$35M Raised. 4 Drill Rigs. 25,000m of Drilling. LRS Going After Lithium.

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 5,755,000 LRS shares at the time of publishing. S3 Consortium Pty Ltd has been engaged by LRS to share our commentary on the progress of our Investment in LRS over time.

Lithium prices were sky high in April and enthusiasm for new discoveries was at fever pitch.

That’s pretty much at the exact moment the market really cottoned onto our Investment Latin Resources’ (ASX:LRS) new lithium discovery in Brazil.

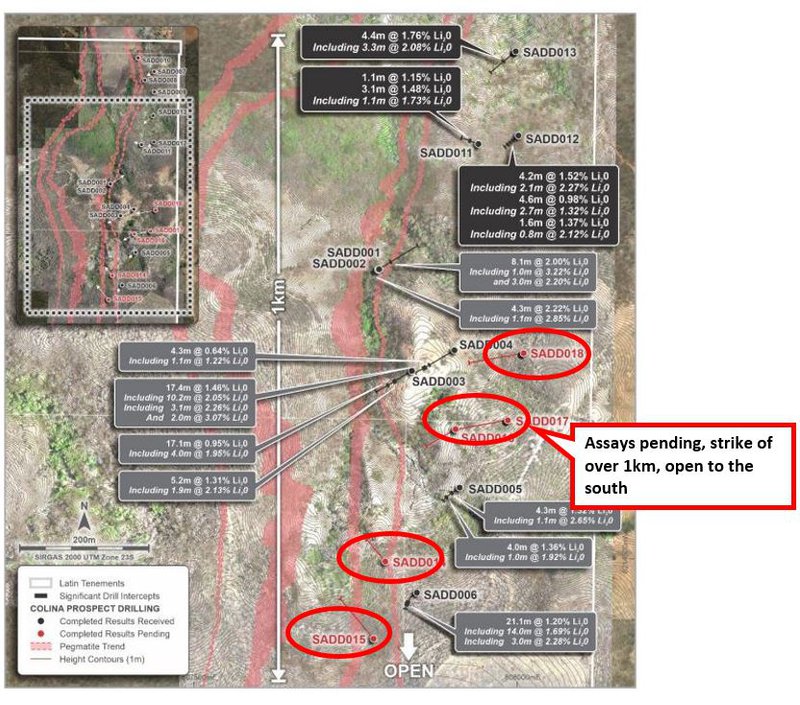

With a discovery hole of 8.13m at a peak grade of 3.22% lithium, LRS defined 500m of strike, which has now expanded to more than 1km.

Over a wild couple of weeks from mid March, LRS went from ~4 cents per share to a high of 22.7 cents per share in early April.

In order to capitalise on this opportunity, LRS raised $35M at 16 cents per share in April.

The fresh funds came from institutional investors, anchored by a Canadian cornerstone investor, the Electrification and Decarbonization AIE LP Fund.

With the broader market correction, LRS is currently trading at around 7c - a substantial discount to the level the institutional investors came in at only a few months ago.

LRS’ fresh funds will be deployed on aggressively drilling out a JORC resource at LRS’ Brazilian lithium discovery.

Given the amount of cash raised in April, we aren't expecting LRS to require additional funding for another 12 months, at the bare minimum.

We expect a JORC resource to be defined within that time, which we think will be the next major catalyst to re-rate LRS.

We are hoping the re-rate will see LRS market cap grow to be in line with its lithium peers who already have defined JORC resources.

Given the lithium discovery and $35M capital raise, LRS is a transformed company from the one we wrote about in our first LRS Investment Memo in February.

For that reason we have updated our LRS Investment Memo and are sharing it with you today.

We will also share our assessment of how LRS performed against our first Investment Memo which we will archive on the LRS company page for future reference.

In short, in our new Investment Memo we hope to see another re-rate once LRS defines the size of the resource or secures an offtake partner.

LRS has the playbook to achieve that second re-rate.

