MAN Secures USA Lithium Brine Project

The world needs 10x more lithium if it wants to hit its decarbonisation goals.

Despite a 30% price retreat since the November all time high, the price of lithium is still up by over 10x since August 2020.

We continue to see lithium as a defining macro theme of this decade - especially when it comes to finding it in the right place.

Makes sense then that on Wednesday our Investment Mandrake Resources (ASX:MAN) unveiled its new high-grade lithium brine project in Utah, USA.

MAN has a healthy ~$19M in cash, and is now chasing the commodity of the decade, in the country of the moment.

Lithium is classified as a critical mineral by almost every government all around the world.

The USA in particular is pushing a tidal wave of capital into securing local lithium supplies.

The key legislation is the Inflation Reduction Act 2022, which has earmarked US$391BN in investments related to energy security and climate change.

Within the IRA framework is the Department of Energy’s (DoE) “American Battery Materials Initiative”.

This is a new effort to mobilise the entire US government in securing a reliable and sustainable supply of critical minerals used for power, electricity, and electric vehicles (EVs).

This comes as President Biden has set an ambitious goal to make half of all new vehicles sold in 2030 electric.

The USA looks to be putting its money where its mouth is - over the last ~12 months the US government has committed to funding two ASX listed, US based, lithium developers:

- US$700M to Ioneer Ltd in the form of a loan, and

- US$141.7M to Piedmont Lithium as a grant.

MAN has been building its own lithium project from the ground up in the USA.

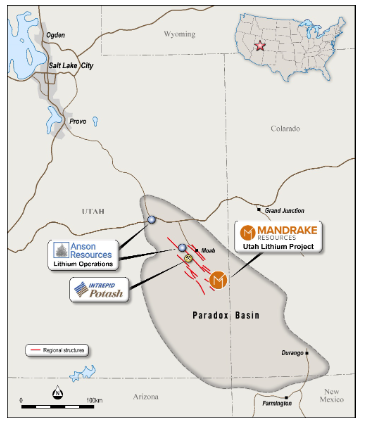

It has already secured ~56,000 acres of ground in the pro-mining state of Utah, USA, in the ‘lithium four corners’ Paradox Basin, and is actively staking more ground.

MAN’s project sits in the same region as $224M ASX listed lithium developer Anson Resources.

MAN’s new project has attracted interest from the $344M capped Galan Lithium - who is investing $1.5M into MAN for a ~5% cornerstone shareholding in the company.

We think that Galan’s decision to invest directly in MAN and have its shareholding escrowed for 12 months is a clear sign of validation of the potential of MAN’s project.

Galan also holds the right to take on and allocate $700k in MAN shares to a strategic advisor if it wants to - so combined that would be $2.2M in cash coming into MAN, taking the current cash balance to ~ $19M.

Capital commitment aside, Galan is also getting involved at the project level, with a commitment to provide technical support to MAN as it builds on its lithium project.

Galan is currently bringing its lithium brine project in Argentina into production - so this lithium brine exploration and development experience will be helpful for MAN.

Another technical validation point from the competent manager that prepared and reviewed all of the project data, Roy Eccles from APEX Geoscience.

Eccles was also the key consultant who provided technical support to Vulcan Energy Resources back in 2019-2020 at its geothermal lithium brine project in Germany.

Roy’s work included site visits, technical reporting and mineral resource/modelling.

Vulcan was our 2020 Small Cap Pick Of The Year and hit an 8,000% gain at its peak following our coverage initiation.

Of course, that does not mean we are expecting similar gains here - past performance of companies is not an indicator of future performance of other companies.

Having generated the project internally, MAN is now in a position where it doesn't need to pay any acquisition costs and more importantly doesn't need to do a dilutive capital raise.

This means that MAN can invest its $19M cash balance defining and de-risking its lithium project. With that amount of cash, we are expecting a significant amount of work to be done (more on that in our new Investment Memo further down), without having to constantly raise new capital.

After the Galan investment, MAN’s market cap at 5.5c per share is ~$33M.

With MAN’s ~$19M in cash, it means the company currently trades with an enterprise value of ~$14M.

Defining and developing its lithium project forms part of our Big Bet for MAN which is as follows:

Our MAN “Big Bet”:

“MAN returns 1,000%+ by making a lithium discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MAN Investment Memo.

Why US based lithium is different

Where “stuff” comes from was something the West, and in particular the US, has long taken for granted.

That was until the double shock of the COVID pandemic and the Russia/Ukraine war.

Now the world is looking to reverse decades of globalisation.

Countries are racing to build out domestic supply chains for things that are considered “critical”.

Lithium is one of those critical minerals where the US has basically no domestic industry.

At the moment the US has only one producing lithium mine that supplies a measly <1% of global lithium supply.

