RAS to drill WA halloysite project in coming weeks

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 2,610,000 RAS shares at the time of publication. S3 Consortium Pty Ltd has been engaged by RAS to share our commentary and opinion on the progress of our investment in RAS over time.

Last year we made our initial investment in Ragusa Minerals (ASX:RAS) because we liked its newly acquired WA halloysite and Alaskan gold projects.

At a 6.5c share price and $8M market cap at the time of our investment, we liked the upside and risk/reward profile of the stock. After climbing as high as 13c, the share price has retreated back below where we first invested.

RAS currently has a share price of 5.6c giving it a market cap of $7.1M.

RAS had $3.4M in cash at Dec 31st, which gives it an Enterprise Value of a tiny $3.7M.

Today RAS announced that regulatory approvals had been granted for its maiden drilling program at its WA halloysite project.

Drilling is expected to start in the coming weeks (subject to rig availability).

When we first invested, we especially liked that RAS’ Halloysite project sits along the border of another of our portfolio companies - the $55M capped Latin Resources 207 Mt JORC resource of kaolinised granite - one of the largest kaolin/halloysite deposits in Australia.

We are soon going to find out whether in fact that halloysite deposit runs across the tenement boundary and into RAS’ ground.

RAS’ drilling program will be undertaken right up against the tenement boundary where we think there is a very good chance the Latin Resources deposit extends into RAS’ ground - more on that further down.

The ultimate aim for the drilling program will be to try and estimate a maiden JORC resource that demonstrates Direct Shipping Ore (DSO) characteristics.

Those readers who have been following the RAS story will also be familiar with RAS’ Alaskan gold projects which are neighbouring almost 16 million ounces in gold resources.

The first of these is the $297M capped Nova Minerals which owns the 9.6 million ounces Estelle Gold project, and the second $287M CAD capped GoldMining Inc has the Whistler, Raintree and island mountain deposits for a total combined 6.6 million ounces.

So even if we ignored the WA halloysite projects for a moment:

RAS sits in an area with over 16 million ounces of gold resources, with its neighbours having a combined market cap of over half a billion dollars.

Remember RAS has a tiny enterprise value of ~$3.7M.

With the gold price now slowly starting to get back into favour with investors and its Alaskan gold neighbours busy, we think that RAS’ gold projects will again start to become front of mind for investors.

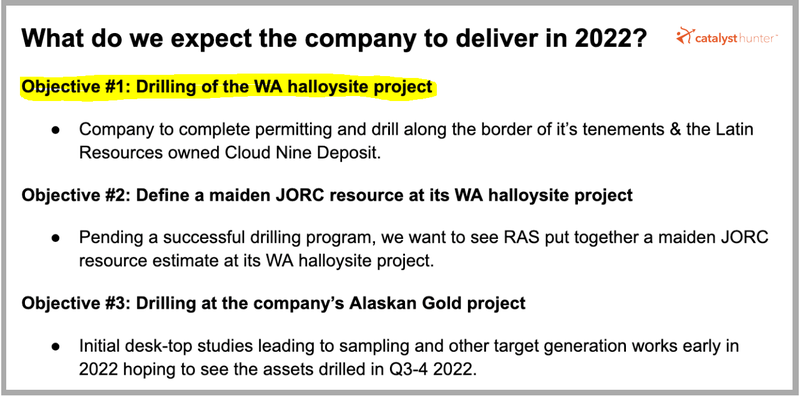

With both its projects rating nicely on our internal nearology scale we set the following two objectives for what we want to see RAS achieve in 2022 in our 2022 Investment Memo:

For a quick high level summary of why we continue to hold RAS, our key objectives for 2022 and a list of the key risks to our investment thesis, read our 2022 RAS investment memo here.

How does RAS’ halloysite projects “nearology” rank?

Those readers who follow some of our other junior exploration investments will know that we like to test ASX small cap nearology hopefuls against on our “nearology scale”.

This is where we try to rank how strong a company’s “nearology” is from a scale of “entry level” to “best”.

Just because a company has some ground nearby, doesn’t mean that ground is valuable OR that being next door to something will mean anything.