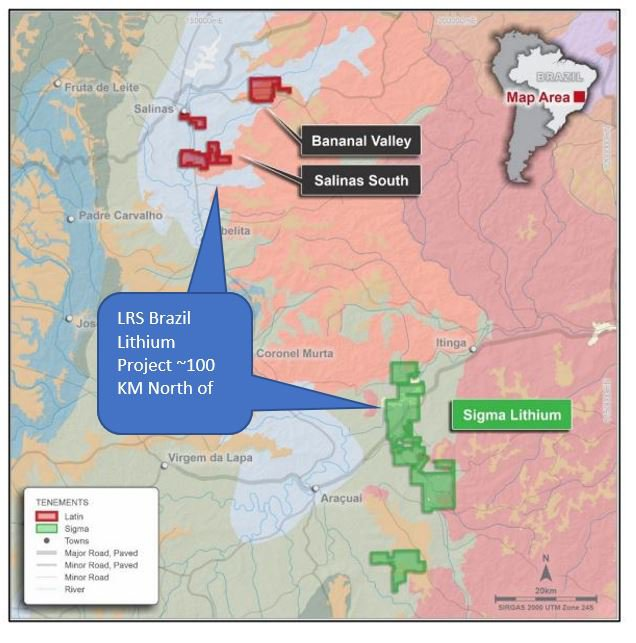

Namely, it can study how its neighbour Sigma Lithium (located ~100kms to the south of LRS) went from explorer to developer in the mine construction phase.

Sigma Lithium has a ~US$1.7B market cap, and is much more advanced than LRS - and is the obvious comparison to the upside potential of LRS.

Sigma has a total mineral resource of 58.9Mt lithium at a grade of ~1.3-1.5% (across Measured, Indicated and Inferred categories).

Sigma has a six year offtake in place with LG Energy Solution for 60,000 tons per year in 2023 and 100,000 tons per year from 2024 to 2027.

Capped at just ~$137M, LRS is a relative minnow compared to Sigma.

LRS has wasted no time with getting to work in Brazil. With drill rigs on the ground now, it has released a number of sets of positive assay results in recent weeks.

LRS plans to eventually have four drill rigs on site. Based on a recent announcement, the third rig should be onsite now and a fourth is due in July.

It's all part of LRS’s master plan to use the $35M raised to aggressively drill 25,000m of drill cores and define the size of its lithium discovery as soon as possible.

We are Invested to hopefully see LRS catch up to its regional neighbour Sigma Lithium as it executes on its strategy.

A lot has happened since our previous Investment Memo on LRS back in February.

LRS was a different beast and at the time we noted our concerns about the funding risk.

That risk was completely mitigated following the $35M capital raise.

LRS scored an “Outperform” on our original memo - you can check out our approach to memos here.

Given the lithium discovery, significant re-rate and cash injection, it's time we re-wrote our Investment Memo for LRS, as it's a much different company to the one in February 2022.

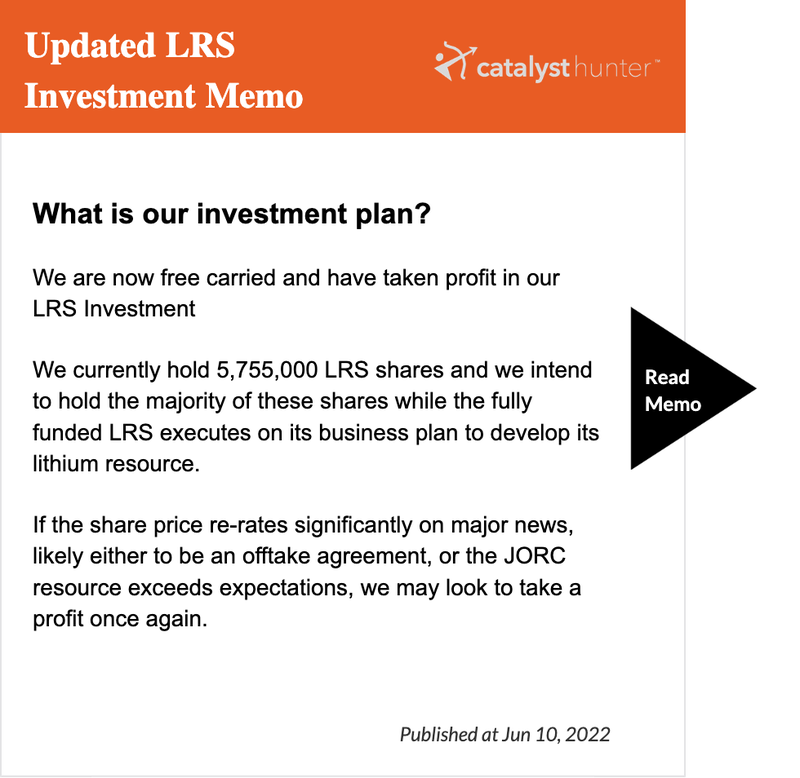

In line with our Investment Plan, we de-risked our position during the recent highs, selling ~40% of our Total Position in LRS, meaning that we have Free Carried each of our three Investments in LRS and have Taken Profit.

