GGE confirms helium discovery - next step is to bring it to the surface

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 32,510,000 GGE shares at the time of publishing this article. The Company has been engaged by GGE to share our commentary on the progress of our Investment in GGE over time.

Our 2021 Catalyst Hunter Pick of the Year, Grand Gulf Energy (ASX:GGE), just took another step towards going from helium explorer to helium producer.

We've been following GGE closely for the last few weeks in our “upcoming share price catalysts” list - and that catalyst just came through.

Today, GGE confirmed its maiden drilling program at its helium project in the Paradox Basin, Utah, USA intercepted commercially viable helium grades.

After completing a workover program at the Jesse #1A well, GGE received multiple samples with consistent helium grades ranging between 0.44% – 0.65%.

Importantly the helium grades are higher than the already producing Doe Canyon field, which is only 24km to the east of GGE’s well location.

For context, Doe Canyon is producing helium with average grades between 0.4-0.5% and is the second largest helium discovery in North America over the last 70 years.

Considering that this is GGE’s first ever well at its helium project - and a wildcat well at that - the confirmation of commercially viable helium grades is an excellent first step towards commercialising its 6.3 bcf prospective helium resource.

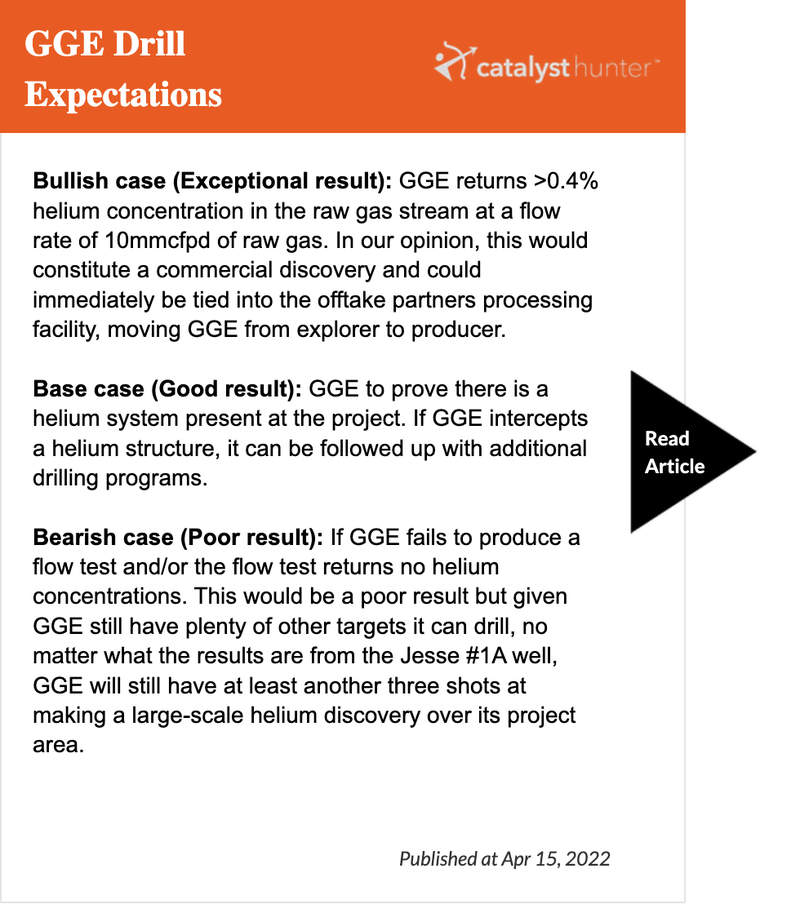

For the readers who have been following our previous coverage of GGE, wey established three different scenarios for our expectations for the Jesse #1A well:

The results from today’s announcement surpassed our base case expectations but fell slightly short of our absolute bullish case expectations, with the results delivering the following:

- A proven helium structure that can be followed up with additional drilling. ✅

- Commercially viable helium grades above our 0.4% expectation (GGE’s grades were between 0.44 and 0.65%). ✅

- No flow rate YET - but the company is already preparing to go back and test for this hopefully in Q3-2022.

The only thing missing for the company to hit our bullish case was if the company managed to put out a steady flow rate.

The positive news is that GGE has confirmed the reservoir section displayed pressures that are amenable to producing a flow-rate.

The only issue being the water content which needs to be designed around in future drilling programs.

Today GGE also stated that it would get its technical team to begin work putting together a new well design which could “enable gas production”.

GGE confirmed that planning and equipment resourcing is already underway with a view to re-entering the Jesse #1A well in Q3 2022.

Overall, we think GGE has actually managed to achieve somewhere in between just below our bullish expectation but well above our base case expectation.

GGE now has two of the three key pieces of information that it needs to declare a commercial helium discovery and take itself from helium explorer to producer.

