share price will likely react well and the company can raise enough cash to progress the discovery through the mining company lifecycle stages:

Exploration, definition, feasibility, development and finally, if all goes to plan, “production”.

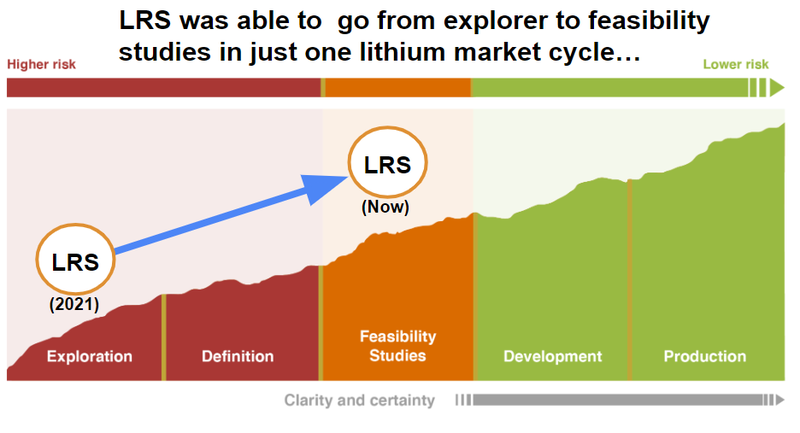

LRS was a perfect example of this.

LRS switched its focus to it’s lithium project when lithium was hot, made a discovery, went up over 1,000%, raised over $100M, and moved well into the studies phase to build a mine.

Even though lithium sentiment has turned for the moment, LRS now has a real project, $34M in the bank to keep progressing their project while lithium sentiment takes a breather, and LRS trades 10x above where it was before switching into lithium.

Now THAT is how to ride a commodity upcycle.

So how do we assess other companies' success during a commodity bull cycle?

Later stage company: how many stages of the mining cycle did you progress through? How much cash did you end up holding once the cycle cooled? Is it enough to keep progressing things until the next cycle upwards for your commodity.

Exploration company: Quality of project acquired for the in-favour commodity, were acquisition terms good? Did you make a discovery? If not, did you at least quickly try a lot of drilling? Did you end up with cash in the bank as the commodity cycles downwards? Enough to have a go at a new project?

This is not the rule, some companies commit to exploring for just one commodity no matter which commodity is currently in an upcycle, usually because their management have previous success in that commodity

...or they genuinely believe their project could be a world class discovery, even in a downcycle.

If an exploration company can make a world class discovery, even in a down cycle for that commodity, the share price will still rerate upwards

(it has to be a seriously face-melting discovery though).

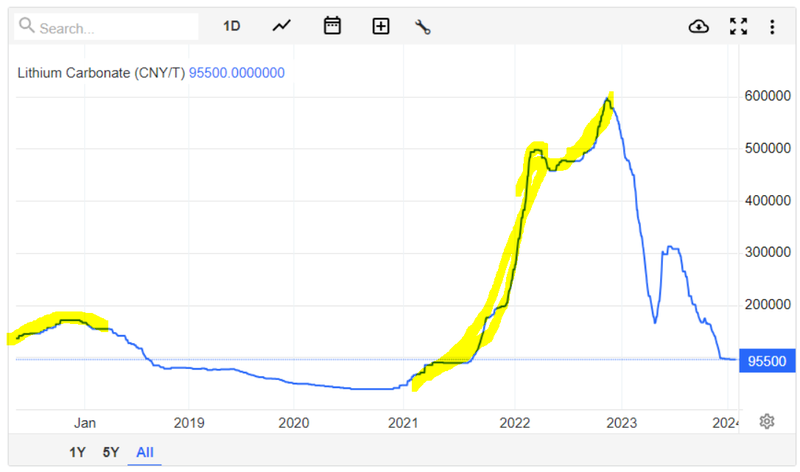

We have seen two lithium cycles now, 2017-2019 and 2020-2022.

Now, we are seeing uranium getting started on its first proper upcycle since 2006.

Gold and graphite look like they are simmering to go...

Iron ore too.

Here are some examples of past commodity upcycles and companies that “surfed” them well and made material progress:

(upcycles shown in yellow)

Lithium

Lithium had an initial kick between ~2017-2018, that was when a lot of the existing mines around the world started ramping up - think Pilbara Minerals Pilgangoora mine and the Greenbushes mine.