We now hold a Free Carried position in LRS and look forward to what it can achieve following the $35M capital raising.

Below is an updated set of reasons we hold LRS post capital raising:

What we’re looking for in the LRS JORC resource

LRS is wasting no time deploying its new financial resources and has already commenced resource definition drilling as well as drilling across regional targets chasing new discoveries.

LRS is in the process of morphing from an exploration company into a lithium development company following the discovery at its Brazilian lithium project.

How to accomplish this has been outlined via the history of other lithium companies.

Sigma Lithium, which lies ~100km to the south of LRS is a good example:

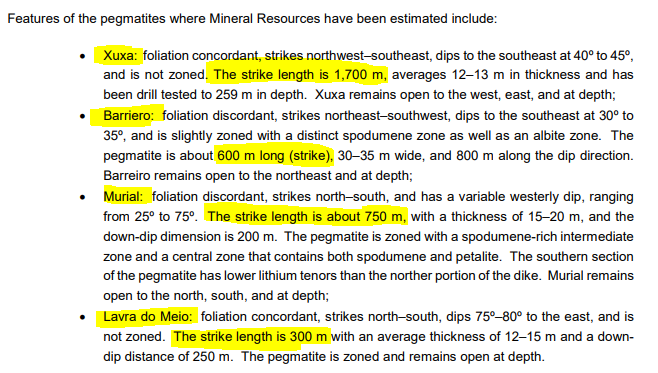

NASDAQ/TSX listed Sigma recently released an updated feasibility study outlining a total mineral resources of 58.9Mt, with a mill feed grade of 1.55% Li2O in Phase 1.

Now, LRS is a long way away at the moment from these kinds of numbers, but it's important to note that Sigma’s deposit was drawn together from multiple deposits (which is why we like LRS’s Monte Alto drilling and the planned drilling at under explored tenements).

The image below is an extract from Sigma’s resource report which shows the four main deposits that make up its project, all of the deposits range from a 300m strike to a ~1,700m strike and come together to produce the resource base Sigma has.

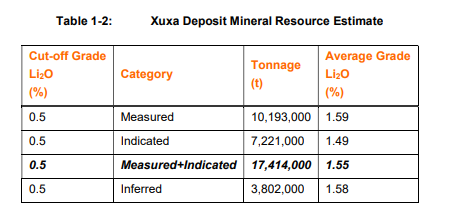

We think that LRS’s discovery is shaping up relatively similarly to Sigma’s Xuxa deposit which has a larger strike length of ~1,700m but thinner intercepts measuring on average ~12-13m, with the deposit drill tested down to depths of ~259m.

LRS on the other hand has hit intercepts measuring up to ~21m with the bulk of the drilling down to depths of ~150-200m.

The Xuxa deposit has a ~20Mt JORC resource estimate which we have used to set up our expectations for the size of LRS’ discovery.

We have set up our expectations for LRS’s maiden JORC resource as follows (we haven't included the potential addition to this from any new discoveries either):

- Bullish case (Exceptional): >15Mt JORC resource with lithium grades >1%.

- Base case (Good: 10-15Mt JORC resource with lithium grades >1%.

- Bearish case (Disappointing): <5mt JORC resource with lithium grades >1%.

We’re also of the opinion that if LRS is to follow Sigma’s playbook, LRS will have to drill additional ground, and make new discoveries.

