ARN adds Rubidium target in battery metals exploration portfolio

Aldoro Resources (ASX:ARN) is a WA metals explorer chasing battery metals nickel and lithium.

Today ARN revealed it also has a sizeable exploration target for rubidium (Rb) in WA - rubidium is an extremely rare and expensive metal.

ARN’s esteemed geophysicist Dr Fu reckons the potential Rb resource could be in the same order of magnitude as the biggest Rb deposit in the world.

Rubidium is used in a few high tech applications, and can be used in sodium-ion batteries. Given how hard it is to find rubidium on planet earth, rubidium is more expensive than gold.

We first invested in ARN for its leverage to a WA nickel discovery and because we believe in the battery metals thematic as the world switches to electric vehicles demand for battery metals rises.

ARN is actively running its nickel exploration having already made a promising nickel drill hit. ARN is still drilling targets right now, and has also found some down hole EM conductors during exploration.

While we wait for news of more nickel results, ARN has announced today’s rubidium target and also has some interesting hard rock lithium projects it is exploring...

These complementary projects, or what we like to call ARN’s “side bets”, have been added to ARN’s portfolio of projects since we first invested, and include the Rubidium Project.

ARN plans to drill this project in late September (4 weeks away) and test this rubidium potential, along with the potential for lithium at the project.

ARN’s rubidium potential?

ARN today announced that it has defined an initial Exploration Target at its recently acquired Rubidium project.

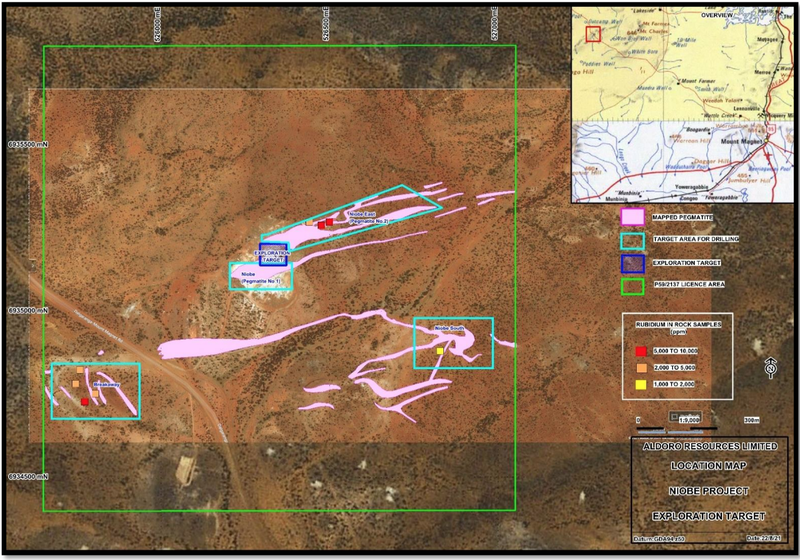

- ARN has re-evaluated the Niobe Tantalum prospect for Rubidium (Rb) potential with historical Rubidium oxide (Rb2O) of up to 1.09% from mid-1980’s RC drill holes.

- The initial Exploration Target (over part of the Niobe Pegmatite 1) consists of approximately 33,000-150,000 tonnes of Rubidium Oxide (Rb2O) at grades ranging 696-1457ppm over an 80m by 65m area of detailed drilling.

- This area represents less than half of the mapped section of the Niobe pegmatite with the results based on 809 samples from historical drilling (1984-1986) from 31 close interval holes with depths ranging from 13 to 48m.

Just this small section has 33,000 to 150,000 tons (330-1,500 contained tons of Rb) with a price over $1 million per ton.

This means with its first drill program, ARN could expect to have an at surface economical resource for Rb. And given the price that Rb demands, we think it might be possible to economically mine Rb in a pretty short space of time.

ARN’s renowned physicist Dr Minlu Fu noted the commercial potential of these historical grades.

Dr Fu said that according to the Mining Association of Guangdong Province of China a major Rubidium deposit called the Tiantangshan Rb deposit, was discovered in Guangdong province in 2019.

The Tiantangshan Rubidium deposit, the biggest in the world, has Rb2O resources of over 100,000 tonnes at the average grade 0.109% Rb2O.

The Guangdong Provincial Government said in 2019 that it will invest multi-billion RMB to exploit this Rb project in the next five years as it expects the project to be “very profitable”.

It seems that the potential resources of the ARN’s Niobe Rb project may be in the same order as that of the Tiantongshan Rb deposit having Rb2O of greater than 1.5% and being associated with other valuable elements, such as Lithium, Caesium and Tantalum.

Rubidium is an alkali metal (think Lithium, Sodium, Potassium and Caesium) and is typically found in hard rock pegmatites.

It has a wide range of industrial applications including specialty glasses in fibre optic cables, GPS systems, and night vision gear, while it also has potential to be applied in sodium-ion batteries.

While not yet used to any great extent in batteries, Rb is an up and coming battery metal that is used to make sodium-ion batteries. Sodium-ion batteries present significant opportunity as they have lower energy density than lithium-ion batteries, are faster to charge and more resilient to cold temperatures.

