GGE extends helium discovery - but not a commercial reservoir… yet

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 25,011,058 GGE shares at the time of publishing this article. The Company has been engaged by GGE to share our commentary on the progress of our Investment in GGE over time.

Drill results day. Always eventful.

Our US helium Investment, Grand Gulf Energy (ASX:GGE 🇦🇺 | OTC:GRGUF 🇺🇸) has been drilling to find a commercial resource of helium and plug it into an existing, nearby processing plant.

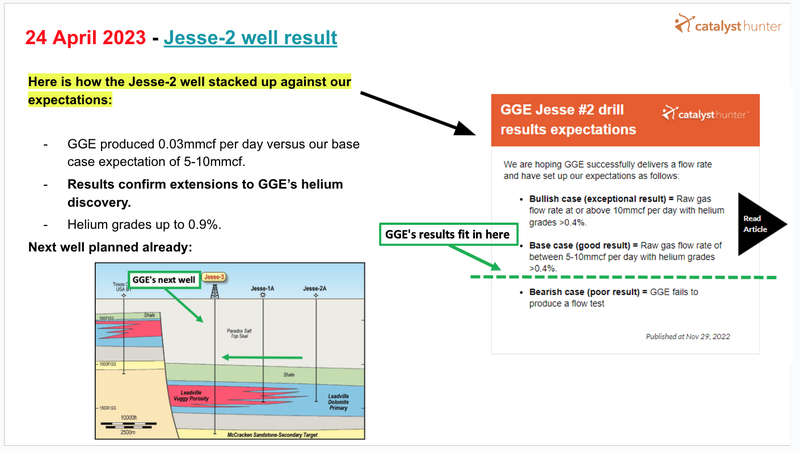

Today, GGE announced the results of its second helium well, which was drilled taking into account lessons learnt from its discovery well it drilled last year.

The market was hoping that this well would deliver a commercially viable helium flow rate - enough to allow GGE to hook it into existing helium processing infrastructure nearby.

The well flowed helium to surface, recording high concentrations of up to 0.9% helium, and it extended GGE’s proven helium system by ~1.5 miles from its first discovery.

Whilst a flow rate was recorded — a maximum of 0.03 mmcf/day — this was not enough to warrant an immediate move into development and production. This may change in the future with more stimulation work on the well to increase the flow rate.

On the next well, Jesse-3, GGE will hopefully finally hit the reservoir in the sweet spot to deliver enough of a flow rate such that it makes commercial sense to plug it into the existing processing infrastructure... and start generating cash flow.

Another near term drill attempt is certainly warranted given these wells are relatively cheap to drill, at ~$1.5M, and more knowledge has been gained from today’s drill result.

With each well GGE is getting closer and closer to cracking the code of extracting commercial quantities of helium from its project.

Here’s what we learnt today from GGE’s helium well:

Positives we can take from Jesse-2:

- ✅ GGE extended its discovery - Jesse-2 was drilled ~1.5 miles away from Jesse-1A, extending GGE’s helium discovery.

- ✅ Gross gas column of ~192 feet (~23 feet of net pay). An improvement on the Jesse-1A well in terms of gross numbers BUT slightly lower in terms of “net pay”. Jesse-1A had ~31m of independently audited net pay.

- ✅ Helium grades up to 0.9%. This is a grade that is considered commercial AND above our 0.4% expectations. The result was also consistent with Jesse-1A which delivered ~1% helium grades.

Here's what didn't meet expectations:

- 🟧 Flow rate - GGE only produced ~0.03mmcf per day of helium, a rate not considered commercially viable.

That fourth and final point could be the answer to the following question, which some market participants may have had today...

Why is the GGE share price down?

GGE was aiming to convert this well into a revenue generating helium production well, and to do that, it needed to demonstrate it could get a commercial flow rate of helium out of the reservoir.

A natural flow rate, ideally without the need for any well stimulation.

The flow test results of a maximum of 0.03 mmcf per day were not the bull case success that we and the market was hoping for.

Because of this, GGE’s share price has been down by as much as 29% today, trading at 1.5c (at the time of writing).