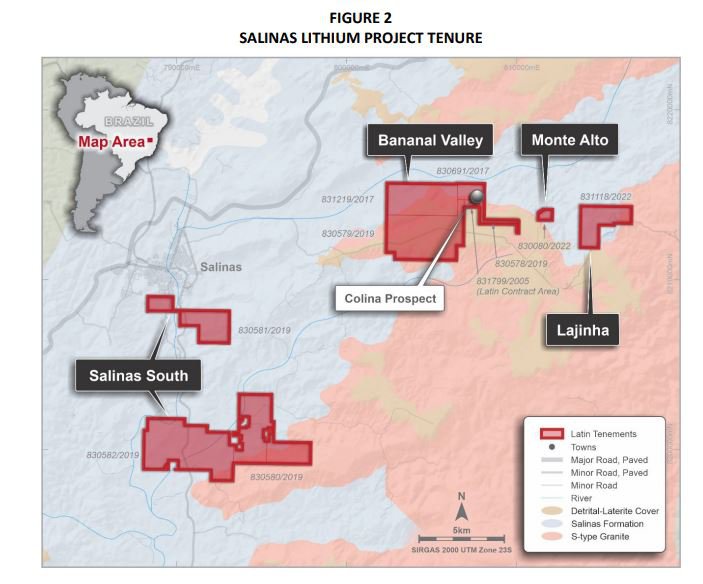

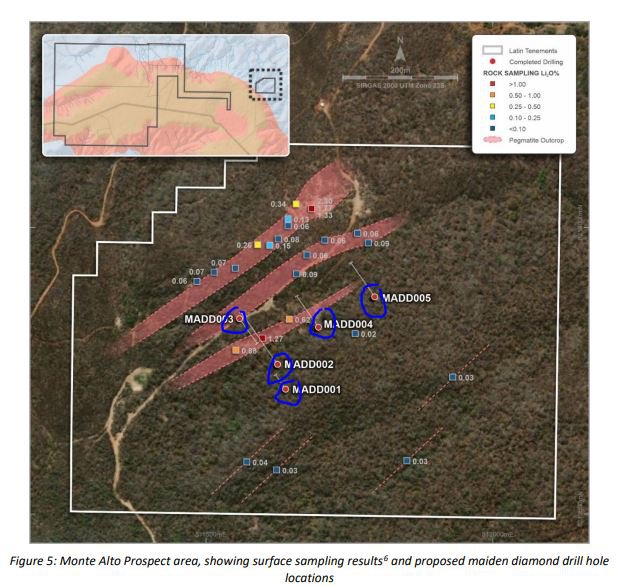

We note that LRS is picking up additional grounds in the area, including the Monte Alto prospect, and has yet to drill the Salinas South prospect or the Lajinha prospect:

With additional ground to drill, we’re looking for LRS to piece together a larger resource from a number of different deposits (like Sigma).

This forms a key part of what LRS has done since the capital raise.

What has LRS done since raising $35M?

LRS has achieved two big things since its capital raise:

- Resource definition drilling has commenced, focusing on the ~1km of strike LRS’s new discovery sits over.

- Put five drill holes into the recently acquired prospect to the east of the initial lithium discovery

1 - Resource definition underway, extension of strike at lithium discovery

LRS confirmed in mid-May that it expects to bring in another drill rig in early June to speed up the 25,000m drilling program (increasing the total number of rigs on site to three).

It would then bring in a larger fourth rig in July to complete the drilling planned to target mineralisation at depths >300m.

That drilling is now underway.

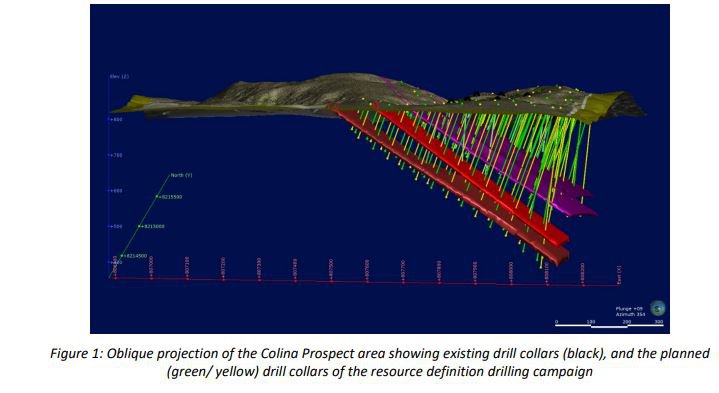

There’s a nice look at both current and future drill holes of this 25,000m program below:

As is evident from the image above, those green and yellow lines show that there are a lot more drill holes to come as LRS attempts a sprint towards a JORC resource.

