The rig is in the outer harbour - towing to begin in five days

Published 13-MAY-2022 10:00 A.M.

|

14 minute read

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,000,000 GLV shares, 49,000,000 PRM shares and 11,833,332 PRM options at the time of publishing this article. The Company has been engaged by PRM and GLV to share our commentary on the progress of our investment in PRM and GLV over time.

It’s happening.

One of the world’s highest impact oil and gas drilling events is set to take place on the North West Shelf in the coming weeks.

Prominence Energy (ASX: PRM) and Global Oil and Gas (ASX:GLV) both have exposure to the Sasanof-1 well on the North West Shelf of WA.

The drill rig is currently in Dampier’s outer harbour, and will start towing to the drill site on 16 May, with drilling to commence on 24 May 2022.

The Sasanof-1 well is targeting the Sasanof Prospect - a 2U Prospective Resource of 7.2 Tcf gas and 176 million barrel condensate.

IHS Markit (part of S&P Global) put this well in the Top 20 Most High Impact wells of 2022.

The only well on the list that any ASX companies have exposure to is the Sasanof-1 well — and PRM and GLV are the ASX companies.

With the potential for a large scale discovery and a 32% chance of geological success, we are expecting a binary outcome with this Investment. We believe we will either make multiples of our original Investment or take significant a loss.

This is high-risk / high-reward investing, so we have only allocated a small portion of our Portfolio to this near term drilling event (less than 2% of our Portfolio).

Whatever happens, it won't take long for us to know if this Investment is a success or a failure.

We recently noticed a video released by “Stockle” covering the Sasanof-1 drilling event. Stockle gives a “deep dive” into the background of the drilling, the geology and the chances of success.

We have no idea who this guy is, but we found the analysis in the video to be quite insightful, and obviously, Stockle did a lot of research in producing it.

The link to the video is here - Stockle Deep Dive on the Sasanof Prospect, or just click the image below.

Today, PRM and GLV both confirmed that the drill rig was docked and ready to start moving towards the Sasanof-1 drilling location.

The following drilling timeline is now locked in

- 16 May: Drill rig to mobilise to the Sasanof-1 well location

- 20 May: Drill rig to arrive at the well location

- 24 May: Drilling to commence

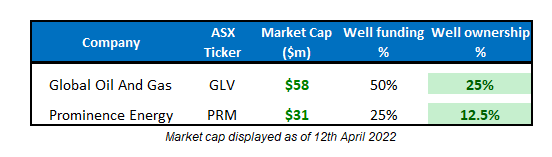

Together, our investments have a 37.5% interest in the Sasanof Prospect - PRM holds 12.5% interest and GLV has a 25% interest in the Sasanof Prospect.

The difference in ownership comes from the different commitments to fund the drilling program. PRM is paying 25% and GLV is paying 50% of the wells drilling costs, which have been estimated at US$20-25M.

We are invested in both companies because it helps us hedge our exposure to the upcoming drilling program.

We expect the share price of each company to respond differently based on the differences in market caps, the composition of shareholder registers, and the differing cap structures of PRM and GLV.

The risk and reward is being priced in with GLV trading at a higher market cap relative to PRM.

GLV currently trades with a market cap of $49M and PRM with a market cap of $22M an almost 2:1 split which makes sense given the 2:1 difference in exposure to the Sasanof Prospect.

To see the key reasons we Invested in GLV/PRM check out our 2022 GLV/PRM Investment Memo by clicking on the image below.

Those who follow our investments in the oil and gas space know that we like to take positions in companies that are looking to drill truly company making prospects, where the risks are high but the reward can be transformational if a discovery is made.

Long-time readers might remember our first ever investment, Africa Oil, which made a basin opening discovery in eastern Africa. Its share price jumped by over 1,200% off the back of the successful discovery.

Another one is our Investment in Invictus Energy, which is yet to drill its elephant scale prospect in Zimbabwe but has already delivered a return of over 600%.

Although our investment approach to PRM and GLV is slightly different (opting to make our investment closer to the major drilling event than we would normally), we are Invested to see similar type returns in the event a successful discovery is made.

