NTI autism clinical trial results in next 8 weeks - can it save billions of dollars in NDIS funding needs?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,400,000 NTI shares at the time of publishing this article. The Company has been engaged by NTI to share our commentary on the progress of our Investment in NTI over time.

Big cost blowouts.

The looming threat of a funding cut.

While providing important support for Australians with disabilities, Australia’s National Disability Insurance Scheme (NDIS) is in a precarious position right now.

The number one disability amongst NDIS participants?

Autism.

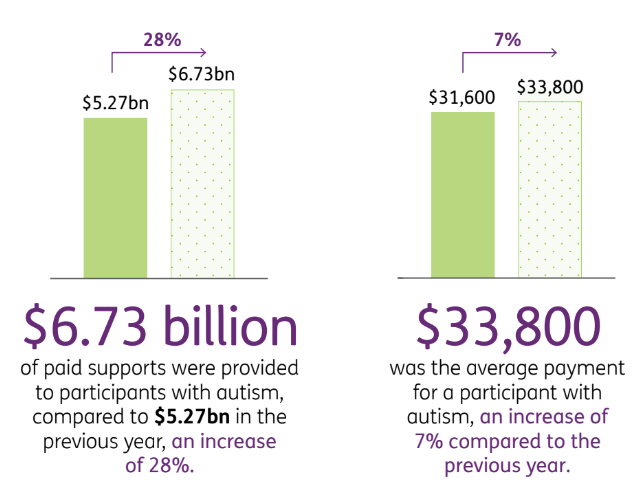

Autism costs now make up $6.7BN per year of the NDIS budget.

Last month, NDIS cost blowouts relating to Autism treatment was hitting mainstream media:

The NDIS provides an average annual payment of $33,800 per patient to NDIS participants with autism.

This $33,800 per year is to cover ongoing support services such as speech pathologists, psychologists, neurologists, occupational therapists and carers.

(and this is JUST in Australia alone)

But there could be a cheaper and more effective way to significantly improve the wellbeing of children with autism (and their parents, carers) AND reduce the need for so many expensive support services.

It has the potential to save the NDIS billions of dollars in costs.

Our biotech Investment Neurotech International (ASX:NTI) is developing an oral drug treatment that is being clinically trialled with children suffering from some of the negative effects of autism.

NTI’s treatment has the potential to significantly improve socialisation, communication, and adaptive behaviours for children with autism.

NTI is currently running a Phase II/III clinical trial to further establish its efficacy and safety as a treatment for some of the negative aspects of autism.

NTI already completed a Phase I/II trial which showed material reduction on a “severity of illness” scale over 52 weeks - so much so that ALL the parents of kids participating in the trial opted to voluntarily continue using the treatment AFTER the trial finished.

If NTI can advance its autism treatment to the commercialisation stage, we would expect it to be highly cost effective compared to the current $33,800 per year that the NDIS pays.

NTI is due to report results from its Phase II/III Autism Spectrum Disorder (ASD) trial in the next two months.

NTI is not only focussed on autism though, it is clinically trialling its oral treatment across various neurological disorders in children.

Given the various trials that are at various stages, NTI has plenty of newsflow to come over the course of 2024.

Aside from the autism trial results, and also in the next two months, there’s a second major catalyst, NTI’s Phase I/II Rett Syndrome trial results.

Another company, Neuren Pharmaceuticals re-rated 2,000% on commercialising a treatment for that disorder, and is capped at $2.9BN.

In the context of Neuren - good results for NTI could eventually help secure strong commercial terms under the orphan drug regime.

We think both clinical catalysts (autism and Rett syndrome) provide excellent “shots on goal” for NTI, each with their own differing commercialisation pathways.

With our eyes on both these near term clinical trial results, today NTI released its quarterly to Dec 31st, which showed NTI had a cash balance of $4.5M.

NTI says this is sufficient to run all active trials as previously indicated to the market.

