RAS Picks up Prospective Lithium Ground Near $2.3BN Core Lithium

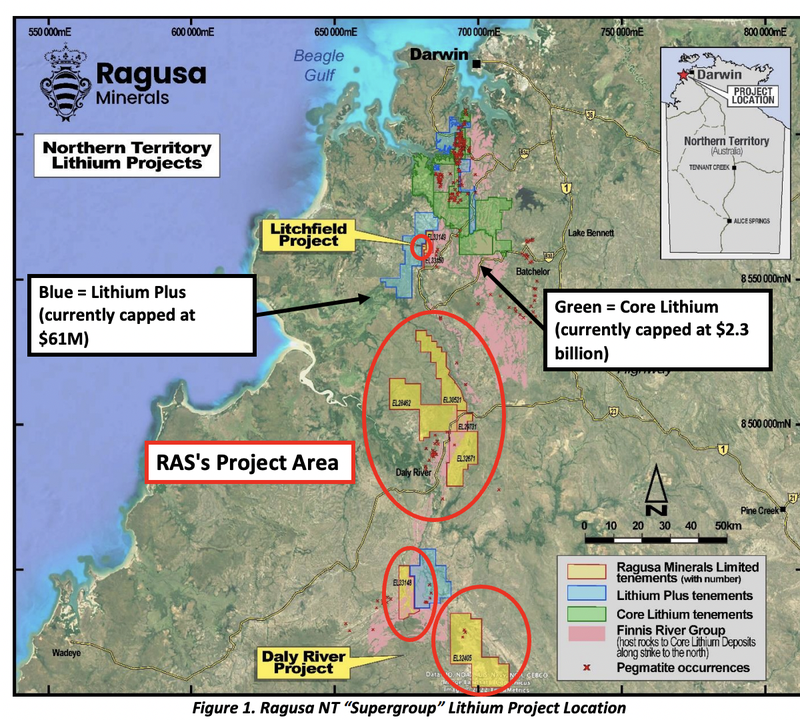

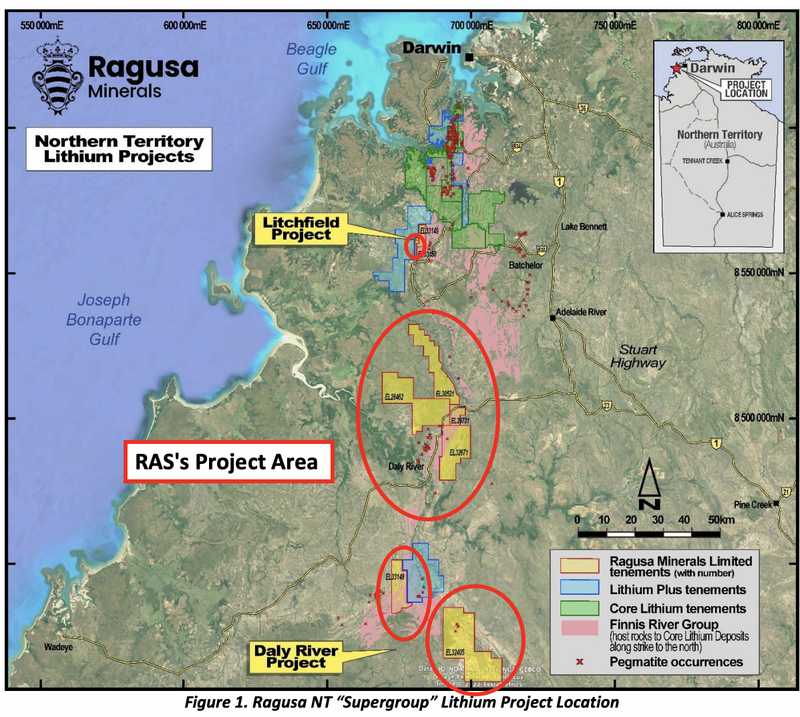

Our $10M capped explorer Ragusa Minerals (ASX:RAS) has picked up more lithium ground near $2.3BN capped Core Lithium’s and $61.1M capped Lithium Plus in the Northern Territory.

Today, RAS announced the acquisition of an earn-in right for a 90% interest (with an option to buy out the remaining 10% interest) in lithium prospects that sit on similar geological fundamentals that host Core Lithium’s 15mt @ 1.03% lithium project.

Interestingly, RAS’s MD Jerko Zuvela is also the MD of Argosy Minerals which is taking its Argentinian lithium project into production and is currently capped at $548M. With expertise in the lithium industry we are hoping Jerko can take tiny RAS’s project forward in a similar fashion.

