ARN delivers rubidium assay results, good enough to drill again

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 845,000 ARN shares and 220,000 Options at the time of publication. S3 Consortium Pty Ltd has been engaged by ARN to share our commentary and opinion on the progress of our investment in ARN over time.

Last week one of our junior exploration Investments, Aldoro Resources (ASX:ARN), announced assay results from its Niobe Rubidium-Lithium Project in WA.

In 2021, ARN estimated an exploration target of 33,000-155,000 tonnes of rubidium at grades of 0.07%-0.15% for this project.

ARN’s exploration target is large enough to put it in the same order of magnitude as some of the largest rubidium deposits in the world.

The obvious caveat though is that the figures previously released by ARN are just an exploration target, which is a high level estimate of what the company thinks could be in the ground.

We like having exposure to rubidium in our portfolio because it is used in high tech applications, including biomedical research, electronics and quantum computing.

On top of this, rubidium is being used in the research and development of sodium-ion batteries, which are not yet being used commercially.

Most of the use cases for rubidium are still at the research and development stage, which is the primary reason for the rubidium market being in its infancy.

As a result, very few companies are chasing rubidium discoveries, which is the primary reason for rubidium prices trading higher than gold.

In March, ARN completed a 65-hole drilling program to try and upgrade its exploration target into a maiden JORC resource.

Last week, ARN announced the assays for this drilling program - returning peak grades of 0.76% rubidium and 1.18% lithium in smaller intercepts ranging from 1m to 4m.

These results align with ARN’s exploration target and are good enough to warrant the company committing to a further 3,000m drilling program over the project area.