The obvious caveat is that PRM and GLV are yet to drill the Sasanof Prospect and with high impact oil and gas exploration there is always a chance that the drilling program returns nothing.

This is why we have Invested less than 2% of our Portfolio in this drilling event (when our positions in both PRM and GLV are accounted for).

Coming back to the reward case, we don't put price targets on any of our Investments as these can be extremely arbitrary when investing in small cap stocks. Small changes in assumptions can mean massive differences in valuations.

Instead, we focus on project fundamentals with the expectation that the quality of an asset will be noticed by the market and is ten bid up in line with transactions completed across the same industry.

In an earlier note, we pointed out the AWE acquisition by Japanese conglomerate Mitsui for $602M, which valued AWE’s proven reserves at $1.5M/BCF.

This gives us a ballpark figure for how an oil and gas supermajor might value a discovery on a BCF basis, should PRM and GLV make a successful discovery.

NOTE: Investing in high impact oil & gas exploration wells so close to the spud date is very high risk and the result of drilling will be near term and binary. The result will be known in the next two months, and depending on the result we expect the share price could rise OR FALL significantly.

A potential North West Shelf discovery and why it matters

With drilling now around two weeks away and the international gas markets in turmoil with buyers scrambling to secure LNG supplies, now’s a good to detail why we think a discovery at the Sasanof Prospect will have regional and international significance.

It comes down to the macro environment for gas, where gas markets are facing a collision of short term and long term issues.

The long term issues come from decades of underinvestment in new high impact oil & gas exploration as the world shuns investment in new oil & gas supply in favour of renewable energy investment.

The recent move by oil & gas major BP using its balance sheet to invest in the Asian Renewable Energy Hub in the Pilbara, WA is as good an indicator of this as anything else.

That project would see 1,753 new wind turbines and up to 10,800 megawatts of solar capacity installed to power ~14 GW of electrolysers to produce green hydrogen.

All with a total project value of $48 billion.

The significance of all of this?

BP, one of the world’s top five oil and gas supermajors, is diverting the cash flows that its oil and gas assets are producing into renewables, meaning there is significantly less being spent on bringing new fossil fuel supplies to market.

For some context, McKinsey estimates that despite the pressure to transition to renewable energy sources, the world still needs more oil and gas production of at least ~23 MMb/d to meet demand after 2030.

So capital is being scared away at a time when the world needs new discoveries.

This brings us to the short term supply side shocks in the oil and gas markets.

In February, Russia’s invasion of Ukraine sent oil and gas prices soaring and the world reacted to the potential fall out across oil and gas supply chains with Russian exports likely to be sanctioned.

For example the EU, which previously imported ~40% of its natural gas supplies from Russia, is now in a position where it has to consider sanctioning Russian exports which would create a continent-wide energy crisis.

Instead of doing this right away, the EU opted to tap the international Liquefied Natural Gas (LNG) markets first, where supply is already tight and any available capacity has already been swooped up from other net energy importing countries like China.

All of this has meant LNG prices globally have increased significantly. For example, the LNG netback price as published by the ACCC in Australia has risen from ~A$7.64 per gigajoule in May 2021 to now trade around $40 per gigajoule.

Prices aside, importing and exporting natural gas through LNG terminals isn’t easy work.

Massive LNG export terminals are required to convert the gas into the liquid form that’s suitable for transportation using very specific ships to carry the LNG.

LNG import terminals are also then required so that these ships can be offloaded and the LNG can be converted back into gas form ready for distribution.

These plants take years to construct and can’t be switched on overnight, meaning pricing pressures in the LNG markets are unlikely to be resolved in the short-medium term.

More specifically coming back to the EU situation, the supply side shocks are unlikely to be solved by boosting gas imports through international LNG markets.

To summarise, natural gas markets are in a position where pressures on pricing will remain for a lot longer than markets are expecting...

1 - Because of the decades of underinvestment in new supply

AND

2 - Because the situation in the EU will mean any excess LNG capacity will be snapped up by energy hungry countries like China and India.

Below we have listed some of the mainstream news that we think help to really understand the macro snapshot for the oil and gas sector as a whole:

Key takeaways:

- LNG export demand from Asian countries leaves less LNG available in global markets for others to purchase, creating an even tighter market.