Our nearology scale goes a little something like this:

"Entry level” nearology - only geographically close - almost irrelevant:

If two projects are geographically close but have different geology - it's almost irrelevant.

These almost always are only a play on “we are 40km away from the world’s biggest deposit therefore our grounds should also hold a world class deposit”.

This rarely works out.

“Better” nearology - geographically close AND same geological structures:

This is when two projects have the same geological structures below the ground, but no supporting data - or drilling that has de-risked it to date.

This is a good starting point for an explorer, with the grounds most likely being unexplored.

There is still a lot of risk with plays like this but the potential upside is high. Generally, we manage to pick these types of explorers up at fairly low enterprise values.

“Even Better” nearology - geographically close AND the same geological structures AND supporting exploration work:

This is when two projects have the same geology and structures WITH supporting drilling data/geochemistry and/or geophysics.

With these, we like to see either some drill intercepts showing something is where the company thinks it is rock chips in the area pointing at something, or geophysics showing massive EM targets that need to be drilled.

“Best” nearology - geographically close AND same geological structures AND supporting exploration work AND confirmation same deposit extends.

This is when there is an extension of the same deposit.

This is fairly straightforward, sometimes deposits extend out from the imaginary lines set by “tenements” and straight into grounds held by other companies.

These situations are fairly easy to spot and are the best type of nearology plays.

So how does RAS’ halloysite project rank on our nearology scale?

In our last note, we did a deep dive into the details of the nearology at RAS’ halloysite project in WA.

RAS’ halloysite project fits into all of the categories we mentioned above and gets a “best” nearology rating from us.

Time will tell in the upcoming drilling and beyond, how much value the market ascribes to this ground.

Here is how we think RAS’ project gets this ranking:

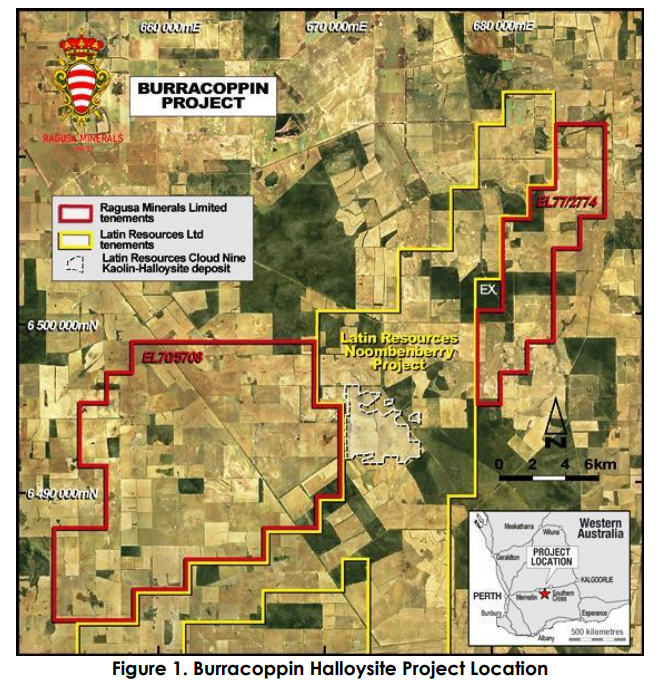

"Entry level” nearology ✅ – RAS’ halloysite project is directly adjoining Latin Resources 207 Mt JORC resource.

As seen in the image below, RAS definitely ticks off this level with ground directly abutting Latin’s ground.

“Better” nearology ✅ – Neighbour’s deposit is “open in all directions”

Latin Resources’ has previously stated that the Cloud Nine deposit is ‘open in all directions’. This basically means that it believes it extends to the north, south, east and west.

RAS has ground directly to the west of Latin’s deposit and logically it could be assumed that the Latin deposit should extend into RAS’ ground.

