What we want to see from gold explorer TG1 over the next 12 months

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 2,331,081 TG1 shares. The Company has been engaged by TG1 to share our commentary on the progress of our Investment in TG1 over time.

It's getting closer...

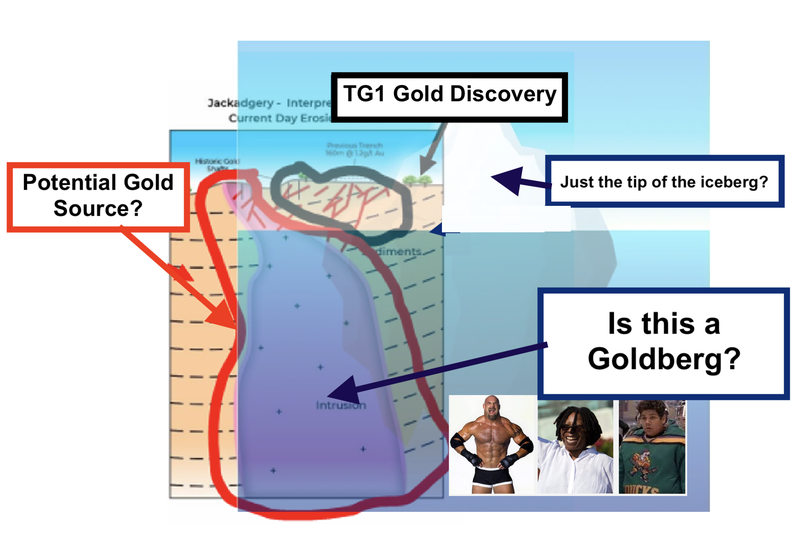

Our microcap explorer Techgen Metals (ASX:TG1) is just a few weeks away from drill testing a theory that the company’s gold discovery last year is just the “tip of the iceberg”...

The tip of a larger intrusive related GOLD iceberg.

We’re calling this the “Goldberg”.

Late last year TG1 made a gold discovery at its NSW project after hitting a ~95m intercept with gold grades of ~0.95g/t.

Since then TG1 worked on a theory that its discovery is hosted by a larger source - an intrusive related gold system.

In just a few weeks, TG1 will drill the first three holes primarily aiming to test the theory that TG1 has a “Goldberg” on its hands.

And, we’ll soon see whether this microcap company’s discovery has serious size/scale potential.

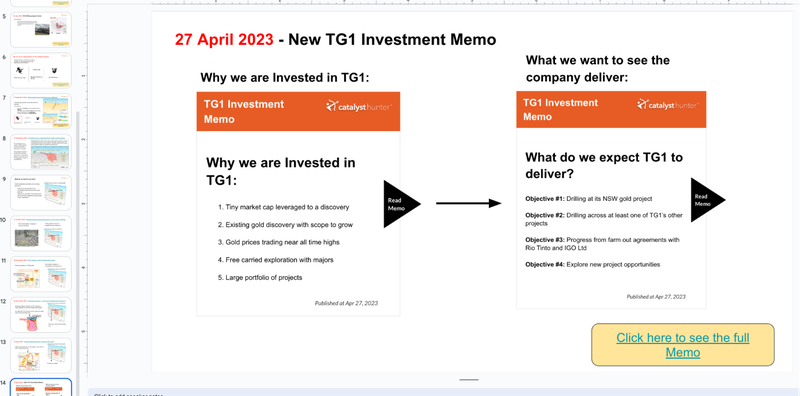

Today we are going to share our new Investment Memo #2 to track TG1’s progress over the next ~12 months.

We will also share our detailed review of how TG1 performed against our original Investment Memo #1 from May 2022

We have a large holding of TG1, owning around ~3.6% of the company’s shares on issue, so we want to see the company deliver on this result.

TG1 has a market cap of just $4.5M and had $1.7M in cash (at 31 Dec 2022).

The quarterly report with TG1’s March 31 cash balance should be out any day now.

With a low enterprise value, we think TG1 is in a position where positive news could re-rate the company’s share price significantly.

Strong macro tailwinds are also blowing in TG1’s favour - the gold price is trading near all time highs of around US$2,000 per ounce.

The strongest share price re-rates tend to come from a mix of fundamental progress at a project/company level and capital inflows from macro momentum.

Now with the gold price back up near record highs, we think that the stars may align for TG1 if it can deliver on its intrusive “Goldberg” theory with some strong drill results.

However, exploration drilling is risky and there is no guarantee that TG1 finds anything - or that what they find is commercial.

