GGE’s Maiden Helium Drilling Event has Begun - Here’s what we are looking for next

Our 2021 Catalyst Hunter Pick of the Year, Grand Gulf Energy (ASX:GGE) has just started drilling its first helium exploration well.

Spudding of the well occurred on Sunday April 24th at 5:30PM local time.

GGE’s maiden helium well comes at a time of surging helium prices. Helium is now selling for as high as US$2,000-3,000 mcf - not long ago it was priced around $350-600 mcf.

Now that GGE’s maiden helium well has been spudded, it's time to take a look at what to expect over the coming weeks from GGE:

- Drilling is expected to take ~30 days to reach the total depth of ~8,500 feet.

- Ideally we hope to see some initial results less than one week after the drilling is completed.

- We would expect detailed results, including any flow testing to take another 2-3 weeks after this.

- Offtake partner already secured, so GGE already has a buyer of any helium it finds.

With drilling now underway, we have set up some expectations for what we are looking for after the results from the well come in.

This helps us determine whether or not a company has met, exceeded, or failed to achieve what we thought would be a good result before the drilling program started.

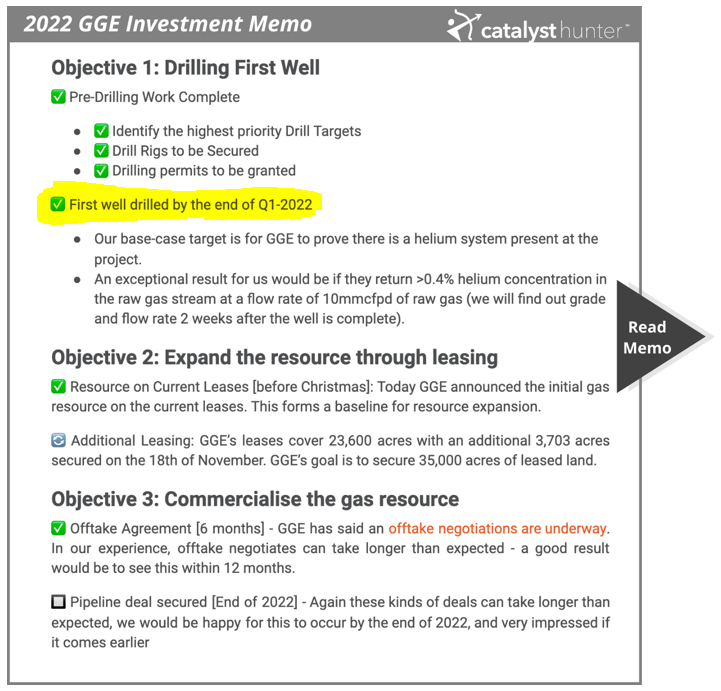

We previously published our base case expectations for the Jesse #1 well in our 2022 GGE Investment Memo and have set this as the barometer with which we will measure the success of the drilling program.

Our expectations were mostly based on the flow rates being achieved at the nearby Doe Canyon field. We think that if GGE’s flow rates are as below, this will mean that it has made a commercial discovery.

Here’s what we will be looking for from the Jesse #1 results:

- Our base case target is for GGE to prove there is a helium system present at the project. If GGE intercepts a helium structure, it can be followed up with additional drilling programs.

- An exceptional result for us would be if GGE returns >0.4% helium concentration in the raw gas stream at a flow rate of 10mmcfpd of raw gas. In our opinion, this would constitute a commercial discovery and could immediately be tied into the offtake partners processing facility, moving GGE from explorer to producer.

Effectively, if GGE identifies a working helium structure with this drilling program, the company would meet our base case expectations. But if GGE then completed flow rate testing and returned the results we set above of >0.4%, we think GGE could move from explorer to producer off the back of Jesse #1 alone.

This is why we have set this up as our exceptional case (bullish case).

🎓 = To learn more about how we go about setting our expectations for drilling events check out our educational article here.

We think GGE has timed this drilling program perfectly given the macro environment.

The Russia/Ukraine conflict appears to have removed future Russian supply from the global supply pipeline (a nation that was expected to become a top three supplier in 2025). Russia’s Armur facility is also out of action indefinitely after catching fire (capable of producing ~11% of global supply).

This is coupled with the shutdown of the biggest producer in the US, the Cliffside Helium plant, after a leak caused an unplanned shutdown in January.