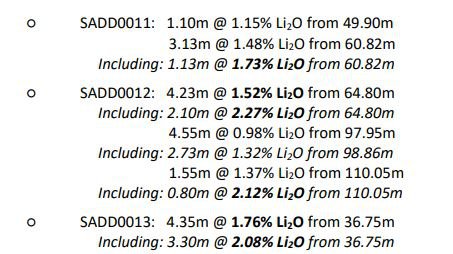

LRS has called their lithium discovery in Brazil the “Colina Prospect” and the latest assays include the following:

Nearly all the intercepts are above our minimum target of 1% lithium and are at relatively shallow depths which is a bonus.

Assays are pending from more drill holes to the south, where spodumene bearing pegmatites were also encountered and visually logged.

Importantly, the deposit remains open to the south and we are yet to see LRS test whether or not it actually extends out that way.

Given the consistent nature of results out of LRS we expect more of the same from these drill holes, which should extend the strike to over 1km - a good sized amount of strike for a lithium discovery (see Sigma Lithium comparison below).

2 - Five drill holes into the recently acquired prospect to the east of the initial lithium discovery

We like the early look of the “Monte Alto'' prospect specifically because it may form part of a constellation of lithium deposits and be a welcome bonus to LRS’s JORC resource further down the track.

Furthering that aim, LRS has drilled five holes into this prospect which can be seen below:

Two of those drill holes, MADD004 and MADD005 on the right to the east, hit pegmatites but not spodumene.

The other three did hit visually logged spodumene.

We look forward to the assays from those three drill holes and the prospect’s potential to contribute to a JORC resource.

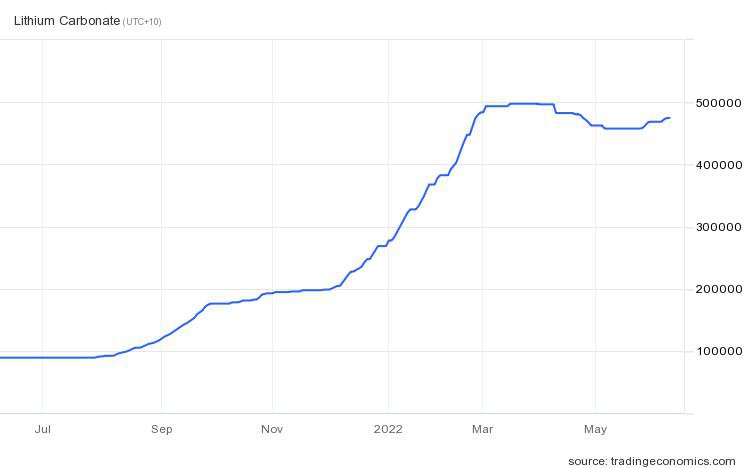

Macro theme: lithium price commentary

The lithium price run has slowed down of late, but we’re still of the view that lithium prices will remain elevated — due to underinvestment and growing demand for battery metals from the rapidly growing EV market.

That run up in price caused lithium to stray into demand destruction territory - a situation where prices are so high, demand is forced to fall off.

As much as $7B in investment is expected to be needed annually through to 2028 to effectively quadruple production in order to meet the anticipated demand of 2.4M tons of lithium a year by 2030. This compares to the 600,000 tons that will likely be produced in 2022.

That said, there is ongoing debate around which direction lithium prices will go this year.

Goldman Sachs say the battery metals bull market is “over for now,” while Credit Suisse also has a bearish take.

Despite these bearish short term perspectives, we think battery metals are a decade long investment thematic so we’ve made long term Investments in the space, such as our Investment in LRS.

The Goldman Sachs note sparked sell-offs on a number of major ASX listed lithium names and the LRS share price may be feeling the effects as well.

Ultimately though, an elevated lithium price means a better margin on LRS’s product from its Brazilian lithium discovery, which we think adds to LRS’s chances of LRS securing an offtake.

