GGE Drilling 15 Miles Away from the Second Largest Helium Discovery in 70 years

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 43,300,000 GGE shares. S3 Consortium Pty Ltd has been engaged by GGE to share our commentary and opinion on the progress of our investment in GGE over time.

Our US helium investment and Catalyst Hunter 2021 Pick of the Year, Grand Gulf Energy (ASX:GGE) is set to drill an exploration well in the coming weeks in a region of Utah that is dubbed the “Saudi Arabia” of helium.

We think they have timed it well.

Helium is a critical gas that is needed to manufacture high-end computer chips and other semiconductors - an industry which is experiencing a global supply crunch.

Russia is aiming to bring on new helium production sources and ultimately supply around one third of the world’s helium by 2029.

Given the punitive sanctions placed on Russia following the invasion of Ukraine, we think the US will now place new emphasis on securing a local helium supply.

Lucky for GGE, their project sits just 15 miles away from the second largest helium discovery in North America in the last 70 years - the Doe Canyon Helium Field in Utah, and also 20 miles from a helium processing facility.

In mid-April, GGE will be drilling into a structural closure that is interpreted to be high to, and 4-5 times bigger than the geologically analogous Doe Canyon Helium field.

Doe Canyon is pumping out 10.7 million cubic feet (mmcf) of helium per month, and has an anticipated total production of 3-5 bcf of helium.

Given GGE is drilling in the “Saudi Arabia of helium”, there is plenty of infrastructure to bring any discovered helium to market.

GGE’s project is located 20 miles from a helium processing facility - the Lisbon gas processing plant. This gas processing facility is comprised of a 60 mmcfd treating plant with a 45 mmcfd cryogenic plant capable of 0.5 mmcfd of 99.9995% helium.

99.9995% is Grade 5.5 “research grade” helium suitable for, among other uses, semiconductor manufacturing.

Around the “Saudi Arabia” of helium there’s a total of US$50BN in semiconductor chip facilities getting built in neighbouring states (more on that below).

What all this means is that given GGE’s project location, we think that any helium GGE can discover in the coming weeks could be commercialised relatively easily (versus drilling in the middle of nowhere).

Today GGE announced that it has secured a drilling contractor and it plans to drill the first pure helium well on the project in mid-April.

So in summary, GGE will soon be drilling:

- 15 miles away from the second largest helium discovery in 70 years ✅

- In a geologically analogous spot ✅

- That looks like a structural enclosure (allowing the gas to be trapped in one place) ✅

- 20 miles from a helium processing facility ✅

- In a region dotted with helium transport pipelines ✅

- With almost US$50BN in big chip factories being built in neighbouring US states ✅

With geopolitical tensions reaching fever pitch and countries rushing to secure their own supply of critical materials like helium, we think the timing couldn’t be better for GGE’s drilling.

We think the world is on the cusp of a major helium bull market - driven by the major powers’ need to secure friendly supply for their chip manufacturing industries.

We’re talking about Russia, China and the US.

Although helium prices are hard to gauge, today GGE mentioned current helium prices are in the range of US$300-500/mcf.

We think prices could continue to move higher in light of geopolitical tensions and supply issues.

GGE’s project contains a gross P50 unrisked prospective helium resource of 10.9 billion cubic feet (bcf).

Drilling will aim to test flow rates and grades - informing the positioning of other wells at the project.

This first well is expected to cost US$1.6M ($2.2M).

As of December 31st 2021, GGE had ~$3M in the bank. So we could reasonably anticipate that at some stage in the coming weeks it would be prudent for GGE to look to raise capital to fund the drilling, especially if we see late to the party speculators pile into the stock ahead of the spud date and anticipation of a positive result.

As long term holders of GGE, we would hope that this capital raise is completed at as high a price as possible.

As GGE moves from a planning phase to an operational drilling phase, it's pleasing to see that GGE recently appointed a highly experienced Managing Director - Dane Lance.

Mr Lance is a seasoned oil and gas / reservoir engineer, with previous experience at companies like Woodside, Ophir and Oil Search.

We think he will bring the necessary operational and commercial acumen to the job - in particular the ability to not only deliver operational goals but also seal offtake deals for GGE.

