Cashed up MAN picks up high grade Chilean copper asset

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 2,150,000 MAN shares at the time of publication. S3 Consortium Pty Ltd has been engaged by MAN to share our commentary and opinion on the progress of our investment in MAN over time.

As copper prices hit record highs this month, copper projects are front and centre of investors' minds.

Goldman Sachs has gone as far as calling copper the “new oil” due to how critical copper is in the transition to a lower carbon world.

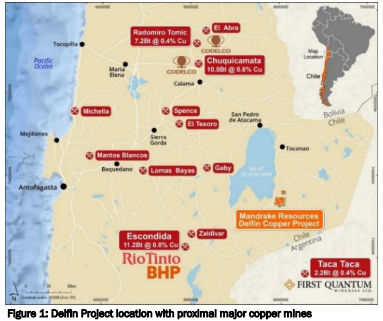

Making the most of this, our junior exploration investment Mandrake Resources (ASX:MAN) has just acquired a high grade copper project in the Antofagasta region of northern Chile.

This is a premier copper mining district, home to some of the world's largest copper porphyry deposits. Copper producing majors including BHP, Rio Tinto, and state-owned Codelco are all operating in this region.

BHP/Rio Tinto has the largest copper mine in the world here — a 11.2 billion tonne @ 0.8% copper deposit, which contributes ~ 5% of total global production. There is also the 10.5 billion tonne @ 0.6% copper deposit owned by Chilean state controlled Codelco.

MAN’s new Chilean copper project sits less than 100km to the east of BHP/Rio Tinto’s project.

MAN’s new project acquisition comes with ~15,000m of historical RC/diamond drilling results.

This drilling returned intercepts as large as:

- 86m @ 4.83% copper from 121m - which includes higher grade sections of 27m @ 7.1% copper from 134m, and 3m @ 14.4% copper from 164m.

These drilling results were all returned pre-2007 when the market appetite for new copper discoveries was nowhere near where it is now.

More recently, we have seen the market re-rate companies with copper drilling results like this into the hundreds of millions market caps. Carnaby Resources is one example.

Carnaby’s share price jumped from ~$0.20 to $2.20 in December last year on a high grade copper discovery at its project in Queensland only ~4 months ago:

MAN’s project has an intercept twice the thickness, of higher grade, and at almost half the depth of Carnaby’s.

Carnaby Resources is currently trading at $1.36 with a $194M market cap.

Prior to today’s acquisition, MAN was capped at $22M, with $16.2M in cash.

That historical intercept, coupled with the source of mineralisation being unknown (due to a lack of modern exploration techniques and ~80% of historic drilling limited to depths of only 140m), has us suspect that MAN’s project has the potential to host a copper deposit of serious value, especially when we consider what else is in the region.

With the copper price at near record highs above US$4.7/lb, and the potential for a large-scale porphyry discovery similar to others in this part of Chile, MAN may have picked up the right prospect at the right time.

Armed with the historical drilling results, we hope to see MAN establish some high priority drill targets and start aggressively drilling with the aim of establishing a maiden JORC resource.

With $16.2M in cash and an enterprise value of only $6.4M prior to today’s news, MAN can really flex the strength of its balance sheet and press forward with exploration work for as soon as possible.

MAN will be paying a total of US$3.8M (A$5.1M) in cash, 80 million shares in MAN, and a net smelter royalty of up to 4% that is based around the average copper price.

Importantly though, the cash component is deferred with US$300k due by 31 May 2023 and US$3.5M by 31 May 2024.

The significance of this?

MAN can spend all of its cash on drilling for a discovery and can delay making those payments when (we hope) its market cap is multiples higher than where it is now.

We decided to launch our 2022 MAN Investment Memo off the back of this announcement and identified this project as the key reason why we continue to hold MAN in our portfolio.

To see all of the reasons why check out our Investment Memo below:

We have also set some expectations for MAN and will be tracking the company’s progress as it delivers against our expectations for the remainder of this year. These expectations can be seen in the 2022 MAN Investment Memo.

