New Investments: Sasanof-1 Well

Published 13-APR-2022 09:59 A.M.

|

15 minute read

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,000,000 GLV shares, 49,000,000 PRM shares and 11,833,332 PRM options at the time of publishing this article. The Company has been engaged by PRM and GLV to share our commentary on the progress of our investment in PRM and GLV over time.

Long time readers will know that we have a history of investing in high-risk/high-reward small cap explorers with near term price share catalysts.

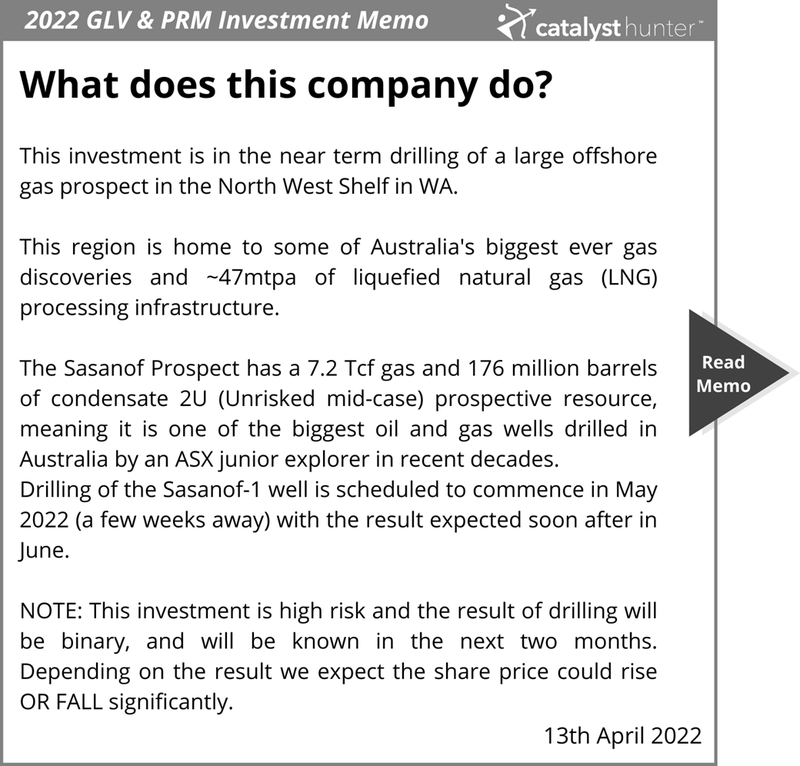

Today we are adding two oil & gas exploration companies to the Catalyst Hunter portfolio.

Together, they are undertaking one of the biggest oil and gas drilling events done by a junior ASX-listed exploration company in recent decades.

The project, in which the two juniors hold a combined 37.5% interest, is the enormous Sasanof Prospect in the North West Shelf, offshore WA which has a prospective resource of 7.2 trillion cubic feet and 176 million barrels of condensate on a 2U basis (unrisked mid case).

The North West Shelf is home to some of Australia's biggest ever gas discoveries.

The extensive oil and gas region off WA’s northwest coast has a considerable number of oil and gas wells, pipelines, and production areas, including ~47mtpa of LNG processing infrastructure.

The Sasanof Prospect has the potential to host a resource larger than, or at least rival the size of, discoveries made by oil and gas majors like Exxon, Chevron and Woodside in this part of WA.

...and the big drilling event is just a few weeks away.

The two companies’ combined 37.5% interest in the prospect means they each have enough ownership that in the event a discovery is made, it could be transformational for both.

If the result doesn’t come in positive, then of course we expect their share prices to fall accordingly.

NOTE: Investing in high impact oil & gas exploration wells so close to spud date is very high risk and the result of drilling will be near term and binary. The result will be known in the next two months, and depending on the result we expect the share price could rise OR FALL significantly.

The spudding of the well is expected between 9th-16th May. Importantly, this process is now largely de-risked with all of the funding, permitting, and rig contracting complete.

Now the only thing we need is the drilling to hit a long gas bearing column.

Two junior explorers have a share in this project, and we hold positions in both.

