FYI’s Net Present Value Almost Doubles - Now Over US$1 Billion

Published 01-APR-2021 12:15 P.M.

|

8 minute read

FYI Resources (ASX: FYI) is a $100M capped stock positioning itself to be a world class producer of High Purity Alumina (HPA).

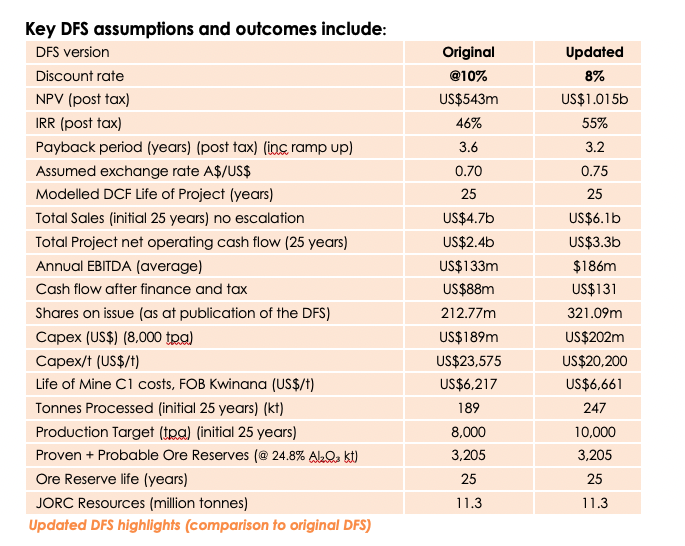

This week, FYI announced an update to its Definitive Feasibility Study (DFS) on its HPA Project.

FYI’s project’s Net Present Value (NPV) has almost doubled - from $543M to now over US$1BN.

This is a step change in the economics of FYI’s project, and continues to demonstrate that FYI’s market cap appears undervalued.

Generally, we think a company should be valued at around one third of its NPV in a DFS. That would value FYI at circa $333M. FYI is currently capped at $175M, so we see a lot of upside here.

Over the last 24 hours, we have been digesting the DFS update and have been impressed with what we’ve read, particularly by the 87% increase in Net Present Value (NPV) which now exceeds US$1 billion.

FYI’s 100% owned Cadoux Kaolin Project is located 220 kilometres north-east of Perth.

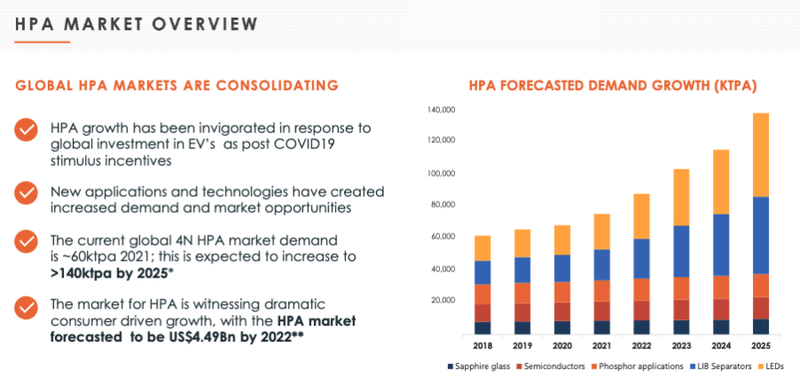

The HPA market is currently witnessing dramatic growth, forecast to grow to a $4.5BN market by 2022 on the back of increasing demand for electric vehicles and myriad products that require lithium-ion batteries.

FYI possesses a high-quality aluminous clay (kaolin) resource with a 25 year plus mine life, a state-of-the-art processing technology to convert the clay into HPA (HPA is defined as alumina having a grade equal or greater than 99.99% Al2O3), and robust economics to bring its project into reality.

Key to the company’s success is a pilot plant that will be essential in determining project success and economics as FYI’s HPA strategy moves towards commercialisation.

Today, its project economics received a huge boost via an updated DFS.

FYI has effectively doubled its NPV from US$543M to US$1.015BN, increased its Internal Rate of Return (IRR) from 46% to 55% and decreased its payback from 3.6 to 3.2 years.

The company is now estimating total sales of US$6.1BN up from $4.7BN.