More on the new copper acquisition

MAN’s new copper project is in the same region of northern Chile as the 11.2bt @ 0.8% copper Escondida project owned by BHP/Rio Tinto and the 10.5bt @0.6% Chuquicamata copper project of state-owned Codelco.

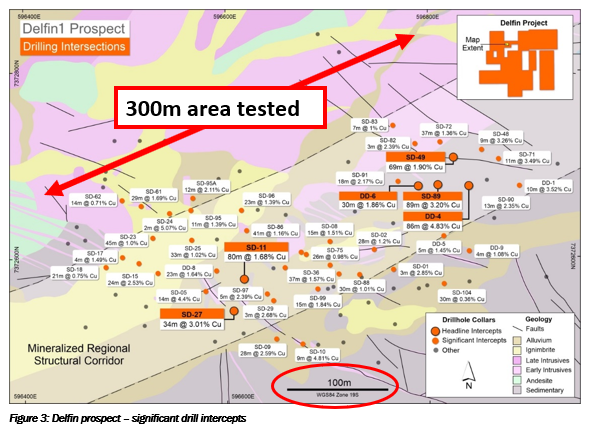

At first glance, the 84km2 tenement package may sound small but the project is still very much underexplored — only 300 x 100m of the project area has been explored previously.

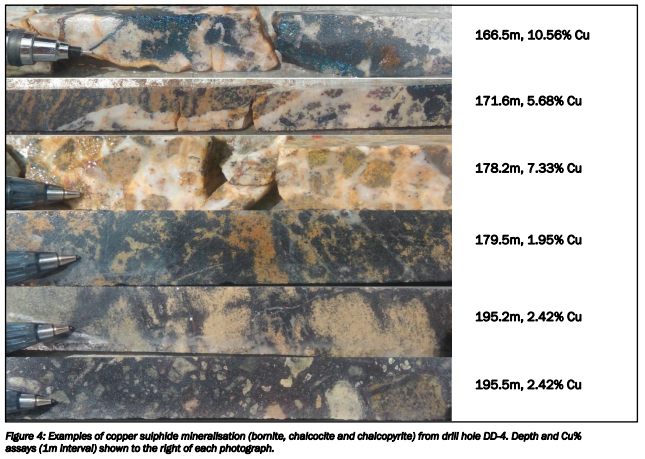

Drilling in that tiny section of the project was focussed around two artisanal mines. That drilling consisted of over ~15,000m of diamond and RC drilling with intercepts returned as high as:

- 86m @ 4.83% copper from 121m, including higher grade sections for 27m @ 7.1% copper from 134m; and 3m @ 14.4% copper from 164m.

- 89m @ 3.2% copper from 122m

- 34m @ 3.01% copper from 18m

- 69m @ 1.90% copper from 44m

Having this already well tested section of the project means that with just a few rounds of drilling, MAN should have enough drilling data on hand to put a maiden JORC resource.

We would hope that MAN’s market valuation would then reflect that resource.

For some context, Carnaby Resources’ major copper gold discovery in December 2021 was underscored by its intercept of 41m @ 4.1% copper from 247m.

That intercept is close to half the size of the peak results from historical drilling at MAN’s project and is almost twice as deep underground.

The market viewed that result extremely favourably. Off the back of that discovery, Carnaby’s share price moved from ~25c to a high of $2.20/share adding over $200M to its market cap.

MAN had a market cap of $22.6M prior to today’s news and with $16.2M in cash, that equates to an enterprise value of $6.4M — leaving plenty of room to re-rate off the back of a confirmed discovery.

The exploration opportunity for MAN comes from the fact that almost all of this exploration work was done between 1992 and 2007, when there was limited demand for copper and little interest in new copper discoveries.

The high copper price and green energy revolution now point to significant increases in demand for copper. New copper discoveries are all of a sudden of interest to the market again.

MAN highlighted in its announcement today that “the genesis of copper mineralization at Delfin has not yet been identified”. Remember that ~80% of the historical drilling was limited to depths of only 140m, with the deepest drillhole reaching depths of just ~293m.