As for processing capacity, the story is similar - with basically no lithium processing industry in the country.

Processing capacity is instead ~80% controlled by the Chinese and most of the world's lithium mine production comes from Australia and South America.

The USA doesn’t like losing, and it's not giving up on these massive industries without a fight.

To flip the current lithium script, the US recently launched billions of dollars in initiatives aimed at building out domestic supply chains and redeveloping its domestic infrastructure.

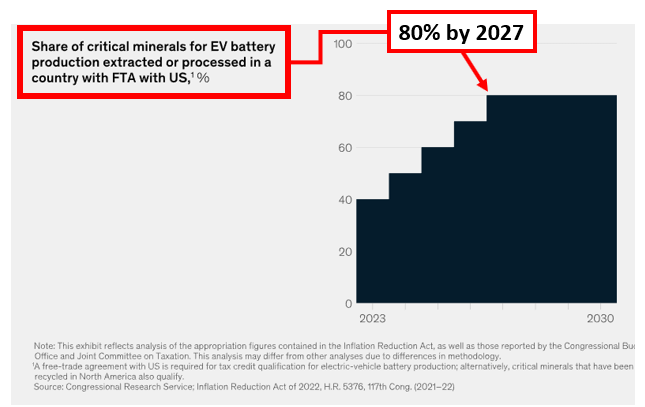

One specific target is to try and source ~80% of all critical minerals for EV batteries from INSIDE the USA or from countries with free trade agreements with the US by the year 2027.

As we mentioned above, the US government has already started getting involved at the project level - by providing cheap capital at lithium developers:

- US$700M conditional loan to ASX listed Ioneer Ltd.

- US$141.7M to ASX listed Piedmont Lithium.

Just last week we saw downstream private capital commitments - with Ford announcing a $3.5BN battery manufacturing plant in Michigan.

The US is therefore throwing capital to the entire lithium supply chain from mines all the way through to battery plants.

The key issue with this strategy is that manufacturing and processing capacity can be built out a lot quicker than securing enough raw materials supply.

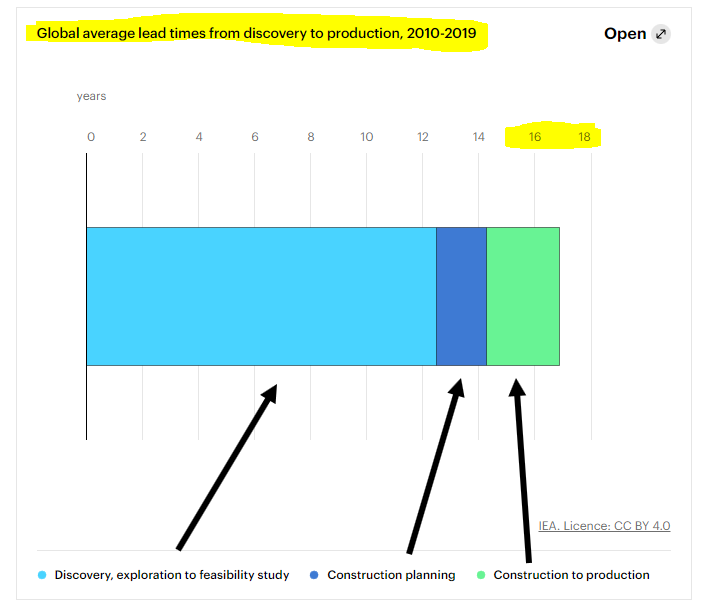

For some context, the International Energy Agency (IEA) estimates that the average lead time from discovery to production on critical minerals projects was >17 years.

This is compared to the 2-3 years it takes to build out downstream processing/battery manufacturing capacity.

The US has just started pushing capital into the manufacturing and downstream space and we think to speed up that ~17 year timeframe, it will need to push even more capital into the mining space.

Unlike here in Australia where the lithium mining industry is a lot more advanced, the US lithium mining industry is still in its infancy.

This is why we think there are opportunities in the early stage exploration space inside the USA.

We think MAN has therefore picked up a project for minimal cost in an industry that will grow exponentially over the coming years.

Our NEW Investment Memo:

Just under 12 months ago we covered an announcement from MAN that it would be bringing in a copper project in Chile.

In that Investment Memo, we highlighted “Acquisition risk” as a key risk to watch given that MAN was still in the process of completing due diligence on the project.

In August last year, MAN re-negotiated the terms of its acquisition so that vendor payments would be made based on project access/drilling milestones.

One month later MAN decided to cancel the transaction altogether. So unfortunately this risk did eventuate for that project.

To see our retrospective review of our 2022 Memo click here.

However, the Chilean copper project is behind it now.

MAN has a new strategy - build a lithium brine project from the ground up - inside the USA.

With $19M in the bank, it should have a decent runway to build some value here over the coming months.