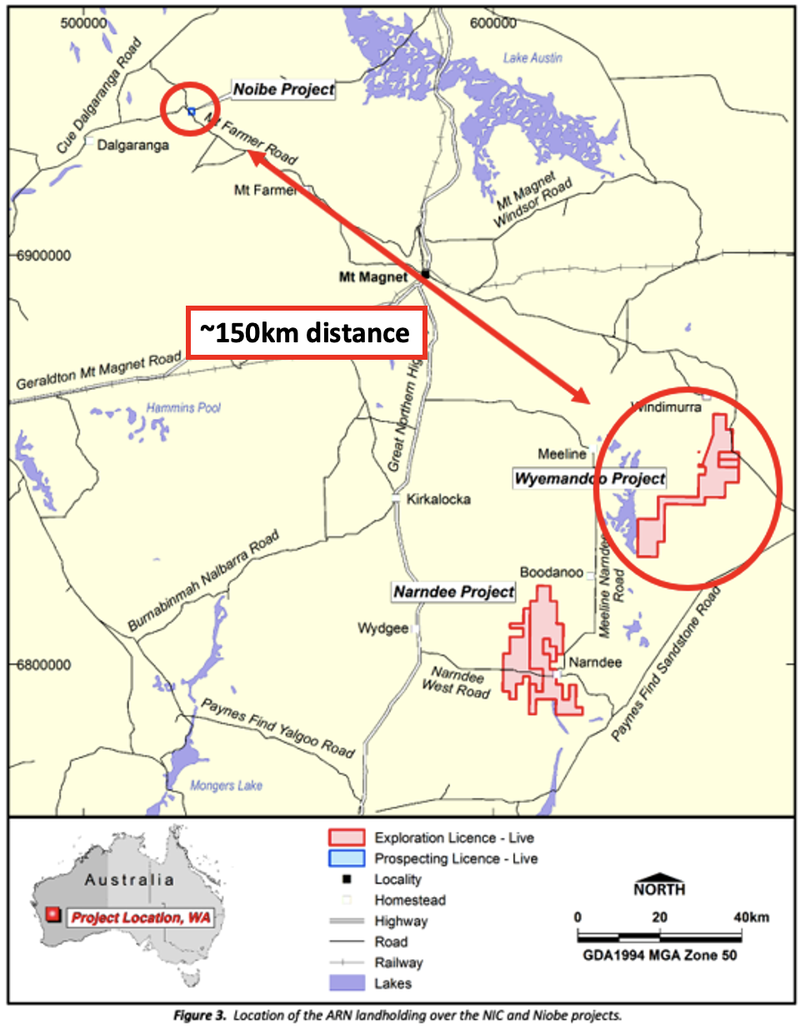

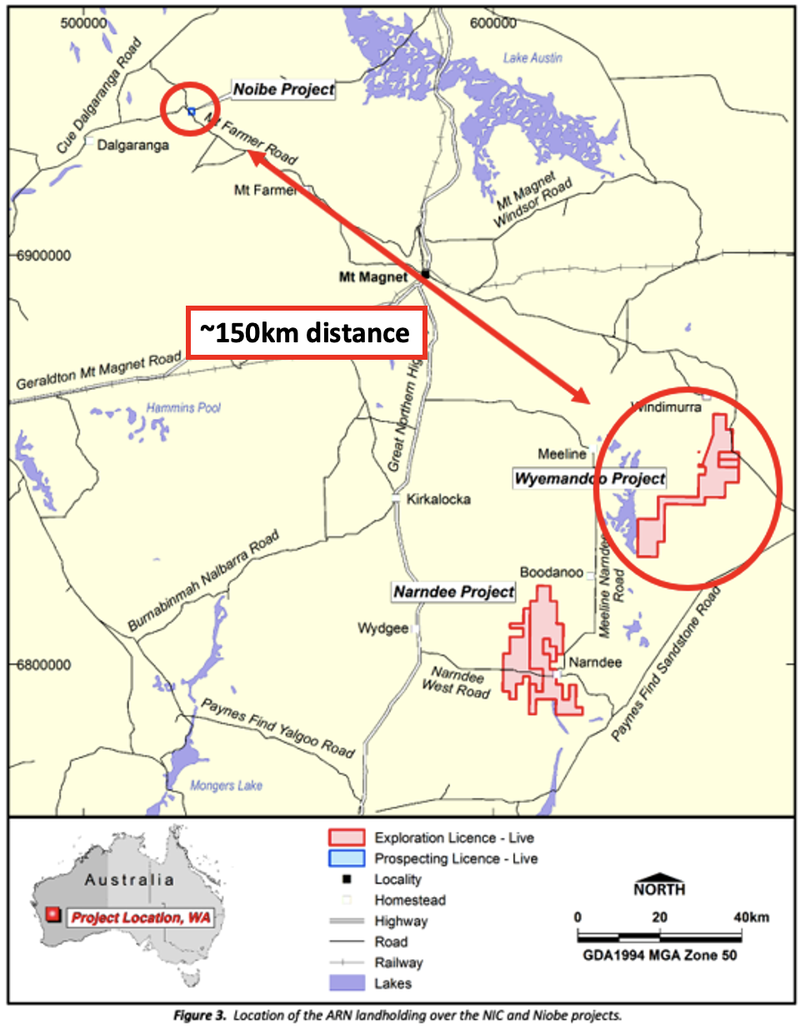

All whilst the company continues to drill at its nearby rubidium-lithium project (Wyemandoo), ~150km away.

Whilst ARN has not made an economic rubidium discovery yet, our Investment in ARN does give us some exposure to this relatively unknown commodity that is yet to have a large commercially viable use case set out for it.

A good comparison to this situation would be lithium years BEFORE the demand for lithium-ion batteries grew.

With research and development going into novel and potentially disruptive use cases for rubidium right now, any monumental breakthrough could see demand for the metal increase and, in turn, bring market interest to companies exploring/developing rubidium projects.

It’s a bit of a moonshot, and it is still too early to say if rubidium will ever have its lithium moment, but we like the exploration exposure as part of our diversified Portfolio.

Turning to the company’s balance sheet, ARN recently raised $2.3M at 25c per share, adding to its $730k cash balance (reported on 31 March 2022).

With ARN currently drilling and its quarterly report due next week, we should get a better idea of the company’s cash position very soon.

At the moment, ARN trades at a market cap of $14.4M. Without accounting for June quarter expenditures, this would give the company an enterprise value (EV) of ~$11.1M.

Like we do with all drilling programs, we set our expectations for how we would evaluate ARN’s assay results.

In early March this year, we set our expectations for last week's drilling results as follows:

- Bull case: Average rubidium grades at or above the 0.15% upper range ARN set for its exploration target, with the project also proving a lithium resource simultaneously.

- Base case: Average rubidium grades above 0.07% and some indication of lithium mineralisation - ✅ This is what ARN achieved

- Bear case: Average grades <0.07% rubidium and no lithium mineralisation in the assays.