Then between 2020-2022 the lithium sector went into the “euphoria stage” with the price going up ~10x.

One of our portfolio companies Vulcan Energy Resources (ASX: VUL) perfectly rode that bull market by rapidly taking its projects from the “exploration” stage all the way through to the end of the feasibility study stage.

VUL and its lithium project came onto the ASX in 2019 when lithium sentiment was terrible.

(a counterintuitive move but it ultimately paid off)

The lithium project was acquired by KRX, who originally had a crack at exploring for zinc and copper in Norway but failed. KRX changed its name to VUL after acquiring the lithium project.

By the end of the lithium bull market, VUL ended up with hundreds of millions of $ in cash in the bank and a cornerstone investment from one of the biggest automakers in the world (Stellantis), feasibility studies completed and ready to find financing to build their project,

Not to mention 10x above where it was when it first acquired the lithium project.

Top marks to VUL for surfing the lithium upcycle.

Another big win for us in the lithium sector was Latin Resources (ASX: LRS).

LRS managed to make a lithium discovery in early 2022 and by the end 2023 had already upgraded its JORC resource 2x, announced a preliminary economic assessment (feasibility study) and raised over $100M.

LRS at its peak was up ~2,332% from our Initial Entry Price.

On the flipside, we still hold a bunch of junior lithium explorers that drilled but failed to make a meaningful discovery during the lithium upcycle and are now might be back to the drawing board - not every Investment will be lucky enough to pull off an LRS style feat.

Uranium

Uranium junior Bannerman Resources surfed the 2006 to 2008 uranium bull market.

Surfed a tidal wave...

Bannerman IPO’d at 20c back in 2005, and declared a maiden JORC uranium resource in 2006 just as the eye watering uranium price run was underway - it hit an all time high of $41.40 just two years later in 2007.

Bannerman was officially the best performing stock on the ASX in 2006.

We didn't have any Bannerman stock, but currently hold HAR, which is drilling to extend its JORC uranium resource in Senegal, just as the uranium price is starting to upcycle.

...and HAR has the same Managing Director in charge who presided over Bannermans epic run during the great 2006 U price surge - Peter Batten.

Peter was responsible for taking Bannerman’s African uranium projects from exploration into the feasibility stage during the 2006 U run.

We are hoping he can do it all again with HAR during the current U bull run.

HAR has been listed since February 2022... way before uranium was cool.

Gold

An example in the gold sector was ASX listed De Grey Mining (we were not shareholders).

Just before the big run up in the gold price in 2020, De Grey discovered what is now the Hemi project.

Between 2020 and the end of 2023, De Grey put out multiple resource upgrades and raised hundreds of millions of $.

Along the way, De Grey published a scoping study in 2021, a Pre-Feasibility Study (PFS) in 2022, and finally a Definitive Feasibility Study in 2023.

Now the project has a ~12.7m ounce gold resource and the company is capped at ~$2.2BN.

Top marks for surfing the 2020/2021 gold run (wish we had Invested in this one).

Iron Ore

A small cap success story in the Iron Ore space was Champion Iron.

Champion, back in 2016, had a share price of ~20c per share, and at the bottom of the iron ore cycle (2016-17) the company picked up a previously operating iron ore mine that had been put on care and maintenance in Quebec, Canada.

(again, counterintuitive timing, but worked out very well).

At the bottom of the cycle, the company worked around debt refinancings, signed an offtake deal with Glencore and eventually, by the end of 2019, had refinanced the asset completely and taken 100% control.

Along the way, Champion slowly ramped up production at the project and released feasibility studies on expanding the mine.

By the time the iron ore price was back above US$100 again, Champion was in a position where it had a producing asset that had been optimised for success.

Champions share price went from ~20c in 2016-17 to briefly trade at ~$8.75 per share while iron ore was upcycling.

Another top mark for surfing a commodity upcycle (and yet another where we didn’t hold any shares)

Copper

Small cap copper success stories aren’t the easiest to find but they do exist...

One small cap company that managed to take advantage of the battery metals boom & copper price growth between 2020 and 2023 was Carnaby Resources.

Until late 2021, Carnaby was a small cap explorer chasing discoveries across multiple assets in Australia.

Then in December 2021 the company announced a discovery at its copper project in QLD.

