Large fresh green crystals everywhere - is this a new lithium discovery?

Spodumene bearing pegmatites...

Large, fresh, green spodumene crystals sighted...

Open in all directions...

Assays due in the coming weeks...

And more drill holes still to come.

Our investment Latin Resources (ASX:LRS) is reaching a very interesting juncture in its lithium exploration in Brazil.

LRS keeps releasing promising visuals of drill cores, and attention is now starting to turn to the potential lithium grades from assay results, which are due in a few weeks.

The timing couldn’t be better for LRS with lithium prices at all time highs due to a combination of tight supply, growing demand and under investment during the July 2018 - July 2020 “lithium winter.”

It’s a powerful market narrative. And after the three additional holes announced yesterday, LRS has managed to hit what looks like spodumene bearing pegmatites in all six holes drilled so far.

For the uninitiated, spodumene is a lithium bearing mineral and a pegmatite is the host rock.

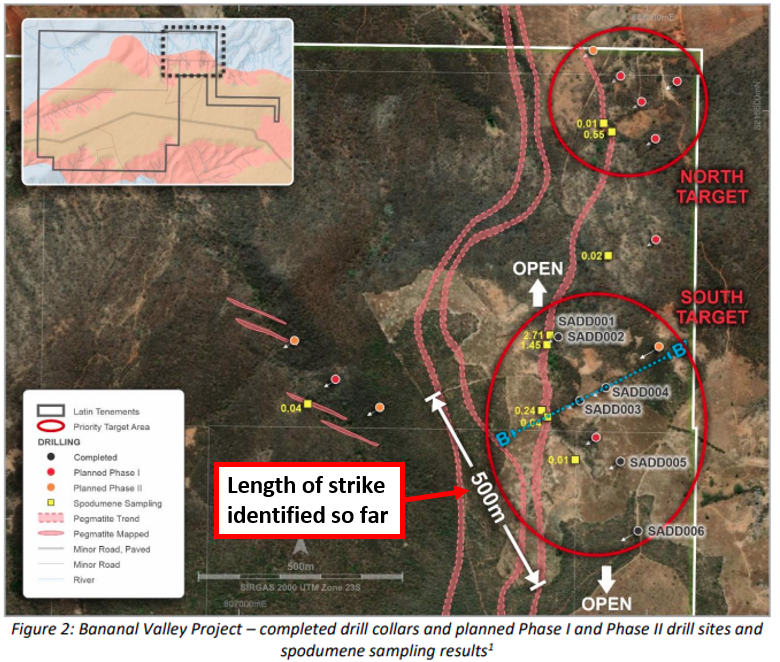

The market seems to like the latest LRS news, with the company confirming that the visually identified spodumene bearing pegmatite structure extends over a ~500m strike zone in the southern part of the prospective area.

With drilling now moving to the north, the upcoming drill holes will aim to show whether the strike extends to the north and if the structure runs along the entire ~1.5km prospective strike zone.

With first assays from previous spodumene hits expected in the next few weeks, we’ll soon know if LRS is onto a lithium discovery.

Today we’ll explain the significance of the strike zone and highlight why lithium keeps making the headlines.

Regular Catalyst Hunter readers will be familiar with the emerging LRS lithium story which we first covered early last year.

Since the end of 2021, LRS has put more resources into its Brazilian lithium project and delivered promising early signs with what looks to the naked eye to be large spodumene crystals in drill cores.

Assays will confirm if these lithium bearing minerals are indeed in the cores. And after these six drill holes, it means LRS is now almost halfway through its 14 drill hole campaign.

The grades from the assays could prove to be important — we’re looking for a >1% lithium grade.

LRS has a few projects it is working on, but its Brazilian lithium project has gradually been getting all the focus. We have tracked this project since August last year. You can find our previous coverage of the LRS Brazilian lithium project below:

- 19-Aug-2021: Latin Resources eyes lithium potential at Salinas Project

- 23-Sep-2021: LRS strengthens lithium story with commitment to ESG

- 26-Oct-2021: Great Time to Look for Lithium - LRS Building Lithium Footprint in Brazil

- 17-Feb-2022: Spodumene alert: Has LRS just made a new lithium discovery?