Here’s how we’ll approach the rest of today’s note:

- Details of today’s drilling announcement

- Helium market dynamics

- New MD Dane Lance: Can GGE get an offtake?

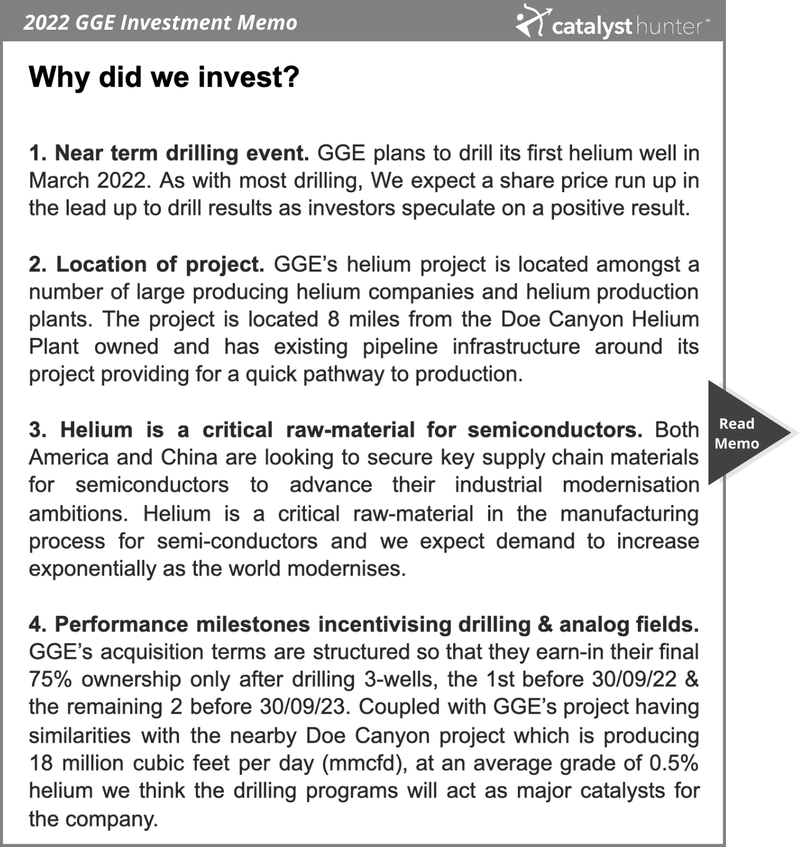

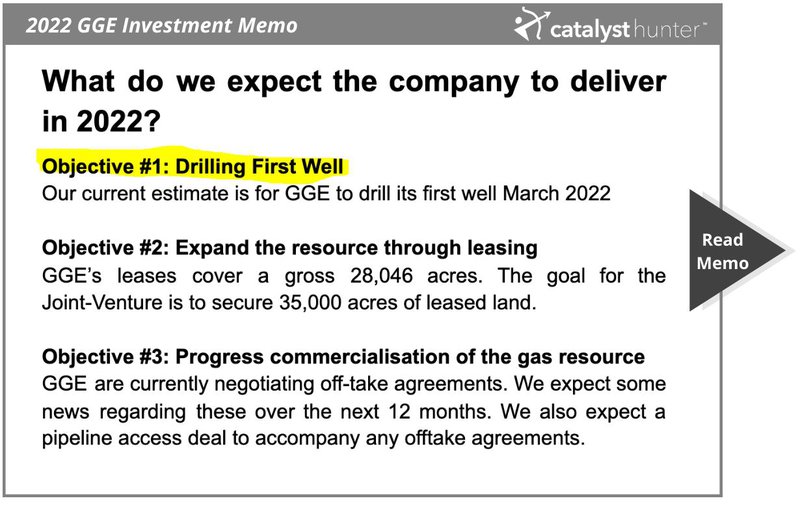

You can see a summary of why we hold GGE in 2022 below, drawn from our GGE Investment memo:

Click the image above for a quick high level summary of our GGE investment thesis, key objectives, risks and our investment plan.

Today’s announcement directly advances our primary objective for GGE, which is to drill their first well.

