EXR has just spudded THEIR well...

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,777,858 EXR shares and 1,071,429 EXR Options at the time of publishing this article. The Company has been engaged by EXR to share our commentary on the progress of our Investment in EXR over time.

NHE pointing toward discovery.

IVZ is a few days away from results now.

The third oil & gas company drilling this side of the new year is Elixir Energy (ASX:EXR).

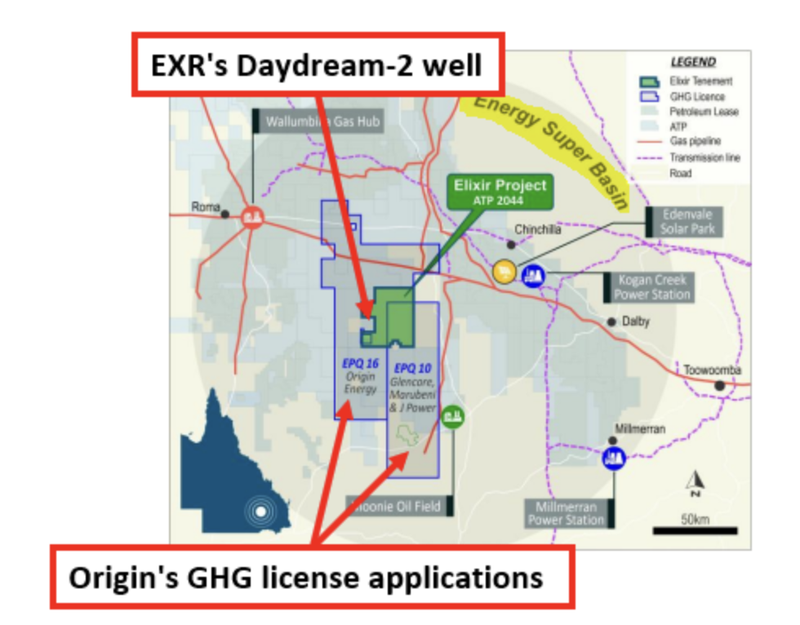

EXR just started drilling its Daydream-2 well at its gas project in QLD.

EXR’s well is a little different to our other two Investments.

EXR is drilling an “appraisal” well into a ~395 billion cubic feet contingent resource - testing a known gas discovery which sits inside a ~3.3 Tcf prospective resource.

Appraisal wells are a little bit different to wildcat exploration wells.

Instead of the target being to make a new discovery - the objective for an appraisal well is more about trying to prove up a bigger resource or to prepare for future flow testing.

(another company made the “discovery” around 5km away, EXR snapped up the nextdoor land is drilling anticipating that the discovered hydrocarbon system extends onto its block)

EXR’s intention is to drill the well (drilling expected to take about a month)...

...and then flow test the well shortly after.

In EXR’s case we want to see the company make progress one one (or all) of the three fronts: :

- Prove commercially viable flow rates - Commercially viable flow rates would signal to the market that the project can be developed into a producing gas asset.

- Book a maiden reserve number - EXR will be looking to convert some of the existing contingent resource into the reserve category. Booked reserves typically mean commercially developable resources.

- Increase its contingent resource number - There is also a chance EXR converts some of the ~3.3 Tcf prospective resources into the contingent category - increasing its overall contingent resource.

Context on EXR’s well:

