Shallow Copper Resource - waiting to be de-risked through “met work”

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 1,515,152 AKN shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by AKN to share our commentary on the progress of our investment in AKN over time.

It's been 3 months since our last new Catalyst Hunter investment and today we are adding a new stock to our portfolio.

Our latest investment is Auking Mining Ltd (ASX:AKN).

AKN has a JORC copper resource of 6.8MT @ 1.3% Copper, and are currently drilling to see if they can further expand it...

We like the high grade and tonnage here, especially given AKN’s current market cap.

AKN has other metals in its JORC resource, but for us this latest investment is all about copper.

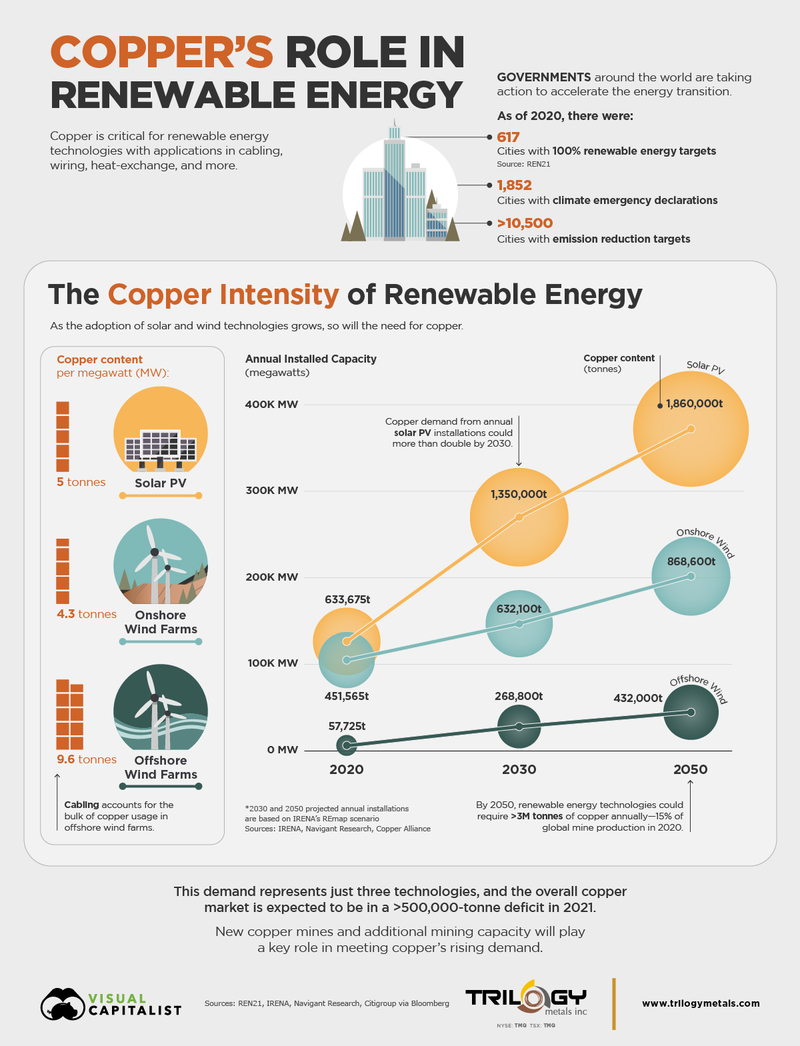

That’s because copper demand is widely tipped to double by the end of this decade.

Emerging industries like the EV market, renewables and a rapidly electrified developing world will need heaps of copper.

The collision of traditional industrial applications with technology applications is something that we believe will put any company with a decent sized copper resource firmly on the radar of investors.

With a current market cap of $11.6M, we think AKN is trading at attractive prices relative to the JORC resource it has on its hands - we invested at 16.5c in the most recent capital raise.

There’s one crucial detail that’s missing here though - and likely why the market is valuing AKN at just $10M right now - that is a processing solution to extract the copper.

AKN is currently doing metallurgical work (met work) to test how efficiently their copper deposit can be extracted - they are applying a new extraction technology which we hope will yield a previously unavailable economical extraction method.

The met work results from this new extraction technology is the big news we are waiting on with AKN, and we think a successful outcome on this front would de-risk our investment and potentially lead to a share price re-rate.

In short, a powerful share price catalyst is waiting in the wings here - which is why we think our latest investment is perfectly suited to the Catalyst Hunter portfolio.

A positive met work result is the key step to AKN becoming a near term copper producer, hopefully while copper prices remain high.

As the world moves towards a “greener” energy mix it will require a LOT more copper. BHP thinks so too - one BHP executive recently said that copper demand is primed to double by the end of the 2020s.

Right now, copper is sitting just shy of all-time highs at US$4.47/lb. Meaning copper companies, and those that can find economic resources, are firmly in the spotlight. AKN picked up its copper asset when copper was out of favour with a spot price of ~ US$2.60/lb.

We note that electric vehicles (EV’s) need three times as much copper as a normal petrol car and an EV charger needs up to 80kgs of copper.