The helium flow rate captured at this specific location at Jesse-2 just wasn't enough to be deemed a commercial flow rate.

Our plan is to continue to hold our GGE position into the next drill campaign, and we may look to increase our Position.

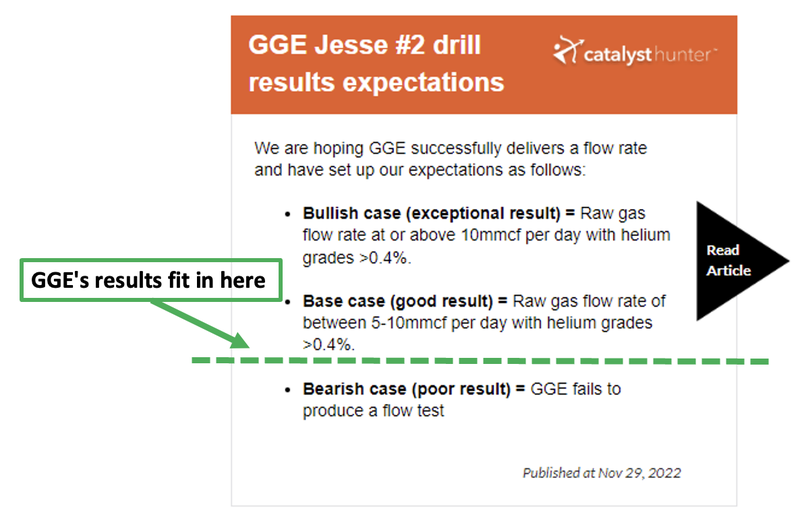

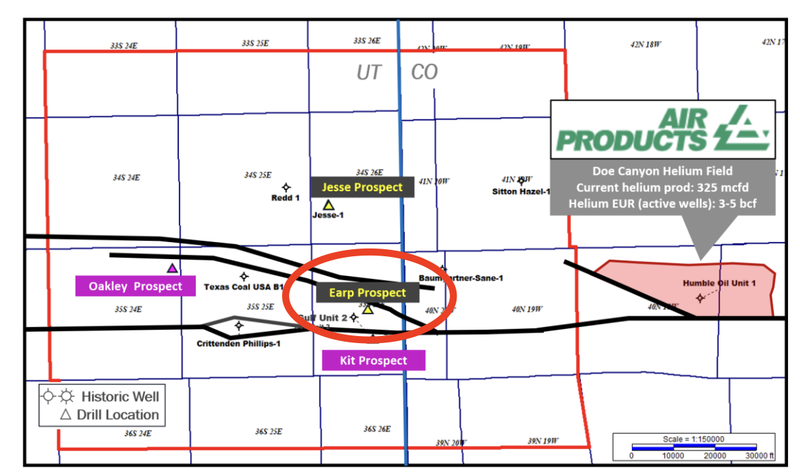

Pre-drill, we set our bull case expectations for the results based on the average flow rates being achieved at the producing Doe Canyon helium field.

This helium production field sits only ~24km to the east of GGE’s project - and it produces ~50% of North America’s new helium production.

The average flow rate across the Doe Canyon wells is ~20mmcf per day with helium grades of ~0.4%.

Our Investment thesis was that if GGE could deliver even a decent fraction of this flow rate, it would be deemed a success.

GGE did manage to flow helium to surface - however the flow rate was not commercial at 0.03 mmcf per day.

Interestingly the helium grades were up to 0.9%, which is higher than Doe Canyon.

The drill results fit above our bear case expectation, but below our base case expectations for this particular drill programme:

Market reactions are never entirely based on fundamental improvements or risks at the project level, but are almost always a reaction to news relative to preconceived expectations.

If a result comes in better than expected, then share prices tend to go up, if they come in below expectations, they go down.

In GGE’s case, we think today was the latter - whilst GGE learnt more about the reservoir, the market expected a better flow rate than what was achieved.

🎓We touched on the impact expectations have on share prices in a recent weekend email which you can read here: Why do Small Cap Share Prices go up?