- 03-Mar-2022: LRS Keeps Showing Us More Spodumene

Since announcing its initial visual spodumene pegmatite hits, the LRS share price has started to move.

From a low of 2.7 cents on 23 December, the LRS share price now sits at over ~5 cents.

This movement is closely aligned with the third reason we continue to hold LRS in 2022 from our LRS Investment Memo - the potential for a re-rate:

More on yesterday's announcement:

LRS announced yesterday that they hit what looks like spodumene pegmatites in drill holes four and five, and a first look at drillhole six which is further positive progress towards Key Objective #1 in our LRS Investment Memo.

These holes were each drilled at the southern section of the ~1.5km prospective strike zone which LRS is targeting a maiden JORC resource for.

The southern section is circled in red below - and LRS is quickly moving on to the Northern target area in the coming weeks:

We think all three of these drill holes are telling us a different story which could lead to that all important JORC resource LRS is targeting with this drilling program.

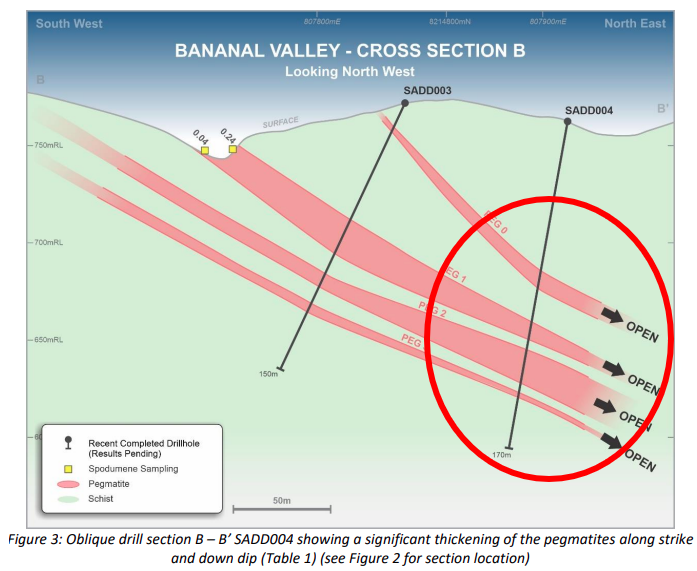

First is drill hole four (SADD004):

In our last note we highlighted a visually identified 16.2m spodumene bearing pegmatite intercept which was ~180m along strike to the first two drill holes where LRS first hit spodumene crystals.

The significance was that LRS now had an indication of the spodumene structure extending along strike to the south.

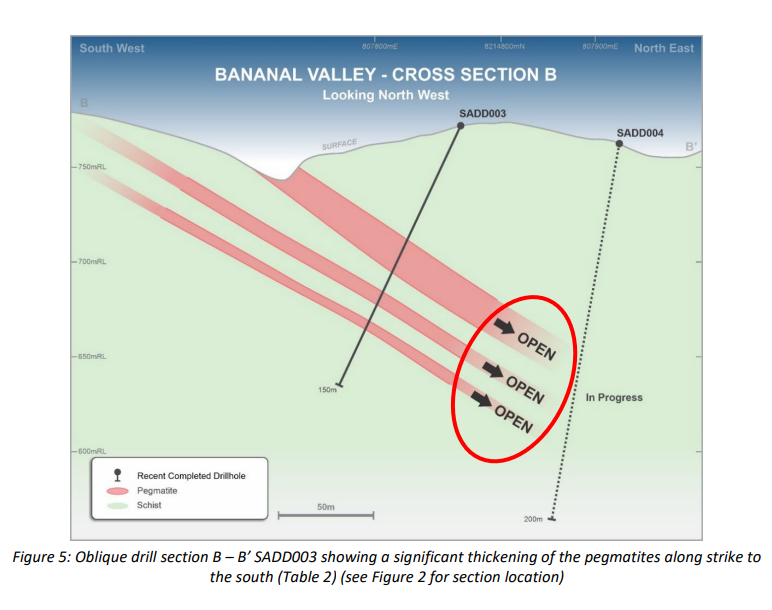

In that note we mentioned that we were looking forward to seeing the results from drillhole four, which would demonstrate whether that structure continues to extend down dip.