We believe this major macro theme should provide tailwinds for companies that are seeking (or already have) copper resources.

Our latest addition to the Catalyst Hunter portfolio is aiming to get a unique copper resource into production as quickly as it can.

Our latest investment in the Catalyst Hunter portfolio is a WA based Copper/Zinc explorer which already has a JORC resource.

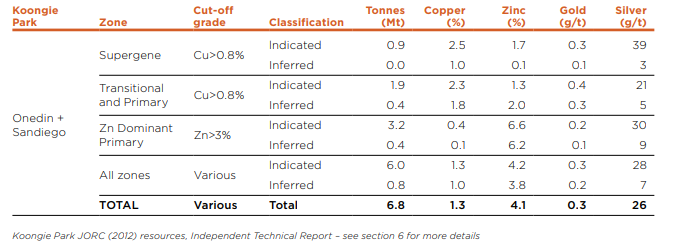

AKN has a current JORC resource of 6.8MT @ 1.3% Copper, 4.1% Zinc, 0.3g/t gold and 26g/t Silver.

That’s a seriously large deposit for such a small company.

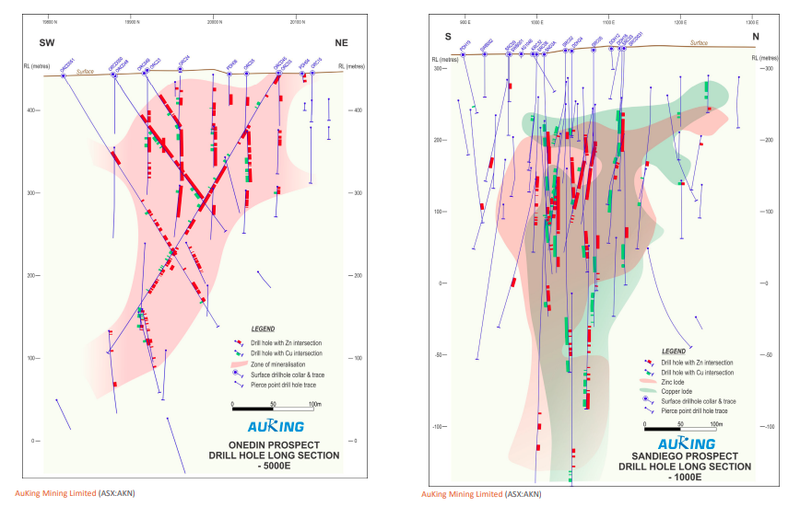

The JORC resource sits across two deposits, the “San Diego” deposit which is at depth and would be mined using underground mining methods and the Onedin deposit which is a shallow high-grade copper deposit starting basically from surface.

In June 2020, AKN signed an agreement with Anglo Australian Resources to earn-in up to a 75% interest in the Koongie Park Copper/Zinc project.

As of today AKN has completed the entire earn-in agreement and is now the unencumbered owner of 75% of the project - it paid $1M in cash and spent $3M on exploration to get to this ownership.

AKN is currently completing a 7,000m drilling program, across the area where the JORC resource sits.

With the drilling program consisting of both in-fill and extensional drilling we expect drilling results and any subsequent increase in the JORC resource to be the immediate catalysts for AKN’s share price.

Our investment in AKN however is longer-term and we will back the company through at least another two drilling programs and all the way through the critical metallurgical testwork that could be the catalyst for the company to put its shallow resource into production.

With the current JORC resource split across two deposits that both sit on active mining licenses...

We think AKN can quickly put these deposits into production, should metallurgical test-work (using new technology) come back positively. This is where the re-rate potential is for AKN, and why it fits so well within our Catalyst Hunter portfolio.

The key word is ‘should’ here - previous owners failed to find a commercial process for one deposit (called Onedin). If AKN doesn't manage to find a solution then the commercial viability of the project will be seriously compromised.

With strong macro thematic tailwinds - we think copper is the right place to be in the long run.

Governments globally are committing to significant fiscal spending on infrastructure investments and we expect this to strengthen current copper demand. With copper being critical to the electrification thematic we also expect demand in the long-run to consistently surprise to the upside.

Throw in the prospect of commodities being used as a hedge against inflation (as they have before), and we have the perfect cocktail of factors behind our latest investment.

Introducing our latest investment and portfolio addition:

2022 AKN Investment memo

Below we will do a deep dive on the company and the key reasons for our investment, for a shorter summary detailing why we hold AKN, what we want to see them achieve in 2022 and our key objectives for the company check out our 2022 Investment memo here.

We will be using this investment memo to track the progress of AKN throughout the year.

What is our Investment Plan for AKN?

When we announced our 2021 Pick of the Year for the Catalyst Hunter portfolio, we mentioned that our investment strategy had slightly changed for the portfolio as a whole.

In our Grand Gulf Energy initiation note we mentioned the new Catalyst Hunter portfolio model wouldn't specifically chase short-term price catalysts anymore, but instead look to take larger and longer-term positions in companies we choose to invest in (2 to 3 years).

We are invested in AKN to see the company try and unlock the potential of its current JORC resource and will look to see how the Halls Creek region develops over a 2-3 year period.