While it appears that the timing for drilling is a month later than we anticipated, we still think today’s announcement is a major positive for the company. We’ve occasionally seen small exploration companies’ timelines get pushed back years, or many months, so we’re glad GGE is delivering here only a few weeks behind schedule.

The drilling contractor is called Aztec Well Services which previously worked with new drilling superintendent Doug Frederick at the Doe Canyon helium field.

Remember as we highlighted above - Doe Canyon is the second largest North American helium discovery in over 70 years.

As mentioned before, their project sits just 15 miles away from Doe Canyon.

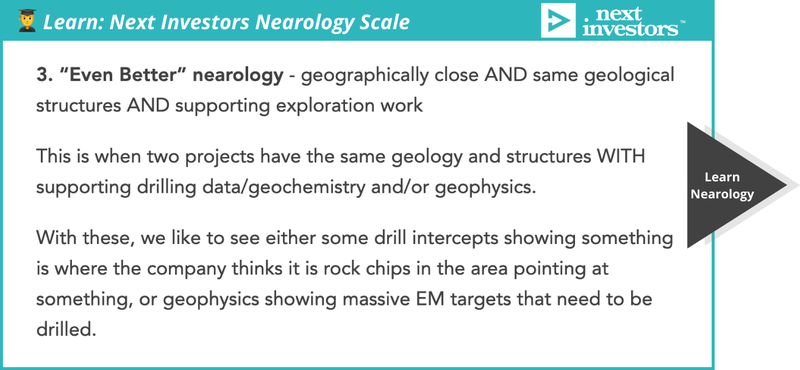

Just because a sizable discovery is close, doesn't mean a company is going to discover anything next door. In fact a number of factors need to be in place for “nearology” to be meaningful.

GGE will be drilling into a structural closure that is interpreted to be high to, and 4-5 times bigger than the geologically analogous Doe Canyon Helium field

By our reckoning, GGE scores a 3 out of 4 on our nearology scale - but drilling could upgrade it to a 4.

Below is what a nearology score of 3 means in our opinion, just click the image below to learn more about how we rank nearology:

This very large nearby helium field is currently producing 10.7 million cubic feet (mmcf) of helium per month and has an anticipated recovery of 3 - 5 bcf.

While GGE’s maiden well will be located in a project area “which contains a gross P50 unrisked prospective helium Resource of 10.9 billion cubic feet (bcf).”

We’ll be watching the flow rates closely because that could determine the success of the project.

If not enough gas is coming out quick enough, this could cause GGE some headaches.

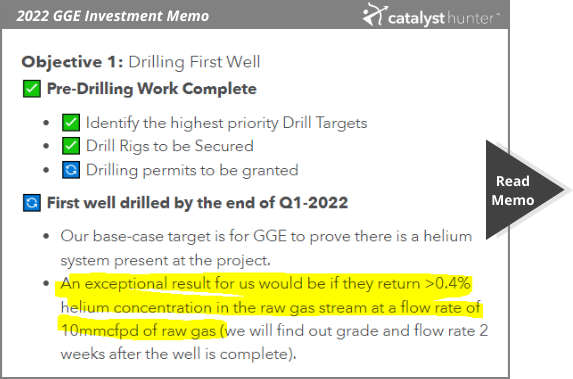

This is what we are hoping for in terms of flow rates following drilling:

So greater than .4% helium concentration in the raw gas at a flow rate of 10mmcfpd of raw gas would be a win as .3% is generally a cut off in terms of commercialisation.

Importantly, today’s announcement has some figures in it about the helium market:

- December 2021 helium import prices trending over US$300 per thousand feet (mcf)

- Some reports of US$500/mcf prices.

With such a major catalyst for the GGE share price so close, whatever happens, we think the next couple months could be a company making period for GGE.

If the drilling is successful and the flow rates meet expectations in the two weeks afterwards, then the next step would be to get a pipeline going from the well.

We think that would be a relatively straightforward task as there are pipelines all over the area in which GGE operates (dotted red lines):

After today’s announcement, we think it is clear the goal is to get it to the Lisbon Helium Plant (to the North) where it can be processed.