Introducing the latest additions to our portfolio, both providing exposure to the Sasanof-1 well being drilled in May:

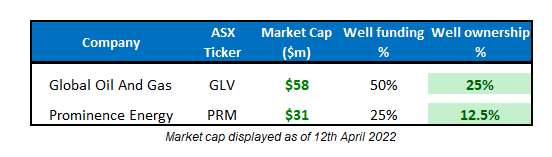

We have invested in both GLV & PRM as each provides exposure to the drilling result.

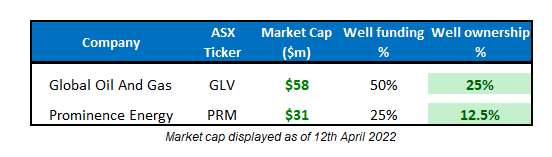

Here are the current metrics for each company in relation to the well:

Investing in both companies also helps hedge our investment exposure as we expect the share price of each to respond to the result differently, due to their different market caps, compositions and cap structures, and how tightly each is held.

We will see if there is a deviation in the share price activity in the lead up to drilling next month and the result.

We don't make many investments in the fossil fuels sector but when we do, it is always in junior explorers with a small market cap and a project that has true company making potential.

Back in 2012, TSX-listed Africa Oil Corp was our first ever investment in this type of oil & gas exploration event.

Africa Oil made one of Africa’s largest oil discoveries in Kenya, unlocking an entirely new oil rich basin across East Africa. Our investment was up over 1,200% off the back of this drilling event.

The latest additions to the Catalyst Hunter portfolio — GLV and PRM — are now only a few weeks away from drilling the enormous Sasanof Prospect in the North West Shelf, offshore WA.

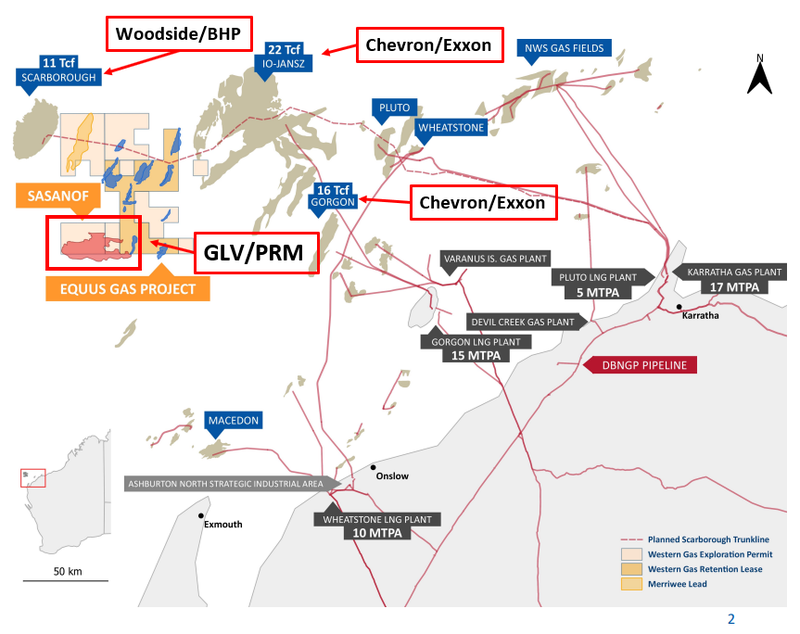

The Sasanof prospect sits right in the middle of the 22 trillion cubic feet (Tcf) discovery made by oil and gas supermajors Chevron and Exxon, and the 11 Tcf discovery being developed via a JV between Woodside and BHP.

The comparisons to these mega projects comes from the Sasanof prospective resource which sits at:

- 17.8 trillion cubic feet and 449 Million barrels of condensate on a 3U basis (high case)AND

- 7.2 trillion cubic feet and 176 million barrels of condensate on a 2U basis (mid case).

For context, the Bass Strait (where most of Australia's gas supply has been coming from for several decades), held 10 trillion cubic feet of reserves at its peak.

The North West Shelf in WA is already shaping up to be multiples the size of this and has potential to supply Australian and international gas markets for decades into the future through the region’s ~47 Mtpa of LNG processing infrastructure capacity.

Rarely do we see ASX small cap explorers get exposure to drilling events as large as this, with prospects of this size generally ending up in the hands of majors who have the firepower to explore them.