- Woodside, Australia’s largest exporter of liquefied natural gas (LNG), has reported soaring demand from democratic Asia.

- European countries have resorted to taking on any excess supply from the American/Qatari LNG markets.

Key takeaways:

- Germany has signed contracts to procure four floating LNG import terminals as it races to reduce its energy dependence on Russia.

- The four terminals will have a total capacity to convert at least 20 billion cubic metres of gas per year, about a fifth of Germany’s needs.

- European countries are seeking to rapidly diversify their energy supplies to punish Russia over its invasion of Ukraine

Key takeaways:

- Fierce competition for cargoes between Europe and Asia has led to an increase in Atlantic to Pacific basin flows of ~52%.

- Demand across Europe was up 11 percent from Q1 to Q3 2021 with 1/3rd coming from Germany +23%, and a 17% increase from North Western Europe.

Key takeaways:

- With Russian supplies being shunned, the world is desperate for top LNG exporting countries like the US, Qatar, Australia and Malaysia to fill in the gaps on the supply side.

- To encourage a supply side response, governments need to to support more oil and gas exploration.

How does the North West Shelf fit into the global gas market?

The North West Shelf, offshore in WA is home to the is home to some of Australia's biggest ever gas discoveries, including the Greater Gorgon Project owned by a joint venture between supermajors Chevron, Exxonmobil and Shell.

At the same time, the oil and gas export hub is also home to ~47mtpa of liquefied natural gas (LNG) processing infrastructure and some of the single largest facilities ever developed in the entire world.

Having all of this LNG processing infrastructure means that any discovery made here can be exported all around the world in the form of LNG.

With first gas production starting in 1984 and first exports made in 1989, export capacity in the North West shelf has been falling because of a lack of new commercial gas discoveries in this region.

With declining production from the region’s gas fields and new export capacity coming online, unless new discoveries are made then the whole region could have ~7 mmtpa in idle supply by 2027 unless new discoveries are made and then brought online.

With LNG exports/imports now making up ~50% of the global gas trade and one-third of European consumption, along with demand from Asian developing economies (pre the China lockdown) surging, we expect demand for gas exports from the North West Shelf to remain strong for the medium-long term.

This is why we are invested in both PRM and GLV leading up to the drilling of the Sasanof-1 well.

If a discovery is made, we expect the project to immediately pop up on the radar’s of all supermajors that are operating projects in the area as the ideal bolt on acquisition target.

With a prospective resource of 17.8 Tcf and 449 million barrels of condensate on a 3U basis (high case), AND 7.2 Tcf and 176 million barrels of condensate on a 2U basis (mid case), a discovery at Sasanof could potentially help keep up production rates in this region and ensure that the operators who are expanding their export capacity dont let this additional capacity sit idle.