With only three drill holes in the program there is a limited window of opportunity for TG1 to deliver a result.

Like most micro cap explorers, TG1 relies on raising capital to continue to add value to its projects through drilling and exploration.

However, as major holders of TG1 shares, we hope this occurs on the back of a strong drilling campaign that materially de-risks the project’s exploration prospects.

This brings us to our TG1 Big Bet:

Our TG1 Big Bet

“TG1 will return 10x by discovering and defining a significant enough deposit to move into development studies for one of its projects.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our TG1 Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor TG1’s progress since we first Invested and how the company is performing relative to our “Big Bet”, we maintain the following TG1 Progress Tracker:

Our NEW TG1 Investment Memo

A large part of our first TG1 Investment Memo was based around the maiden drill program at its NSW gold project.

Given that it has been over nine months since the drill program was completed and with TG1 preparing to run its second drill program over the project, we have reset our expectations for the company with a new Investment Memo.

Today we launch our NEW TG1 Investment Memo, where you can find:

- Why we are Invested in TG1

- Our long term bet - what we think is the upside Investment case for TG1

- The key objectives we want to see TG1 achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

We have also done a memo retrospective which you can see below as well.

Click here to see our new Investment Memo

TechGen Metals (ASX:TG1) - OPEN

Opened: 27-April-2023

Shares Held at Open: 2,331,081

What does TG1 do?

Techgen Metals (ASX:TG1) is a junior exploration company focused on gold and nickel-copper-PGE projects across Western Australia and New South Wales.

TG1’s current focus is its NSW gold project (John Bull).

What is the macro theme?

TG1 holds gold projects that are both pre and post-discovery.

Gold generally outperforms other asset classes in times of market volatility and we believe it provides a good hedge to a portfolio of longer-term investments.

TG1 also has nickel-copper-PGE exploration prospects, all of which provide exposure to the battery metals theme.

Demand for batteries is set to increase exponentially over the next decade from things such as electric vehicles and semiconductor wiring.

Our Big Bet for TG1:

“TG1 returns >1,000%+ by discovering and defining a deposit significant enough to move into development studies for one of its projects.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our TG1 Investment Memo.

Why we are Invested in TG1

Tiny market cap leveraged to a discovery

As of 27 April 2023, TG1 has ~64 million shares on issue with a market cap of just $4.5M (at 7 cents per share) .

This tiny market cap means TG1 is highly leveraged to a large exploration discovery from a drilling campaign.

Existing gold discovery with scope to grow

TG1 has already made a gold discovery at its NSW gold project and has scope to grow the discovery with drilling to its north/south and at depth.

The company has an exploration theory that its project may contain an intrusive related gold system. If this theory is correct, there may be a deeper lying large source to its gold discovery.

At present, the project has only been drilled for seven RC holes (by TG1 in 2022) where it hit 94m at 0.95g/t of gold.

Gold prices trading near all time highs

Gold is currently trading at ~US$2,000/oz - just shy of its all time high in US dollar terms.

Relative to the Australian dollar and many other currencies gold is now trading at all time highs.

Free carried exploration with majors

TG1 has farm out agreements in place with Rio Tinto and IGO Ltd who are free carrying TG1 for exploration expenditures across two of its projects. This means there is always a chance TG1 could be a partner to a discovery made by one of the majors without having to spend any capital on it.

Large portfolio of projects

TG1 holds ground across multiple regions in WA and in NSW. In the event that new major discoveries are made in any of these regions, TG1 will already hold ground nearby and could see market interest off the back of its land position.

What do we expect TG1 to deliver?

Objective #1: Drilling at its NSW gold project

We want to see TG1 drill to the north and south of its existing gold discovery in NSW. TG1 has defined targets over an area measuring ~1km in length and 200m in width.

Given this is an existing discovery our bull, base, bear case expectations for the drill programs are as follows:

Bull case = TG1 proves continuity in its discovery to the north/south or at depth with intercepts >10m and gold grades >1g/t.

Base case = TG1 proves continuity in its discovery to the north/south or at depth with intercepts <10m and gold grades >1g/t.

Bear case = TG1 hits no significant mineralisation to the north/south or at depth of its discovery.

Milestones:

⬜ Rig mobilisation

⬜ Drilling commencement

⬜ Drilling results

Objective #2: Drilling across at least one of TG1’s other projects

TG1 holds projects right across WA with potential for nickel-copper-PGE and rare earths discoveries. We will set up expectations for drill programs as TG1 announces them.