Jesse-2 well - an overview

To summarise, GGE’s Jesse-2 well has flowed helium to surface with high helium concentrations in an extension of the existing helium discovery.

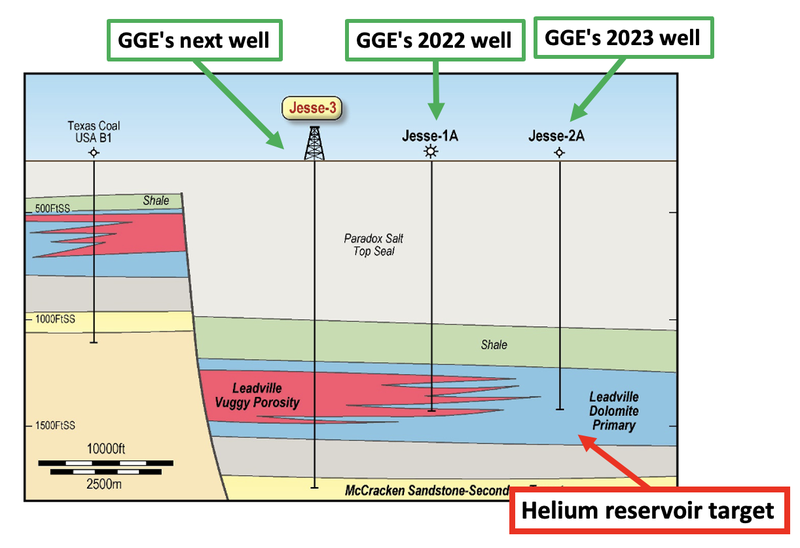

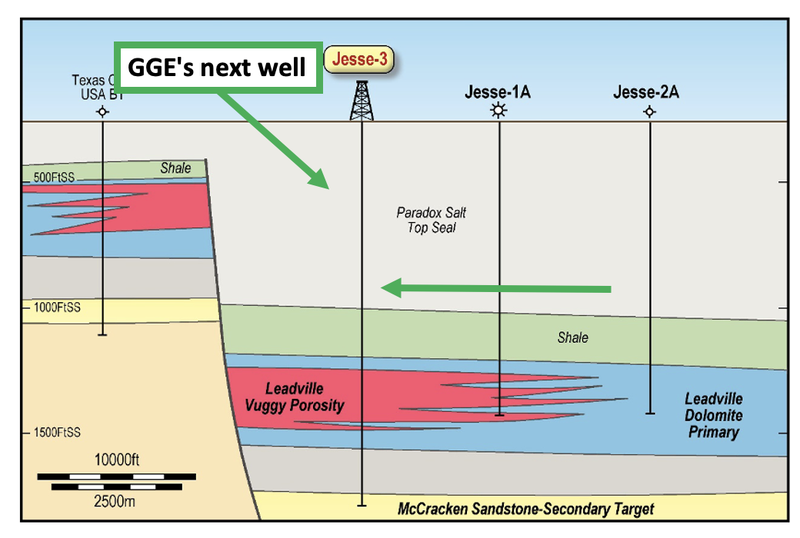

Here you can see the latest Jesse-2A well alongside last year’s Jesse-1A well, and the planned Jesse-3 well, along with the helium reservoir target at the bottom in blue.

Our overall take on the announcement is that while GGE extended its discovery, the ‘meatier’ part of its helium reservoir may actually be in the direction of Jesse-1A, or in the opposite direction to Jesse-2A - an idea to be tested with the company’s next well.

GGE also noted that the Jesse-2 well data was “consistent with the nearby analogue Doe Canyon Helium Field where ~3 out of the 20+ wells” had deliverability issues that impacted flow rates.

This is where GGE’s already permitted Jesse-3 well would come into play, drilling into a part of the project where GGE expects to hit stronger reservoir characteristics.

This type of result is commonplace in oil and gas

While the news today wasn’t entirely what we (or the market) wanted to see, it wasn’t completely unexpected.

Commercialising gas (in this case helium) discoveries can take years.

Arguably, making the discovery — which GGE has already done — is the hardest part of exploration.