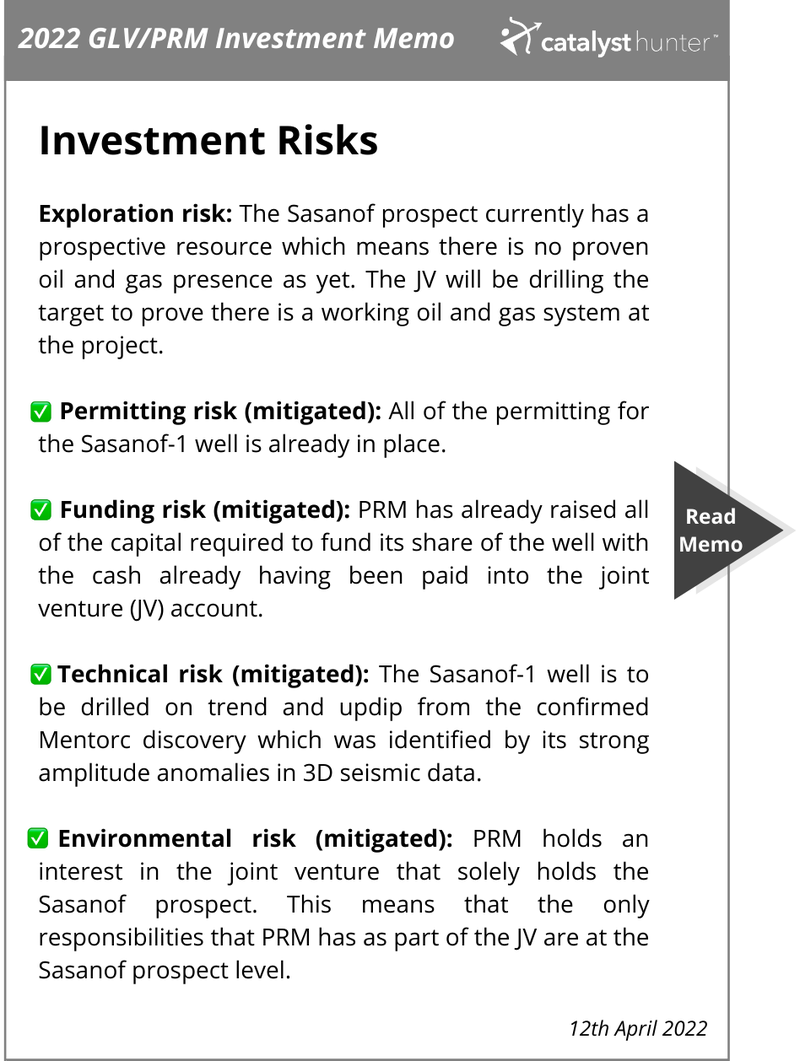

What are the risks?

We are invested in PRM and GLV to see them drill the Sasanof-1 well.

The drilling program is a pure exploration well which means there is a prospective target in place, that the drilling program will try to test and see if there is actually a commercially recoverable resource below.

These type exploration wells can have binary outcomes and certainly dont guarantee a discovery no matter how large a prospect.

The Sasanof-1 well is no different.

In our 2022 PRM/GLV Investment Memo, we detailed the key risk (exploration risk) which you can view in detail by clicking on the image below.

Our Investment plan

Update: The global share market weakness appears to have muted the pre-spud share price rise that started in April (for now), so we are still holding our entire Initial Position.

With drilling to commence in two weeks, we will monitor the price and see if there is an opportunity to execute our Investment Plan (from our GLV & PRM Investment memo April 22nd):

With oil & gas exploration, our usual strategy is to Invest long before the key drilling event and hold while the company de-risks the project (permitting, funding, geological analysis, target selection).

As the company de-risks the project in the lead up to drilling, the share price will typically rise. This is where we look to de-risk our position to be Free Carried into the drilling and drill results.

Our Investment in GLV & PRM is different — the majority of the pre-drill de-risking is already complete, and all that remains is to drill the well in a few weeks time, so this Investment is essentially a “bet” that the well will come in.

This particular Investment is heavily weighted to the actual success of the drilling event, which is a much higher risk than our usual strategy for Investing in oil & gas exploration.

Our Investments GLV & PRM will be farming in a combined 37.5% interest in the prospect based on the following terms:

We took positions in both companies because in early April they had a similar market cap to % project interest ratio. We consider that holding both is a hedge against which company has more tightly held shares and might rise more on a successful result.

If the share price runs up in the lead up to drilling in the coming weeks we will look to Top Slice and hopefully Free Carry.

NOTE: This Investment is unusually close to a binary drilling event compared to our usual strategy, so we have sought and received a once off approval to adjust ourusual 90 day trading blackout after a new portfolio addition to be allowed to sell up to 30% of our positions in PRM and GLV after 20 days (prior to the drill result).

But given the short time to spudding we suspect we will be holding a significantly larger than usual position heading into the drill result. We hope drilling will be successful, but are fully prepared for it to fail.

This Investment is high risk and accordingly the position makes up less than 2% of our total small cap Portfolios across Associated Entities.

This Investment suits our risk profile, but it may not suit yours.

Our 2022 PRM/GLV Investment Memo

Below is our 2022 Investment Memo for PRM and GLV where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our PRM/GLV Investment Memo you’ll find:

- Key objectives for PRM/GLV in 2022

- Why we continue to hold PRM/GLV

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.