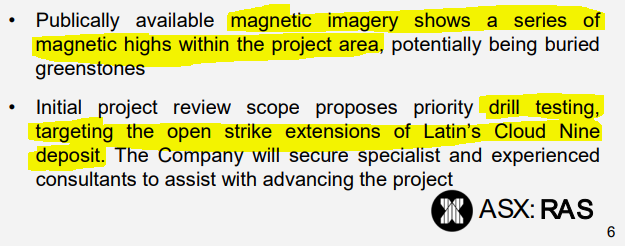

“Even Better” nearology ✅ – Deposit is open along strike in the direction of RAS’ ground

RAS has high priority magnetic highs over its ground, but more importantly, the Latin Resources deposit is open along strike in the direction of RAS’ ground.

Combined with a possible extension into RAS’ grounds from the previous category, the “series of magnetic highs” RAS described in its September 2021 investor presentation gives a target area for the project that is enough for it to pass the “Even Better” ranking.

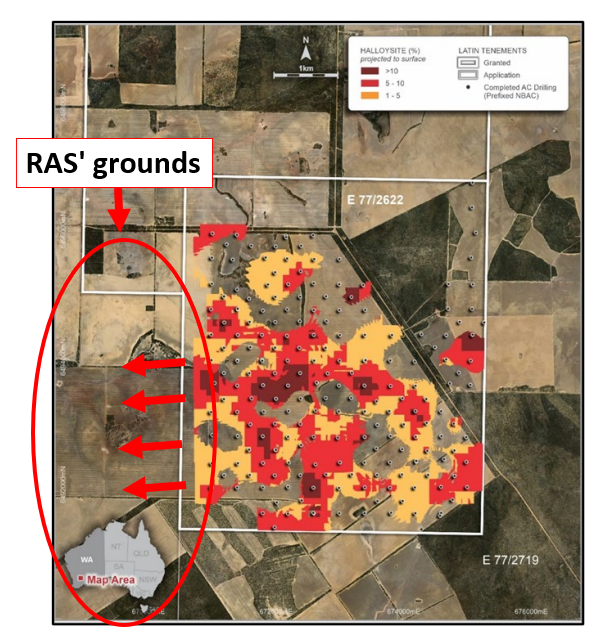

“Best” nearology ✅ – Deposit looks to extend directly into RAS’ ground - drilling to confirm

With RAS’ WA halloysite project, we think it is one of the clearest fits into our “best” category in our nearology scale across our portfolio.

Keeping in mind this is all based on our assessment of the project, before any drilling works have confirmed anything.

The image below is taken from Latin Resources’ presentations and shows how the deposit seems to be cut off almost in a square shape right along the border where RAS’ grounds are.

We don't think deposits like this respect imaginary tenement boundaries and there is a good chance that cut-off actually extends into RAS’ grounds.

So to summarise, RAS’ halloysite project fits in with all four of our categories and achieves the highest possible ranking with respect to its nearology.

“Entry level” nearology - Sitting in the same region, ✅

“Better” nearology - Sitting on identical geological structures ✅

“Even Better” nearology - Electromagnetic highs across RAS’ grounds ✅

“Best” nearology - Possible extension to Latin Resources’ deposit ✅

Bringing this all together, RAS ranks in the highest tier (“Best”) of our nearology scale.

We are invested in RAS because we think there is a good chance Latin Resources’ deposit extends into RAS’ grounds, but there has been no drilling work done to prove this as yet.

Just like any junior explorer though, the proof will be in the drilling.

Without actually seeing the drilling results along the tenement boundary we wont know if Latin Resources’ deposit does in fact extend into RAS’ grounds.

Why we like RAS’ gold projects in Alaska:

With Alaska currently deep in the winter months, RAS has mostly been doing desktop reviews on its Alaskan gold project.

This is all in preparation for better weather conditions so it can do some more fieldwork.

We think that with market volatility increasing and gold starting to get back into favour with investors RAS is preparing to explore its gold projects at just the right time.

First some context on what first got us interested in RAS’ Alaskan gold projects.