Those key pieces of information discovered during the drilling of Jesse #1 are as follows:

- A proven gas system - 62m gas structure ✅

- Flow Rates - GGE to re-enter Jesse #1A to test for flow rates in Q3-2022 🔄

- Helium concentrations - Grades between 0.44 and 0.65% ✅

With all of this information at hand, the next step for GGE will be to prove that its project can deliver a commercially viable flow rate.

GGE is also well placed to do this work with $2.5M in cash at the end of the March quarter and $11M raised recently via a placement at 4.4c per share, well above the current share price which was 2.3 cents at last close .

This should mean GGE have ~$13.5M in cash (before paying for Jesse #1A) to prove a commercially viable flow rate.

GGE already has an offtake agreement already in place with “strategic partner” Paradox Resources to buy any commercial helium that GGE can produce, who owns the nearby Lisbon helium processing plant.

All GGE have to do now is to prove out a commercial flow rate that can be tied into all of the existing surface infrastructures so that it can start receiving revenues for its helium.

More on the Jesse #1A results:

With the drilling program completed and the workover rig run over the Jesse #1A, now is a good time to take stock of what we think GGE has on its hands.

Less than a month ago, GGE first came out with its announcement confirming a 62 metre long gas column had been intercepted.

Importantly, the ~203 foot intercept (62 metres) was made across a primary target which GGE had previously estimated to be at depths of between 8,100 feet and 8,300 feet, effectively GGE managed to intercept gas columns throughout the entire primary target area.

With a reservoir section identified, GGE then brought in a workover rig and started testing the well to see whether or not it would produce commercially viable gas flow rates and if the helium concentrations (grades) were high enough to announce a new helium discovery.

Today, GGE confirmed commercially viable helium grades of between 0.44% – 0.65%.

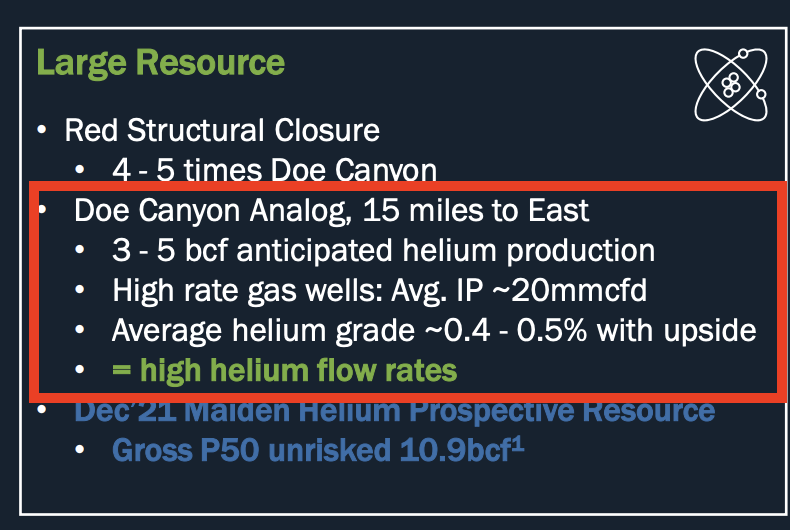

For some context on commercially viable helium grades, we only need to look at the already producing Doe Canyon helium field which sits only ~15 miles (~24km) to the east of GGE’s project.

The Doe Canyon field which is the second largest North American helium discovery in over 70 years is producing helium out of seven different wells with helium grades of between 0.4-0.5%.

Comparably, GGE’s highest helium grades are 30% higher than a helium field which is responsible for producing up to 50% of new North American helium production over the last five years.

With the results from today, GGE now has two of the three key pieces of information required to declare a new commercial helium discovery.

- A proven gas system ✅

- Commercially viable Helium concentrations - Grades between 0.44 and 0.65% ✅

The final piece to proving a new discovery was the flow rate, which GGE failed to produce in today’s announcement.

We think the information gathered to date is a big step in the right direction though, especially considering that this is GGE’s first ever drilling program.

In contrast, the Doe Canyon helium field is producing helium from a combined seven different wells.

Clearly, the Doe Canyon field was put into production after several rounds of drilling programs.

GGE is now in a similar position whereby it can apply all of the learnings it gained from the Jesse #1A well and apply it to any follow-up exploration program.

GGE clearly stated in its announcement that “The work-over rig has been de-mobilised to allow the technical team to develop the appropriate well design to enable gas production”.

This to us shows that GGE is confident that by putting together a new well design the company can address the risks that it thinks stopped the well from producing commercially viable flow rates.

This brings us to what is next for the GGE and the Jesse #1A well.

What’s next for GGE?

Re-enter Jesse #1A to prove out a flow rate (Q3-2022) 🔄

We have now established that GGE has two out of three key pieces of information before it can announce a new domestic US helium discovery.

