Castillo Emerges with Highest Grade Recent Copper Drill Results in Australia

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Catalyst Hunter presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high-risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Base metal explorer Castillo Copper Limited's (ASX:CCZ) hard work at the Cangai Copper mine looks to be paying off with the company producing excellent assay results from the first five drill-holes showing up to 10.25% copper, 6.04% zinc and 46.7 g/t silver.

Earlier in the year, its Phase 1 drilling results at Cangai illustrated the similarities between CCZ and mining giant Sandfire Resources (ASX:SFR), with both projects carrying supergene ore and high-grade copper.

We’ll look a little further into supergene shortly, but sticking with Sandfire for the moment, there are more similarities to the $1.1 billion capped group than you might think.

Have a look at these recent copper results from CCZ’s peers and you get a sense of how strong the company’s position actually is:

- TLM: 5.6m @ 17.6% Cu & 3.5g/t Au from 179m. Monty: June 2018

- SFR: 11m @ 3.5% Cu from 73m. Morcks Well: June 2018

- DRM: 1.6m @ 144g/t Au & 17.8% Cu from 77m. Deflector: Aug 2018

- AML: 42m @ 2.6% Cu from 332m. Walford Creek: Aug 2018

- PEX: 31m @ 3.2% Cu & 11g/t Ag from 299m. Wirlong: Sep 2017

- TLM: 11m @ 4.8% Cu from 127m. Lachlan: Jul 2018.

When compared to Sandfire alone, CCZ is definitely up there with the best of them, not just the rest of them.

CCZ’s recent results confirm extensive massive sulphide mineralisation across the majority of drill-holes completed and the company believes this is a clear point of difference from many of its ASX listed peers.

It should be noted, however, that CCZ remains a speculative company and investors should seek professional financial advice if considering this stock for their portfolio.

As a side note, higher copper prices, low costs and strong production fired a 59% jump in Sandfire’s net profit to $123 million for fiscal 2018.

You can get a further sense of CCZ’s history and where it is playing in the following Next Small Cap articles:

- $31M Capped CCZ Confirms Same Geology as $148M Capped Neighbour COB

- CCZ’s Phase 1 Assay Results Similar to Sandfire’s Mineralisation

Further assay results are due back shortly, along with the deployment of a diamond drill rig and down-hole electromagnetic (DHEM) results.

There’s a lot to like with what is going on at Cangai, so let’s get straight into the catalyst and deep dive into the excellent assay results that are continuing to change CCZ’s game.

The catalyst: ‘extraordinary’ assay results

Castillo Copper Limited (ASX:CCZ) has described its assay results — released just minutes ago — as ‘extraordinary’.

It is a big call, however results released for drill-holes CC0021-25R at Cangai are highly encouraging.

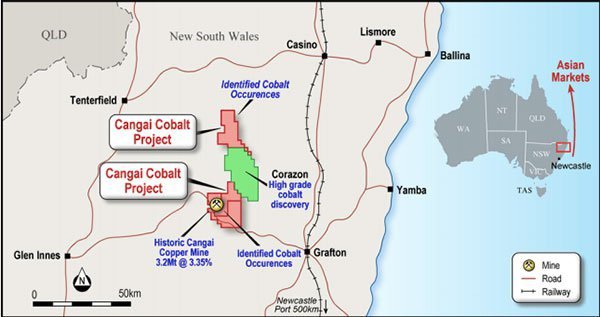

To give you some background, Cangai is located on an ultramafic system that is well known for high-grade copper and cobalt and has an exceptional high-grade JORC 2012 Inferred Resource derived from 3D modelling of legacy data at 3.2mt at 3.35% cobalt, representing circa 108,000 million tonnes of contained copper.

Remember, CCZ’s project also carries supergene ore and high-grade copper. For those unfamiliar with supergene, it refers to ore that can be shipped directly to key export markets at relatively low cost. And it could give CCZ a massive competitive advantage.

Cangai actually hosts very rare supergene ore, which suggests the presence of an enriched copper Resource. The supergene zone is the richest part of the ore deposit and is close to surface.

This is enormously important because copper is a key ingredient in renewables technology. With the EV-powered future moving at a lightning-fast pace and the global EV battery market set to grow at a compound annual growth rate (CAGR) of 42% to 2021, the fact CCZ can ship to key export markets really could set it apart from other companies in the copper mix.

Of course, how much of a stake in these markets CCZ can take remains to be seen, so investors should seek professional financial advice if considering this stock for their portfolio.

Here’s a look at where the Cangai Project is situated:

CCZ has been exploring here for some time now and it looks like they will be there for some time to come given the results of today’s assays, which as stated above, not only confirm extensive massive sulphide mineralisation across the majority of drill-holes completed, but also show significant zinc-silver credits, which support the primary copper focus.