This potentially company-making drilling event is now only a few weeks away... it is fully permitted and fully funded for the total drilling cost of US$20-25m.

In our view both companies have relatively low market caps relative to a successful drill result, and so are highly leveraged to a re-rate, should the Sasanof-1 well deliver what we hope it will.

But we are also prepared for a failure to hit gas, where both share prices will be decimated accordingly. This is high risk exploration and investors should only invest what they are prepared to lose in near term, high impact oil & gas exploration wells like this.

For context on the potential upside for PRM and GLV, in 2018, junior WA gas explorer AWE was acquired by Japanese conglomerate Mitsui in a $602M takeover.

AWE had a net 2P resource of 410 petajoules (388 billion cubic feet), valuing the transaction at ~$1.5M per BCF of gas resource.

Sasanof will be drilling with the view to convert a 2U (mid case unrisked) 7.2 trillion cubic feet and 176 million barrels of condensate mid case prospective resource into a proven economic discovery.

Almost 18x the size of AWE’s resources, at the $1.5M per BCF number, Sasanof would have a value of $11 billion (if it comes in).

However, this is based on the prospective resource. It’s likely that in the event of a successful discovery the actual proven resource will be smaller than the prospective figure.

And its worth noting these are rough calcs that should never be used as a basis to make an investment decision. An in ground value of any discovery is based on a myriad of assumptions that can change based on a number of factors.

If the drill is successful, we expect the plan will be to sell the project to one of the energy majors already operating in the North West Shelf - or potentially be an asset that would attract a new major onto the NW Shelf.

Our primary reason for investing in both companies is to see the Sasanof-1 well be drilled in May of this year and gain exposure to a hopefully successful drilling event. As a result we have put together a joint Investment Memo based on the Sasanof prospect itself which forms the basis for our investments in GLV & PRM.

The drilling event is now scheduled to take place in May and we expect that from the drilling rig being mobilised through to the first results it should be between 5 and 6 weeks.

...allowing for the usual delays we see in junior explorers, we think this means that in the next ~12 weeks we will know whether or not our investment in GLV & PRM has paid off or the well was a failure.

Below we will run through the key reasons for our investment in both GLV and PRM and importantly detail our investment strategy going into a drilling event with a binary outcome as big as the Sasanof-1 well.

NOTE: Our usual investment strategy in oil & gas exploration is to invest at least a year before a key drilling event, where the share price usually rises in the lead up to drilling while the company secures permits, funding and a drill rig. This investment is just weeks away from the drill event, so the strategy is slightly different and carries more risk and less opportunity to Free Carry or Top Slice prior to the binary drill result - see our investment strategy section for more details.

Check out the Sasanof Investment Memo here.

Our investment memo has been done at the Sasanof Prospect level, the only difference between GLV & PRM being the ownership interest in the prospect. GLV will pay for 50% of the well costs and own 25% of the prospect, PRM will pay 25% of the well costs and own 12.5%.

This is reflected in the difference in their market caps and means that they each share the risks and rewards of the Sasanof drilling program in proportion to their ownership interest.

Our investment thesis: The 6 reasons we invested in GLV and PRM

Here’s the summary of the key reasons why we invested in both GLV and PRM. (We provide a deep dive into each reason further down in this note).

- Near term major catalyst - Drilling is scheduled to commence in May 2022. The Sasanof-1 well is fully funded, fully permitted and all of the rig contracting is already in place. This means it won't be long before we find out whether our investment has been successful...or not. This investment is high risk and will deliver a binary outcome in the next 6 to 12 weeks - note our specific investment strategy for this drilling event at the end of this memo.

- Roll of the dice - we don’t usually invest in high impact drilling campaigns like this so close to a binary drilling event, but we really liked the prospect and have invested on the chance it could be a success. This investment is high risk and accordingly the position makes up less than 2% of our total small cap portfolios across associated entities.

- Significant prospective resource: The Sasanof-1 well is targeting a 2U (unrisked mid case) prospective resource of ~7.2 trillion cubic feet of gas and 176 million barrels of condensate making it regionally significant. For context, the Bass Strait (the main supplier of Australian domestic gas for decades) at its peak had 10 trillion cubic feet of gas reserves.