As a result, there is potential for MAN to drill down at depth to see if the source of the mineralisation is a much larger porphyry deposit - this is the real upside here.

Given the nearby 11.2bt @ 0.8% copper mine of BHP/Rio Tinto and Codelco’s 10.5bt @ 0.6% copper mine were large scale porphyry discoveries, we think MAN has managed to bring in the right assets to potentially deliver something of scale.

Most importantly, this project has seen no modern exploration techniques. This means that with some more geochemical/geophysical surveys, MAN could find what others may have missed in the past.

Of course the caveat here is that this is all prospective at the moment.

MAN will need to run several rounds of drilling and spend multiple millions of $ before we can know for sure if this potential exists.

In any case, the acquisition is coming into MAN at a relative low point in the share price. If it can prove up a resource we would expect the market to value MAN higher over the journey.

So how much is MAN paying for the project?

MAN stated today it had $16.2M in cash, leaving it with plenty of firepower to make an acquisition such as the one announced today.

As part of the acquisition MAN will be paying:

- A total of US$3.8M (A$5.1M) in cash,

- 80 million shares in MAN (worth ~A$3.76M at last close), and;

- A net smelter royalty of up to 4% that is based around the average copper price.

MAN will also be providing the vendors with a loan of $1M. But as it’s just a loan we didn't consider it in our calculation of the acquisition price.

The payments are not all being done upfront but are split into deferred components with the following terms and conditions:

- 80 million shares to be issued after an initial 12 week due diligence period - 50% of this will be escrowed for 6 months.

- US$3.8m split (US$300k by 31 May 2023 and US$3.5M by 31 May 2024), meaning MAN won't need to pay anything upfront and can instead spend their cash drilling out the project.

- Net Smelter Royalty of upto 4% which is tiered based on the average monthly copper price.

The interesting part of the terms was the exploration commitments MAN have baked into the deal, which requires at least 10,000m of drilling by 31 May 2024 and a JORC resource of at least 150,000 tonnes of copper at a grade above or equal to 0.2%.

MAN has essentially managed to secure an option to acquire a project whereby no cash payments are being made upfront. Instead, MAN can spend all of its time and money drilling out the project.

If we can see MAN put a JORC resource behind the project then we think that the total consideration being paid would dwarf the value of the project and MAN’s valuation in the future.

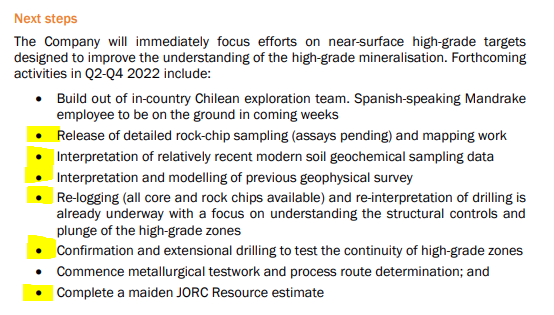

What’s next for MAN’s new copper project?

Rock chip sampling and geochemical mapping results 🔄

MAN has confirmed that more assays from recent rock chip sampling programs are pending, with the results to form part of a geochemical mapping exercise.

We expect to see MAN use the results from this program to identify drilling targets for its upcoming diamond drilling program in Q2-2022.

Re logging and re interpretation of historic drilling results 🔄

This is all important as it will improve MAN’s understanding of the geological structures below ground.

We expect to see MAN begin to build up its understanding of what the previous drilling looked like and where the high grade copper zones were found.

This should produce some interesting images that should help us better visualise what MAN will be targeting over the coming months.

Interpretation and reprocessing of previous geophysical surveys 🔄

This will likely form part of the target generation works leading up to the maiden drilling program by MAN.

We expect to see all of these results overlaid with the upcoming geochemical sampling (rock chip sampling) program to best determine where the diamond drilling should focus on.