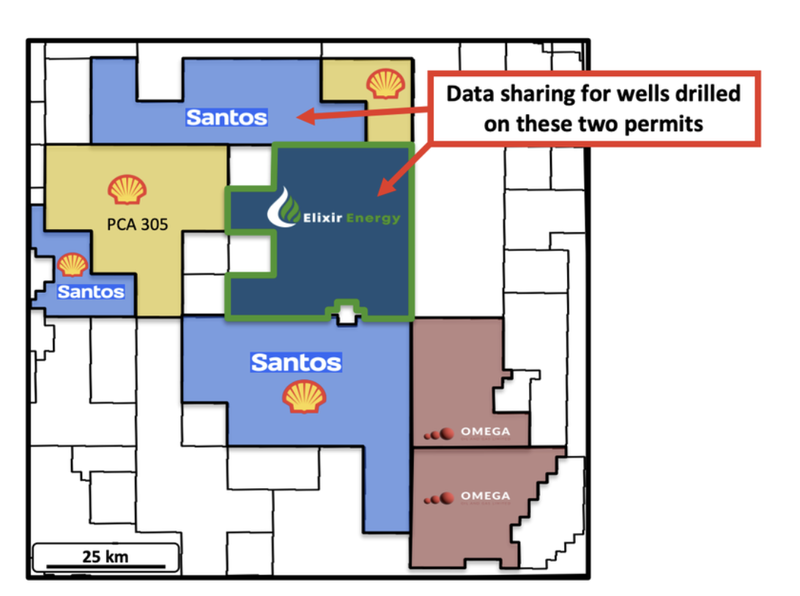

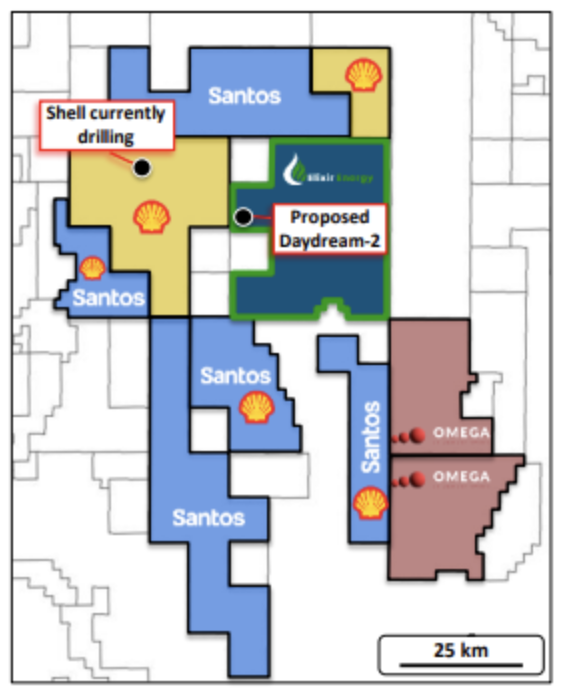

EXR’s well sits right next to ground owned by Shell, Santos and Origin.

EXR has already managed to sign data sharing agreements with Santos and Origin so its fair to say the two majors are both watching what EXR is doing.

The data sharing agreement with ~$24BN capped Santos includes:

- Data shared on wells across two permits - Santos and EXR will share data from all wells drilled on EXR’s permit (ATP 2044) and Santos’ permit (ATP 2056).

- Exploring regional prospectivity - As part of the deal, Santos and EXR will also start technical discussions about the deeper exploration plays in the region.

The deal with $15.2BN Origin actually sees EXR receive $1M in non-dilutive funding toward its well.

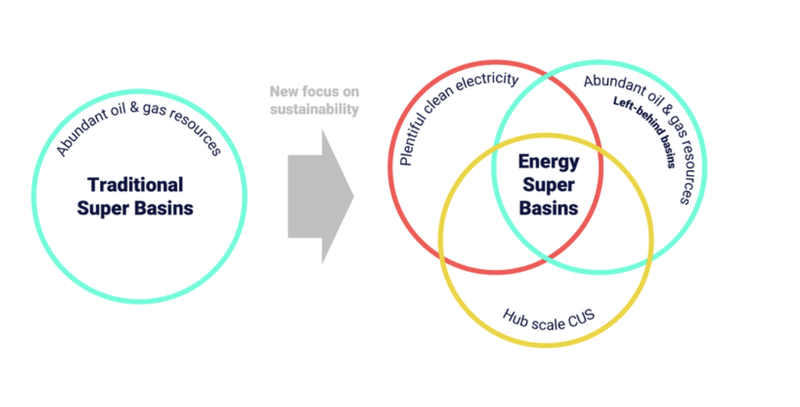

The deal makes sense in the context of the “Energy Super Basin” concept, which we touched on in a previous EXR note.

For context - EXR’s well sits inside licenses where Origin is looking into carbon capture and storage projects.

Origin’s interest in the data is because they are looking at carbon capture and storage potential over two greenhouse gas licenses that are pending (covering EXR’s project area).

At a very high level, an energy super basin is where large hydrocarbon resources are co-located with clean electricity supply and Carbon Capture and Storage facilities.

(Source)

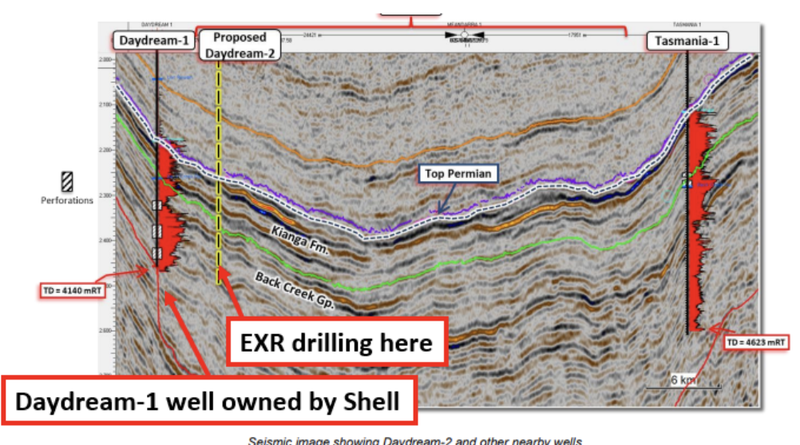

As for Shell - EXR is drilling right next to a well that Shell is drilling right now AND is looking to emulate the success of a well previously drilled by BG Group (now Shell) ~10 years ago.

Shell’s Daydream-1 well is analogous to EXR’s and sits ~5km away.

Daydream-1 was drilled to a total depth of ~4,140m and produced flow rates of ~3.5Mcf per day, which today would be considered commercially viable.

Similarly, EXR will drill down to a total depth (TD) of ~4,200m, targeting the same oil/gas reservoirs.

