HVY appoints renowned garnet expert to Board

Today, our garnet Investment Heavy Minerals (ASX: HVY) announced the appointment of Aaron Williams as a non-executive director to the HVY board.

Using garnet in blasting allows companies (such as major shipbuilding companies and infrastructure maintenance companies) to safely reduce corrosion and extend the life of surfaces prone to rust.

Williams is an expert on garnet and the garnet supply chain, having worked in executive roles across the garnet and blasting industries.

We see this as a major coup for HVY, given Williams’ extensive previous experience - notably 9 years at GMA Garnet Group between 2002 and 2011, which culminated in a role as Chief Operating Officer (COO).

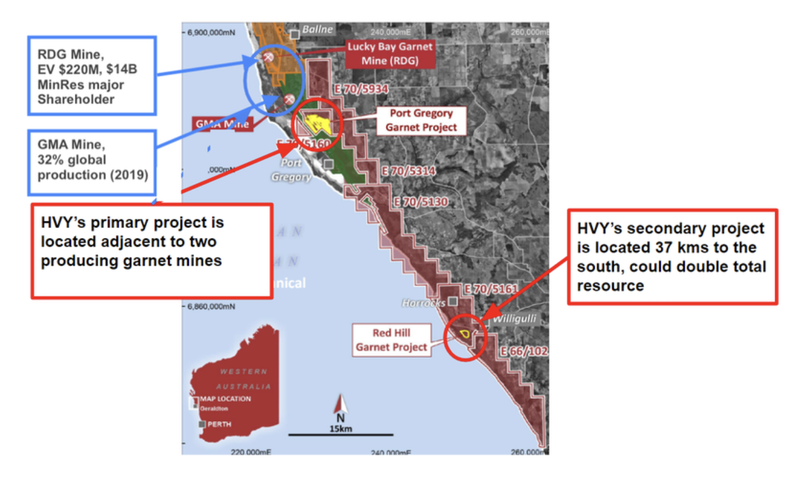

GMA Group is the world’s largest garnet producing group, and the GMA Mine sits in a tenement immediately adjacent to HVY’s primary project, Port Gregory:

Following Williams’ time at GMA Garnet Group, he went on to be Managing director of Schmidt Abrasive blasting for 8 years between 2012 and 2020 - a manufacturer and distributor of a range of industrial blasting equipment and abrasives.

More recently Williams had a role as Managing Director of Malaysian specialist abrasive blasting media supplier - which supplies Almandine garnet.

Almandine garnet is the premium blasting product that HVY is seeking to supply to the blasting industry via its Port Gregory project.

Almandine alluvial garnet has notable advantages over other blasting products, such as copper slag/coal slag which have established health risks.

Why are we interested in garnet though?

It comes down to corrosion - which by the estimates found in the most recent (2013) study on the topic, costs the world roughly 3-4% of global GDP.

Another study goes on to note that:

“Using available corrosion control practices, it is estimated that savings of between 15% and 35% of the cost of corrosion could be realized, i.e., between US$375 and $875 billion annually on a global basis.”

A recent Wall Street Journal article highlighted the cost of corrosion (particularly in the important US market) - which could in fact be more than twice the number quoted in the 2013 study:

(Source)

And as we outlined in our first note on HVY, the US is spending ~US$1T on infrastructure.

Meanwhile, China accounted for roughly 38% of global production in 2022 according to the US Geological Survey, the US consumes ~35% of global production.

Get the full rundown on why we’ve Invested in HVY below:

Click here to read our note on HVY

What’s next for HVY?

Prior to today, HVY announced that it is pursuing a royalty funding arrangement.

Royalty agreements can be a beneficial funding method, as it can secure funding for the company without the dilution of equity - a win for long term shareholders.

Given the HVY quarterly showed the company had $320K of cash as of 30 June, we’re looking for further information regarding funding as the company aims to build a globally significant garnet mine.

The size of HVY’s resources was strengthened in the last quarter, with the company completing an upgrade of its Port Gregory JORC Mineral Resource with the total resource increasing by 23% to 166Mt @ 4.0% THM.

We are also looking for progress on a proposed pre-feasibility study (PFS) and perhaps an update on a further strengthening of the relationship with Atradius Dutch State Business (Atradius) which manages the government credit guarantee scheme on behalf of the Government of Netherlands official Export Credit Agency (ECA).