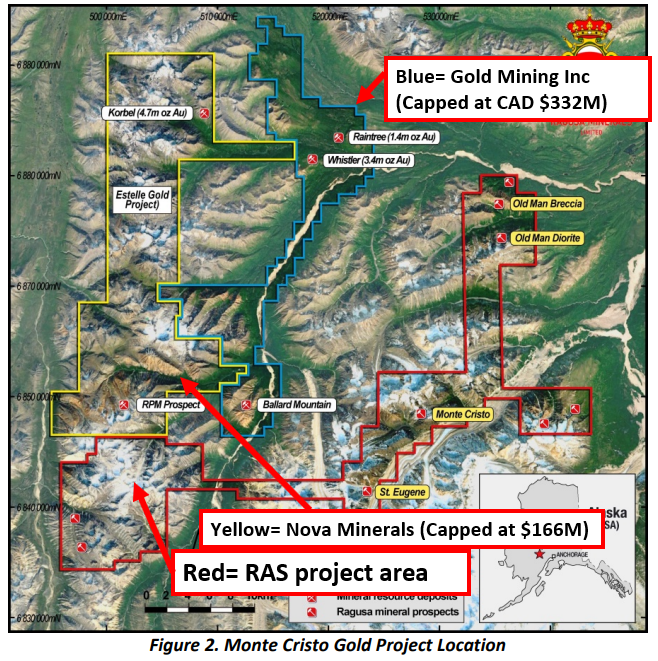

RAS’ project sits next door to ASX listed Nova Minerals (currently capped at $166M) and TSX listed Gold Mining Inc (currently capped at CAD $332M) so we thought we should summarise what they have been busy doing of late.

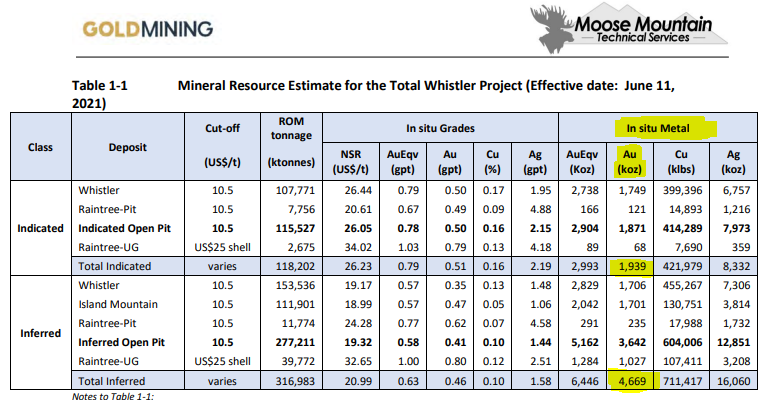

The tenements are wedged in between Gold Mining Inc.’s ~6.6 million ounce gold resource across three of its deposits Raintree/Whistler and Island mountain (seen in the image below):

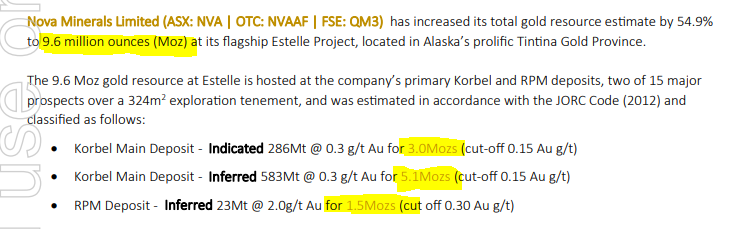

And in between ASX listed Nova Minerals' massive 9.6 million ounce gold resource at its Estelle gold project:

These are all established gold resources, highly valued by the market.

So RAS with a tiny enterprise value of ~$3.7M sits in an area with over 16 million ounces of gold resources and its neighbours have a combined market cap above $530M.

