How to Read Oil & Gas Resources

Published 15-MAR-2022 15:49 P.M.

|

4 minute read

Defining oil & gas resources

So you’ve invested in an oil & gas explorer, the company has done all of the pre-drilling targeting works and has put out a maiden resource figure.

Great, now what does that mean?

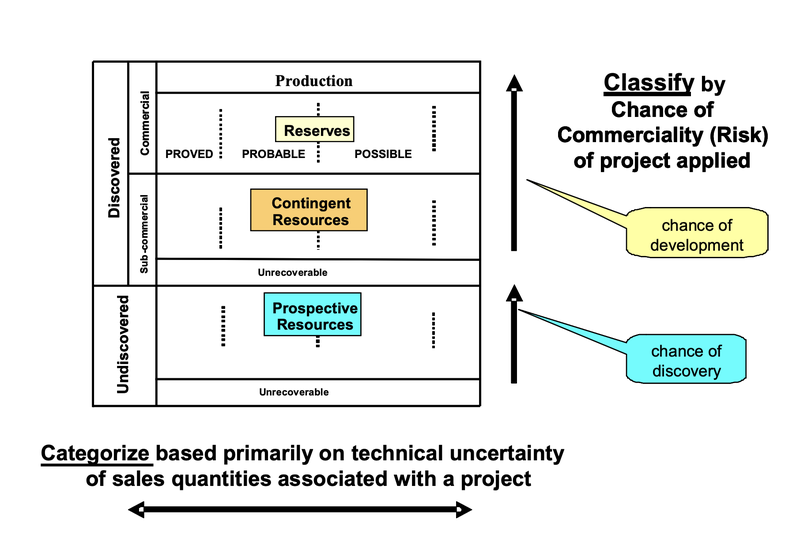

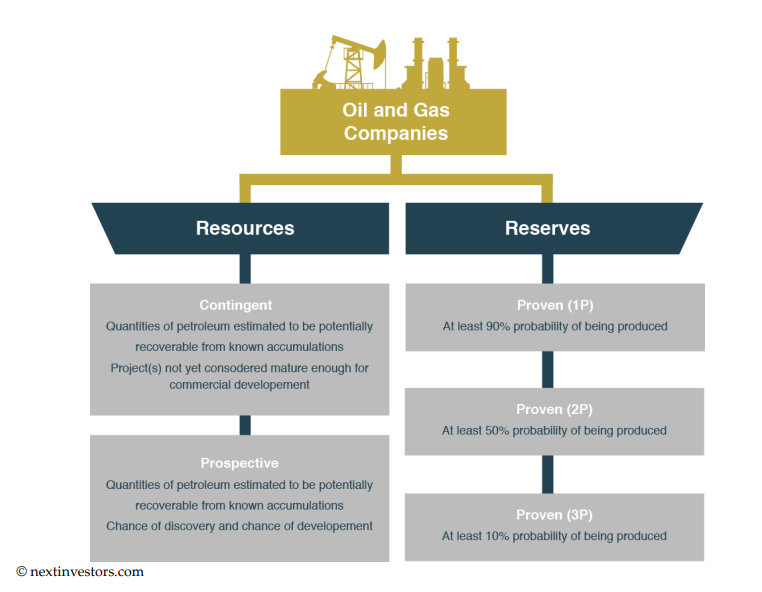

Oil and gas deposits can be classified as resources or reserves. The difference being how confident the company is that the deposit is valuable and extractable.

In summary, reserves are better than resources... and here is why.

Resources are valuable, with reasonable prospects for eventual economic extraction. Resources can be classified as either contingent or prospective.

Reserves are valuable, and legally, economically and technically feasible to extract. For oil and gas companies, reserves can be proven, probable or possible.

What is a prospective resource?

Oil and gas explorers will generally set the scene for the target they are drilling by putting together a ‘prospective resource’ - think of this as a high level estimate of how much oil and/or gas a company thinks it has under its exploration ground.

This prospective number is generally put together after a company goes through a process of completing geophysical surveys, more commonly referred to as “seismic acquisition programs”.

After mapping out the structures beneath the ground looking for specific features of an oil and gas deposit, companies will estimate the size of a potential discovery and bundle all of this information up into a prospective resource figure.