Off the back of the discovery Carnaby’s share price went from ~25c per share to highs of ~$2.25 per share.

Between 2022 and the end of 2023, Carnaby made multiple follow up discoveries and managed to take its project from the exploration through to a maiden JORC resource and is currently working on a scoping study for the project while copper is moving sideways.

Oil and Gas

A recent small cap success story from the oil and gas sector was Perth based Norwest Energy.

Norwest had been working toward a drill program at its Lockyer Deep project for a number of years but managed to time its drill program perfectly.

Norwest started drilling in late 2021 when oil and gas prices were rallying as COVID lockdowns all around the world were being lifted.

Then Norwest started flow testing the project in 2022 just as global gas prices went exponential off the back of the Russia/Ukraine conflict.

By the end of 2022-23 Norwest was under a takeover offer from Mineral Resources at a ~$497M valuation.

At the lows for the oil & gas market Norwest shares were trading as low as ~0.3c per share, by the time the Mineral Resources takeover happened, shares were trading at >7c per share.

The key is to be Invested in the right companies when the cycle turns...

Based on the above examples it appears maximising the chance for a 10 bagger involves already holding exploration companies or later stage companies BEFORE a commodity upcycle.

No one can predict when upcycles will happen. Which means a lot of boring holding and waiting around.

20 years ago, back when we first started investing in small cap exploration stocks, the goal was to double a $500 pizza delivery paycheck in a time frame of a couple of months (which barely ever worked).

10 years ago we really started to understand exploration investing, and learned about backing the right management teams, quality projects and broader bull and bear market cycles - taking more of a “five year view” for Investments.

After the most recent bull-bear market cycle, and now having held a few later-stage resource companies in our portfolio for a while, we are starting to appreciate how many commodity bull cycles it actually takes to go from an explorer to a producing mine.

And also why many exploration companies switch focus when a new commodity cycles upwards.

Long term share price strength depends a lot about how many stages of a project lifecycle can be progressed during a commodity bull cycle.

For explorers it’s about making a discovery at the right time and progressing as fast as possible.

It’s important to have plenty of cash in the bank to still make progress while a commodity is cycling downwards.

And for investors, to still be holding a position when that particular commodity cycles back into favour.

What we wrote about this week 🧬 🦉 🏹

Evolution Energy Minerals (ASX:EV1)

Also on Monday, our graphite Investment Evolution Energy Minerals (ASX: EV1) announced that due diligence has been successfully completed by the world's biggest anode producer, China based BTR, for a strategic investment of ~A$3.6M into EV1 for a 9.9% stake.

Following China’s graphite export controls and USA tax incentives to limit Chinese materials into electric vehicles - EV1 is primed to benefit.

Suddenly major Chinese suppliers can’t sell to the US anymore. US car makers can’t buy from them anymore.

...and how does the Tanzanian government and a junior ASX stock fit into solving all of this?’

Get our deep dive note on EV1 below.

Read: EV1 Acts to Thaw US-China Battery Spat. Supply Chains Intact

Mandrake Resources (ASX: MAN)

On Monday, our US clean energy materials Investment, Mandrake Resources (ASX:MAN) announced a lithium brine discovery in Utah.

... and in parallel, MAN will shortly be mapping and sampling for uranium (the “commodity of the moment”) across its project area too... .

It just so happens that MAN’s project area, while being highly prospective for lithium, also happens to be in the most significant uranium mining district of Utah.

DLE testwork results are due shortly too...

Read: MAN Delivers Lithium Discovery in USA Brines. MAN Uranium Fieldwork Commencing.

Neurotech International (ASX: NTI)

Our biotech Investment Neurotech International (ASX: NTI) is developing an oral drug treatment that is being clinically trialled with children suffering from some of the negative effects of autism.

Autism costs now make up $6.7BN per year of Australia’s NDIS budget.

Pending the Phase II/III results due this quarter, NTI could be in an enviable position.

We think it’s the type of large total addressable market, safe and effective treatment that would get big pharmaceutical companies very interested.

Quick Takes 🗣️

GLV: GLV working with more than 20 oil & gas targets in Peru

GAL: GAL now running IP surveys ahead of 2024 drill programs

PRL: PRL Completes PFS, Updates Project Timelines

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc: The Future Money: https://future-money.co/

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.