We knew that the structure was open down dip but the next drillhole would be crucial to seeing whether it actually extended at depth.

Previous announcement - the hole to the right was “In Progress”...

Latest announcement - hole complete - and the pegmatites are still going:

Today, LRS confirmed that the structure does in fact extend down dip with a cumulative ~36.08m in pegmatite intercepts in the fourth drillhole — so far the largest cumulative amount of intercepts.

This is significant as it extends the structure at depth, and it is starting to look very similar to what the first two drill holes were indicative of.

When drilling to define an orebody, an explorer is basically looking to show conformity of a deposit along strike and at depth.

With the results from drillhole four, LRS has confirmed the “at depth” part of this.

The second drillhole covered in yesterday's announcement is the fifth (SADD005).

This one is testing a further ~100-150m along strike from drillhole three and four, with yesterday’s announcement LRS confirmed ~10.58m of cumulative pegmatite intercepts across that hole down to a depth of ~201m.

Again an indication that the pegmatite structure extends further along strike to the south.

Here’s a couple shots of what these drill cores look like:

The third is drillhole (SADD006) which was drilled right near the bottom of the ~1.5km prospective strike zone.

In yesterday’s announcement LRS confirmed that as of 15th March ~33.46m of pegmatite interceptions were made, with drilling of this hole still ongoing.

The reason we think this is so significant is that it confirms that from the first two drill holes all the way down to the 6th drillhole LRS has managed to intercept what looks like spodumene bearing pegmatites across ~1/3rd of the ~1.5km prospective strike zone.

Effectively confirming that the structure is at least ~500m long now.

The ~33.46m of pegmatite intercepts are also the second highest cumulative number of intercepts of the whole drilling program so far - a great result considering the drillhole isn't completed yet.

To summarise:

- Pegmatite structure extends down dip: Drillhole four confirmed that the previously identified spodumene bearing pegmatite structure extends down dip.

- Pegmatite structure extends along strike: Drillholes five and six confirm the structure extends along strike, putting together a ~500m strike zone over the southern part of the project now.

So what’s next for LRS’s Brazilian lithium project?

14 hole, 2,000m diamond drilling program 🔄

LRS is now 6 holes into its 14 hole drilling program.

Having identified the ~500m strike zone after the sixth drillhole is completed, LRS will move the drill rigs up towards the northern part of the ~1.5km prospective strike zone.

By moving the drill rigs ~500m to the north, LRS is looking to see if the structure extends to the north the same way it does to the south.

We expect to see some more visual drill cores from the drilling program come back over the next 4 weeks before the focus turns to the assay results.

LRS will consider expanding the drilling program to ~5,000m so that a maiden JORC resource could be put together. We may see some news on this over the coming weeks.

Assay results from the first six drill holes 🔄

Of course the intercepts mean nothing if there is no lithium mineralisation in them.

LRS confirmed yesterday that it expects the first assays from the drilling program within the next few weeks.

This is the key bit of newsflow for LRS, considering the first two drill holes were completed above rock chip samples taken from outcropping pegmatites which returned peak lithium grades of 2.71% and 1.45% lithium oxide.

We think that should the assays return lithium grades at or above 1% lithium oxide, then LRS could be on the cusp of formally announcing a new discovery.

The remainder of the drilling program and the resulting assay results will form the basis for the data from which LRS will be hoping it can announce a discovery and at the same time a maiden JORC resource for its Brazilian lithium project.

Again, we set this as our Objective #1 in our 2022 LRS Investment Memo, which can be viewed by clicking the image below.

Update on funding:

In both of our last two notes we have written about LRS’ financing situation, specifically because it was running low on cash on hand at the end of December 2021.