The updated DFS reflects the technical and commercial progress of FYI’s HPA project development, its de-risking and its positive value re-rating.

In late January, we announced that we had taken a position in FYI Resources as our first foray into the world of HPA.

We entered at 36 cents and the company is now trading at 55.5 cents.

Here’s why we are invested:

- Following our own due diligence and calls with management, we backed FYI against its peers, given the advanced nature of its HPA flagship project.

- The world’s biggest aluminium company Alcoa has signed an MoU with FYI and is progressing towards a JV as a project partner: the company has an $80M financing package secured.

- The DFS is a precursor to obtaining project financing - a critical step towards commercialisation. The higher the NPV, the more attractive a project is to attract financing.

- The updated DFS also incorporates supplying premium 5N product (representing 15% of the slated total 10,000 tpa production).

- Previous production trials have resulted in outstanding quality HPA, which is currently being assessed by potential offtake parties.

- If FYI can confirm an offtake agreement, that would be another catalyst for investors to look out for.

- FYI has a number of Tier 1 industry participants very interested in what the company is developing.

- FYI has established a framework and is transitioning to best practice ESG for its long term HPA.

FYI has developed a robust, significantly de-risked HPA strategy and it is operating with positive long-term market fundamentals working in its favour.

With all that in mind, we believe FYI provides a ground floor entry for investors looking for imminent upside.

The Catalyst - Updated DFS Shows NPV Increases To Over US$1BN

FYI Resources Ltd (ASX: FYI) has released its DFS and with that an impressive update to its NPV.

The NPV is now over $1BN, doubling in size.

The release of today’s highly positive DFS reflects the major technical improvements, substantial project de-risking and other key commercial developments accomplished since the initial DFS announcement in 11 March 2020.

Here’s a look at the excellent progression the company has made in just a few short months.

FYI updated the base NPV by applying more market appropriate inputs (exchange rate) and discount rate (8%) resulting in the increase of the project NPV by 87% to US$1,014,630,133.

Here are the highlights:

- Sensitivity analysis demonstrates robust project economics

- NPV study inputs are supported by extensive pilot plant trials and validated data

- Study conducted by leading hydrometallurgical experts

- The DFS study and financial analysis was completed to an overall accuracy of -10% to +15%

- Updated key project NPV metrics include:

Post-tax NPV8% of US$US$1.015Bn

Project post-tax IRR 55%

Annual production:

- 8,500 tpa 4N (99.99% Al2O3)

- 1,500 tpa 5N (99.999% Al2O3)

Average selling price US$26,400/t (basket 4N and 5N pricing)

Annual project revenue US$261m

Annual project EBITDA US$186m

Project capex US$202m

Project opex US$6,661

Project payback 3.2 years

AUD:USD exchange rate of 0.75 (from 0.70)

This DFS upgrade is the culmination of further process design improvements, detailed test-work via numerous pilot plant trials and other supporting project de-risking activities.

We agree with the company that this DFS “represents a persuasive economic case and demonstrates the merit of the project in being developed as potentially one of the sectors highest quality, lowest capital and operating cost projects”.

The latest DFS is a strong reflection, a better reflection, of the HPA project’s potential.

The HPA market continues to grow

According to market analyst Cru Group, the HPA market is entering a phase of mild tightness and supplies of reputable 4N HPA are becoming limited.

In terms of sales volumes, assuming unconstrained supply of 4N+ HPA, CRU predicts demand is forecast to grow from ~30 kt in 2021 to over 104 kt in 2028, a CAGR of 18.7%.

Given the demand for HPA, we think FYI is a point of difference in battery metals stocks.

Here’s a look at what is happening in the market and why:

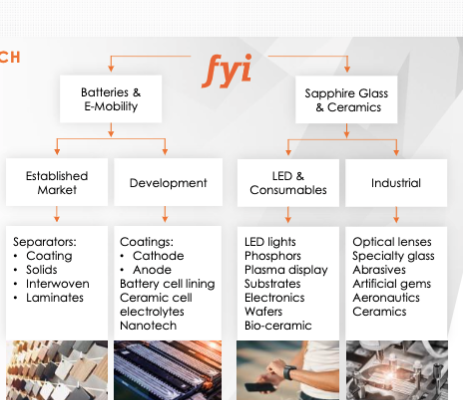

As you can see from the above graph, demand is growing in a number of industries.