RAS’s new project has seen some prior exploration work, including the sampling of outcropping pegmatites that are scattered over the project area.

This sampling returned assays grading as high as 8.03% lithium and 23.1g/t gold.

In fact, the last group to look at the tenements in 2018 reported “several distinct trends and many kilometres of untested strike length of pegmatites occurring within the leases”.

We are looking forward to seeing RAS drill test this ground in the near term, and given the project vendor is a drilling company, we expect it wont take too long to get a drill rig in.

The acquisition comes after RAS entered this part of the NT by pegging two other prospects to the north and south of these newly acquired projects.

After today’s deal, RAS will hold ~570km^2 in ground in a highly prospective lithium belt - a landholding that is larger than both Core Lithium (~500km^2) and Lithium Plus (~490km^2):

After today’s acquisition, RAS has a project where a new discovery could have company making potential.

At last close RAS traded with a market cap of just $10M and with $3.2M in cash on hand at 31st March, the company has a tiny enterprise value (EV) of $6.8M.

This gives the company significant leverage to a re-rate in the event of a material lithium discovery.

We have seen this happen before in our Catalyst Hunter portfolio - Latin Resources’ recent hard rock lithium discovery in Brazil sent the share price surging 550% on high grade drill results.

Latin was capped at $51M at ~3.5c per share prior to the discovery, it now trades at ~14c per share with a market cap of ~$270M.

RAS is a much smaller company so if it can deliver a similar style result, we could see a much larger re-rate relative to its current market cap.

Interestingly, the two companies are following an almost identical playbook.

Latin Resources first had outcropping pegmatites where sampling programs returned ~2-3% lithium grades. RAS has outcropping pegmatites with grades as high as 8.03% lithium.

Latin Resources drilled directly underneath those outcropping pegmatites to make its discovery hole and has since raised over $35M off the back of the discovery.

This is where the upside for RAS will be. If RAS can put together some interesting drill targets and return a high grade lithium drill intercept then we think the market will really start to take notice, especially if the lithium price remains as high as it is currently.

The other peer in the region - Lithium Plus’ recent IPO success also demonstrates what the value the market sees in this lithium region. The company listed at 25c and a $13M Enterprise Value, then went up to over $1/share, before settling now to above 60c.

So what do we know so far about RAS’s new lithium project?

- The project area hosts the same geological fundamentals as Core Lithium and Lithium Plus' project areas.

- There are known pegmatite occurrences over its project area.

- Previous rock chip sampling of these pegmatites has returned up to 8.03% lithium grades.

And what do we want to see next?

Next will be all about defining some high priority drill targets and taking exploration shots at a new discovery.

Capped at just $10M (at last close), we can't forget about RAS’s other projects.

RAS only recently completed a drilling program at its halloysite project in WA, next door to Latin Resources’ Cloud Nine Halloysite-Kaolin deposit which has a 207Mt inferred mineral resource.

With the drilling program completed on 4th May, assay results should start to come through in the next couple of months. So we should soon find out whether or not Latin’s deposit does in fact extend into RAS’s ground.

RAS also holds grounds in Alaska prospective for gold that neighbours ~16 million ounces of JORC gold resources.

The first of these is the $116M capped Nova Minerals which owns the 9.6 million ounces Estelle Gold project. The second is CAD$234M capped GoldMining Inc’s Whistler, Raintree and Island Mountain deposits for a total combined 6.6 million ounces.

To summarise, RAS now holds:

- Lithium projects, next door to Core Lithium (capped at $2.3 billion) and Lithium Plus (capped at $61.1M).

- Gold projects, next door to Nova Minerals (capped at $116M) and GoldMining Inc (capped at $234M).

- Halloysite project, next door to Latin Resources (capped at $270M).

🎓 To learn more about “nearology” check out our educational article here.

Going into the second half of the year, RAS will be busy doing all of the target generation work at its lithium project in the NT, the exploration window in Alaska will be opening up, and the drill results from the halloysite project should start to come through.

All of this means our tiny portfolio company will have multiple chances to re-rate off the back of some good news.

With $3M cash in the bank, we think that the current RAS’s upside potential makes for good exploration exposure in our portfolio, on a risk reward basis.