These supply issues have put serious pressure on helium prices — prices are now trading as high as US$2,000-US$3,000 Mcf.

For some context, GGE initially started planning its drilling program assuming helium prices of US$350-600/Mcf.

With an offtake agreement and a strategic alliance in place with Paradox Resources (owners of the nearby Lisbon helium production plant), GGE already has a buyer for its helium.

This means that should GGE achieve our “exceptional case” result, the Jesse #1 well could immediately be tied into Paradox’s nearby pipeline infrastructure and then processed through its Lisbon helium production plant.

With today’s announcement confirming the Jesse #1 well has now been spudded, GGE has ticked off the final milestone under objective #1 in our 2022 Investment Memo.

With another eight months left in the year, GGE is progressing extremely well with achieving all the key objectives we wanted to see achieved this year.

What’s next with GGE’s drilling program & what we want to see

Jesse #1 drilling 🔄

Based on a combination of the historical drilling data and the flow rates/grades of the Doe Canyon helium field next door, we set our expectations (as we do with all drilling programs) well in advance of the drilling program.

As per our 2022 Investment Memo, below is what we will be looking for from the Jesse #1 results:

1 - Bullish case (exceptional result):

- Helium grades greater than 0.4% with raw gas flow rates of ~10mmcfd (Million cubic feet per day)

This in our opinion would constitute a commercial discovery and could immediately be tied into the offtake partners processing facility, moving GGE from explorer to producer.

2 - Base case (good result):

- GGE can prove there is a helium system present that warrants follow up drill testing.

A proven helium structure will mean GGE can then follow-up with more drilling.

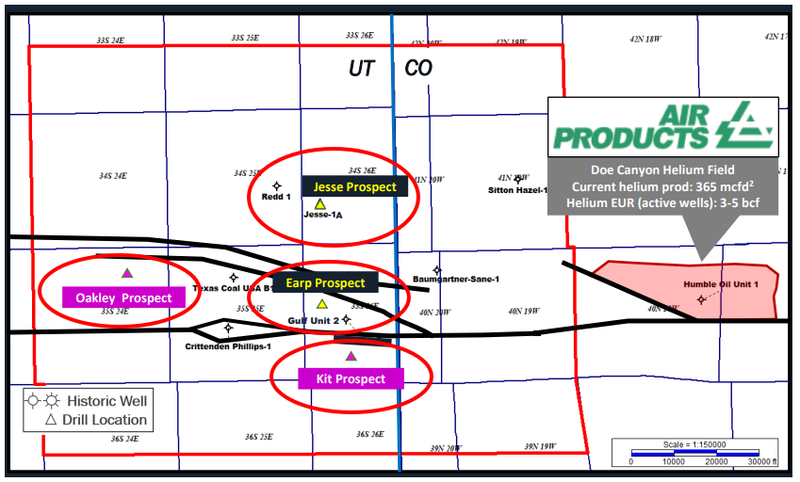

Only a few weeks ago GGE announced that it had already identified three new independent helium prospects inside its project area, in addition to four separate step out drilling locations at the Jesse prospect (where Jesse #1 is being drilled).

Importantly the Doe Canyon helium field which sits ~24km to the east of GGE’s project area is currently producing approximately 10,700,000 cubic feet of helium per month, the bulk of which comes from seven wells.

Just like the Doe Canyon field, if GGE can prove a helium structure is present it can then follow up Jesse #1 by testing these new targets with the aim of increasing overall production rates.

3 - Bearish case (poor result):

- No helium system and no raw gas flow rates from the well.

As with any exploration program there is always a risk that nothing comes from the big drilling event.

In the event that GGE don't manage to make a discovery with Jesse #1, the recently raised $11M will mean the company will have multiple chances to drill out other prospects over its project area.

In this case, the Jesse #1 well would give GGE a better geological understanding of its project area which it could leverage in future drilling programs.

What has GGE done leading up to the drilling program?