- High success rate at nearby Equus project: The Sasanof well is an exploration prospect that sits around JV partner Western Gas’ Equus Project, which has a discovered resource of 2 Tcf and 42 million barrels of condensate. That project has had US$1.8 billion invested in it since 2007 and a historic exploration drilling success rate of 88%, with 15 discoveries from 17 wells.

- Low cost well on a risk reward basis: Targeting a tier 1 scale project with a deep water well at a cost of only US$20-25M. Offshore drilling can be extremely expensive — some drilling programs cost upwards of US$75M.

- Takeover target if a discovery is made: Majors in the area like Woodside/BHP, Exxon and Chevron are already investing heavily in their North West Shelf projects. Given the scale of the Sasanof prospect, a new discovery could lead to a takeover by major players already in the region, or alternatively it could be the “entry asset” for a major who is looking for a flagship project to get exposure to Australian gas. In 2018, Japanese conglomerate Mitsui acquired AWE for $602M. AWE had a ~380 billion cubic feet (Bcf) proved resource, this transaction is a signal of the appetite internationally for Australian gas projects.

We will be releasing the detailed deep dives for each of these reasons over the coming weeks in the lead up to the drilling event.

In the meantime, here is a quick summary that forms the basis of our 2022 Investment Memo:

What is the Sasanof prospect?

The Sasanof prospect is the big reddish blob highlighted below:

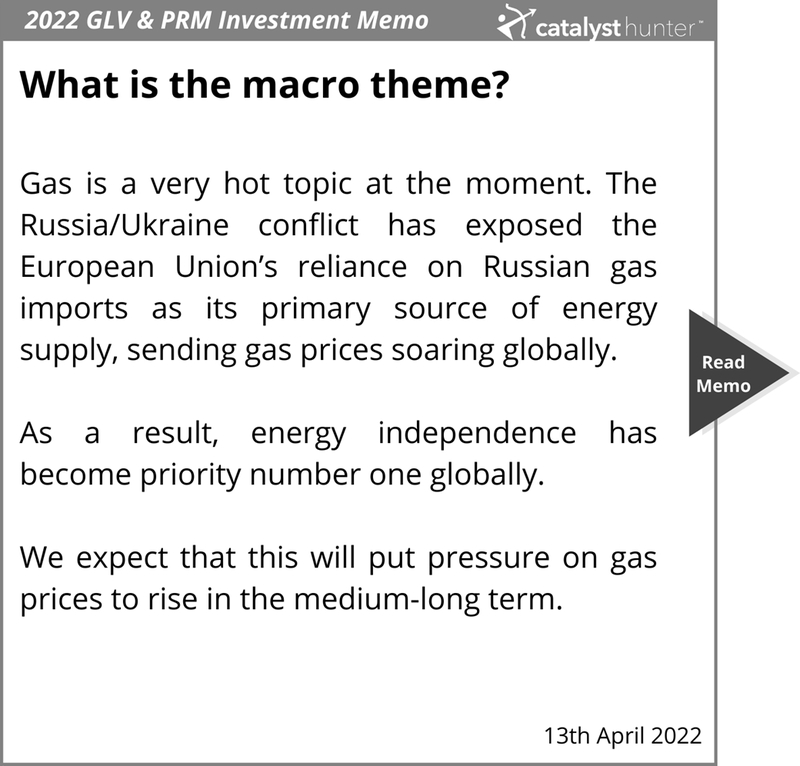

The macro theme behind gas projects

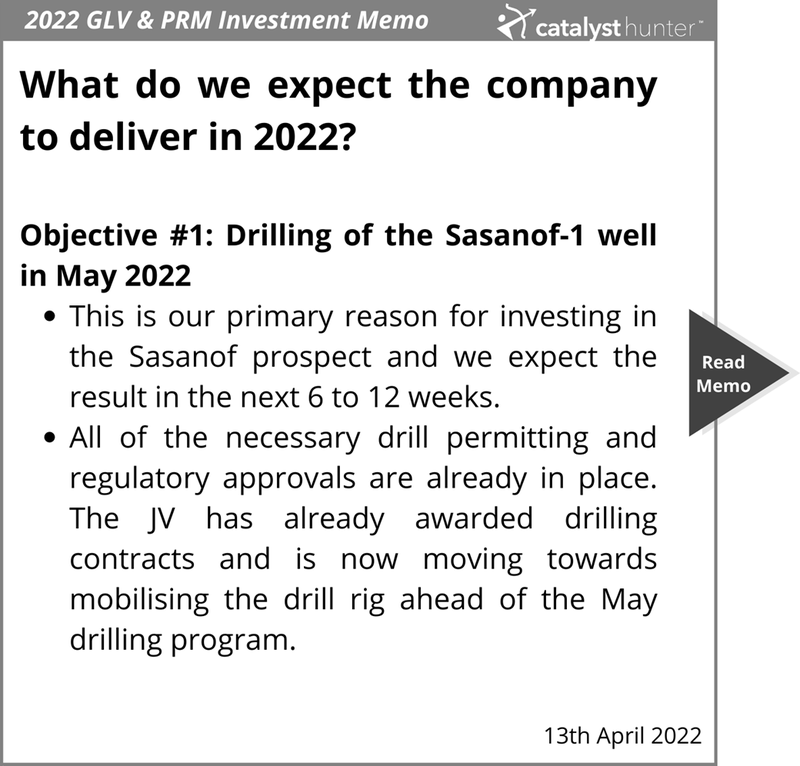

What we want to see GLV and PRM achieve in 2022:

As per our investment memo, we are solely focused on the drilling of the Sasanof well.

Given that a lot of the preparatory work has been completed we have set up some sub milestones for the drilling program which we will be tracking closely.

Milestones:

We want to see the following take place in the lead up to and during the drilling program, we have also set our expectations for what success/failure would look like from the drilling program:

🔲 Drill rig mobilisation at the well site.

🔲 Drilling commencement.

🔲 Drilling results -

- At this stage we will be solely focused on the size of the gas column that is intersected with the following three scenarios which we will use to measure how much of a success/failure the drilling program was.

- Bearish case= <10m of gas bearing columns.

- Base case= 10-20m of gas bearing columns.

- Bullish case= >20m of gas bearing columns.

- BONUS: Spectacular case= 40m+ of gas bearing columns

🔲 Forward plan to be put together based on the drilling results.

🔲 Prospective resource converted into a resource/reserve.

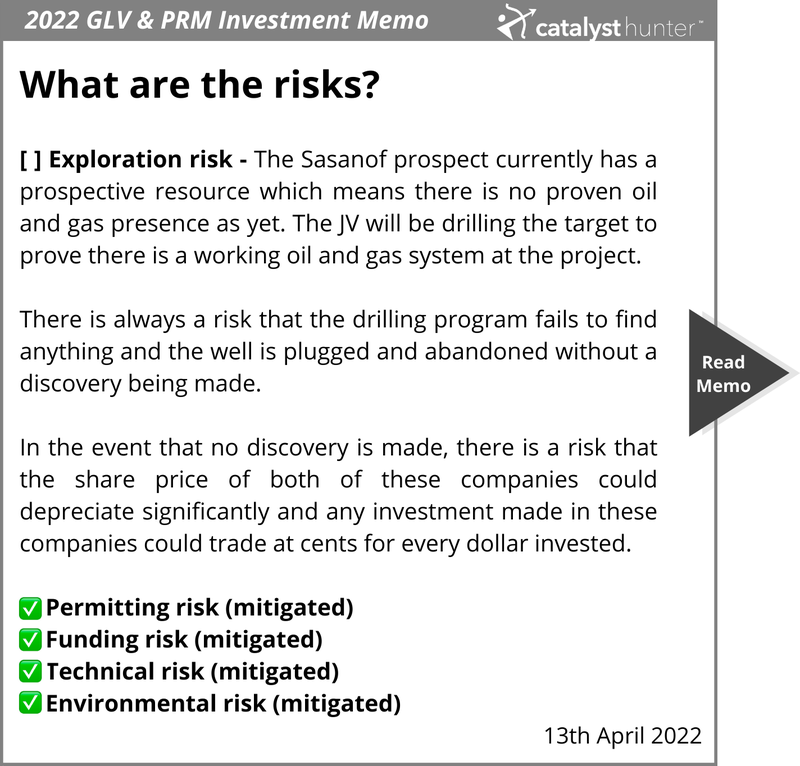

What are the risks?