On the last day of February, LRS found a solution to its financing plans, announcing a $2.5M funding arrangement with New York based financier Lind Asset Management.

The deal is secured against LRS’ listed options - so that if the company receives any conversions from investors, the funds are used to immediately pay down the principal of the loan outstanding.

The terms of the funding facility are as follows:

- Immediate cash paid for LRS of $2.5M

- $2.75M face value loan, repayable over 14 months.

- On closing date, LRS to issue Lind 35 million unlisted options with an exercise price of 5c, expiring March 2026.

- LRS to pay Lind a $75k commitment fee.

- Funds raised from “in the money” options being exercised must be used to repay the principal of the loan.

So in total over the 14 month loan term, LRS is paying $325k in loan fees and 35 million in unlisted options exercisable @ 5c. To view more details of this deal see our previous note here.

With over $6M in options in the money, any conversions from the options would easily cover the Lind facility.

Since our last update we have seen ~$209k of those options converted @ 1.2c. Given LRS is currently trading above 5c, we would expect more to be converted in the coming days.

The positive here is that LRS can continue to drill without an immediate need to do a capital raise.

The conversions could mean there is some selling pressure though. If the ~411 million 1.2c options are exercised it means the investors who hold them would be effectively buying LRS shares @ 1.2c.

Depending on the LRS share price at the time, those investors might be looking to sell some of these at market prices - especially right now given the LRS share price is above 5c.

In the short term this is likely to create some selling pressure - HOWEVER if LRS can go on to prove out a substantial JORC lithium resource, and any selling pressure is met with strong buying, then the impact to the share price could be minimal.

If LRS can confirm a discovery we suspect the share price for the company will move much higher and future capital raises for shareholders will be less dilutionary.

Media review - lithium market news

We’ve done a sweep of some of the latest lithium market news, pulled out the most interesting articles and summarised them.

The first article we look at is in relation to a nearby lithium giant called Sigma - Sigma is listed on the TSX-V exchange and has a current market cap of $1.3 billion CAD.

Sigma’s lithium deposit happens to be ~100km north of LRS:

Bloomberg: Lithium Squeeze Has Sigma Looking to Double Brazil Capacity

Key takeaways:

- Sigma Lithium Corp plans to make 240,000 metric tons of lithium by the end of the year at its Grota do Cirilo hard-rock facility after operating on a pilot basis since 2018. (Sigma is located ~100km North of LRS)

- Economics of Sigma’s project are aided by a dense medium separation plant and dry-stacked tailings - lowest quartile of production costs

- Upgrading plant capacity to almost double output by the end of 2023

- As LRS investors we can’t help but wonder if Sigma would be interested in what LRS might find...

In other broader lithium news, all signs point to continued bullish sentiment in lithium producers and explorers.

S&P Global: Lithium supply race heats up

Key takeaways:

- New and restarting lithium assets to add 355,000 tonnes of LCE capacity by 2023. Spodumene projects will account for 81.8% of the capacity increase

- Capital intensity of lithium brines will be higher than spodumene concentrates

- Lithium chemicals demand to increase nearly twofold in 3 years — to 904,000 tonnes of LCE in 2024 from 492,000 tonnes in 2021

Lithium is part of a much larger commodities boom with a glut of funding going to exploration projects.

AFR: Hot lithium market drags exploration sector to fresh records

Key takeaways:

- Cash inflows to the pre-revenue exploration sector surged by 47% to $3.75 billion in the final three months of 2021, leading to record spending on drilling and a six-year high in the number of exploration companies

- Commodities boom has led to 2021 having triple the exploration spend seen in 2016

- Liontown Resources, Vulcan Energy and Global Lithium successfully raised money for lithium projects.

Our 2022 LRS Investment Memo

Below is our 2022 Investment Memo for LRS where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our LRS Investment Memo you’ll find:

- Key objectives for LRS in 2022

- Why we continue to hold LRS

- What the key risks to our investment thesis are

- Our investment plan

To access the LRS Investment Memo simply click below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.