Maiden prospective resource ✅

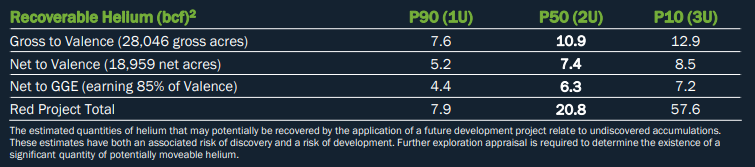

In December last year, GGE put out a maiden prospective resource number for its project of:

- P50 (unrisked prospective, medium case) 10.9 billion cubic feet (BCF) of helium. (6.3 Bcf net to GGE)

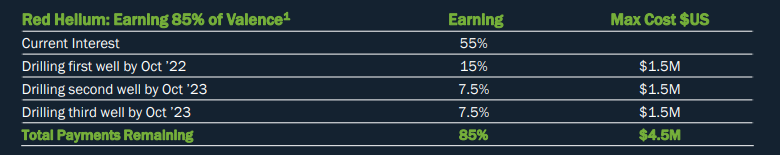

GGE then immediately moved to increase its ownership of the project by 30%. It completed a transaction to increase its current ownership to 55%, with earn-in terms bringing its eventual position to 85%.

As part of the earn in agreement, GGE will become a 70% owner of project immediately after the Jesse #1 well drilling program is completed.

The remaining 15% can be earnt in after the next two wells are completed.

We particularly like that the bulk of GGE’s ownership is weighted for before the Jesse #1 well.

This means that, should a discovery be made, GGE will be the majority owner of a producing helium project.

To read our deep dive on the prospective resource check out our previous note here: First Look at GGE Helium Resource. How does it stack up?

Drilling contractor + exploration manager appointed ✅

In mid-January GGE appointed Doug Frederick as the company’s drilling manager.

Doug brings over 40 years’ experience with drilling programs, including 16 years working for oil & gas behemoth, Shell Oil Company.

More importantly, Doug spent ~20-years with Kinder Morgan who owns the Doe Canyon Field and is capped at ~US$40 billion. As drilling director at Kinder Morgan, Doug oversaw nine drill-rigs and 30 workover rigs and managed annual exploration budgets of up to US$300M, plus OPEX budgets of US$200m.

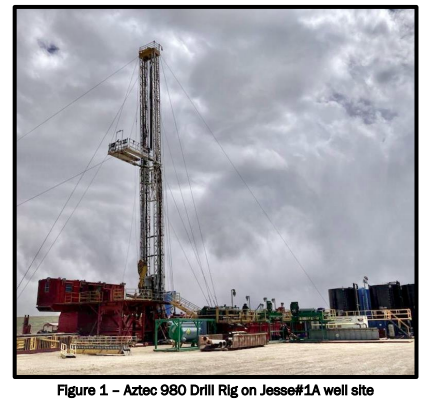

Only a month after his appointment to GGE, Doug nominated drilling contractor Aztec Well Services as his preferred contractor for Jesse#1.

In March, GGE signed Aztec up as the drilling contractor for the Jesse #1 well.

Aztec makes for the perfect drilling contractor given their experience drilling in and around GGE’s project. Aztec is based ~201km to the southeast of GGE’s project and are the same contractors who worked with GGE’s drilling manager at the Doe Canyon field next door.

To see our coverage on the appointment of Doug as drilling manager, check out our previous note here: GGE starts well permitting, appoints experienced driller as helium supply tightens.

Permitting completed ✅

Earlier this month GGE’s drilling permit was approved.

Offtake agreement signed ✅

A few weeks ago GGE signed an offtake agreement BEFORE the drilling of Jesse #1. This was significant as these type offtake agreements are rarely secured leading up to a maiden drilling program or before a commercial discovery has been made.

The key points of GGE’s offtake agreement are as follows:

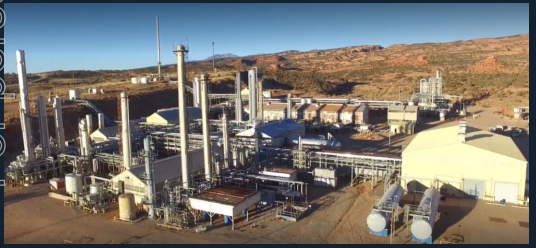

- The owner of the Lisbon Helium Plant, 20 miles (~32km) to the north, has signed a “Gas Sales & Processing Agreement” with GGE.

- The Lisbon Plant is currently selling helium for up to US$605 per thousand cubic feet.

- The agreement is an industry standard 80/20 revenue split in favour of the producer (GGE).

