Halloysite Heavyweights Go Head to Head - LRS vs ADN

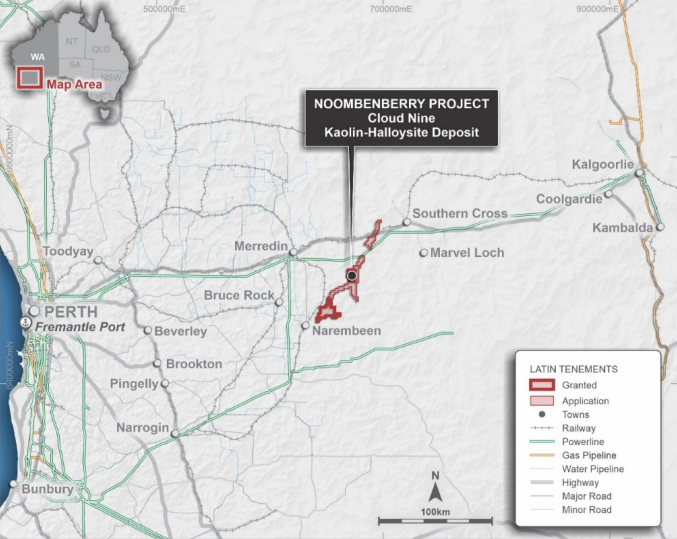

On Monday, Latin Resources (ASX:LRS) delivered its Maiden Inferred Mineral Resource for its 100% owned Noombenberry Halloysite-Kaolin Project, 300km from Kalgoorlie in Western Australia.

LRS declared a Global Inferred Mineral Resource of 207 million tonnes of kaolinised granite as a starting point, hinting that it could get bigger and higher grade with more work.

The $87M capped LRS is trying to follow the same pathway as Andromeda Metals (ASX: ADN), currently capped at $442M.

ADN was one of the best performing stocks on the ASX last year and is a great example of how a micro cap explorer can unlock serious value in a halloysite project - its share price hitting 10x at its peak.

The market has been waiting for LRS to release its news for some time - as it has given investors the opportunity to get a better idea of how LRS might stack up against its bigger and more advanced halloysite peer, ADN.

We expect it might take a few trading sessions for the fast money and day traders to finish their post announcement activity on LRS before it can start its move up.

While we wait for this, we have been going over LRS’ announcement, comparing it to ADN, and have attempted to measure it up against its bigger peer ADN.

Disclosure #1: We are not hard core qualified geologists, but have been investing in speculative mining stocks for many years. We have done our best to compare the merits of each company.

Disclosure #2: We are long term LRS holders, having first invested in November 2020, and we increased our position a few months later.

We do not hold any shares in ADN.

As LRS holders, we are hoping it can have similar success to ADN.

ADN vs LRS - at a quick glance

Here is the visual representation of the rest of this article - green is good, yellow means not as good.

Before we go too far - what actually is halloysite?

Halloysite is a rare derivative of kaolin where the mineral occurs as nanotubes.

The wider kaolin market is expected to reach US$8.23BN by 2024, while halloysite has a wide variety of industrial uses beyond simple kaolin.

Consequently, halloysite commands a significant premium above the average kaolin price. Whilst pricing can be fairly opaque and depends on quality, pure halloysite is selling for up to US$3,000/t.

Halloysite is in short supply due to the exhaustion of existing global reserves and the closing of environmentally damaging mines in China.

There is also the potential for downstream marketing of the high grade halloysite to emerging new applications, including the carbon capture and Hydrogen storage markets.

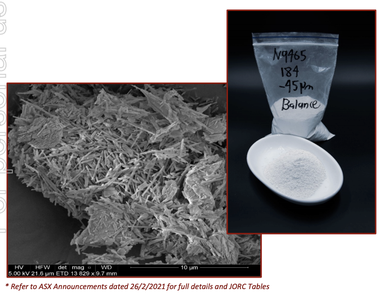

Here is a sample of LRS’ stash - you can see the nanotube formations on the left, and the brightness of the product on the right:

LRS vs Andromeda - let’s see how they stack up?

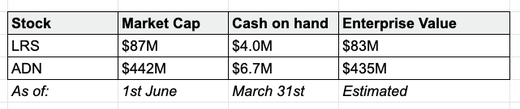

Market Cap and Cash on Hand:

First thing - let's take a look at how much the market is currently valuing each company:

LRS is still cheaper as it is less advanced than ADN, and we are hoping as LRS continues to deliver positive results, this valuation gap will start to reduce.

One of the best things about these halloysite kaolin resources is that they are relatively cheap to drill out, as the clay material is soft to drill through.

LRS has a shallow deposit with limited cover, and LRS has said it's well placed to deliver its next phase of drilling and resource growth with existing cash resources.

