1 in 3 Chance of a 20 Bagger? Offshore Drilling Weeks Away

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A binding drill rig contract has just been signed for the Hawkeye-1 well in the Philippines.

This is the official green light for the spudding of an offshore drilling event targeting 112 million barrels.

In just a few weeks’ time, investors in $13M AUD market capped Red Emperor Resources NL (ASX:RMP; AIM:RMP) essentially have a 1 in 3 chance to make over 20 times their money.

Success is no guarantee, and you need to decide whether this opportunity suits your own investment strategy.

We will explain at how we arrived at these numbers below.

RMP are currently sitting on about $12M AUD in cash, and will still have around $6M AUD after drilling – so given their market cap is $13M AUD, almost no value is ascribed to the upside potential of this upcoming drilling event.

The Hawkeye-1 well is to be drilled in Block SC55 in the Philippines by RMP’s JV partner and operator; the $130M AUD capped Otto Energy (ASX:OEL), who has a 78.18% working interest and a proven track record in the region.

With the looming spud date approaching, this is the exact kind of stock that catalysthunter.com looks for.

RMP: 1 in 3 chance for 20 times value uplift

We arrived at these numbers for RMP’s upcoming well based on the following:

- After examining all the data to date, both internal and independent geologists have concluded the Hawkeye-1 well has a 1 in 3 chance of success

- Total discovery potential on the well is in excess of 100 million barrels, with over 14 million barrels attributable to RMP after government share

- RMP’s JV partner Otto Energy recently sold its interest in the producing Galoc Oil Field in the Philippines for US$108M, valuing the oil there at $34USD/barrel

- Given this recent sale, an estimated value of an undeveloped barrel to RMP would be approximately $15 USD/barrel – or $20 AUD/barrel

- RMP’s current market cap sits at just $13M AUD and the company has $12M AUD in cash

- Yet 14 million barrels at $20 AUD/barrel gives a potential discovery value to RMP of $280M AUD

- Based on the above numbers, should RMP successfully strike oil in the coming weeks, the company’s market cap could multiply 20 times over.

- This is no guarantee however, and many variables apply which could impact the result.

RMP – The Timing: Spudding in weeks, potential outcome days after

Deepwater frontier drilling at Hawkeye-1 is set to begin in weeks:

- Long lead time items have been procured and are waiting in a nearby warehouse in Labuan, Malaysia

- JV operator Otto Energy has executed a binding contract with Maersk Drilling to secure the Maersk Venturer ultra-deepwater drillship – mobilisation will occur shortly

- We see the signing of this drilling contract as the trigger for a pre-spud ramp up in market interest in RMP in the coming weeks, leading to continued speculative interest during drilling

- Hawkeye-1 is assessed to be a straightforward target in water depth of approximately 1,700m, with the top of the target structure ~1,000m a further below the mud-line

- Hawkeye-1 could hit oil within 12 days of spudding

- RMP’s JV operator Otto Energy estimates it will take 23 days from spud to release of the rig – it won’t be long until we get a result.

Our previous Catalyst Hunter stock

Since our previous article on Stonehenge Metals (ASX:SHE) Wave Energy Technology Deal Complete , SHE has risen over 750%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

RMP: The fiscal position

It is an opportunistic time for RMP to drill for oil offshore.

The global price of oil is in a temporary down cycle at the moment, and rig costs have been slashed globally.

The well cost for Hawkeye-1 is estimated at around US$30-$35M– at any other time the cost for this event would be upward of US$50M – a low cost hydrocarbon discovery could be made in the coming weeks.

RMP is well funded for this drilling event:

- The company’s spend for its 15% stake is capped at US$5.625M, less than half of its current cash reserves.

- RMP will still have between $5 and $7M AUD in the bank after drilling to fund future endeavours.

- RMP also has a 20% share of two other oil assets in Puntland, Somalia and Georgia; both of which have shown the ability to be potential company making assets in the past.

RMP: The drill target

The Hawkeye-1 target was identified and worked up to a high level through a Joint Venture between Otto Energy and BHP Billiton (ASX:BHP) on the SC55 Block.

BHP farmed into this Block on the back of its significant prospectivity.

The JV shot extensive 3D seismic over area and worked up two targets – Hawkeye-1 and Cinco – a 1.6Tcf gas target to be drilled later down the line.

However, a corporate review of BHP’s global operations led it to exit its entire South East Asian portfolio, and under exit terms, the company is contributing US$24.5M to the imminent drilling of Hawkeye-1.

The JV of which RMP is now a part of, as well as the cash injection, retained all of BHP’s technical input, and is now armed with this data for the imminent drilling of Hawkeye-1.