- Assuming GGE’s maiden well “Jesse-1” is a success (It’s being drilled in a matter of weeks), GGE can monetise it almost immediately with minimal CAPEX.

- Potential sales volumes will be based on what GGE discovers at the Jesse-1 well.

The owner of the Lisbon Helium Plant is a private US company called Paradox Resources LLC - a proven helium refiner and seller with deep helium processing and marketing experience. Paradox also owns 570 miles of gas gathering lines with four compression stations that feed the Lisbon plant.

To read our deep dive into the offtake agreement and what we think that means for GGE check out our previous note here: GGE gets helium offtake BEFORE drilling

Strategic alliance with offtake partner signed ✅

Just weeks ago, GGE expanded its partnership with offtake partner Paradox Resources by signing a “strategic alliance”. This is designed to fast-track and optimise any commercial opportunities that exist in the helium market on a joint venture basis.

So instead of GGE simply supplying raw helium to Paradox who then refines it and on-sells it, GGE can share in the higher value added refined product sales.

The strategic alliance mostly centres around four different opportunities for GGE and Paradox to target (assuming GGE can make a successful discovery):

First, is the potential to restart Paradox Resources’ Helium Liquefier:

- A helium discovery at GGE’s project could provide the needed supply for Paradox to restart its liquefaction plant and produce high purity helium (99.9995% helium) that can be sold into markets where prices are >US$1,000/mcf.

Second, is to collaboratively sell helium products to high purity end users:

- GGE and Paradox will together market helium to high-purity helium end-users in the semiconductor, medical, research, space and defence industries.

Third, is the expansion of the existing offtake agreement into an almost joint venture:

- GGE and Paradox will assess and jointly pursue corporate opportunities.

- The key point is that the offtake agreement (signed 16 March 2022) was limited to the Jesse #1 well. The strategic alliance effectively expands the relationship beyond just the single well.

Finally, GGE will look into CO2 disposal - enhanced oil recovery and carbon sequestration:

- Explore pathways to dispose of, and derive revenue from, the Red Helium residual gas stream (primarily carbon dioxide and nitrogen).

- With CO2 selling for US$1.50/mcf, this could potentially bring additional revenues to GGE’s project via the processing of a by-product.

To read our deep dive into the strategic alliance and what we think that means for GGE check out our previous note here: GGE’s First Helium Well Happening this Month, More to Come

Additional drilling locations identified ✅

Earlier this month, GGE confirmed it had identified three new independent helium prospects inside its project area, after ~315km of 2D seismic data was reprocessed.

GGE also announced that internal analysis had determined that the Jesse Prospect (the prospect the Jesse #1 well is targeting) was large enough that four separate step out drilling targets had been identified.

Importantly, most of these targets could be quickly brought up to drill ready status in time for a follow up drilling program in Q3 of this year, contingent on positive Jesse #1 well results.

The significance of this is that the neighbouring Doe Canyon helium field produces out of a combined ~7 active wells.

With these additional prospects identified, GGE can look to ramp up production (contingent on a successful discovery being made).

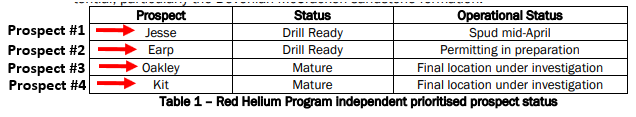

Below is the latest update on the status of these prospects showing if they are “drill ready” yet.

To read our technical deep dive on these additional drilling targets check out our previous note here: GGE’s First Helium Exploration Well Now 10 Days Away.

Funding secured ✅

Finally just last week, GGE raised $11M at 4.4c per share.

Initially, GGE was targeting a capital raise of ~$8M, but the amount was lifted to accommodate increased demand from both domestic/international institutions.

The higher level of interest reflects the quality of the helium prospect GGE that has on its hand.

With the Jesse #1 well expected to cost US$3.3M, GGE is now well funded through to the completion of this well. We expect the company to have enough cash on hand to at least get it through the planning stage of the next round of drilling.

To read our take on the capital raise and what it means for GGE check out our previous note here: GGE’s First Helium Well Happening this Month, More to Come

Our 2022 GGE Investment Memo

Below is our 2022 Investment Memo for GGE where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our GGE Investment Memo you’ll find:

- Key objectives for GGE in 2022

- Why we continue to hold GGE

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.