NTI’s share price has started a bit of a run over the last 6 weeks, moving from ~6c in mid December to ~8c now.

This might be in anticipation of the clinical trial results in the coming weeks...

It might be partly down to Neuren’s continued success...

Or it could also be down to the growing body of evidence that NTI’s treatment is working...

Here are more details on the two upcoming NTI catalysts:

Catalyst #1 - Autism - due this quarter

NTI’s treatment has already shown strong signs of efficacy and safety in a previous Phase I/II Autism Spectrum Disorder (ASD) trial.

The results were strong enough for NTI to move quickly into the next phase.

Even more significant, was the extension of that Phase I/II trial for another two years - we think this is a very good indication that parents and carers saw a clear improvement in their child’s symptoms.

If it works, then staying on NTI’s treatment is the best idea.

The Ethics Committee overseeing the trial agreed.

We’re hoping the Phase II/III trial will further validate those results - and unlock potential commercialisation options for NTI.

And IF these Phase II/III trial results are positive - the implications are both clear and significant.

We think NTI, the NDIS, the Australian taxpayer and especially patients and families all stand to benefit from a successful trial here.

As of June 2023, 35% of NDIS participants have a primary disability of autism, at least 610,000 people.

For autism, the average payment is $33,800 and the annual cost of the payments stands at $6.7BN, a 28% increase on the 2022 numbers.

Which would make it one of the fastest growing areas of NDIS expenditures.

And the care that is provided for with this $33,800 payment often includes speech pathologists, psychologists, neurologists, occupational therapists, carers and other support services.

So if NTI is able to prove the efficacy and safety of its treatment in these upcoming trial results...

AND commercialise the treatment...

This could in turn reduce the reliance on these services - and it could all be made possible by an orally administered dose provided by NTI.

Any solution commercialised by NTI domestically would not only solve a pressing problem in Australia but could be extended overseas to other countries - including the lucrative US market.

Pending these Phase II/III results due this quarter, NTI could be in an enviable position.

We think it’s the type of large total addressable market, safe and effective treatment that would get big pharmaceutical companies very interested.

Suffice to say, a lot hinges on these results, and the market may have picked up on this during a period of improved sentiment for biotechs - NTI is up ~150% in six months and nearly 50% in the last three weeks:

Catalyst #2 - Rett Syndrome - due this quarter

NTI is also undertaking another trial on a child neuropsychiatric disorder called Rett Syndrome.

ASX biotech darling Neuren Pharmaceuticals has re-rated ~2000% on commercialisation of its treatment for this disorder.

We think NTI could be safer than Neuren’s treatment and if it works better or similar, hopefully, re-rate accordingly.

Rett Syndrome is a rare genetic neurological and developmental disorder that affects the way the brain develops in very young women.

NTI’s product has an anti-inflammatory effect in the brain that may help to treat the disease.

Neuren Pharmaceuticals is a good blueprint for small cap biotechs on how to successfully commercialise a treatment.

In December, Neuren Pharmaceuticals surged past $2.8B on the back of a successful phase-two clinical trial results for its NNZ-2591 drug, focusing on Phelan-McDermid syndrome in children.

This is the company’s SECOND orphan disease it has advanced (with the first being Rett Syndrome).

(Source)

NTI is looking to copy this playbook with both its Rett Syndrome treatment and PANDA/PANS treatment for a rare child neuropsychiatric disorder.

NTI published strong results in a Phase I/II trial showing both safety and efficacy of its PANDA/PANS treatment in a small group.

For our full take on the results read: NTI’s clinical trial meets primary endpoints for neurological disease.

It also has results from its own Rett Syndrome trial due this quarter.

As Neuren has shown, orphan drugs can be very lucrative opportunities for companies that develop them successfully.

This is because governments provide generous incentives to companies with orphan drug designation to encourage the development of treatments of rare diseases.

These incentives include:

- Fast Tracked Approvals: This means that the company will not always need to undertake the entirety of a Phase III clinical trial in order to get the product to market.

