$61M capped MNB Secures Funds to Build $70M EBITDA per year phosphate mine within 12 months?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 12,026,429 MNB shares and 4,141,429 MNB options and the Company’s staff own 285,714 MNB shares and 285,714 options at the time of publishing this article. The Company has been engaged by MNB to share our commentary on the progress of our Investment in MNB over time.

When this phosphate mine is built it is forecast to generate $70M of EBITDA per year.

Phosphate makes fertiliser, which is needed to make food.

It already has offtake MOU’s for ~66% of its production for 7 years.

Our Investment Minbos (ASX:MNB) has been trading at a ~$61M market cap while the market waited to see it secure the funding to build its phosphate mine in Angola.

Today MNB has come out of suspension having secured an AUD $21.5M debt funding facility from the Industrial Development Corp of South Africa.

Plus MNB also completed a $6M capital raise.

(we participated in this capital raise)

MNB says that Phase 1 of construction is commencing in two weeks.

MNB expects the project to be commissioned and ready for production nine months after construction starts.

Next thing we want is to see progress update photos of MNB’s phosphate plant getting constructed.

MNB has now secured the majority of the funding it needs to build its phosphate mine.

Based on the US$24M in costings for Phase 1, 2 and 3 of construction and the ~A$27.5M raised today we calculate MNB needing another ~$10M.

The remaining ~$10M could come from different Angolan government initiatives - especially considering the amount of emphasis being put on the domestic Agricultural industry.

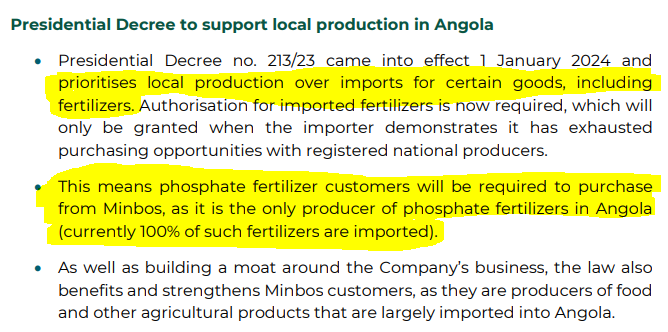

As of the 1st of January of this year, the government has implemented a Presidential Decree in Angola, which we think effectively gives MNB a monopoly on the supply of fertiliser to the country’s agricultural sector.

(Source)

While we don’t speak Portuguese (well, one of us actually does), a summary of the Presidential Decree can be found on the United Nations Environment Programme’s website. (Source)

Our key takeaway: MNB will be the go-to provider of fertiliser and may be supported by the Angolan government with additional financing.

As MNB noted today:

The Angolan Government is looking to make ~US$500M of debt funding available for projects like MNB’s - MNB mentioned today that it was “in the initial stages of the process to access such credit with Angolan financial institutions”.

And in terms of where MNB will sell its final product, on Jan 1st 2024, a government decree came into effect to prioritise local productions (like MNB) over imports for certain goods...

Including fertiliser.

Meaning that local buyers must buy MNB’s phosphate ahead of imported phosphate.

Currently Angola imports 100% of its phosphate.

MNB is now forecasting the first production from its mine will happen in around 12 months from today, in Q2 2025.

This is a delay from an earlier forecast of this year, after MNB had to change the construction company they had contracted, which unfortunately caused a setback on forecast timeframes.

We have noticed over the last few years across many companies that “first production from a new mine” timelines seem to often get pushed out.

We are still new to seeing resource companies move from feasibility studies to construction, but MNB has a bit of work to do over the next few months to rebuild investor trust in the timelines they put out.

These delays to construction and first production are part of the reason we think MNB is trading at just a $61M market cap (that's basically one year worth of the EBITDA the mine is forecast to make once it’s producing in early 2025).

Now that MNB is near fully funded, if they can show real progress on construction AND stick to their timelines we think the share price will re-rate off its current base.

We are betting that MNB will be our first Investment to get a project into production...