The Lisbon Helium Plant consists of a 60 mmcfd treating plant with a 45 mmcfd cryogenic plant - which we think means that subject to negotiations, it could have the required capacity for GGE’s potential product.

And all of GGE’s work here takes place in the context of an increasingly hot helium market, which is becoming coloured by powerful macroeconomic and geopolitical forces.

Helium market dynamics

The helium market is all about the space where tech and geopolitics meet. In other words, with the crisis in Ukraine reaching a crescendo, local US supply will become important.

Among a range of applications, we are most interested in helium's use in semiconductor manufacturing - a feature which makes the inert gas particularly important to countries looking to secure supply of critical raw materials.

These are the materials that make domestic supply chains tick - and without them, countries like the US could be forced to secure supply from countries that they have strained or downright awful relationships with.

Russia for example, is aiming to become a major player in the helium market, with the immense Amur facility in Siberia coming online in September of last year.

And we noted in our last GGE communication (27 January 2022) that the Amur facility had suffered from an explosion and would be offline for around 6 months, further constraining helium supply.

This is how much helium Russia could be supplying by this year through to 2029 below:

That’s around a third of total helium supply by 2029 - which means that in the current environment, the US needs to get moving on securing this critical material.

The ongoing sanctions against Russia are likely to mean that the US will do virtually no business with Russia - especially after the recent ban on oil imports from the country.

That purple bar is Qatar - which is friendly to the US, but like Russia, Qatar is a long way away.

Helium can generally only be stored in containers for a maximum period of 45 days, which could impact Qatar’s ability to be a reliable supplier - especially if supply chains get squeezed again.

This all means that the US will have to move quickly if it’s going to get the helium it needs for its big semiconductor manufacturing industry push.

Although helium prices are hard to get a good gauge on, as you can see, helium prices are starting to move a bit going into last year:

Now, given what we know about technology - we believe those prices should improve in the coming years as semiconductor manufacturing makes up a larger chunk of the demand equation.

That outlook is corroborated by one consultant who says the following:

“Moore’s Law has driven increase[d] functionality and new applications. However, it has also driven increased complexity in making a chip...Helium demand in the semiconductor segment has strong correlation with key vacuum processes, and helium intensity is increasing with the most advanced semiconductor devices.”

Moore’s Law, named after one of the founders of Intel, is the idea that the processing power of chips doubles at a predictable rate - roughly every two years.

And although that rate is starting to slow - the helium intensity is increasing because chips are getting harder to make.

Throw in the fact that EVs are loaded with chips, the advent of Internet of Things (IoT) and Edge Computing advances (think EV sensors) are ramping up - it all points to the following...

Faster chips, more of them, and a greater need for helium.

The next natural step is for GGE to seal an offtake in the US.

Can GGE’s New MD Deliver an Offtake Agreement?

Today’s announcement puts a firm timeline on spudding, so in that way we see it as also advancing Key Objective #3.

As in, as we get closer to drilling, we would expect that that pushes the potential offtake discussions further along.

GGE flagged in a presentation from September of last year that offtake discussions were underway.

We expect those negotiations to ramp up as drilling approaches - especially in light of the near US$50B in chip facility investment going into neighbouring states from companies like Taiwan Semiconductor Manufacturing Company, Intel and Samsung.

Again, we think GGE is ideally placed to supply helium to these kinds of companies and operations. Remember, GGE is 20 miles away from a helium processing plant, and there are helium transport pipelines littered all over the region.

Aiding GGE’s cause here, is the new Managing Director Dane Lance. Mr Lance has experience across roles at Woodside, Oil Search and others.

The appointment announcement notes about his experience (emphasis added):

‘[Mr Lance] has been involved in exploration, appraisal, development, and M&A on four continents, providing economic and technical evaluations for investment decisions, commercial negotiations, gas sales agreement terms, and corporate and asset acquisition & divestment.’

In short, we think Mr Lance is a person who knows how to cut a deal with potential offtake partners.

We’ll be looking forward to what he can accomplish in this area.

And what are the risks?

We outline the key risks before we enter an investment, here is a summary of what we are watching out for from our investment memo:

Again, click the image below for a quick high level summary of our GGE investment thesis, key objectives, risks and our investment plan.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.