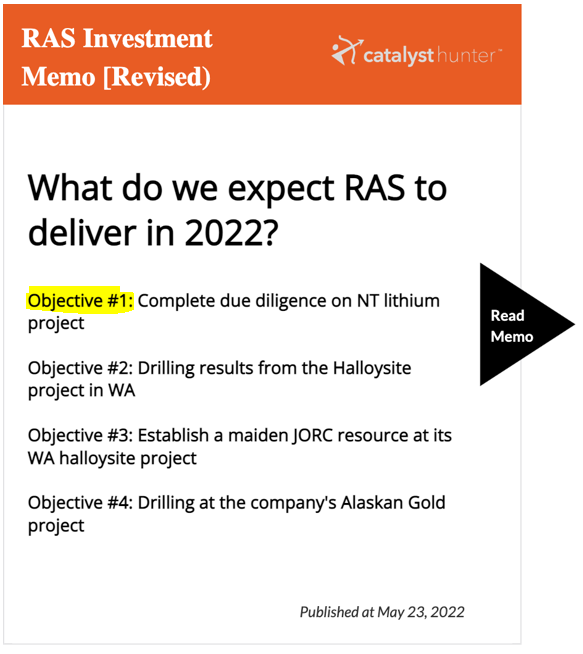

Given this new acquisition - one that RAS has called has “transformational”, we have revised our 2022 Investment Memo taking into consideration where the new project ranks in terms of priority for us.

With supply shortages a real problem in the lithium markets, the nearology to Core Lithium and the high grade rock chip results taken from the pegmatites sitting inside the project area, we have moved the newly acquired lithium prospects to number one in terms of project priority for RAS.

We think a discovery at the newly acquired lithium projects will attract a lot of market interest and could significantly re-rate RAS. This is why we have made the lithium projects a key reason for why we continue to hold RAS in our portfolio.

To see all of the reasons, check out our updated 2022 RAS Investment Memo below:

🎓 To learn more about what type of company events trigger a rethinking of our investment thesis and a subsequent update to our Investment Memo’s check out our educational article here.

We have made the exploration of the lithium prospects Key Objective #1 for what we want to see RAS achieve in 2022.

Below is an excerpt from our revised 2022 RAS Investment Memo which shows all of these objectives.

Check out our updated 2022 Investment Memo which shows all of the key reasons for our Investment in RAS, the key objectives we want to see achieved for the rest of the year, and the key risks to our Investment thesis.

More on RAS’s new acquisition:

Today’s announcement expands RAS’s lithium landholding in the Northern Territory, but more importantly, brings in already granted tenements where RAS can start exploring straight away.

The project area being acquired covers ~570km^2 in ground in the Northern Territory with almost identical geological fundamentals to the ones which host Core Lithium’s Finnis Project and the same fundamentals that newly listed Lithium Plus are looking to make a discovery on.

The similarities come from the specific types of pegmatite outcroppings that are found in this part of Northern Australia which are marked with small red crosses in the image below.

The project being acquired by RAS has had historical exploration done on them too, leaving RAS with a series of walk-up drill targets for both lithium and gold. This means RAS will have some sense of the potential of these projects and aren't picking up completely fresh ground.

During 2016-2017, several rounds of geochemical soil and rock chip sampling programs were completed, focusing on the already mapped outcropping pegmatites.

Those programs returned peak lithium grades from the rock chip sampling of ~8.03% lithium and 7.3g/t gold.

Then in 2018, PNX Metals assessed the project area but most of its exploration programs were focused on gold and base metals. Despite this, rock chip sampling works again returned lithium grades of 7.25% lithium and 23.1g/t gold.

More importantly, PNX actually reported “several distinct trends and many kilometres of untested strike length of pegmatites occurring within the leases”.

This is where we think RAS has seen the upside.

RAS can now go in fully focused on lithium and try to test the sole lithium potential of this project area.

It's also pretty clear what RAS is aiming for with this project. The two comparisons of success in this region are Core Lithium and Lithium Plus.

First is the Core Lithium comparison.

Core Lithium’s project is very well advanced with a JORC resource of 15mt @1.03% lithium and has had 10’s of thousands of metres of drilling done on it to get that JORC resource put together.

The market has rewarded Core with a market cap of $2.3 billion.

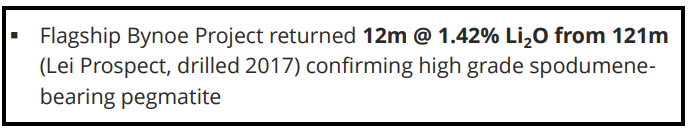

Second, Lithium Plus who only listed on the ASX in April this year.

Lithium Plus has two project areas sitting over ~490km2 of ground with no JORC resources.

It’s flagship project had a discovery hole drilled in 2017 for 12m @ 1.42% lithium from 121m confirming high grade spodumene bearing pegmatites.