Milestones:

⬜ Drill permits

⬜ Drilling commencement

⬜ Drilling results

Objective #3: Progress from farm out agreements with Rio Tinto and IGO Ltd

We want to see Rio progress the Harbutt Range project and IGO the North Nifty project.

Objective #4: Explore new project opportunities

Given TG1 is capped at just $4.5M the company can be nimble and take advantage of new project opportunities should they come its way.

Milestones:

⬜ New project acquisition

What could go wrong?

Exploration risk

TG1 has made a gold discovery at its NSW gold project but is yet to define an in-ground JORC resource. Most of TG1’s other projects are still pre-discovery. As a result we think exploration risk remains a key risk for TG1.

Market risk (macro)

Broader market conditions could change for the worse. This could mean small cap exploration stocks, like TG1, suffer from a “risk off” market move.

Funding risk

As a junior exploration company, TG1 will need to seek additional capital to advance the company’s projects. Access to capital could be impacted by a combination of the above risks.

TG1 also has a lot of tenements that each carry ongoing licensing costs. In order to fund exploration of these tenements, TG1 will need to raise capital.

Investment plan

We would like to see TG1 strengthen its balance sheet to fund exploration activities in 2023.

We may look to increase our position in TG1 and “average down” on our Investments in the company to-date.

We intend to hold onto the majority of our position in the lead up to the NSW gold project (John Bull) drilling campaign in May. We may sell ~20% of our Total Holdings if the share price runs on speculation in anticipation of the drilling or a successful drilling result.

Techgen Metals

ASX:TG1

Here is our retro from TG1-IM1:

TechGen Metals (ASX:TG1) - CLOSED

Opened: 16-May-2022

Closed: 27-April-2023

Shares Held at Open: 1,250,000

Shares Held at Close: 2,331,081

Reason Memo Closed: It has been ~12 months since our first Memo and the company has delivered most of the key objectives we wanted to see it achieve.

What is the macro theme?

Copper is already the third most widely used metal in the world - and with demand set to increase from things such as electric vehicles and semiconductor wiring — we see it as leverage to the global electrification boom and anticipated commodities supercycle over the coming decade.

The Gold sector generally outperforms other asset classes in times of volatility (e.g market bubble crash, inflation taking hold) and we believe gold provides a good hedge to a portfolio of longer term investments.

[Memo Assessment - 27-April-2023]: Sentiment = Strong

Copper has exposure to the electrification boom that is still running strong.

The gold sector has also performed relatively well despite recent market volatility. The gold price is trading at all time highs against the Australian dollar and near all time highs against the US dollar.

Why did we invest in TG1?

Well defined gold prospect that has never been drilled:

TG1 has just completed the acquisition of a 90% interest in a gold project in NSW where the previous surface trenching returned 160m @1.2g/t Gold. These targets have never been drilled before and could be indicative of an intrusive related gold system.

[Memo Assessment - 27-April-2023]: Grade A

TG1 drilled its NSW gold project and announced a new discovery after hitting over 94m at 0.95g/t gold.

Well located projects:

TG1 has projects in regions that are home to some of the biggest Copper/Gold discoveries in WA. Ashburton Basin - which hosts Northern Star’s Paulsens Gold mine & the Paterson Province - where Rio Tinto recently made the massive Winu discovery.

[Memo Assessment - 27-April-2023]: Grade A

Being in the right area is important because it typically means major companies become interested when a discovery is made. Over the last 12 months, TG1 signed joint venture agreements with both Rio Tinto and IGO Ltd for two of its exploration projects.

We see this as validation from mining heavyweights that TG1 has the right ground in the right areas.

Copper/Gold prices near all-time highs:

Copper is trading at US$4.20/lb just shy of its all time high. Gold is currently trading at US$1,820/oz just shy of its all time high

[Memo Assessment - 27-April-2023]: Grade A

Over the course of the last year gold also hit new all time highs it now sits at US$2,000/oz. Copper traded lower in early 2022 but has since recovered and sits at around US$4.00/lb.

Tiny enterprise value (EV) means leverage to a discovery:

TG1 has ~53 million shares on issue with ~14 million under escrow. With a market cap of $7.3M (at 14c/share) and cash in the bank of $2.6M (at March 31st 2022), the current enterprise value is only $4.7M. This means TG1 is highly leveraged to any exploration discovery.

[Memo Assessment - 27-April-2023]: Unchanged

This is largely unchanged. TG1 has only 64 million shares on issue and a market cap of just $4.5M (at 7 cents per share), meaning it is still highly leveraged to a discovery.

What do we expect TG1 to deliver?

