Oil & gas crisis leads to record inflation

Published 18-APR-2022 13:34 P.M.

|

8 minute read

Surging gas prices continue to dominate headlines.

Those following us for a while know that we love a big oil & gas drilling event - where share prices can move wildly up or down depending on the result.

Our usual strategy is to invest at least a year before the drilling event and de-risk the position in the lead up to the drill result.

With this particular drilling event we are taking a significantly more risky approach - the binary outcome will be known next month when the drilling happens, leaving little time to attempt a Free Carry.

The latest additions this week to our (higher risk) Catalyst Hunter Portfolio are Prominence Energy (ASX:PRM) and Global Oil and Gas (ASX: GLV) which combined have a 37.5% interest in this near term drilling event.

Over at Catalyst Hunter we focus on higher risk, early stage opportunities.

PRM and GLV have a share in one of the largest oil & gas wells being drilled by an ASX junior in recent decades:

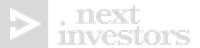

The Sasonof Prospect in the North West Shelf of WA.

The North West Shelf is home to some of Australia's biggest ever gas discoveries.

The Sasanof Prospect has the potential to host a resource larger than, or at least rival the size of, discoveries made by oil and gas majors like Exxon, Chevron and Woodside in this part of WA.

And the Sasonof Prospect is being drilled next month and depending on the result, we expect the share price could rise OR FALL significantly.

Investing in high impact oil & gas exploration wells so close to drilling is very high risk and the result of drilling will be near term and binary.

We don’t usually Invest in high impact drilling campaigns like this so close to a binary drilling event, but we really liked the prospect and have Invested on the chance drilling it could be a success.

This Investment is high risk and accordingly the position makes up less than 2% of our total small cap Portfolios across Associated Entities, and we are fully prepared that the result could go against us next month.

Win or lose - the next few weeks are certainly going to be eventful.

For all the reasons we took a position, objectives, potential risks, disclosures and our investment strategy, see our launch note here:

Read More: Introducing Our new Catalyst Hunter Portfolio additions PRM and GLV

Drilling for gas as gas prices surge. More pressure on inflation.

The US inflation rate hit 8.5% during the week and the US government claimed it was because of “Putin's price rises”.

The connection the US government is trying to make is the fact that the Ukraine/Russia conflict has disrupted oil and gas supply chains and in turn is putting pressure on inflation rates globally.

The natural gas price in the US has gone from ~US$3.60/MMBtu to all time highs of ~US$7/MMBtu after Russia invaded Ukraine.

To put that into context, for a majority of the last 10 years the price has traded between US$2/MMBtu and US$4/MMBtu.

The connection to inflation comes from energy being the core input in just about everything that is produced.

If the oil and gas price moves higher then the cost to produce everything from wheat and corn all the way up-to cars and planes becomes incrementally more expensive.

This however is not a US or Europe problem exclusively.

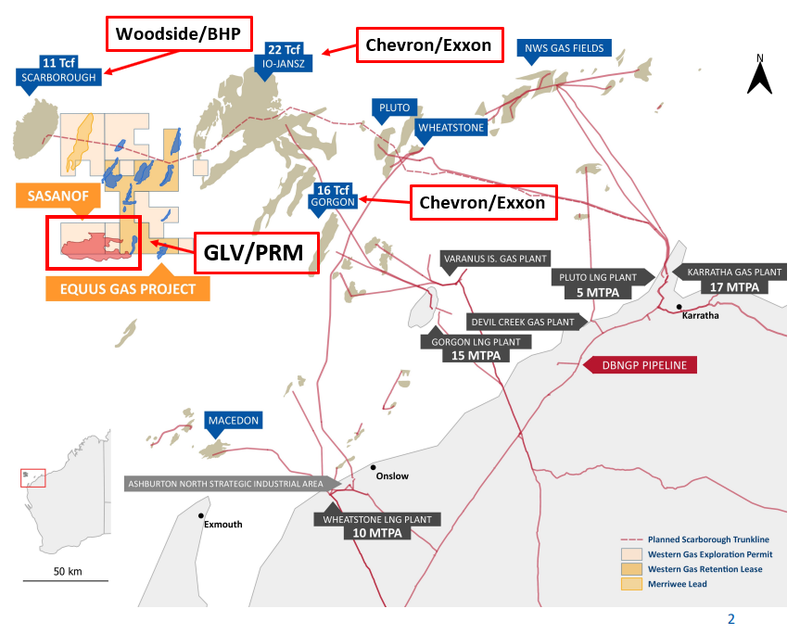

The ACCC in Australia which tracks the Liquefied Natural Gas (LNG) “netback” prices are also starting to move exponentially higher.

The netback price is just another name for the price equivalent that an LNG exporter could expect to receive if it was to export its gas internationally.

Basically the price moving higher means countries are willing to pay more for Australian gas, which in turn means we have to pay more to stop companies from converting it into LNG and selling it overseas.

📰 This week on Next Investors

Improved MNB DFS Due in Q3 on Record Fertiliser Prices

On Wednesday, our African food security investment, Minbos Resources (ASX:MNB) announced an update with respect to its DFS, which is now on track to be delivered in Q3 of this year.

With fertiliser prices nearing all time highs, MNB detailed its plan to alter its plant configuration in its Definitive Feasibility Study (DFS) adding optionality to the type of fertiliser MNB can produce and in turn hoping to maximise the economics of its low CAPEX project.

With geopolitical tensions likely to remain heightened for years, countries all around the world have started to realise that diversifying supply routes is of significant importance.

Which is why we’re of the view that MNB’s announcement today is a strong net positive. It pushes back the timetable for the DFS from Q2 2022 to Q3 2022, in exchange for the ability to capture even more value from the project

Crucially though, MNB’s plant commissioning is still on track for H1 2023 which means nothing has changed with regards to the production start date.

