BPM Commences Drilling at Claw

Our exploration Investment BPM Minerals (ASX: BPM) has commenced drilling at its Claw gold project.

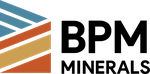

The project sits immediately along strike to the Capricorn Metals’ (capped at $1.66BN) 3.24Moz Mount Gibson gold mine.

BPM is capped at just $4.5M, and will be drilling to the south of Capricorn over the coming months.

BPM will drill two drill ready targets right near the southern border shared with Capricorn Metals.

- The Louie Prospect - 500m away from Capricorn’s mine.

- The Chickie anomaly - which covers an area of ~1,000m x 500m.

What is BPM looking for?

The best way to understand what BPM is exploring for at Claw is to look at what Capricorn has ~500m to the north…

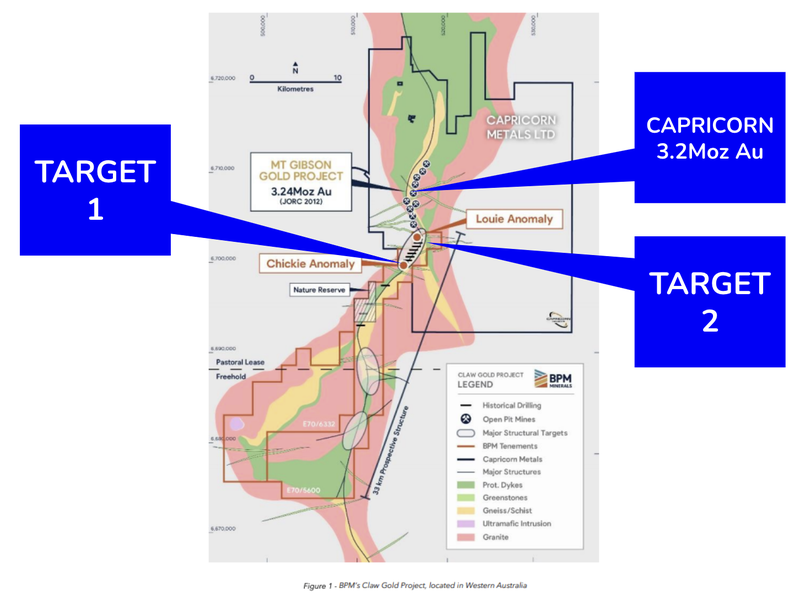

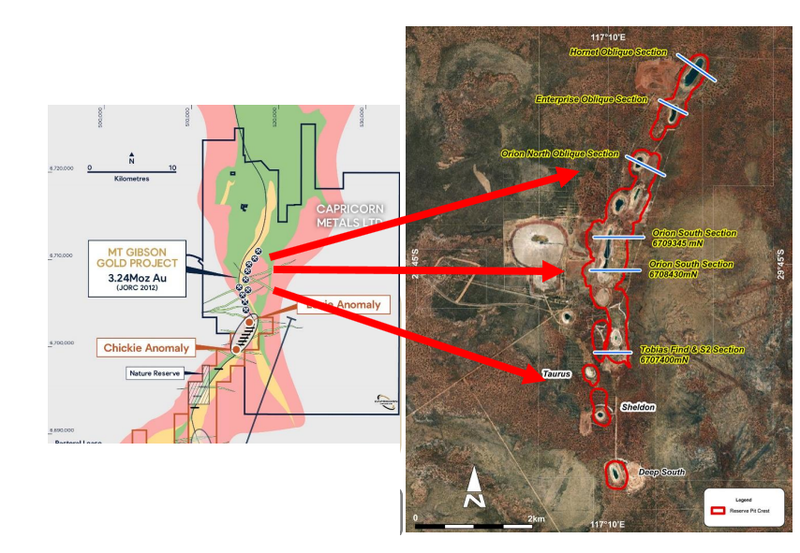

Capricorn’s Mount Gibson project is made up of several open pit mines coming together to form a ~3.24m ounce gold project.

All of the open pit mines (shown as black dots on the image below) run along a north-to-south trend and are along strike from BPM’s project.

At a very high level, BPM isn't necessarily looking for an extension to Capricorn’s gold project - instead, it is looking for repeat structures along that north-south trend.

If BPM can find even one of these structures, considering the company’s tiny market cap we think it would be a great result for BPM.

Just last week Capricorn announced in a Quarterly Activities Report drilling results from its “Gunslinger” prospect, just 500m north of where BPM will drill.

There were heaps of intercepts with grades above 2g/t and thickness above 7m.

The best result was 16m @17.16g/t from 32m.

Although we are not expecting BPM to achieve this result on its first try (it would be an exceptionally bullish result), the drilling shows the potential for BPM to make a discovery on its ground with the upcoming drilling campaign.

Our expectations for the drill program

We have set up a bull/bear /base case scenario for this drilling.

This is based on Mt Gibson's JORC resource which is 104.9mt at 0.8g/t gold for a total of 3.24m ounces of gold:

- Bull: 5m+ intercepts with gold grades greater than 1.5g/t - this would be a really good result for a first pass drill program especially considering the Capricorn JORC is based on grades of ~0.8g/t gold.

- Base: Grades above 0.8g/t but thin intercepts - any hits with grades above 0.8g/t no matter how thin will be a good start to drilling at the project and be enough for us to want to see BPM run at least one more drill program at the project.

- Bear: grades <0.5g/t - this would probably mean any gold found is too low of a grade to become an economic mine.

We will get an update on BPM’s cash position closer to the end of the month, but the company is only capped at $4.5M.

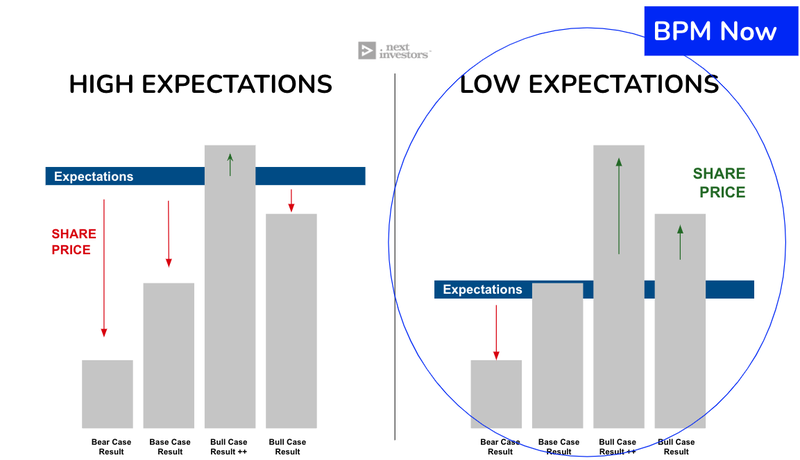

We think that the market is currently valuing BPM’s projects in the low ~$1M (depending on the cash position of the company), which means that expectations are low.

Therefore, any discovery that exceeds the bull case scenario could see the company’s share price materially re-rate.

What is next for BPM?

Claw Project

The latest guidance from BPM includes a timeline of events in the lead up to drilling results:

- ✅ November 2023 - Program of work granted by DMIRS

- ✅ December 2023 - Heritage Survey complete

- ✅ January 2024 - Drilling approval granted

- ✅ January 2024 - Site preparations

- 🔄 January 30th 2024 - 10,000m AC/RC Drilling

- 🔄 January 2024 - Soil sample results

- 🔲 March 2024 - Drilling results from Claw Project