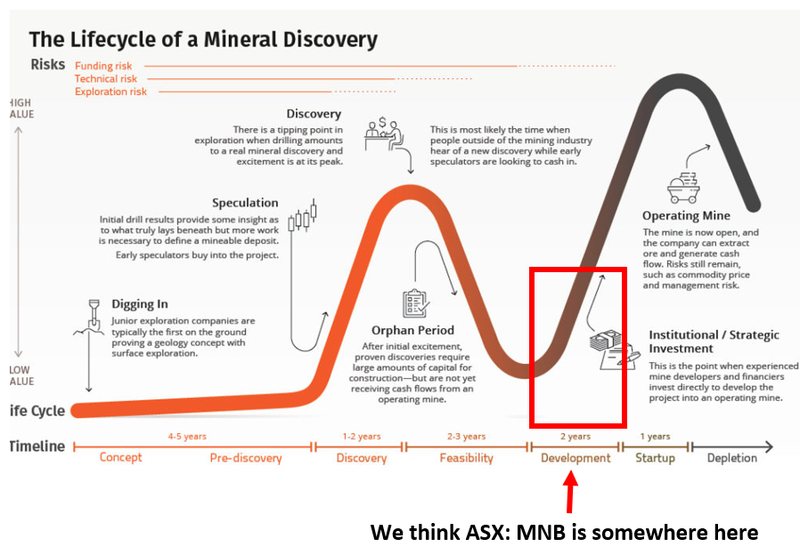

If MNB can stick to their new timelines and announce progress as expected (with photos of construction happening) we think that is the time when MNB’s share price will start following the Lassonde curve:

In 2023 we visited MNB’s project in Angola to tour the phosphate deposit and where the processing plant will be built.

Long lead items and key processing equipment is already purchased and waiting in a warehouse for the earthworks to be completed so it can be transported and assembled on site.

We also saw key plant parts arriving in port (this was last year in 2023):

So construction could all start happening pretty quickly, barring any unforeseen delays like the initial construction company change out.

MNB’s processing plant is not a big complex set up, so we are hoping that the construct phase is fairly smooth - here is a rendition of what the final plant will look like:

(source)

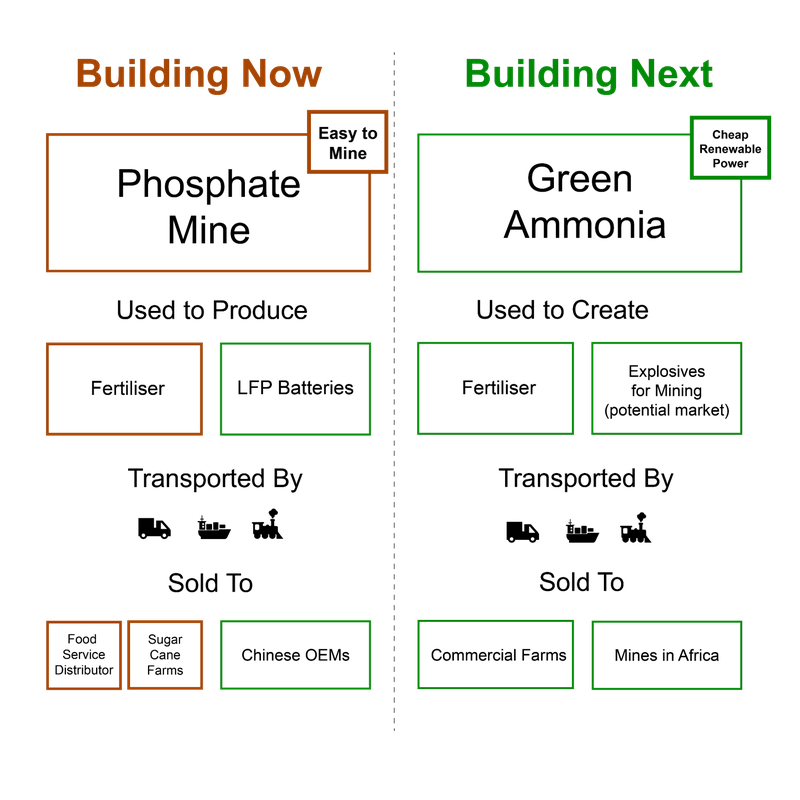

Aside from the phosphate project, MNB also has an earlier stage green ammonia project.

We think of this as the “blue sky” opportunity for MNB.

Ammonia is the main building block for nitrogen fertilisers.

To make the ammonia “green”, renewable energy is required.

MNB secured supply of some of the world’s cheapest renewable energy which will come from Angola’s underutilised hydro-electric dam, built by the Russians in the 80's.

Unsolicited interest in both MNB’s projects?

Today’s announcement also made mention of approaches MNB seems to have gotten while it was closing out the capital raise.

MNB confirmed in today’s announcement that the approaches were for both its projects.

(Source)

While it appears no deals were done (otherwise we would have seen it in this announcement) - corporate interest is always a good sign especially in a market like the one we are in today.

At the moment, small cap, pre-revenue stocks aren't getting much love from investors - primarily because the expectation from the market is that the company will need to raise more capital at a discounted price at some point in the future.

Investors instead choose to sit on the sideline and wait for that buying opportunity.

Obviously, as share prices drift lower, the assets of a company become more attractive to corporates who are looking to make strategic investments or take over companies outright.

That's where genuine corporate interest can positively impact a company’s share price.