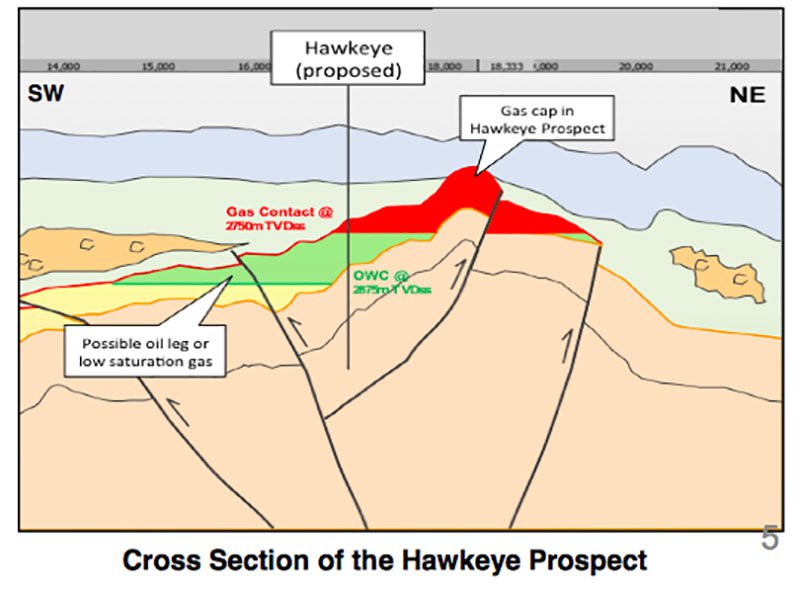

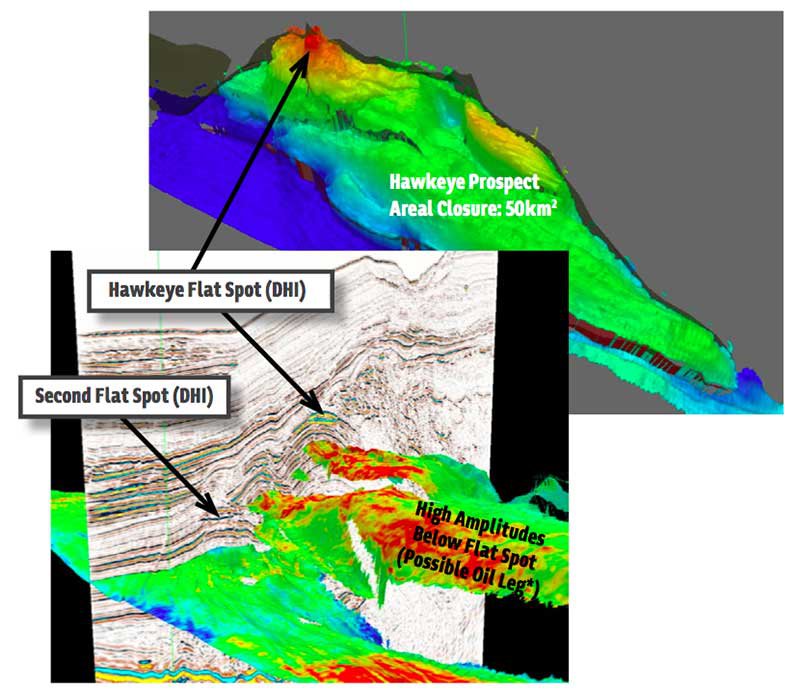

Extensive 3D seismic imaging shows the Hawkeye prospect to be a likely gas cap above what’s thought to be a pocket of oil:

- Hawkeye-1 lies at a water depth of 1,700m and detailed 3D seismic imagery shows a flat spot in amplitude on all datasets consistent with a gas contact at 2,750m

- Bright amplitudes down dip are consistent with structural contours on the western side. Modelling assesses these deeper amplitudes as either an oil leg below the gas cap or low saturation gas caused by leakage

- The mid case estimate for Hawkeye is 112M barrels of oil gross, yielding 14.3 M barrels net to RMP (15% working interest after government share)

- An independent assessment of Hawkeye-1 by Jordan & Pay Exploration Consultants gives it a 32% chance of success to discover the oil leg – 1 in 3 – a relatively strong chance of encountering hydrocarbons

The Operator estimates it will take 23 days from spud to release of the rig and an oil pocket could be penetrated within a fortnight of spudding.

And because of the potential gas cap, there is the upside that even if oil isn’t discovered, a hydrocarbon discovery would more than likely add significant value to the SC55 Block.

RMP’s Hawkeye-1 well could also prove to be the key that unlocks a new oil and gas frontier for the Southwest Palawan basin offshore the Philippines.

The JV has nine additional gas drilling targets worked up in the vicinity of Hawkeye-1, and RMP will have the opportunity to participate in these drilling events as they come.

RMP’s JV partner Otto Energy is a vastly experienced operator in the region, having operated the Galoc Oil Field and sold its stake for US$108M. It has an excellent relationship with the Filipino government and is a seasoned offshore explorer. All of which are benefits that RMP can leverage from.

Drilling is now weeks away

In just weeks, the ultra-deepwater drillship Maersk venturer will arrive at RMP’s Hawkeye prospect and spud the Hawkeye-1 well.

The drill bit will punch through an anticipated gas cap below the sea floor, then in as little as 1000m beyond the mud it could hit a pocket of oil.

From there, the drill bit could go on to discover a mid-case of 112MMbbl oil.

With 14.3M of those barrels net to RMP, this well could be worth as much as $280M AUD – RMP is currently capped at just $13M AUD – so there is significant upside leverage on a successful outcome.

RMP is spending just US$5.625M (potentially less) to participate in this imminent drilling event, and will still have $6M AUD in the bank account after this.

Beyond Hawekeye-1, RMP should have the opportunity to participate in the drilling of up to nine additional gas targets with 18.6Tcf of gas potentially up for grabs.

Oil and gas exploration is high risk – but it’s also high reward – and RMP could see great interest in the coming weeks as the drilling event ramps up.

RMP’s Hawkeye-1 well is beginning imminently with results expected within 12 days of spudding.

We won’t have to wait long for an outcome on this one.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.