- Market Exclusivity: Once the US FDA grants orphan drug designation to a drug, it also gets seven years of market exclusivity.

- Orphan drug pricing: Orphan drugs are priced at a point that encourages drug developers to make treatments.

The average price for an orphan drug is US$32,000 per year per patient.

This amount is not paid by mums and dads, but rather governments and insurance agencies subsidising the treatment.

For more information read: 🎓 Orphan Drugs Explained.

Ultimately, one of the key reasons we Invested in NTI was for its trio of near-term catalysts.

With strong results delivered from the first one, we are hoping that the company can make it three from three with regards to developing its pipeline of treatments for neurological disorders.

This brings us to our “Big Bet” for NTI...

Our Big Bet for NTI

“NTI re-rates to a +$500M market cap by successfully advancing one or more of its clinical trial programs through to regulatory approval, partnership/licensing and/or is acquired by a large pharmaceutical company”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our NTI Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

More on why the NDIS needs a proven autism treatment...

The cost of the NDIS has been expanding rapidly and the October 2023 budget revealed that the NDIS is the second fastest area of spending, second only to the interest on the national debt.

With spending cuts on the agenda, the NDIS was squarely in the sights of politicians for change.

In December, the headlines have honed in on autism’s role in the growing bill for the $42BN dollar program, following an independent review:

(Source)

This is reflected in the NDIS’ numbers from a June 2023 report on the costs associated with autism:

(Source)

While we are not health economists, we do think any government would jump at a chance to BOTH improve patients' lives AND reduce the cost burden of support services.

NTI could be the “shortcut” that Australia needs here.

We’ve discussed previously the promising evidence from NTI’s first autism trial.

In particular, the Phase I/II trial was extended by all patients on the program.

This is a strong vote of confidence from the carers with children on the trial who have seen a marked improvement in their children’s symptoms and are comfortable with the safety of NTI’s treatment.

Likewise, the trial design of the current Phase II/III trial allows for an extension period of an additional 38 weeks, if the patients choose to continue taking NTI164.