Sometimes it is takeover offers and other times it is strategic investments, whatever the deal is investors will often be wrong-footed by the news and then realise that the opportunity to buy in a future raise might not be there anymore.

Usually that then leads to a material re-rate upwards as the market realises a floor valuation for the company and its projects that a corporate is willing to pay.

A good example is Liontown Resources, when it traded at ~$1 per share, as the market expected the company to raise money to finance the building of its lithium mine.

Out of the blue Albemarle came out and offered $2.50 and then $3 per share for the company, re-rating the share price by ~200%.

(we are not suggesting there might be a takeover offer for MNB, this is to illustrate how markets can be wrong footed by corporate activity or strategic investment)

🎓Learn: What is a share price catalyst?

Our base case expectation is to see MNB put its project into production and re-rate to a multiple of its net profits BUT any corporate interest between now and then could be a major catalyst for MNB’s share price.

And according to the MNB announcement, these discussions have been happening.

Our MNB Big Bet:

“MNB delivers a 10x return by building a profitable phosphate project AND progressing its green ammonia project to construction phase.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our MNB Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for MNB’s fertiliser project?

🔄 Funding for the remainder of CAPEX on the project

We estimate that MNB requires a further $10M to fund the CAPEX of the fertiliser project.

In October last year, MNB secured an indicative term sheet on a loan facility of US$14M from the Industrial Development Corporation (IDC).

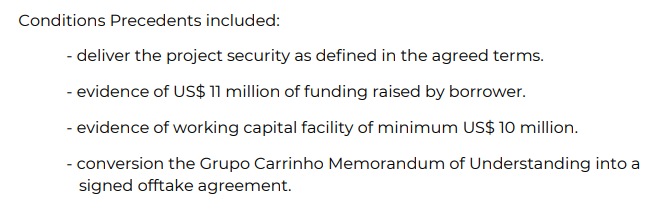

That has now been approved, contingent on the following pre-conditions being met:

(Source)

(pre-conditions are standard in these type of deals)

The facility allows MNB to draw down on cash when they need it. The interest rate on the loan is the Secured Overnight Financing Rate + 6.77% payable quarterly in arrears.

The IDC is a South African development finance institution established in 1940 to promote economic growth and industrial development. MNB’s engagement with this corporation provides other commercial opportunities for offtake of Stage 2 production for South African customers.

With this loan facility in place, it means that MNB will still need to find the remaining $10M to fund the rest of the project construction.

At the end of the December Quarter, MNB had ~$4.6M in the bank.

🔄 First production from phosphate fertiliser project

MNB is targeting first production in Q2 2025 in order to ensure the major phosphate customer has the majority of its fertiliser requirements for the 2025/26 growing season.

🔄 Converting offtake MOU into a binding offtake agreement

We want to see MNB convert its offtake MOU with Grupo Carrinho (Angola’s largest agro-industrial group) into a binding offtake agreement.

Offtakes are almost always looked upon favourably by debt financiers and so MNB will likely need to lock this in before it gets the remaining funding for its project locked in.

We also note that the US$14M debt deal announced today is contingent on the offtake MOU being converted into a binding deal.

What are the short term risks to MNB?

Phosphate / Fertiliser Project

For MNB’s phosphate/fertiliser project the short term risks are “Funding risk” and “Delay risk”.

MNB has a relatively small CAPEX funding gap that needs to be filled and so will need to try and secure additional funding to complete construction works and get its project into production.

There is a risk that the final funding package takes longer than expected to secure OR isn't secured at all which forces MNB to pivot in its development strategy.

As for delay risk - any delays from a funding perspective could impact the time it takes for MNB to get to first production (and revenues) from the project.

Delays with construction could also hurt the MNB share price. MNB has faced delays before and the market may punish MNB if further delays happen.

Green Ammonia Project

In terms of MNB’s green ammonia project - the key short term risk is “Project Feasibility Risk” and “Funding Risk”.

With MNB entering the feasibility stage, the biggest risk comes around technical and commercial aspects of the project such as:

- Will the project be viable technically?

- Will the project economics be favourable?

- Are there environmental challenges to overcome?

- etc...

Big infrastructure projects, such as an Ammonia Plant, are complex to design and construct.

So, after completing a PFS, MNB may find itself in a position where it needs to find a large financing partner to commit large amounts of capital to get the project off the ground.

This funding risk is relevant for all large projects of this kind.

Therefore, MNB will need to demonstrate that the project economics stack up AND all of the technical, environmental, legal and feasibility risks are mitigated.

Our MNB Investment Memo

Click here for our Investment Memo for MNB, where you can find a short, high level summary of our reasons for Investing.

In our MNB Investment Memo, you’ll find:

- Key objectives we want to see MNB achieve.

- Our MNB “Big Bet”

- Why we are Invested in MNB

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.