Drilling program before the end of the year 🔲

In today’s announcement MAN confirmed that it was also planning a diamond drilling program to test the targets that are thrown up after all of the target generation works are completed.

At present, MAN has two prospective targets which were identified using all of the historical drilling results and recent rock chip samples which returned 10.17% and 3.26% copper.

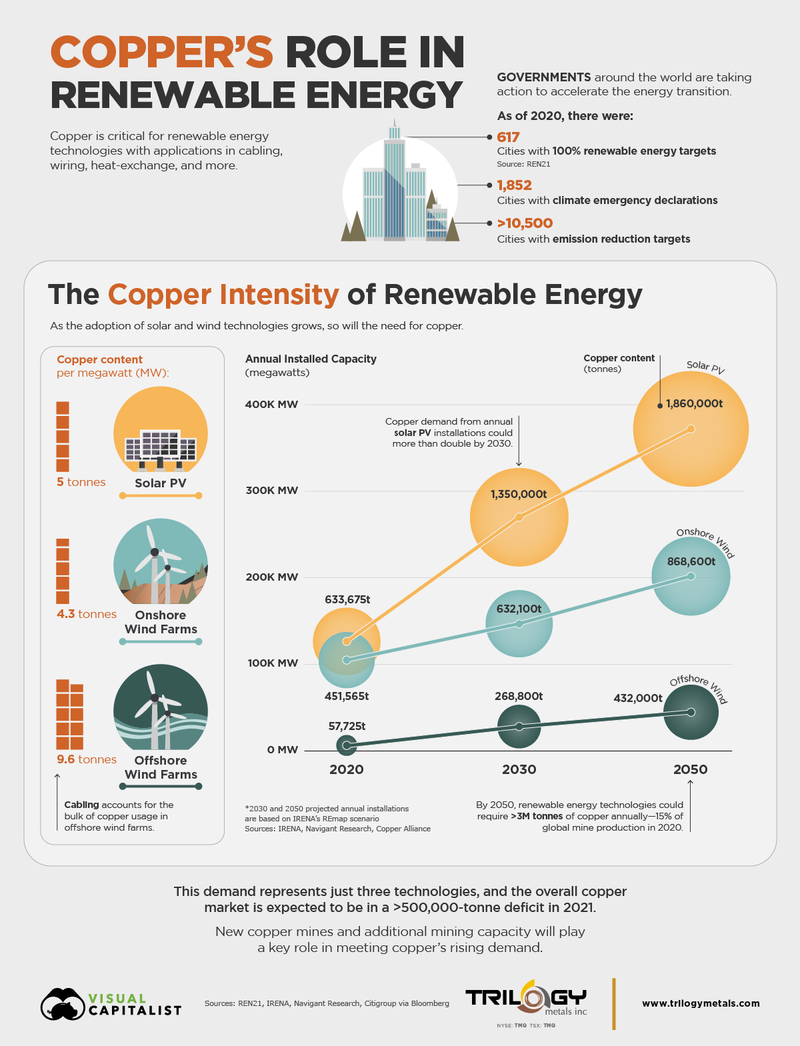

Why copper, why now?

Copper is already the third most used industrial metal, which means any current demand issues are de-risked. This is different to commodities in rapidly developing / fast growing new industries that can face a sort of “ramp-up stage”, which leads to choppy supply and demand and volatile pricing.

The best recent example of this is the lithium bear-market between 2018-2020 where investors realised that lithium demand was not developing as quickly as they expected.

There are no such issues for copper given its already well established demand. With copper having one of the highest thermal and electrical conductivity of all metals, it is essential for all electricity-related infrastructure.

This is where we think the real upside for copper comes from, as the world increasingly becomes climate conscious and is rapidly moving to a more sustainable energy mix. Electrification of industries is becoming priority number one globally.

For example, electric vehicles use up to 80 kgs of copper, as opposed to internal combustion engines which use up to 20kg of copper. This equates to over a 4x increase in copper demand from EVs.

The increased demand for copper doesn't end there though, with copper being the primary input for cabling in wind-farms and the key input for solar farms.