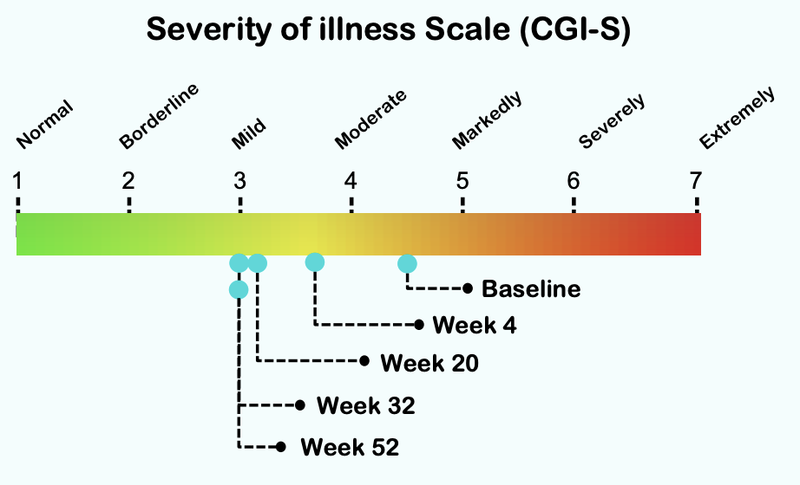

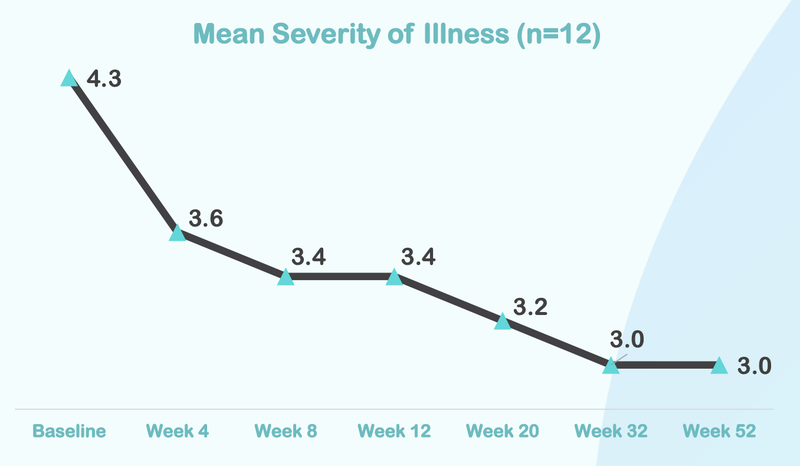

Below is the data from NTI’s first ASD trial...

From this chart you can see that the severity of illness for children with Autism moved from “Markedly” to “Mild”.

Here is how the treatment reduces over time, with significant improvement after just four weeks of taking the treatment:

Autism Spectrum Disorder (ASD) is estimated to affect around 1 in 100 children around the world, and in Australia, 35% of the ~610,000 National Disability Insurance Scheme (NDIS) participants have ASD, and 78% are under 18 years old.

If NTI’s treatment is proven safe and effective for ASD, we think it could become an important part of the overall care for ASD sufferers, ease the burden on both carers and government programs, and as a result, make NTI’s treatment commercially attractive.

We see NTI’s ASD trial results as potentially opening up a large Total Addressable Market (TAM) commercialisation opportunity in Australia - with the rest of the world, in particular the lucrative US healthcare market to follow subsequently.

Naturally, the more severe the autism the more support services are needed - and given the results above, our view is that NTI’s treatment may help strip out some of the biggest pain points in the NDIS budget.

And herein lies the immediate commercialisation opportunity in Australia...

Doing a back of the envelope calculation, if NTI’s treatment could reduce the average payment by 20% from $33,800 to $27,040 - the flow on savings to the total NDIS budget could amount to ~$1.3BN a year.

Noting that we are not health economists, and NTI’s treatment is only in the clinical trial stage, however on NTI trial success, it still points to significant value for the government in Australia and potential commercialisation partners in Australia.

That is also to say nothing of more lucrative healthcare markets such as the US - where we hope NTI’s treatment eventually goes.

NTI’s Phase II/III trial results are due in the next two months and can help build the evidence base for a long-term solution for ASD and ideally, some major commercialisation opportunities.

Risks

Clinical trial risk

It is important to be aware that clinical trials can be unsuccessful.

In particular, there are some standard risks that are associated with biotechs that are undertaking clinical research:

- Patient recruitment is delayed or fails

- Ethics approval is delayed or fails

- Clinical trial cost blowouts

- The drug/treatment is not considered safe for human consumption (usually established in Phase I)

- The drug or treatment is ineffective at treating the particular disease (usually determined by clinical trial results in Phase II and Phase III)

- The design of the trial is such that the regulatory body does not approve the drug/treatment

There is a chance that one or more of NTI’s clinical trials fail to meet their primary or secondary endpoints, meaning the treatments fail to satisfy the criteria of the studies. Any clinical trial results, if negative, could hurt the NTI share price.

Funding/dilution risk

Pre revenue biotech companies regularly need to raise capital to fund their growth ambitions. Capital raises can cause dilution to existing shareholders.

NTI will likely need to raise capital at some stage in the future, potentially at a discount to market prices to secure funds. This will be contingent on clinical trial results and broader market sentiment (see next risk).

Market risk

Broader market sentiment for small pre-revenue biotechs could get worse and the sector as a whole trades lower, taking NTI’s share price with it. Alternatively, the entire market could sell down as well.

Our NTI Investment Memo

In our NTI Investment Memo you’ll find:

- Key objectives for NTI

- Why we Invested in NTI

- What are the key risks to our Investment thesis

- Our Investment plan

Key resources for this article:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.