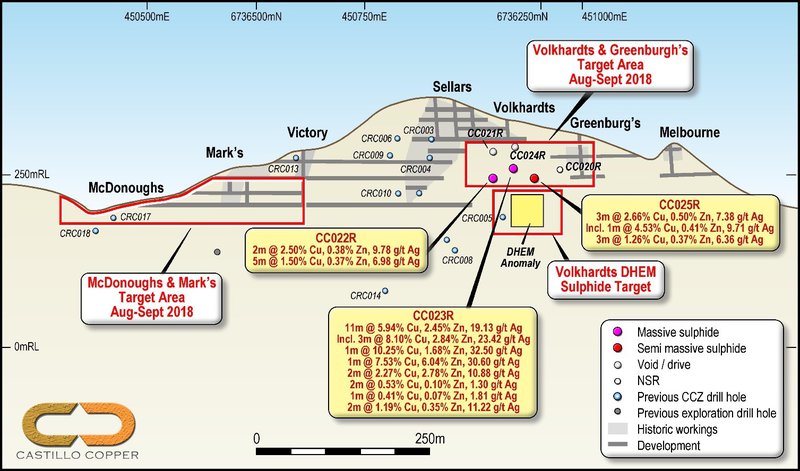

Here’s a look at the best intercepts:

CC0023R: 11m @ 5.94% copper (Cu); 2.45% zinc (Zn) and 19.13g/t silver (Ag) from 40m including:

- 3m @ 8.1% Cu; 2.84% Zn & 23.42g/t Ag from 41m

- 1m @ 10.25% Cu; 1.68% Zn & 32.50g/t Ag from 48m

- 1m @ 7.53% Cu; 6.04% Zn & 30.60g/t Ag from 50m

- 2m @ 2.27% Cu; 2.78% Zn & 10.88g/t Ag from 56m

- CC0025R: 3m @ 2.66% Cu; 0.50% Zn & 7.38g/t Ag from 90m, including:

- 1m @ 4.53% Cu; 0.41% Zn & 9.71g/t Ag from 90m

- CC0022R: 2m @ 2.50% Cu; 0.38% Zn & 9.78g/t Ag from 92m

- 5m @ 1.5% Cu; 0.37% Zn & 6.9g/t Ag from 85m

Importantly Cangai’s style of mineralisation is conducive to DHEM surveys. Numerous drill-holes will be tested to find incremental conductors/mineralisation and with 30 holes to be drilled, the information garnered will be used to facilitate the campaign’s progress.

Here’s what CCZ Chairman Peter Meagher had to say about the results:

“Assay results up to 10.25% copper, 6.04% zinc and 32.5g/t silver from the first five drill-holes is extraordinary. The event clearly represents a demarcation point that materially distinguishes our Cangai Copper Mine project from numerous peers. Moving forward, the focus now is to leverage these outstanding results to extend the known mineralisation through commencing follow up DHEM surveys, which can optimise the remainder of the current drilling campaign. In addition, the Board is looking forward to assay results from soil and rock-chip samples east of the line of lode, as they are likely further extend the mineralised footprint.”

A quick look at copper

Copper prices are down currently, however all indications are that it will come back strongly, so the timing for CCZ looks pretty good.

The price is being hindered by US-China trade war fears, however according to Commonwealth Bank commodity analyst Vivek Dhar ongoing industrial disputes surrounding BHP’s Chilean copper mine could see the price spike.

Supply side factors could also have a positive influence.

The following Business Insider article gives a more comprehensive overview of why copper should recover.

It should be noted that commodity prices and projections do fluctuate and any investment decision should not be based on these alone. As always, take a cautious approach to any investment decision with regards to stocks exploring for any commodities.

The next stage

The results will now act as a further catalyst for CCZ to deploy additional DHEMs.

The significant DHEM anomaly found during the first campaign wasn’t intersected and Drill-hole CC0023R, which intersected the 11m of highly mineralised massive sulphides, stopped short of the DHEM anomaly.

You can see the massive sulphide from drill-hole CC0023R in the image below:

CCZ is now aiming to infill the gaps to give it a better understanding of the orebody.

This will require CCZ to conduct numerous additional DHEMs to commence immediately – a catalyst in itself. The DHEM surveys will then be utilised to reshape the currently drilling campaign to enhance the prospects of extending areas of known mineralisation.

The following diagram summarises the key mineralised intercepts for drill-holes CC0021-25R.

Plenty of catalysts to come

Anecdotal evidence has shown that the mineralisation could extend east of the line of lode.

Based on this assumption, CCZ’s geology team has been intensely mapping the area and collecting multiple rock-chip and soil samples.

Furthermore geochemical assay results are due shortly, which are expected to show compelling evidence the mineralised footprint can be further scaled.

If that is the case and CCZ head east, we could see further ‘extraodinary’ results from its drilling program.

In the next few weeks and months, the newsflow will come thick and fast from CCZ as it updates the market on the next phase of the drilling program, progresses its DHEM surveys to gain greater understanding of the underlying mineralisation, releases assay results for the section east of the line of lode and commences diamond drilling.

We’ll certainly be keeping a look out as results come in.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.