Stage of Development:

ADN:

ADN is much more advanced than LRS with off take agreements, a completed PFS demonstrating an NPV of A$736M and EBITA (LOM) of A$2.06BN, and is planning to start mining as soon as February 2022.

LRS:

LRS has really just begun. LRS has more drilling to do in the coming months, and plans to move to the “Pre Feasibility Study” stage next.

LRS is commencing technical studies to feed into its PFS right now, and the goal of the next phase of drilling will be to extend the resource to the north, and increase confidence of the resource estimate (more on that below).

As LRS investors we are hoping LRS continues to demonstrate the potential to eclipse ADN, and it appears that LRS can follow the same playbook as ADN over the coming months.

Ownership

LRS:

LRS holds 100% of the Noombenberry Halloysite-Kaolin Project.

ADN:

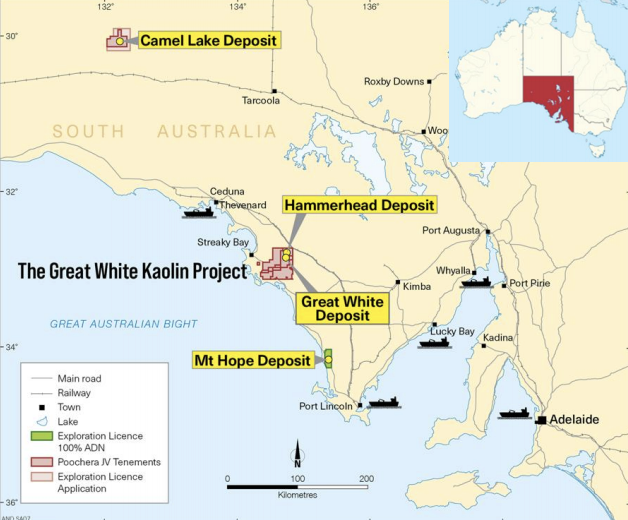

ADN only holds 75% of its Great White Kaolin Project, the main focus.

ADN has 100% of the Mount Hope project further to the south.

Keep scrolling to see maps of each company’s projects.

Resource Size

LRS:

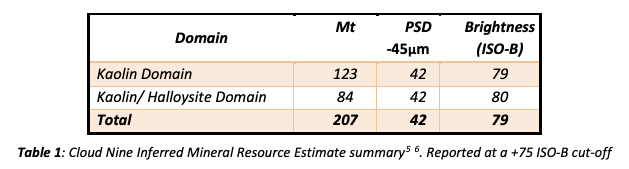

LRS’ Noombenberry Halloysite-Kaolin Project has a Global Inferred Mineral Resource of 207 million tonnes of kaolinised granite, comprising two separate domains:

- 123 million tonnes of bright white kaolin-bearing material; and

- 84 million tonnes of kaolin/halloysite-bearing material.

LRS could get bigger: LRS’ mineralisation is open in all directions - so there is scope for the resource to get even bigger.

LRS could bring out more high grade zones: LRS resource numbers have been smoothed due to the large block size used (limited by the current drill spacing) and Inferred classification.

Additional drilling / closer spaced drill density will increase the confidence and the JORC classification, which would enable LRS to report more selectively, which would bring out the high grade zones.

LRS upside?: LRS has an extensive tenement package - 560 km2, with a strike length of over 105km, with additional high grade halloysite, and ultra-bright kaolin occurrences already identified less than 10km away along strike.

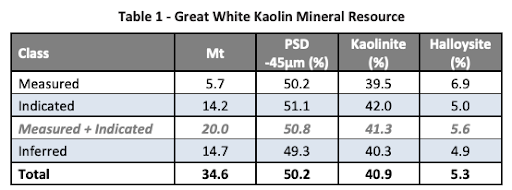

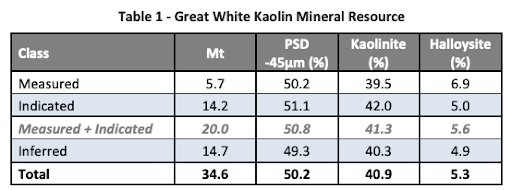

ADN:

According to the ADN’s most recent investor presentation, ADN has current total resources exceeding 100 Mt.

In this interview with Alan Kolher, ADN mentions that the resource is spread across three deposits.

ADN’s Great White Resource has a total resource of 34.6 Mt, which is of a higher certainty that LRS - a lot of ADN’s resource sits in the ‘Measured and Indicated’ category, whereas LRS is still in the ‘Inferred’ category:

Additional commentary on the resources:

LRS’ resource is contained in one deposit.

The ADN resource is spread across three deposits, which may translate to more complicated mine scheduling for ADN.

LRS used an independent consultant to determine the resource size, ADN appears to have applied internal estimates.