We think copper will become one of the most critical metals for the green-energy revolution and with BHP calling for copper demand to multiply over the next 30 years and Citigroup predicting shortfalls in supply in the short term, we have added copper exposure to our portfolio.

What about MAN’s nickel-PGE project?

We first invested in MAN in March 2021 with a view to seeing it drill its Jimperding PGE-Ni-Cu Project.

The project sits ~30km east of $2.6 billion capped Chalice’s massive Julimar discovery in WA.

MAN’s project had three primary geophysical EM anomalies that would be the entire focus of its exploration efforts.

Basically, MAN had three shots at making a discovery. It took two of those shots in 2021. But after drilling two out of three EM conductors, market interest in the project diminished as was reflected in its lacklustre share price over the last 6-10 months.

The company is now drilling the final third EM conductor — the third and final shot —at the nickel-copper-PGE prospect and is solely focussed around the smallest of the EM conductors - conductor c.

MAN are undertaking RC drilling so we expect to see some downhole EM surveys and follow up diamond drilling should this current program be successful. Assays were expected to be back in February/March, which means we should see some results from this relatively soon.

We’ll be watching to see the results of that drilling program but for now, the primary reason for us holding MAN in our portfolio is its newly acquired copper project in Chile.

What are the risks for MAN?

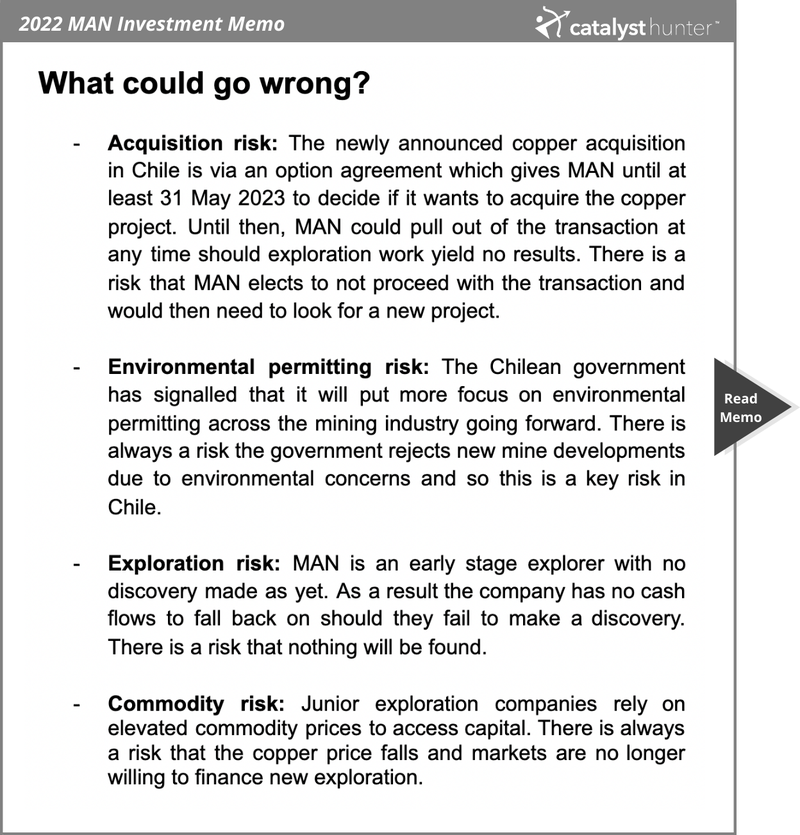

Given the new acquisition and the launch of our 2022 Investment Memo, we have also listed all of the risks that we came up with when reviewing our MAN investment thesis.

Below is a screenshot of the primary risks we came up with:

Our 2022 MAN Investment Memo:

Below is our 2022 Investment Memo for MAN where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our MAN Investment Memo you’ll find:

- Key objectives for MAN in 2022

- Why we continue to hold MAN in 2022

- What the key risks to our investment thesis are.

- Our investment plan

To access the MAN Investment Memo simply click on the button below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.