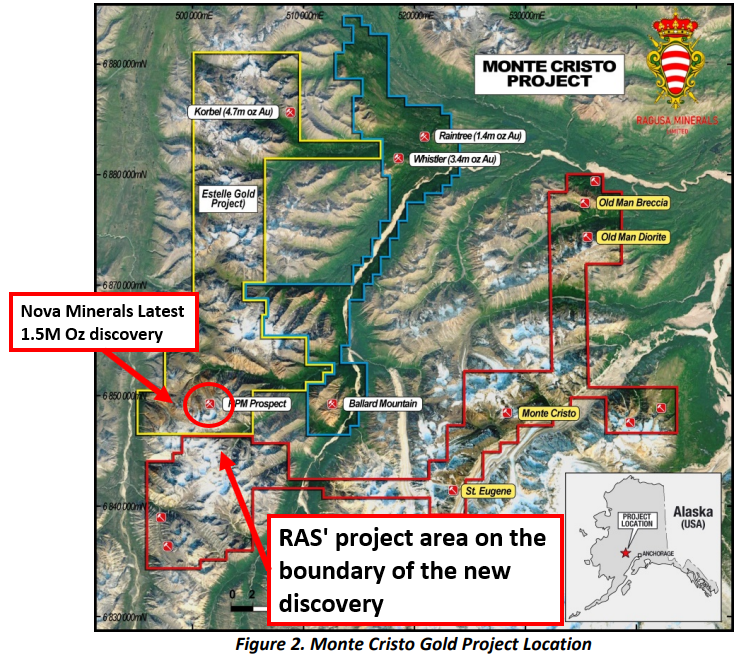

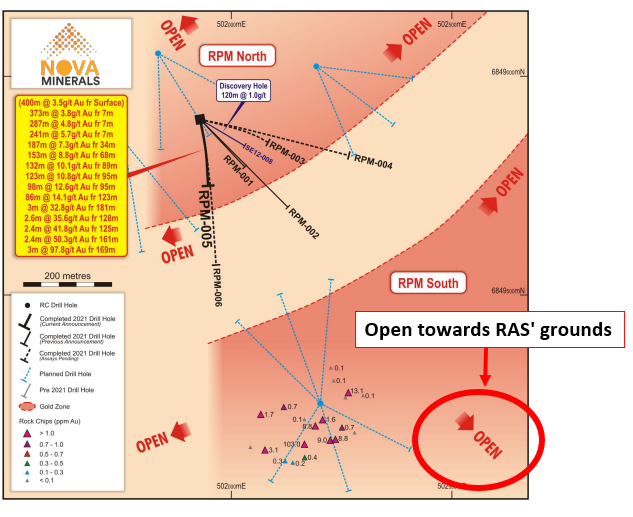

The part of RAS’ grounds we are most interested in is its project area right on the boundary of where Nova Minerals recently made the 1.5 million ounce RPM discovery.

With a 23mt @ 2g/t gold for 1.5 million ounce gold resource, the project at today’s gold prices is considered relatively high grade.

As soon as the exploration window opens up in Alaska we want to see RAS get on the ground and do most of its exploration work in and around that boundary.

If we are lucky this project area can become almost like what we hope RAS’ halloysite project is and turn into an extension of Nova Minerals RPM discovery.

With RAS’ Alaskan neighbour preparing to deploy several diamond drill rigs (as soon as the extreme winter weather clears up) across the project area we will be watching carefully to see if there is any indication of this.

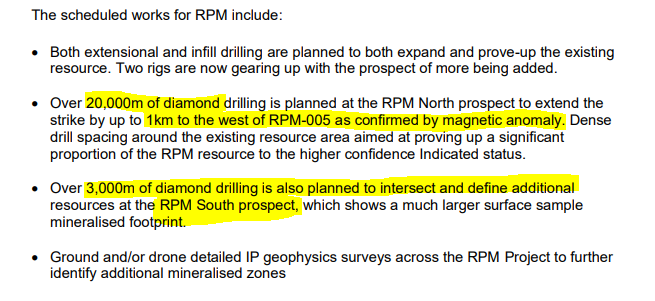

In its latest commentary on 14th Feb 2022, Nova Minerals highlighted that it would be doing over 23,000m of drilling at the RPM deposit, including extensional drilling to the south of the current deposit.

The further south Nova drills, the closer it gets to RAS’ grounds.

Below is that commentary from Nova Minerals and an image showing the RPM discovery is still open along strike towards RAS’ grounds.

Our 2022 RAS Investment Memo:

Below is our 2022 Investment Memo for RAS where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our RAS Investment Memo you’ll find:

- Key objectives for RAS in 2022

- Why we continue to hold RAS in 2022 (Shown above)

- What the key risks to our investment thesis are.

- Our investment plan

To access the RAS Investment Memo simply click on the button below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.