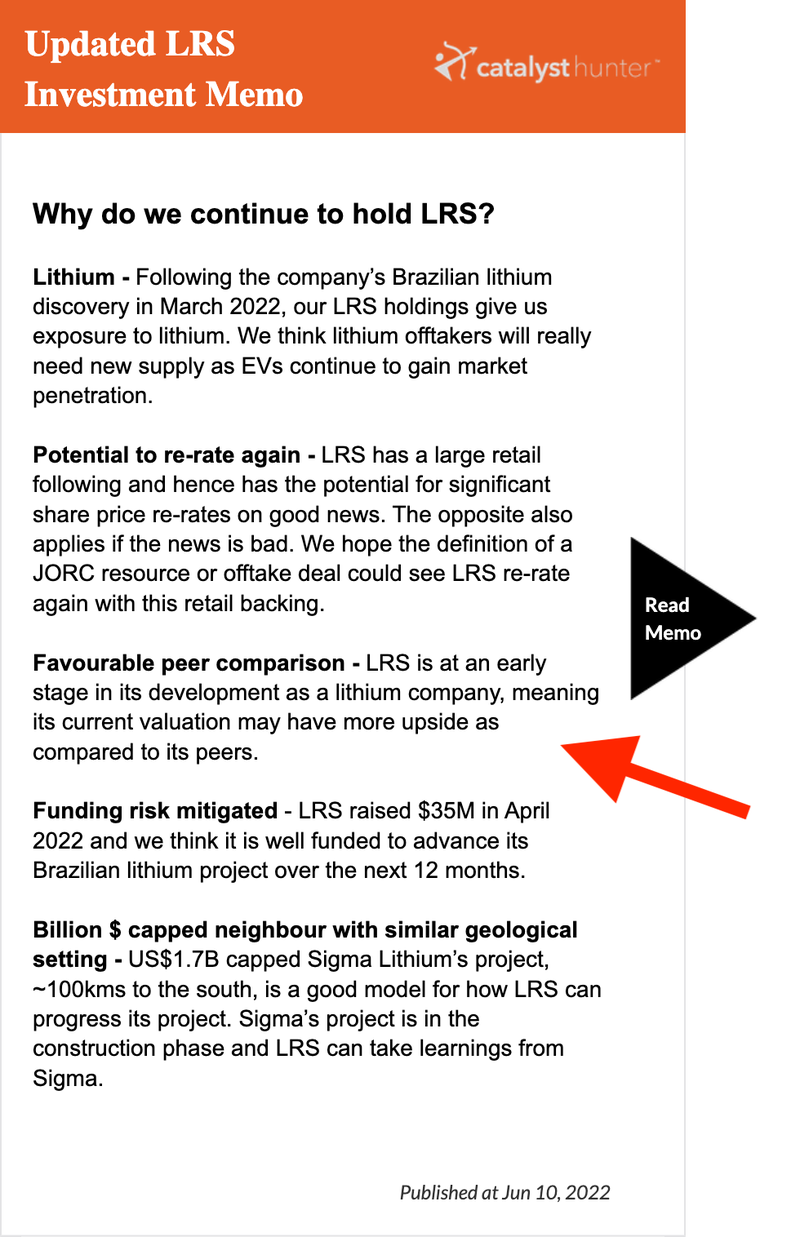

Why do we continue to hold in 2022?

Below are the reasons we continue to hold LRS in 2022:

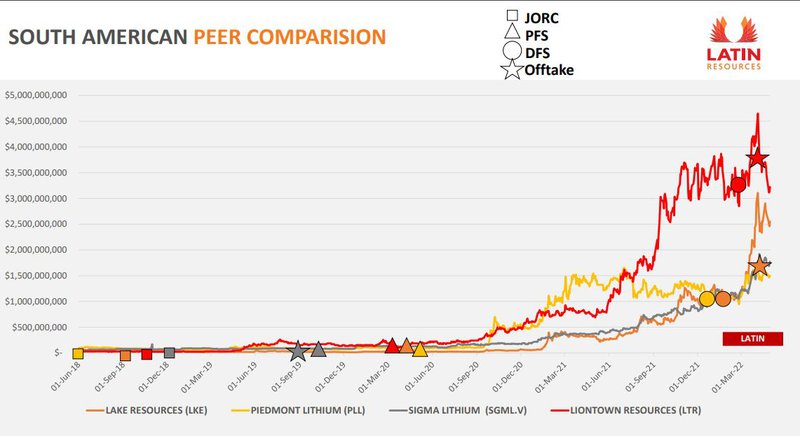

Today, we’ve honed in on reason #3 above “Favourable peer comparison”.