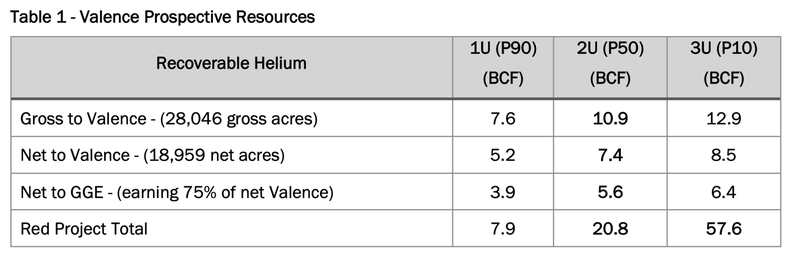

Here is an example of what these prospective resource figures look like for prospective helium resource for our investment, Grand Gulf Energy (ASX:GGE):

The “P” is a reference to the confidence interval:

- P90 = The prospective resource estimate has been set with 90% confidence.

- P50 = The prospective resource estimate has been set with 50% confidence.

- P10 = The prospective resource estimate has been set with 10% confidence.

These are references to how confident the consultants who put together the prospective resource are in their numbers.

As for the “U”, this is just a way of saying “unrisked”, which is a reference to the prospective resource not being tested yet.

To summarise:

- The prospective resource is a high level estimate which sets a target for the company to potentially discover through drilling - we want this number to be BIG.

- These estimates are based on assumptions and are usually referenced with respect to confidence intervals split 90%, 50% and 10% with 90% being the most conservative estimate.

- These estimates sometimes refer to a “U” which simply means unrisked, a reference to the prospective resource not being tested by any drilling yet.

What is a contingent resource?

A contingent resource sits right in the middle between a prospective resource and a reserve.

A contingent resource is announced when a company has discovered recoverable oil or gas but needs to classify these as contingent because they are not able to be pulled out of the ground economically.

In essence the “contingent” name comes from the company being reliant on other developments before that oil and/or gas can be extracted economically.

Some examples include the following:

- There is no pipeline infrastructure in this region and as a result the company thinks the resource cannot be extracted economically

- There are environmental regulations in place that ban the extraction of oil and/or gas in that region

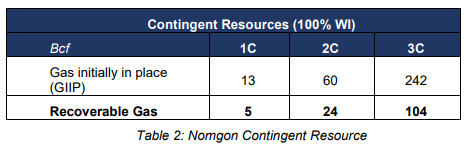

Below is an example of a contingent resource being announced:

This time the figures are reported as 1C, 2C, 3C.

This is again a reference to the confidence intervals, in this scenario they can be interpreted as follows:

- 1 = The contingent resource estimate has been set with 90% confidence.

- 2 = The contingent resource estimate has been set with 50% confidence.

- 3 = The contingent resource estimate has been set with 10% confidence.

To summarise:

- The contingent resource estimate refers to already discovered accumulations of oil and gas.

- The reference to “contingent” comes from the oil and gas not being able to be extracted economically because of external factors that can be but isn't limited to a lack of infrastructure or regulatory barriers to extraction.

What is an oil and gas reserve?

After drilling, discovering a deposit and testing that deposit for production (production and flow testing), a company will work out the size of its oil or gas reservoir and announce a maiden reserve estimate.

Reserves are just another way of quantifying the amount of oil and/or gas that a company believes can be economically recovered from a known discovery.

Reserves are often expressed as either “probable or proven” which is based around the probability of the reserves being economically extracted.

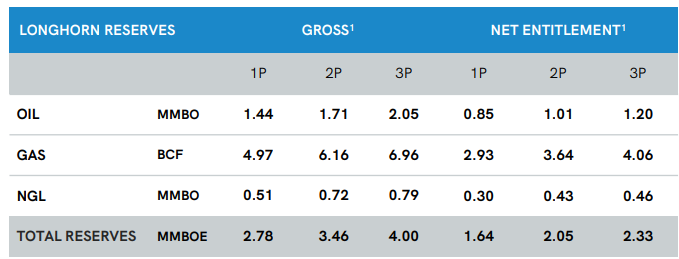

Below is an example of a reserve announcement:

The reserves are split into three different categories, 1P, 2P and 3P.

In this scenario they can be interpreted as follows:

- 1P = Proved reserves with at least a 90% probability of being economically extracted.

- 2P = Proved + probable reserves with at least a 50% probability of being economically extracted.

- 3P = Proved + probable reserves with at least a 10% probability of being economically extracted.

To summarise:

- Reserves are the gold standard for an oil and gas explorer quantifying the size of its projects. They are a reference to the amount of oil and gas that can be economically extracted at any given time.

- Reserves are often split into the proven and probable categories which is a reference to the minimum % probability that a company believes the reserve can be economically extracted.

Here is a chart that we have put together to help you understand:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.