However, it is the lithium-ion battery segment that FYI sees as the largest potential growth sector for HPA demand over the coming decade.

We are already seeing a surge in demand for and manufacture of electric vehicles.

We saw in VW’s Power Day and Tesla’s Battery Day just two examples of how car manufacturers are moving toward a carbon neutral future and upping the ante on electric vehicle production:

However, mobile phones and laptops are also seeing increased uptake.

And, the broad application for LED units, has seen the market turn away from inferior and less efficient LED alternatives. As such, modelled demand for 4N and 5N HPA is likely to grow from 20ktpa in 2020 to 85kt in 2028, with a CAGR of 19.8%.

Effectively, customers are now willing to pay a higher price for quality HPA product and FYI is in the mix to capitalise on each of these segments.

Alcoa MoU also plays well for FYI

The DFS and supporting pilot plant testwork demonstrates production of high quality, high purity 4N and 5N HPA suitable to the LED and Lithium-ion battery markets.

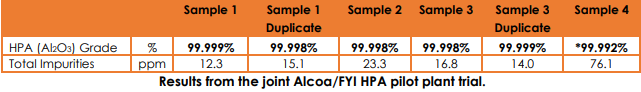

Just last month, FYI released highly promising and commercially crucial analytical results from the recently completed HPA pilot plant trial conducted in collaboration with Alcoa.

FYI and Alcoa entered into a Memorandum of Understanding (MOU) on 8 September 2020 for the potential joint development of FYI’s innovative, fully integrated, high quality HPA product.

The fact that some samples achieved results of 99.999% HPA is an outstanding outcome that surpassed both parties’ operational expectations, providing further validation of FYI’s innovative HPA flowsheet design.

In industry terms, this confirms that FYI has drawn significantly closer to being able to offer its customers a 5N product that fetches approximately double the price (circa US$50,000 per tonne) of the 4N product that had previously been applied as a base case in the definitive feasibility study (DFS).

The sale of a 5N product would not only generate substantially higher income, but it would also open up a much wider range of markets where that quality of HPA is essential.

The trial product will be particularly directed towards the LED lighting and lithium-ion battery (LiB) markets.

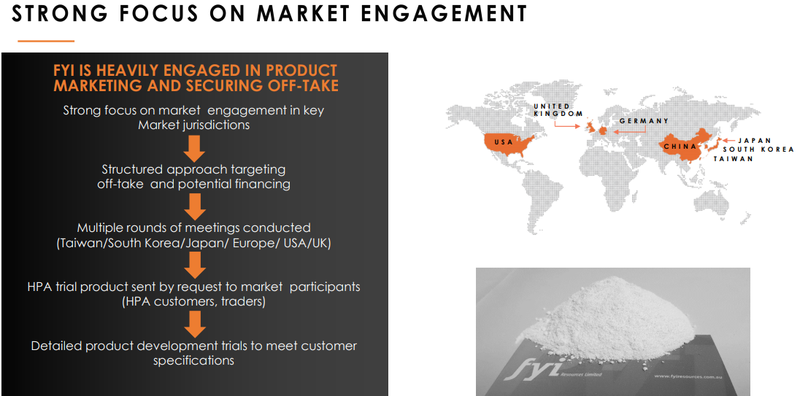

FYI is already engaged in product qualifications with a number of targeted potential customers including those in South-East Asia, Europe and the US.

And FYI is in discussion with potential offtake clients beyond Alcoa. We expect to see several catalysts on this front in the coming months.

More catalysts to come

FYI appears to have what it takes to attract significant investor attention in 2021. It has several share price catalysts on the horizon including:

- Entering into a Joint Venture Agreement with Alcoa

- Additional process flowsheet development and demonstration

- Completion of HPA project detailed engineering, FEED and FID

- Continued product market seeding and qualification

- Signing of customer MOU’s and strengthening marketing relationships

- Advancing financing arrangements

- Investigation on additional internal revenue streams

- Investigation into broader battery HPA utilisation and markets

- New demand growth sectors in HPA appearing through development channel

We see a lot of upside in FYI as we move further into 2021. The updated DFS is a sign of things to come for FYI and we look forward to keeping you updated as the company looks to continue its current momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.