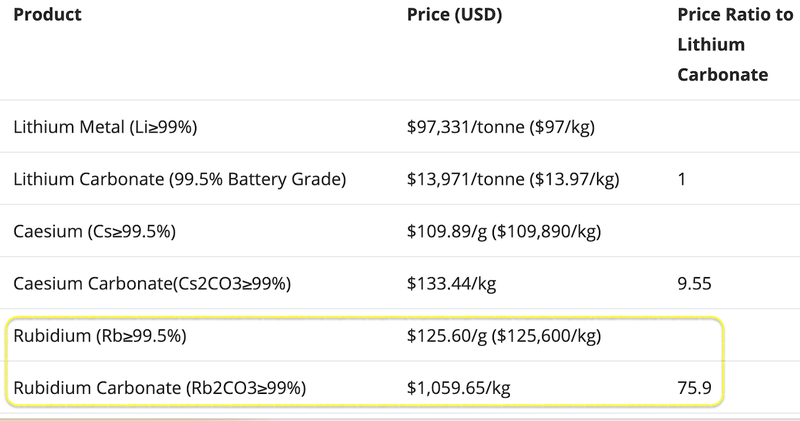

Rubidium’s relative value is reflected by its price when compared to that of lithium and caesium:

Forward plan at ARN’s Rubidium project

As the majority of ARN’s mapped Pegmatite 1 remains untested for Rubidium, ARN will now look to expand the Exploration Target area encompassing the mapped pegmatite on the western side of Niobe, the high interest Rb bearing sections of Niobe East, the Breakaway pegmatites and Niobe South Pegmatites — as can be seen in pink on the map below.

Upon approval of a Programme of Works (POW), ARN expects to commence an RC programme at the end of September, and will also target the Lithium potential of the mapped pegmatites.

Rubidium Project

✅ Exploration Target Defined

✅ Re-interpret Historical Results

🔲 Rock Sample Analysis

🔲 Identify Areas for Drilling

🔲 Programme of Work Approval

🔲 Commence RC Drilling (end of September)

🔲 Assay Results 1

🔲 Assay Results 2

🔲 Assay Results 3

🔲 Estimate Mineral Resource

But of course, Rubidium isn’t the only play that ARN has on the go...

Update: ARN’s Nickel Project

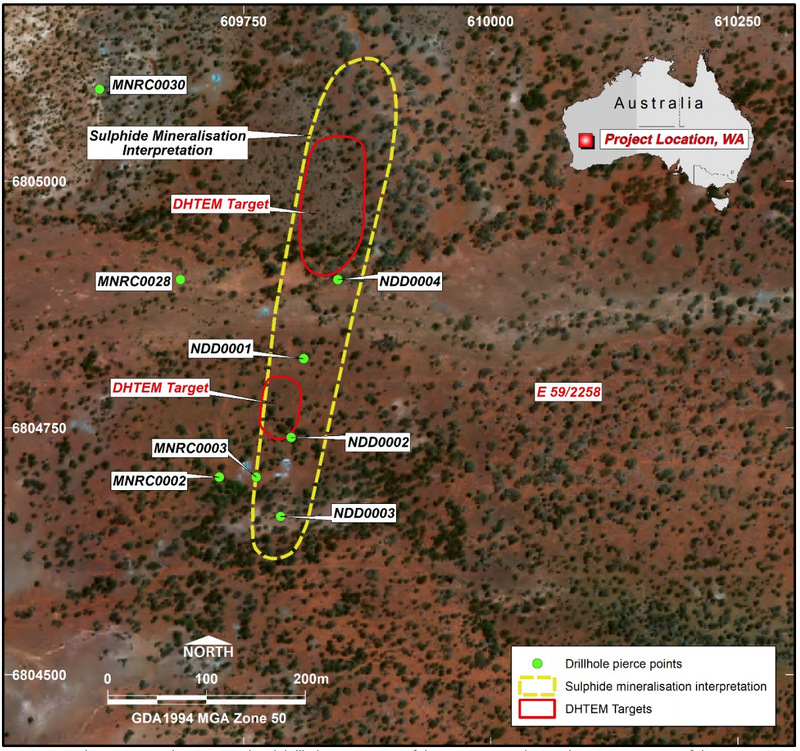

Earlier this week, ARN provided an exploration update for its VC1 and VC3 targets at its nickel project (the Narndee Igneous Complex) having completed downhole electromagnetic (DHTEM) surveying on all holes.

Five drill holes were successfully DHTEM surveyed at the VC1 target over the prior week.

The results are very encouraging with at least two strong off-hole target areas identified for immediate follow-up drill testing.

Here you can see the location of these high priority targets in red, with the DHTEM surveying indicating that the anomaly is strengthening north of hole NDD0004:

The next phase of drilling at VC1 will target the two high priority off-hole targets, test the east-west extent of mineralisation from existing drill pads, and aim to extend the mineralisation further down plunge, north of NDD0004.

VC3 target drilling

The first drillhole (NDD0005) is underway at the VC3 target and is now at a depth of approximately 230m. The hole has already intersected a suite of mafic and ultramafic intrusive rocks over its entire length.

These rocks are interpreted to be a similar package to that hosting the mineralisation at VC1, which strongly upgrades the VC3 target.

We look forward to ARN providing an update on the VC3 target once the target position is intersected.

Narndee Nickel - PGE Project

✅ Land rights Permits and Land rights secured

✅ Drill Targets Identified

✅ Geological Surveys and Prep Work

✅ Drill Rig Secured

✅ Drill Rig Mobilising to Site

🔲 Field Reconnaissance

🔲 Sampling Work Results

✅ 5,000m of Drilling Begins

🔄 5,000m of Drilling Complete

✅ [UPA] First Drill Hole Intersects Massive Sulphides

🔄 Assay Results 1

🔲 Assay Results 2

🔲 New Milestones AddedARN Adds Rubidium Target to Nickel and Lithium in Battery Metals Exploration Portfolio

Our investment plan for ARN:

✅ Initial Investment @20c (before key drilling event)

✅ Increase Investment @20c (before key drilling event)

✅ Price increases 250% from initial entry

🔲 Price increases 500% from initial entry

🔲 Price increases 1,000% from initial entry

🔲 Free Carry

🔲 Take Some Profit

🔲 Hold position for key drilling event

🔲 Decide New Investment Plan after results of key drilling event

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.