Our Investment thesis with LRS in our updated Investment Memo is based around the upside potential of LRS being at an early stage in the mining life cycle.

We’re particularly drawn to the following slide in a post cap raise presentation:

The chart shows the market caps of its larger peers — big lithium companies like Piedmont Lithium (capped at ~$1.25B), Sigma Lithium (capped at ~US1.7B), Lake Resources (capped at ~1.8B) and Liontown Resources (capped at ~$2.5B).

Of those here are the resources of LRS’s hard rock lithium peers:

Piedmont Lithium: 44.2Mt @1.08% lithium (Carolina Lithium project alone) - $1.25BN market cap

Sigma Lithium: 58.9Mt @ ~1.3-1.5% lithium - US$1.7BN market cap

Liontown Resources: 156Mt @1.4% lithium (Kathleen Valley project alone) - $2.5BN market cap

While these companies have come off their highs since the lithium market cooled or paused for breath, it shows how defining a JORC resource, PFS, DFS and offtake deals play key roles in value creation.

With a promising lithium discovery still being defined, LRS, at a market cap of ~$137M, has yet to achieve any of those milestones.

Which leads us to conclude that a JORC resource and the potential for an offtake loom as major catalysts for a share price re-rate.

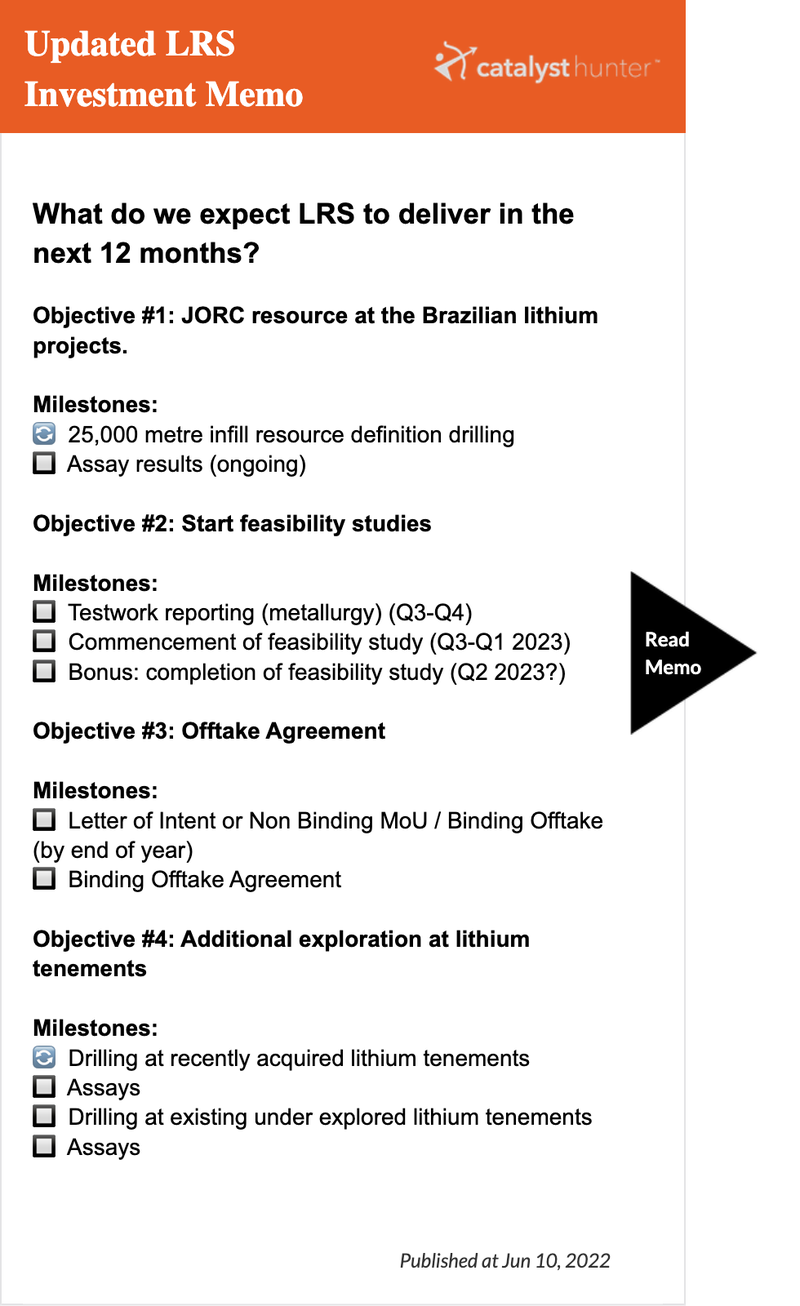

What do we expect the company to deliver in the next 12 months?

We’ve outlined what we expect LRS to get done below (drawn from our updated LRS Investment Memo):

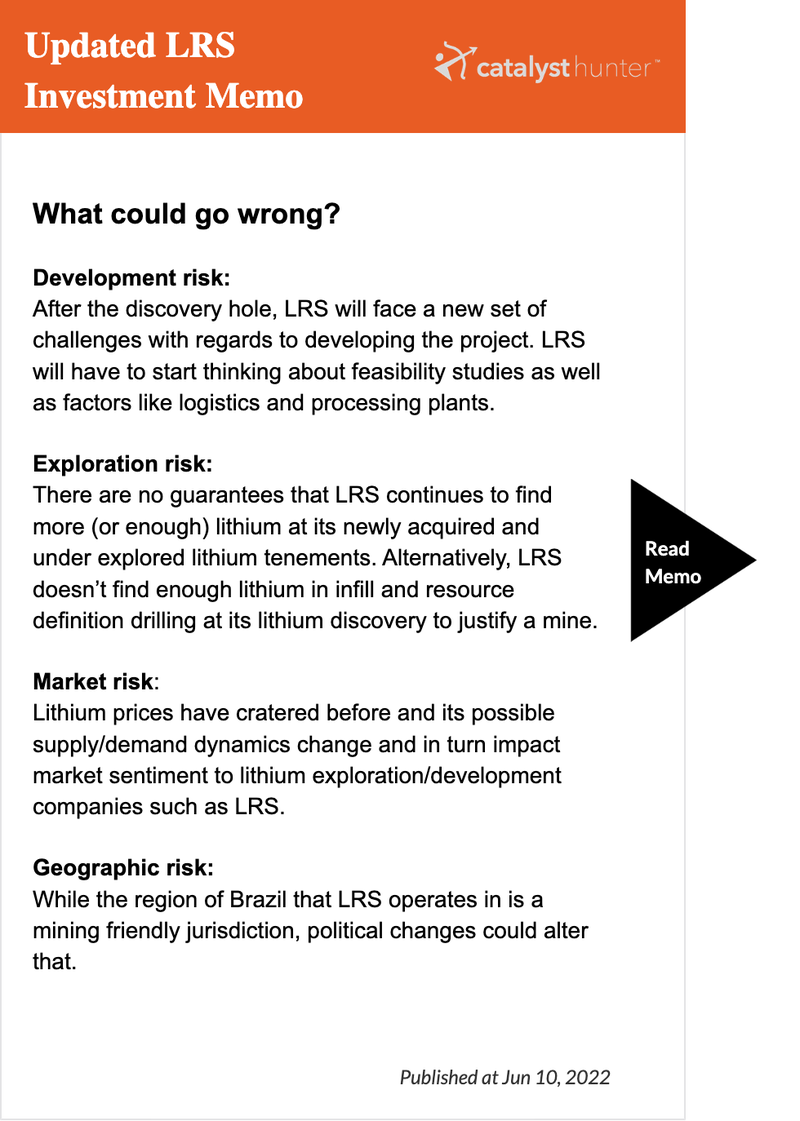

Risks: what could go wrong?

Note in the risks section, we’ve removed our funding risk section and replaced it with a development risk section:

Our Investment plan

Here’s how we intend to manage our Investment in LRS going forward:

Our updated LRS Investment Memo

In our updated LRS Investment Memo you’ll find everything we’ve covered in this note which includes:

- Key objectives for LRS in the next 12 months

- Why we continue to hold LRS

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.