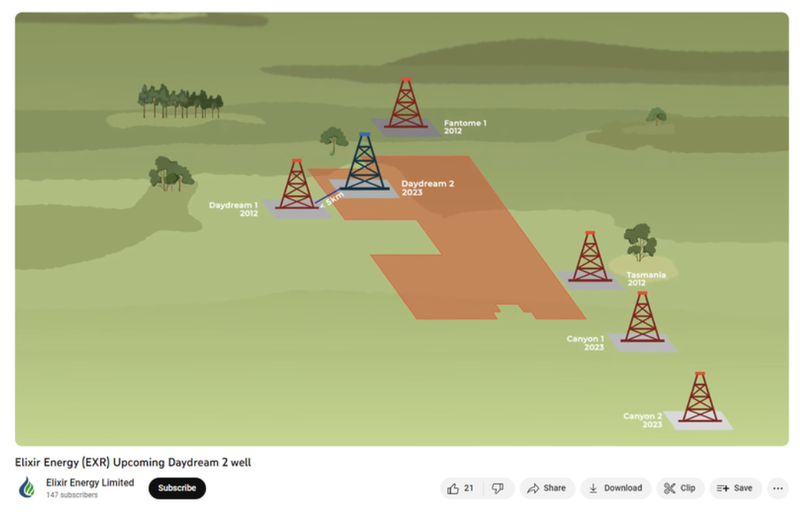

The following video provides an easy-to-understand overview of EXR’s upcoming well:

(Source)

What we will be watching out for next:

With drilling underway we will be looking out for the usual set of announcements we see from oil & gas drilling events:

- Drilling starts - EXR kicked off drilling today. ✅

- Drilling updates along the way (reached X depth, Reached Y depth etc..).

- Well hits TD (Total Depth) and is cased for testing.

- Wireline logging tools are run and data analysed - this is where we expect to see gross/net pay and get some idea of the reservoir characteristics (porosity/resistivity etc).

- Case and suspend for future testing - in EXR’s case we want to see the company case and suspend the well so that it can be flow tested early next year.

With this well it will mostly be about net pay numbers and technical reservoir quality data.

The big catalyst will be in early 2024 when EXR runs its flow test.

Ultimately we want to see EXR achieve our Big Bet which is as follows:

Our Big bet for EXR:

“EXR to achieve a $1BN market cap through successfully advancing one or more of its three projects: its Mongolia gas project, Mongolia green hydrogen project, and/or its Queensland gas project.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EXR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Elixir EnergyASX:EXR

Why we like EXR’s Daydream-2 well:

- Existing discovery - EXR is drilling an appraisal well into an existing 395bcf contingent resource which sits inside a larger ~3.3 trillion cubic feet prospective resource.

- Next to Shell, Santos and Origin - EXR has already signed an information sharing agreement with Origin and Santos.

- Strong nearby well data - EXR’s well is similar to the Daydream-1 well drilled by BG group (now Shell).

- Shell is drilling a well next door - Shell is currently running a drill program on the ground sitting adjacent to EXR’s.

- Inside a potential energy super basin - EXR’s project sits in a part of QLD that could be transformed into an energy super basin. An Energy Super Basin is where big hydrocarbon resources are co-located with clean electricity supply and Carbon Capture and Storage facilities.

- EXR’s team have made gas discoveries before - Managing Director Neil Young is ex-Santos management. Director Stephen Kelemen ran Santos’ Coal Seam gas portfolio And EXR’s chairman Richard Cottee took Queensland Gas Company from a $20M capped junior through to a $5.3BN takeover back in 2008.

- Billionaires are active in the region - The billionaire Flannery family and major US-based oil and gas investors Tri-Star are making investments in the region.

- Project next to existing infrastructure - EXR’s project sits ~35km away from critical gas transmission infrastructure — the Wallumbilla gas hub — which connects to existing and proposed transmission pipelines to reach local and international gas markets

What’s next for EXR?

QLD gas project 🔄

- Drilling starts - EXR kicked off drilling today. ✅

- Drilling updates along the way (reached X depth, Reached Y depth etc..) 🔄

- Well hits TD (Total Depth).

- Wireline logging tools are run and data analysed -

- Case and suspend for future testing -

Mongolian Coal Bed Methane (CBM) gas project:

🔄 Extended production testing

🔄 2023 exploration program

Mongolian Green Hydrogen Project:

🔄 Financing for a pilot plant

🔄 Offtake agreement for the pilot plant

🔄 50/50 Joint Development Agreement (JDA)

What are the risks?

With drilling in Queensland now weeks away, the key risk for EXR’s Daydream-2 well is “commercial risk”.

The drill program may fail to prove commercially viable flow rates.

Uneconomic flow rates would mean EXR spends a lot of capital for very little return in terms of shareholder value, which we think would lead to a re-rate down in EXR’s share price.

Oil and gas exploration and appraisal drill programs are high risk / high reward and so there is always a risk the company’s share price re-rates materially lower off poor drill results.

To see all the risks to our EXR Investment thesis, check out our EXR Investment Memo here.

Our EXR Investment Memo

In our EXR Investment Memo, you can find the following:

- Our EXR Big Bet

- Key objectives for EXR

- Why we are Invested in EXR

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.