The market is rewarding that drillhole and Lithium Plus’ tenure with a market cap of $61.1M.

Effectively, if we see RAS drill its project and deliver a discovery hole, the upside could be comparable to Lithium Plus’ market cap of $61.1M, and potentially more, depending on the grades and widths of any lithium intersected.

If RAS can then go and prove out a giant JORC resource, the outsized upside scenario could be a comparison to a lithium major like Core Lithium at a $2.3 billion market cap.

However it's very early days here, RAS is yet to drill a hole in the project, and this is high risk exploration so RAS might not be able to deliver the success of its peers.

RAS will now be allocating some of its $3.2M in cash towards doing some fieldwork and getting drilling to see whether or not it can put its project on the map as comparable to its higher valued neighbours.

So what is RAS paying for the project?

After today’s announcement, RAS will hold farm in rights over a 90% interest in the project area with an option to purchase the remaining 10%.

RAS will pay $125k cash for the 12-month due diligence right and $150k in cash if RAS go ahead with the farm-in deal.

RAS will then need to spend a minimum of $500k per annum up to a minimum total exploration spending figure of $2.5M. RAS will also pay $50k in cash and $150k in cash or shares (at RAS’s election) if one of the current exploration licence applications is granted.

After all of this RAS will hold a 90% interest in the project, with the vendor free carried through to a decision to mine.

Alternatively, RAS can buy out that remaining 10% by paying the vendors $500k in cash, $500k in cash or shares and a 2% net smelter royalty.

The only other payment due to the vendor then is a milestone payment in the event RAS makes a discovery and puts out a JORC resource. If this happens RAS will have to pay an extra $500k in cash and $1M (either in cash or in RAS shares).

We especially like that the upfront payment is limited to a maximum of ~$275k with the remaining consideration mostly milestone payments or exploration spend.

That exploration spending adds value to the project - a win-win for RAS and the vendor and could be some of the spending that turns the projects into a company maker for RAS. So we like the way RAS has managed to structure the transaction.

Importantly, the 12 month due diligence period means that should no discovery be made, RAS can walk away from the project.

What’s next for RAS

Due diligence and a decision to proceed with the farm in agreement 🔄

With the terms all agreed, we now want to see RAS get all of the due diligence work completed and finalise a decision to proceed with the farm in agreement over the newly acquired lithium projects.

Granting of the two lithium projects in the NT 🔄

We still want to see the remaining exploration licence applications granted across RAS’s lithium project in the NT.

Desktop works across Gold prospects in Alaska 🔄

We set the exploration of the gold projects as key objective #4 in our revised 2022 RAS Investment Memo, so ideally we would see RAS detail its plan for these projects soon.

We will be watching the activity of its neighbours in the meantime.

Drilling results from RAS’s halloysite project in WA 🔄

RAS completed the 63 hole drilling program on the 4th of May, so we should get to see whether or not this drilling program was successful within the next month or so.

We suspect the assays from the program shouldn't take longer than 8-10 weeks from the completion date.

To see our deep dive on this drilling program read our last note here: RAS Now Drilling for Halloysite - Directly Next to Open Resource

With drilling being done right on the border of RAS’s tenements and our other Catalyst Hunter portfolio company Latin Resources’ 207mt halloysite resource, we set the following expectations:

- Excellent = RAS proves the Latin Resources’ deposit extends into RAS grounds.

- Poor = Drilling returns nothing and our nearology thesis fails.

What are the risks?

RAS is still a relatively early stage explorer, today’s acquisition will mean RAS now has another prospect where it will need to do exploration work.

Like all small cap explorers, RAS does not generate any revenues and so there is always a dependence on raising fresh capital to finance exploration.. RAS currently has $3.2M in cash as of the end of the March quarter, which should be enough to get some of the early exploration work done.

If the market starts to show interest in RAS as work is done over the next few months we could also see the options come into play which may mean RAS can defer any future capital raise further.

Note: RAS currently has ~72 million options exercisable between 9c and 16c, if we see RAS’ share price move significantly higher than these levels, then the holders of these options may look to convert them and provide additional funding to RAS.

As with any explorer, we don't expect RAS to make a new discovery overnight, exploration is more about playing the long game where companies do rounds and rounds of drilling before making a discovery.

A great example of this is one of our other long term exploration investments - Galileo Mining which took almost four years of back to back exploration programs before making a discovery.

All of this exploration requires capital.

Our REVISED 2022 RAS Investment Memo:

Below is our revised 2022 RAS Investment Memo where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our RAS Investment Memo you’ll find:

- Key objectives for RAS in 2022

- Why we invested in RAS

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.