Today we will be launching our NEW 2023 MAN Investment Memo, where you can find:

- Why we are Invested in MAN

- Our long term bet - what we think the upside Investment case for MAN is.

- The key objectives we want to see MAN achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Click here to see our Investment Memo

Why we are Invested in MAN:

- Critical minerals (lithium) project inside the USA: The US has signed into law billions of dollars of spending over the next 10 years on building out domestic critical minerals supply chains. Lithium is listed as a critical mineral in the US critical minerals strategy.

- Partnership with Galan Lithium ($344M current market cap): Galan Lithium is currently developing its lithium brine project in Argentina. Galan has agreed to invest $1.5M for a ~5% shareholding in MAN and has a right to bring on a strategic advisor for a further $700k at the same price. Galan has also agreed to provide technical support to MAN as it explores its projects. We think Galan’s direct investment validates the potential of MAN’s project.

- Larger capped neighbour in the same region: MAN’s project sits in the same region as $224M Anson Resources which is developing its lithium project in Utah, USA.

- Strong cash position, small enterprise value, leveraged to a discovery: After Galan’s investment, MAN will have ~$19M in cash in the bank. Given no capital raise is anticipated in the short to medium term, investors seeking exposure to the project will likely only be able to buy on market. MAN is currently trading with an enterprise value of ~$14M. This means we think the company is leveraged to a re-rate on material news.

- The project was generated organically: MAN has put together the project internally meaning the company doesn't need to make any expensive vendor payments or cause additional shareholder dilution. MAN’s balance sheet can instead be used to develop its project.

- Lithium brine potential confirmed inside MAN’s project: It’s early days, however historic well data inside of MAN’s ground has confirmed lithium brine potential. Data shows concentrations of up to 75 mg/L of lithium (inside MAN’s ground). For some context, ~US$1BN lithium brine developer Standard Lithium’s resource is based on concentrations averaging 168 mg/L lithium, nearby Anson Resources' average grade is ~124 mg/l.

Our long-term Big Bet:

“MAN returns 1,000%+ by making a lithium discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MAN Investment Memo.

What we want to see MAN achieve over the coming 12 months:

Objective #1: Increase landholding (project size)

MAN has just recently started staking its ground. We want to see MAN increase its total landholding and in turn the size of its project.

Milestones:

🔃 Stake more ground to increase overall project size.

Objective #2: Maiden exploration target

We want to see MAN first publish a JORC-compliant exploration target and then convert it into a maiden JORC resource estimate.

Milestones:

🔲 Maiden JORC exploration target.

Objective #3: Re-sampling of existing wells and drilling of a new well.

As part of its exploration program, we want to see MAN re-sample existing oil and gas wells in and around its acreage with lithium focused testing methods. We also want to see the company drill at least one NEW well.

Milestones:

🔲 Sampling of existing wells in and around MAN’s project.

🔲 Drilling of at least 1 NEW well.

Objective #4: Maiden JORC resource estimate

We want to see MAN first publish a JORC compliant exploration target (Objective #2) and then convert it into a maiden JORC resource estimate.

We also want to see the company evaluate suitable Direct Lithium Extraction (DLE) processing technologies as this will determine how much of a resource can be converted into a maiden JORC resource.

Milestones:

🔲 Progress on Direct Lithium Extraction technologies.

🔲 Maiden JORC resource estimate.

What are the risks?

Exploration risk: MAN’s lithium project is still relatively early stage considering the company just recently got a hold of its leases. There is always a risk that the company’s exploration programs yield no notable drill results and there is no economically viable lithium resource over its ground.

Processing risk: MAN’s lithium project is hosted in brines. This means that for the project to be processed economically the company needs to find a suitable processing technology for its type of material. Typically this is a type of Direct Lithium Extraction (DLE) technology.

Technology risk: Direct Lithium Extraction (DLE) is yet to be fully commercialised. There is always a risk that no technological advancements are made with the processing tech and so brine projects like MAN’s are considered stranded until suitable processing tech advancements.

Commodity pricing: The lithium price is currently trading near all-time highs. Any negative change in the lithium price may impact demand for new discoveries. This would hurt the share price of a junior explorer like MAN.

Market risk: In the event of a market-wide sell off, we would expect higher risk early stage exploration companies like MAN to sell off even more. This typically happens because during market downturns, investors look to pull capital out of their highest risk investments.

What is our investment plan?

We will look to hold the majority of our position in MAN up until the key catalyst, which we think will be a maiden JORC resource.

If the company achieves key milestones on the way to this catalyst and the share price substantially re-rates on the back of the project de-risking, we will look to sell a further 35% of our Total Holdings in MAN.

Our MAN Progress Tracker

Below is our MAN Progress Tracker document.

We will be using this internally to keep up to tabs on the company's progress.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.