First GGE proved a working gas system, intercepting a 62m gas column.

Now the company has confirmed that it can produce commercially viable helium grades of between 0.44 and 0.65% helium.

Importantly these are grades higher than the ones that can be found at the already producing Doe Canyon helium field next door to GGE.

The third and final step is for GGE to prove a commercially viable flow rate.

In today’s announcement, GGE confirmed that it would get its technical team to begin design works for a new well that could “enable gas production”.

GGE also confirmed that planning and equipment resourcing is already underway with a view to re-entering the Jesse #1A well in Q3 2022.

This means that we won't have to wait very long before we can see if GGE can produce a flow rate and just how much helium GGE can produce.

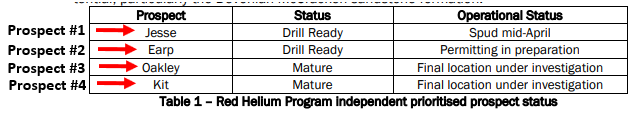

Exploration plan for the other prospects at its US helium project 🔲

Whilst our current focus is on GGE re-entering Jesse #1A and trying to prove out a commercial flow rate, we are looking forward to GGE putting together a forward exploration plan across its other drilling targets at its US helium project.

In our last GGE note, we covered the potential exploration upside at GGE’s project, which gives an indication of just how big GGE’s project could become.

Here are the two key takeaways from that note:

- GGE has identified three NEW potential drill locations in addition to the Jesse Prospect

- GGE has identified four mature step out drilling locations at the Jesse Prospect

To see our deep dive from that note click here and scroll down to the section “Plenty of other targets to follow up after this well”: GGE Hits Gas Column. Flow Rate and Helium Concentration to be Tested Next.

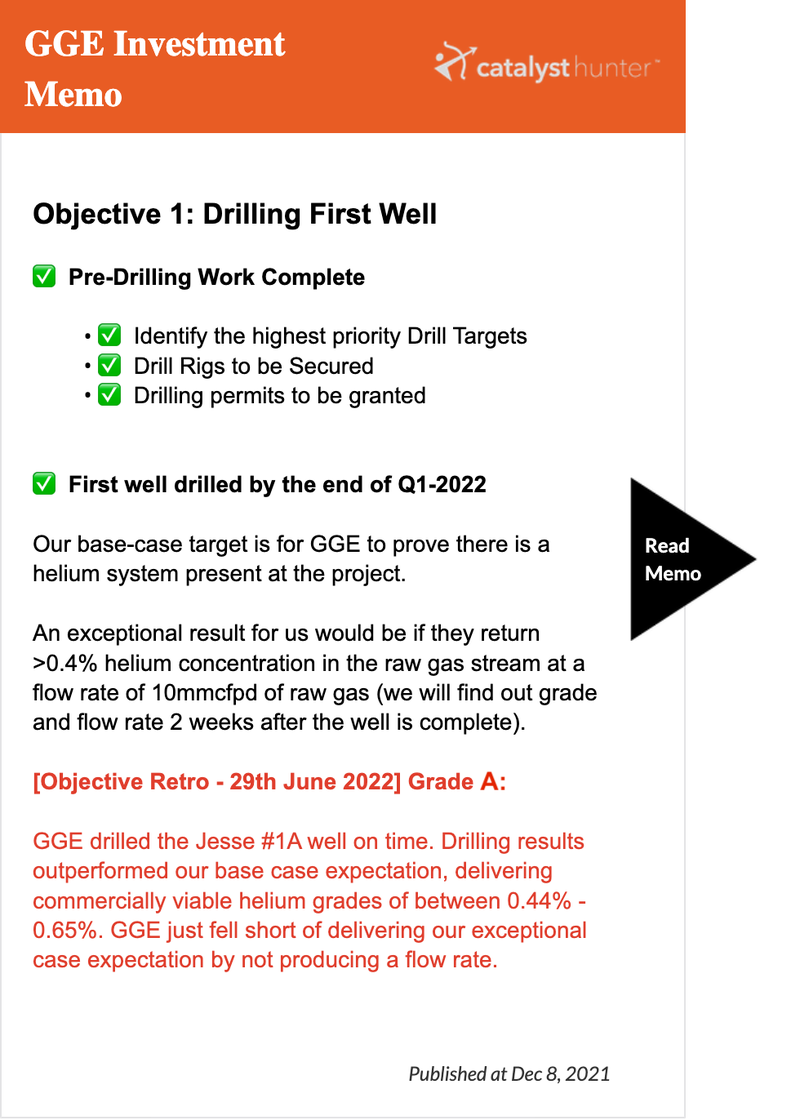

Our 2022 GGE Investment Memo

Check out our 2022 GGE Investment Memo to find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our GGE Investment Memo you’ll find:

- Key objectives for GGE in 2022

- Why we continue to hold GGE

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.