📰 Read the full breakdown: Improved MNB DFS Due in Q3 on Record Fertiliser Prices

KNI Drilling 18 Days Away, Cobalt Targets Firmed Up

On Thursday, our battery metals exploration investment, Kuniko (ASX:KNI), announced that it had further refined its geophysics models only 18 days away from drilling a trio of big cobalt targets in Norway.

With the countdown to drilling underway, and Europe desperately needing cobalt for their EV push, KNI has now firmed up its targets using modern downhole EM surveys to further refine the geophysical models.

One of these targets was completely missed by the previous owner, while a second target was only grazed. This means KNI can target the “bullseye” of the prospective cobalt mineralisation with its drill program starting 2nd May.

This is an added bonus that should lead to a more precise drilling campaign.

📰 Read the full breakdown: KNI Drilling 18 Days Away, Cobalt Targets Firmed Up

In our other portfolios 🧬 🦉 🏹

🏹 Catalyst Hunter

⚠️NEW INVESTMENT ALERT⚠️

Why we’ve Invested in the upcoming Sasanof-1 Well.

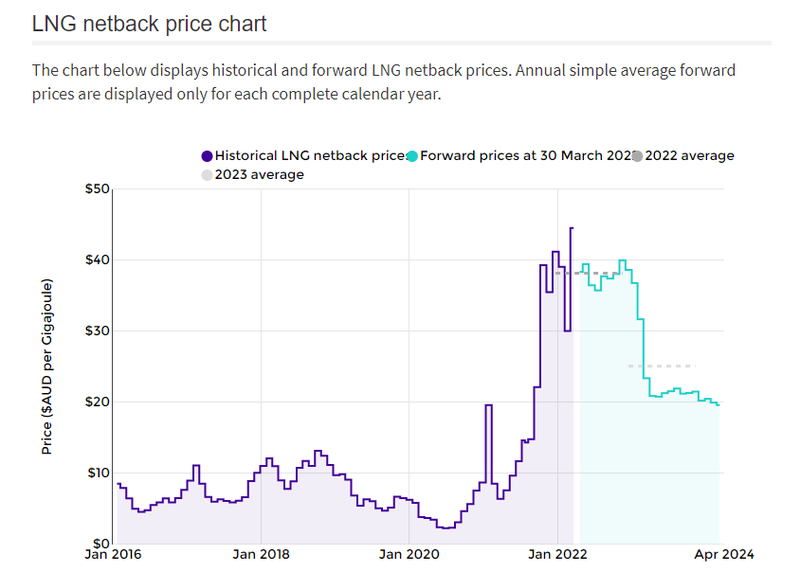

Earlier this week we added both Prominence Energy (ASX:PRM) and Global Oil and Gas (ASX: GLV) to our Catalyst Hunter portfolio.

The two companies each provide us with exposure to one of the biggest oil and gas drilling events done by a junior ASX-listed exploration company in recent decades - the Sasanof-1 well.

PRM and GLV hold a combined 37.5% interest in the enormous Sasanof Prospect in the North West Shelf, offshore WA.

Sasanof has a prospective resource of 7.2 trillion cubic feet and 176 million barrels of condensate on a 2U basis (unrisked mid case).

Yet it has the potential to host a resource larger than, or at least rival the size of, discoveries made by oil and gas majors like Exxon, Chevron and Woodside in this part of WA.

...and the big drilling event is just a few weeks away.

We chose to invest in both companies to hedge our investment exposure. We expect the share price of each to respond to the result differently, due to their different market caps, compositions and cap structures, and how tightly each is held.

Below is each of the companies' exposures to the big drilling event.

LRS raises $35M to fast track Lithium project

To close out the week our exploration investment Latin Resources (ASX:LRS) announced that it has raised $35M @16c per share to fast track drilling at its lithium project in Brazil.

The capital raise was cornerstoned by experienced lithium investors, Canada-based Waratah Capital’s “Electrification and Decarbonization Fund”, which took $15M of the raise.

Waratah Capital manages over CAD$3 billion in assets and is also behind “Lithium Royalty Corp”, which holds royalty investments in lithium explorers including Core Lithium, Sayona Mining and, interestingly, LRS’s Brazilian neighbour Sigma Lithium.

With a transformational amount of capital raised, LRS confirmed that with its significantly improved balance sheet it would now fast track drilling so as to prove out a maiden JORC resource estimate for its new discovery.

To that end, LRS confirmed that it is planning on securing an additional two drill rigs, taking its total fleet to four. The drilling will be focused on delivering the following:

- The ultimate aim of proving up a maiden JORC resource estimate at its new discovery by drilling at least 25,000 metres.

- Chasing new discoveries with 5,000 metres of drilling at the newly acquired Monte Alto prospect and Salina South prospect.

Our investment in LRS is now up over 1,000%, so we also broke down our detailed investment strategy with our LRS shareholding.

📰 Read the full breakdown: LRS raises $35M to fast track Lithium project

🗣️ Quick Takes

NEW: We are now releasing our Quick Take opinions as they happen so you don't have to wait until the weekend to see them.

The link below will scroll you directly to the Quick Take related to the specific company listed.

Bookmark this page to read our Quick Takes LIVE

Below is a list of all of this week's Quick Takes:

EV1: Battery grade graphite just as important as lithium

EMH, VUL, LRS: Elon Musk weighs in on lithium prices

LRS: Positive lithium drilling results from Salinas Lithium Project

GGE: Strategic alliance with helium offtake partner

BPM: Zinc price going ballistic, great time to drill

88E: Texas Oil and Gas production assets update

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.