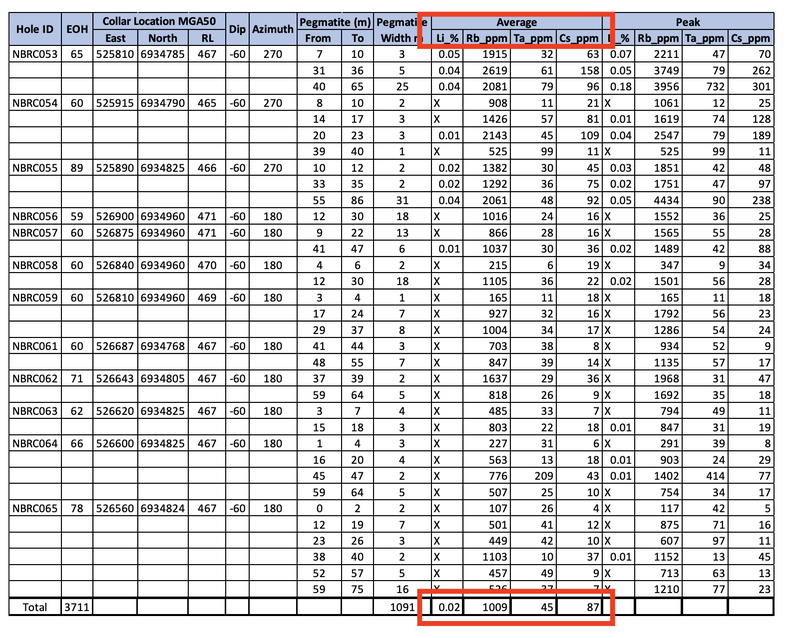

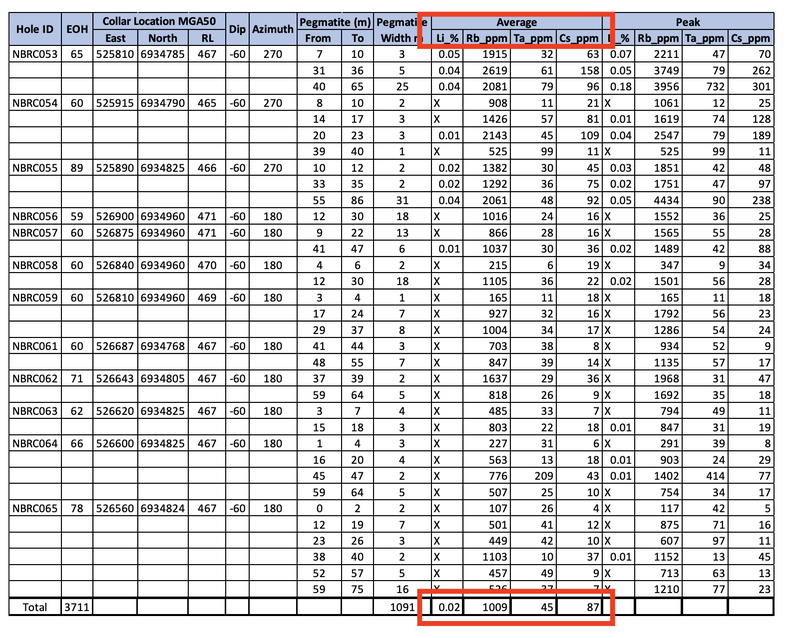

Across the 3,711m, 65 hole drilling program, ARN intercepted AVERAGE rubidium grades of 0.1% (1,009 ppm) along with an average lithium grade of 0.02%.

This puts ARN’s drilling results firmly inside our “base case” target of average rubidium grades above 0.07%, with some indication of lithium mineralisation.

ARN confirmed that it would build on these assay results with an additional 3,000m of drilling targeting extensions to the current mineralisation.

The drilling program is expected to commence in the coming weeks and will focus on increasing the potential resource size and building a resource model.

This isn't the only drilling ARN is doing either, with the drill rig active in ARN’s neighbouring Wyemandoo rubidium-lithium project in WA.

Because of the proximity between the two projects, any new discovery at Wyemandoo could be added to the drilling data from Niobe to form a larger regional JORC resource.

The Joint Ore Reserves Committee Code (JORC) is the standardised method for evaluating a mineral deposit's size and grade. It allows investors to compare other companies with a JORC resource of the same mineral.

A JORC resource can underpin a company's market value, as it defines the discovered in-ground mineralisation. It also allows investors to compare peers with JORC resources. Plus without a JORC resource, ARN cannot undertake feasibility studies to evaluate the project's economics.