Then it takes years of geochemical surveys, geophysics, and data analysis to bring a project up to a level where it can be drilled.

More often than not, when drilling a project, nothing is found, and the company will move on from the project.

For some context, it took even the world's biggest oil producer, Saudi Aramco, years to get its projects off the ground.

Saudi Aramco’s first ever well was drilled in 1935 and despite confirming light oil shows, the company’s first six wells were not enough to commercialise the project.

It wasn't until the seventh well was drilled in 1938 that the company was able to commercialise the project. The rest is history for the state-owned company that has repeatedly achieved the largest annual profits in global corporate history.

GGE, meanwhile, has passed the first hurdle of making a discovery.

While we think it may take a few more shots on goal to unlock its discovery and achieve commercial flow rates, ultimately, we hope GGE can commercialise its project.

GGE had $4.99M cash at December 31st 2022, and raised $2.5M at 2.2 cents in March 2023. However GGE’s current cash balance will be impacted by the costs of drilling Jesse-2.

GGE is drilling relatively low cost onshore wells, and with an updated March 31st cash balance due by the end of the week, we should get a better idea of GGE’s current enterprise value.

Given the project's location inside the US, if GGE can unlock its discovery and commercialise its project, we think the company can trade at multiples of its current market cap.

Ultimately this forms the basis for our GGE “Big Bet”:

Our GGE Big Bet

“GGE makes a commercial helium discovery, ties it into the existing local processing infrastructure, and becomes a USA helium producer - or gets taken over.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GGE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress GGE has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following GGE “Progress Tracker”:

Our GGE Investment Strategy

We first initiated GGE into our Catalyst Hunter Portfolio in October 2021, with an Initial Entry Price of ~1.1 cents.

Over the following ~12-18 months we de-risked our position - Top Slicing in Q1 2022 before the results of the Jesse-1 well, and then Free Carrying our position in Q1 2023 before the results of the Jesse-2 well, again.

This was done all in line with our Investment Plan outlined in our GGE Investment Memo.

After two wells drilled, confirming a high grade helium discovery but not quite getting the commercial flow rate needed, GGE’s share price is now back trading down toward our Initial Entry Price.

The market is built on investor emotions and on days like today, more people are looking to sell than buy - which creates a situation where the supply of shares far outweighs demand.

The urgency from short term holders to sell and a lack of eager buyers can lead to sharp falls in the company’s share price.

We plan to monitor GGE’s share price over the coming months and may look to increase our position ahead of the next round of drilling.

In the near term we expect GGE to go into a bit of a quiet period (as drill results are analysed, final data is released, and a forward plan laid out), which should give the share price time to form a new base.

Our plan is to increase our position at some stage before the company goes drilling again.

What’s next for GGE?

After today’s results, GGE confirmed it would look to recalibrate all of its existing seismic data before going ahead and drilling its project again.

In terms of priority, GGE listed the following:

Drilling Jesse 3 well 🔲

GGE already has permits in place to drill the Jesse-3 well.

GGE thinks there is a good chance the reservoir characteristics improve where the company plans to drill Jesse-3 and so we think it makes sense to drill here.

For some context, GGE is looking to emulate the success achieved at the Doe Canyon helium field next door which has produced helium from over 20 wells.

Jesse-1A/2 workover 🔲

Another option for the company could be to remediate the Jesse-1A/2 wellbore for a cost of less than ~US$1M before trying to produce a flow test from this well again.

Potential to drill the company’s Earp Prospect 🔲

GGE also has permits in place to drill its Earp prospect.

Earp sits on ground similar in size to Doe Canyon and already has two historic wells which have produced helium grades of up to 1.1%.

In a previous GGE note, we covered the potential exploration upside at GGE’s project beyond the current wells.

Our GGE Investment Memo

With GGEs Jesse-2 well drilled, we will wait to see the company detail any final well results, and provide a firm forward exploration plan before we put together a new Investment Memo for GGE.

Be on the lookout for our new Memo over the coming months.

To see our current GGE Investment Memo click here.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.