Objective #1: Drilling at the newly acquired gold project

We want to see TG1 get an RC drilling program done over the newly acquired gold project before the end of the year.

Milestones

✅ Drill rig contracted

✅ Drilling commencement

✅ Drilling results

[Memo Assessment - 27-April-2023]: Grade A

TG1 completed its drill program and made a discovery at its gold project.

Objective #2: Drill test the Ashburton Basin copper projects:

Target generation works through Geophysical surveying from the Mt Boggola and Station Creek projects. Drilling to test geochemical/geophysical anomalies at both the Mt Boggola and Station Creek projects.

Milestones

✅ Geochemical/geophysical survey results

✅ Drilling permitting

✅ Drill rig contracted

✅ Drilling commencement

✅ Drilling results

[Memo Assessment - 27-April-2023]: Grade C

TG1 delivered drill programs at both of its Ashburton Basin copper projects, which we wanted to see. Unfortunately, TG1 didn't make a discovery at these projects.

Objective #3: Drilling at the Paterson Province copper projects:

We want to see the EM targets recently identified at the Harbutt Range prospect drilled in the next 12 months.

Milestones

🟧 Drilling permitting

🟧 Drill rig contracted

🟧 Drilling commencement

🟧 Drilling results

[Memo Assessment - 27-April-2023]: Grade B

While we didn't get a drill program at the company’s Paterson Province copper project, TG1 did sign a farm-out agreement with Rio Tinto on the project.

Under the agreement Rio can earn up to an 80% interest in the project by sole funding exploration up to $3M (a minimum of ~3,000m of RC/diamond drilling).

What could go wrong?

Exploration risk

TG1’s projects are all considered early stage prospects, this means TG1 is yet to make a discovery on the projects. Inherently there is a risk that drilling programs return results with no mineralisation and the projects are considered stranded.

[Memo Assessment - 27-April-2023]: Unchanged

TG1 ran multiple drill programs across its copper/gold projects. While the company made a discovery at its NSW gold project, it didn't return anything significant from its copper projects in WA. Given none of TG1’s projects have an in ground JORC resource yet, exploration risk remains for TG1.

Commodity pricing

Copper is an industrial metal that is reliant on buoyant economic growth, if there is any significant decline in economic activity globally then copper prices are likely to de-rate.

[Memo Assessment - 27-April-2023]: Unchanged

Early in 2022 off the back of recession fears, copper prices fell significantly from ~US$4.50/lb to ~US$3/lb. Since then the price has recovered and demand for new copper discoveries is still strong. The gold price is still trading near all time highs.

Funding risk

TG1 is a very early stage exploration company with zero revenue and is reliant on continuous capital raises so it can undertake high-risk / high reward exploration programs. There is a risk that market conditions deteriorate and investors shun high-risk explorers like TG1, and TG1 is unable to raise capital without significant dilution of existing shareholders.

[Memo Assessment - 27-April-2023]: Increased

TG1 ended the December 2022 quarter with ~$1.8M in cash. The company is getting closer to a position where it may need to raise more capital to finance exploration activities. The current market environment isn’t as conducive to raising capital for high risk explorers than it may have been in previously. Reduced investor appetite for high risk explorers may make it more difficult for TG1 to raise capital, hence we think this risk has increased for the company.

Market risk

TG1 is an early stage exploration company chasing new discoveries. There is always a risk that a market wide sell off will hurt TG1’s share price the most, given investors will look to withdraw capital from the high risk high reward investments in their portfolios first.

[Memo Assessment - 27-April-2023]: Materialised

Market risk has materialised for TG1. Market sentiment shifted significantly and investors have rotated out of high risk explorers like TG1 and into cash. This has resulted in TG1’s share price trading down significantly from its 20 cent IPO price.

What is our investment plan?

Our investment plan for TG1 is the same as for all our early stage, exploration investments:

- Invest early (way before the main, initial drilling event)

- Patiently wait till the drilling event approaches (late 2022)

- Free carry and take some profit prior to the initial drill results

- Hold a position into the result

- Reassess the plan based on the initial results.

[Memo Assessment - 27-April-2023]: C

We first Invested in TG1 at 20 cents and then Increased our Position again at 18.5 cents.

As the TG1 share price did not run on the results of any of its drilling campaigns, we did not sell any TG1 shares since this Memo was published last May.

With “Market Risk” materialising, the company’s share price fell to ~6.6 cents, in line with the broader sentiment for risky small cap explorers.

We are still confident in our long term Investment in TG1, however we recognise that we may have mistimed our second entry point.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.