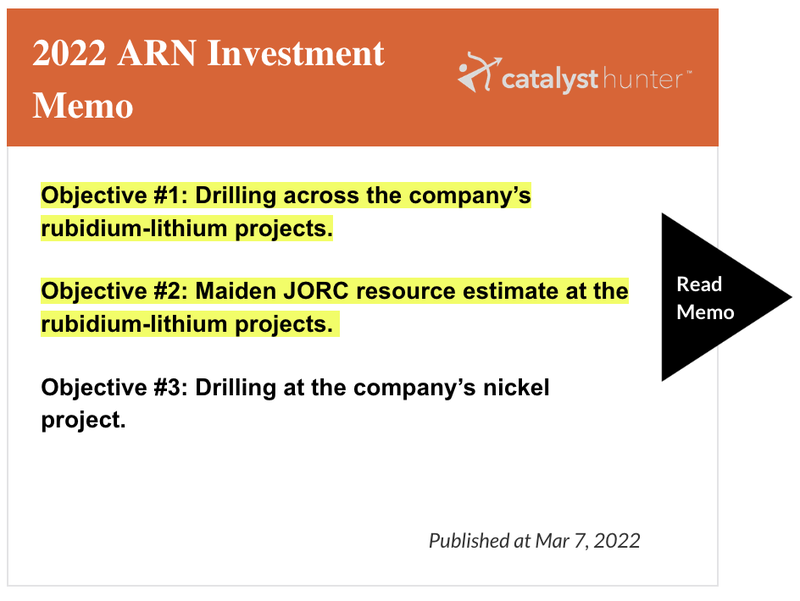

ARN’s announcement last week progresses both Objective #1 and Objective #2 that we set for the company in our March 2022 ARN Investment Memo.

We look forward to ARN systematically working through these key objectives over the coming months.

ARN’s assay results explained

In early March this year, we set our expectations for last week's drilling results detailing what we thought would be a bullish, base and bearish case outcome for ARN.

Our expectations were based on:

- The world’s biggest rubidium discovery, the Tiantangshan rubidium deposit in China, which has a resource of ~100,000t at average grades of 0.109% rubidium. This indicates that grades of ~0.1% are considered commercial with projects of this size and scale.

- ARN’s exploration target was set at 33,000-150,000 tonnes of rubidium oxide with grades ranging from 0.07% to 0.15% (put together using historical drilling data from the 1980’s).

Based on these, we set our expectations as follows:

- Bullish case = Average rubidium grades at or above the 0.15% upper range that ARN set for its exploration target, while simultaneously proving a lithium resource.

- Base case = Average rubidium grades >0.07% and some indication of lithium mineralisation. ✅ This is where ARN’s results sit.

- Bearish case = Average grades <0.07% rubidium and no lithium mineralisation in the assays.

ARN’s assay results sit firmly inside our “base case” target.

Last week ARN announced the following:

- Peak intercept grades at 0.76% rubidium and 1.18% lithium.

- Average grades of 0.10% rubidium and 0.02% lithium.

These results meet our “base case” target, with average rubidium grades above 0.07% and some indication of lithium mineralisation.

Encouragingly, off the back of these assay results, ARN announced a follow up 3,000m drilling program targeting extensions to the current mineralised zones across its project.

Extensional drilling to increase the potential resource size and to gather data to build an overall resource model is due to commence in the coming weeks.

We think this is a good step towards ARN’s ultimate goal of converting its exploration target into a JORC resource.

It is difficult to predict how big the company’s JORC resource could be, but the exploration target and some of the grades so far point to the project being “economical”.

This is based on the biggest rubidium discovery in the world (the Tiantangshan deposit in China), which has a resource of ~100,000 tonnes of rubidium at average grades of 0.109%.

If ARN can deliver anywhere near the upper range of its exploration target of 0.150%, the project economics for ARN could start to look promising.

However, it is important to note that exploration targets are rarely converted into a JORC resource at the same size and scale as set by the company.

Exploration targets are preliminary estimates of the size and grade of mineralisation based on historical drilling data.

It is only after multiple rounds of drilling that this size and grade can be confirmed, and a JORC resource can be identified.

There is also no guarantee that the exploration target will ever be converted into an economic discovery.

ARN drilling at the neighbouring rubidium-lithium project

Upon completing drilling at Niobe earlier this year, ARN moved its drill rigs over to its neighbouring rubidium-lithium project, Wyemandoo.

Because of the proximity between the two projects, any discoveries could be added together to form a larger region wide JORC resource.

Below is an image detailing just how close the two projects areas:

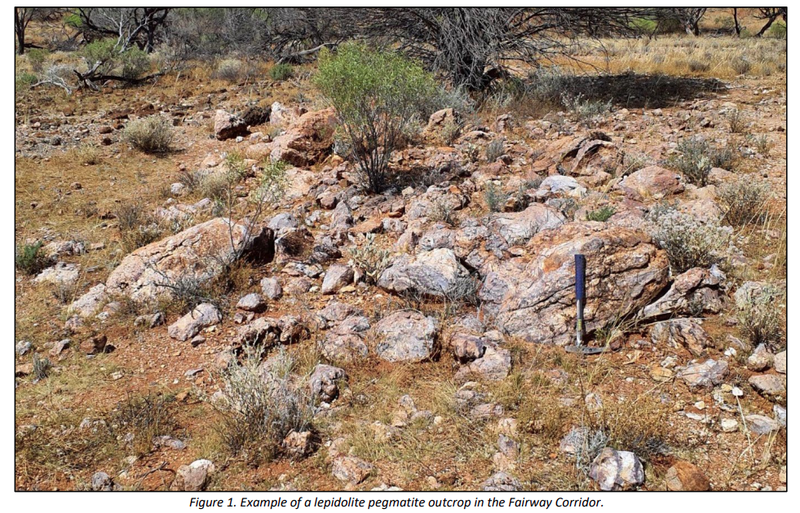

ARN picked up this ground in late 2021 and immediately ran a project-wide geochemical sampling program.

Over the entire geochemical sampling program, grades averaged 0.166% rubidium and 0.12% lithium - enough to warrant project-wide drilling.

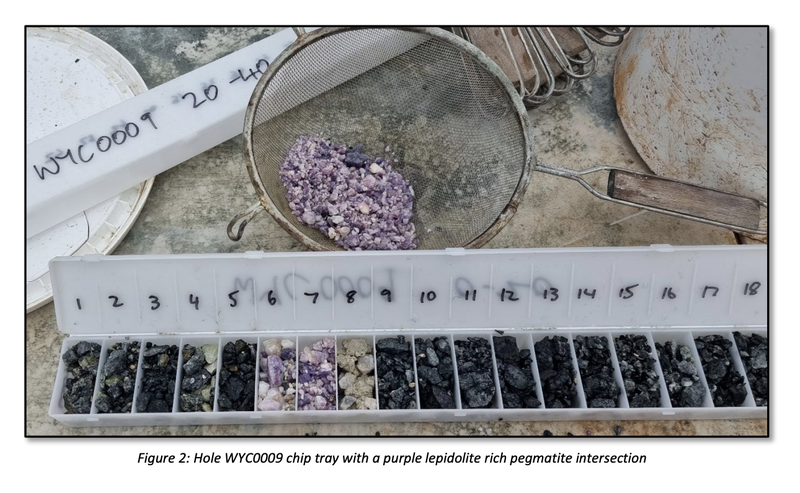

Fast forward to today, and ARN is in the middle of its maiden drilling program at Wyemandoo.

After only 25 drillholes, ARN decided to double the size of the drilling program, increasing it to a total of 6,000m of drilling.

Most of the first 25 drill holes intercepted pegmatites believed to be anomalous for rubidium-lithium — enough promise to warrant additional drilling.

We think that this is a good sign from the company.

ARN’s exploration activities have exclusively been based on rock chip sampling and pegmatite outcroppings found all over the project area.

As there is no historical data, we have not set any drilling expectations.

Instead, we view this project as an almost ‘free option’ for a new discovery over a ~10km by 6.5km target area.

We think that if ARN can establish a JORC resource for its main rubidium-lithium project at Niobe and then follow it up with a new discovery at Wyemandoo, the market will look at this potential development favourably, given its unique exposure to a metal like rubidium.

What’s next for ARN?

Additional drilling to commence at Niobe rubidium-lithium project 🔄

In last week’s announcement, ARN confirmed that it would follow up with an additional 3,000m of drilling, targeting extensions to the current mineralisation.

That drilling program is expected to commence in the coming weeks and will focus on increasing the potential resource size and building a resource model.

We want to see ARN maintain its average grades inside the company’s exploration target of 33,000-150,000 tonnes of rubidium, with grades ranging from 0.07% to 0.15%.

If the results from this next round of drilling continue to deliver intercepts within this range, then we think ARN should be able to put together a maiden rubidium-lithium JORC resource estimate.

Drilling results from Wyemandoo rubidium-lithium project 🔄

ARN is currently in the middle of a 6,000m drilling program at Wyemandoo.

With the majority of the first 25 drill holes intersecting pegmatite measuring up to 6m in length, ARN expanded the size of the drilling program and is likely to put out more news from the drilling program over the next quarter.

We haven't set any drilling expectations, given this is primarily greenfield exploration, but we will monitor the results to see how the project shapes up for ARN.

Our 2022 ARN Investment Memo

Check out our 2022 ARN Investment Memo to find a short, high level summary of our reasons for investing.

The memo's ultimate purpose is to track our portfolio companies' progress using our Investment Memo as a benchmark throughout 2022.

In our ARN Investment Memo, you’ll find:

- Key objectives for ARN in 2022

- Why we continue to hold ARN

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.