The JV that is drilling the Sasanof well is already fully funded for the drilling program, all of the contracts have been awarded and drilling is scheduled to commence in May.

This means that all of the usual risks associated with these types of drilling programs like permitting/environmental and financing are not a cause for concern here.

The single and most important risk associated with our investment in PRM is exploration risk.

At present the project has an unrisked prospective resource meaning it is yet to be tested.

The drilling program will be aiming to prove that the resource is there and that it can be commercially extracted.

This effectively means that the drilling program will have a binary outcome, either:

A) the drilling program will be successful and a commercially viable gas reservoir will be identified, OR B) there will be no working gas system present and the well will effectively be a failure.

This is a really high risk high reward investment for us, we recognise that there is a chance the well does not deliver what we hope it will and the share price of PRM could de-rate as a result.

This style of investing is extremely risky but we are comfortable allocating less than 2% of our portfolio towards a binary event like this.

In the event of a failed drilling event the loss on an overall basis is therefore limited to <2% of our entire portfolio.

This investment suits our risk profile, but it may not be suitable for everyone.

✅ Permitting risk (mitigated): All of the permitting for the Sasanof-1 well is already in place.

✅ Funding risk (mitigated): PRM has already raised all of the capital required to fund its share of the well with the cash already having been paid into the joint venture (JV) account.

✅ Technical risk (mitigated): The Sasanof-1 well is to be drilled on trend and updip from the confirmed Mentorc discovery which was identified by its strong amplitude anomalies in 3D seismic data. The Sasanof prospect has also been identified using 3D seismic data, displaying similar seismic amplitude anomalies. Mentorc was drilled three times and has a 2C resource of 378 billion cubic feet + 16.4 million barrels of condensate.

✅ Environmental risk (mitigated): PRM holds an interest in the joint venture that solely holds the Sasanof prospect. This means that the only responsibilities that PRM has as part of the JV are at the Sasanof prospect level. Any other abandonment liabilities that may be levied on JV partner Western Gas for its other projects are not the responsibility of PRM.

With GLV and PRM, we are more so focussed on the key catalyst being the upcoming drilling event.

In line with most of our investments in the oil & gas space, if the share price runs up as the drilling results become closer, we will look to sell down some of our position, taking the majority of our holding into the results.

After the results are released we will re-evaluate our position in full.

The drilling event is likely to have a binary outcome, meaning that either it will be a success or failure.

These types of binary outcomes may not be suitable for all investors though and we encourage that all readers get professional advice before considering these companies as investments.

Below is an excerpt from our memo detailing our investment plan:

What is our Investment plan? - IMPORTANT

Excerpt from investment memo:

With oil & gas exploration, our usual strategy is to Invest long before the key drilling event and hold while the company de-risks the project (permitting, funding, geological analysis, target selection).

As the company de-risks the project in the lead up to drilling, the share price will typically rise. This is where we look to de-risk our position to be Free Carried into the drilling and drill results.

Our Investment in GLV & PRM is different — the majority of the pre-drill de-risking is already complete, and all that remains is to drill the well in a few weeks time, so this Investment is essentially a “bet” that the well will come in.

This particular Investment is heavily weighted to the actual success of the drilling event, which is a much higher risk than our usual strategy for Investing in oil & gas exploration.

Our Investments GLV & PRM will be farming in a combined 37.5% interest in the prospect based on the following terms:

We took positions in both companies because in early April they had a similar market cap to % project interest ratio. We consider that holding both is a hedge against which company has more tightly held shares and might rise more on a successful result.

If the share price runs up in the lead up to drilling in the coming weeks we will look to Top Slice and hopefully Free Carry.

NOTE: This Investment is unusually close to a binary drilling event compared to our usual strategy, so we have sought and received a once off approval to adjust our usual 90 day trading blackout after a new portfolio addition to be allowed to sell up to 30% of our positions in PRM and GLV after 20 days (prior to the drill result).

But given the short time to spudding we suspect we will be holding a significantly larger than usual position heading into the drill result. We hope drilling will be successful, but are fully prepared for it to fail.

This investment is high risk and accordingly the position makes up less than 2% of our total small cap Portfolios across Associated Entities.

This Investment suits our risk profile, but it may not suit yours.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.