Brightness and Grade

Another thing to look at when evaluating halloysite / kaolin resources is the brightness.

The brighter the material, the higher it is valued.

ADN has demonstrated a quality product already, given it already has offtake Letter of Intents for approx 1 Mt/pa mixed grades, and also has a binding offtake secured from a ceramics maker.

Whilst we cannot profess to be experts in this sector as it gets pretty technical, we will try to break down the quality of the resource for each company.

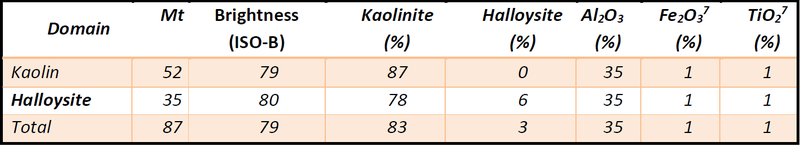

LRS:

LRS’ resource has used an ISO Brightness (“ISO-B”) R457 cut-off of 75:

The global kaolinised granite Resource contains a total of 73Mt of bright white (+75 ISO-B) Kaolin product with an ISO-B of 79 in the -45 μm size fraction, or 29Mt of ultra-bright white (+80 ISO-B) kaolin product with an ISO-B of 82.

Key Takeaway: While the above line is pretty technical, the key takeaway is that both products would be considered high quality product specifications, potentially suitable for a wide range of industrial applications.

LRS’ global resource also contains a relatively contiguous halloysite domain within the kaolinised granite. The halloysite sub-domain yields 50Mt grading 6% halloysite using 1% halloysite cut- off, or 27Mt grading 8% halloysite using a 5% halloysite cut-off within the minus 45- micron (-45 μm) subfraction.

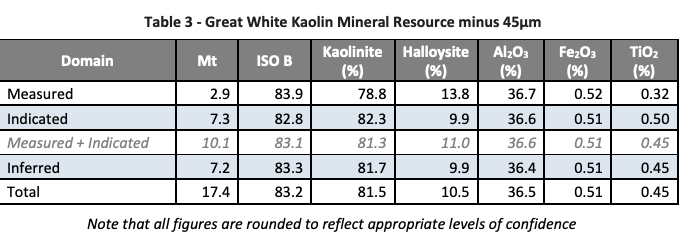

ADN:

Our best reference for the quality of ADN’s resource is this ASX announcement from November 2020 on the updated Mineral Resource for its main Great White deposit.

Like LRS, ADN has also used an ISO Brightness (“ISO-B”) R457 cut-off of 75 - however remember that ADN’s resource size has a higher degree of confidence, as more sits in the Measured and Indicated categories.

ADN then goes on to apply the minus 45 micron recovery factor, which yields 17.4 Mt of high bright kaolin product (ISO B > 75% ). The remaining approximate 50% of material is largely residual quartz derived from weathered granite.

Cover

“Cover” is the extent of rock overlaying the resource you want to dig out of the ground. The less cover, and the softer the cover (more sand, less hard rocks) the cheaper extraction of minerals is.

LRS:

LRS has less than 4m of unconsolidated soil cover. That is shallow, and soil is easy to dig up.

ADN:

ADN has between 7-62m of overlying hard silcrete caprock.

ADN therefore has significant overburden to remove before the ore can be accessed, which typically translates to higher mining costs.

This means at this early stage, LRS would appear to offer lower mining costs with a lower strip ratio than ADN.

Offtake Agreements

LRS:

LRS has nothing so far, it's too early.

ADN:

ADN has an offtake Letter of Intents for approx 1 Mt/pa mixed grades, it also has a binding offtake secured from a ceramics maker.

Infrastructure

Having infrastructure nearby and a base for a workforce contributes to lowering the costs of a project - the easier it is to get your material to market, the cheaper it is to produce.

LRS:

LRS’s Project is located adjacent to existing road, rail, port, power and water infrastructure, with Kalgoorlie 3 hours to the east - a major mining service centre.

ADN:

ADN’s Great White Project is close to a railway and closer to a port than LRS.

The Mt Hope deposit looks a bit more remote, however there is a main road that goes through.

What’s Next for LRS?

More drilling:

Having established a maiden JORC inferred resource, for LRS now it's all about continuing to expand the resource, and improve its quality by additional drilling.

PFS coming:

A PFS will be the next major milestone, as it should give us a first look at the financial metrics of LRS’ project, and how it might be comparable to ADN.

We are looking forward to seeing what LRS can deliver over the coming months.

Market research:

LRS is going to start looking at who might buy its product.

The PFS will consider supply to a range of traditional kaolin-halloysite end users, as well as investigating the potential for downstream marketing of high grade halloysite to emerging new applications - including the carbon capture and hydrogen storage markets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.