We like the AKN valuation now - the current market cap being $11.6M with $2.5M cash in the bank.

Consistent with all of our investments in exploration companies, we will look to partially sell some of our holdings (~20%) if the share price runs to partially de-risk our position, in line with our investment plan detailed in our 2022 investment memo.

We have in place a mandatory 90 day trading blackout on all our new investments prior to being able to sell a maximum of 20% of our position, which gives the company time to deliver some material announcements towards its plan.

Our plan is to review our investment thesis based on the progress the company makes with respect to our 2022 investment memo.

What’s next and what are the key objectives for AKN?

Last year AKN completed a 6,400m drill program, and its near-term catalysts will be from the remaining drilling results and any updates to the JORC resource that emerge.

These are the three key objectives we will be watching out for next with AKN and the results from these will form the basis for a review of our AKN Investment thesis.

Objective #1: More drilling at the Copper-Zinc project to upgrade the JORC resource.

- More drilling at both the Onedin and Sandiego deposits. We want to see deeper drilling at the Sandiego deposit to test the most recent mineralisation found under the known resource zone and some extensional drilling at the Onedin deposit.

- We want to see the drilling eventuate into an upgraded JORC resource.

Objective #2: Complete metallurgical testwork on the Onedin deposit:

- We want to see AKN push forward aggressively with metallurgical test-work testing, this is the key to unlocking the shallow near-surface ore at the Onedin deposit.

Objective #3: Test its regional prospects.

- We want to see AKN go in and test the Emull prospect where Northern Star Resources had previously identified an open-pittable resource of ~4.5mt @ 0.33% Copper.

The above key objectives form the basis for our investment thesis with AKN but it wasn't the only reason for making our investment.

What are the risks?

Metallurgical risk: The shallow part of the JORC resource that could be quickly mined by AKN at the Onedin Deposit is made up of oxide hosted copper mineralisation. Oxide ore is more complex to process, and with AKN’s resource in particular, previous attempts to find a processing solution have failed. There is a chance a solution is not able to be found and this part of the resource is deemed stranded. This is the biggest company specific risk we see in AKN and we are invested hoping the company can get a breakthrough.

Commodity pricing: Copper is a highly industrial metal that is reliant on buoyant economic growth, if there is any significant decline in economic activity globally then copper prices are likely to de-rate.

Funding risk: AKN is still doing a lot of exploration work and so is reliant on financing from investors who are willing to fund high-risk exploration programs. Market conditions turning negative could mean getting these type funds may be difficult.

Eight Key Reasons We Made Our Investment In ASX:AKN

Below we will do a deep-dive into the 8 key reasons for making our investment in AKN.

1. Low Enterprise Value + recently restructured register.

The first box that AKN ticked for us was that the capital structure was relatively clean.

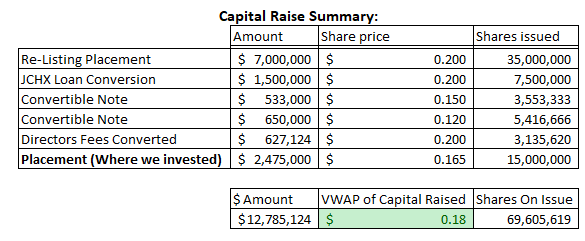

Earlier this year AKN completed a 1:200 consolidation and then immediately raised $7M at 20¢ whilst converting some of the outstanding debts to its directors at between 12-20¢.

Of the total 75M shares on issue, ~45.6M have been issued at 20¢, ~3.5M issued at 15¢ and another 6.25M issued at 12¢. There are no other shares issued below that price.

We made our investment in the recent $2.475M placement at 16.5¢ and the share price is now at a discount to our entry price at ~16c, having traded as low as 12c since the cap raise. As at the end of the December quarter AKN still has $2.5M in cash.

We always aim to invest at a price alongside founders and major shareholders. With AKN we have managed to make our investment at a price well below where all of the capital was injected into AKN.

We like that the restructured register has almost 80% of its float all issued above our entry price of 16.5c. This gives us confidence that we are invested at a lower price at a time where the market may be under-appreciating AKN’s potential.

2. Established JORC resource with resource upgrade upside.

AKN’s core project is the Koongie Park Copper/Zinc Project. The project sits on >500km^2 of grounds in the Halls Creek Region, WA.

AKN owns the rights to all minerals excluding Gold/PGE over the project area.

When going through our rigorous due diligence process, we quickly noticed that the project already had a 2012 JORC resource of 6.8MT @ 1.3% Copper, 4.1% Zinc, 0.3g/t gold and 26g/t Ag.

The resource is split across its San Diego and Onedin deposits where the previous owners had completed a Pre-Feasibility Study (PFS) in the past.

The issue was - and still is - that the mine-life was too low and that the operation would have been a high-cost underground mine, which was not deemed feasible at the time.

The key to unlocking the established resource is to be able to incorporate the shallow-near surface ore from the Onedin deposit. Of course this doesn't come without its challenges (which we will touch on later).

AKN are currently towards the end of a 7,000m drilling program which is made up of in-fill and step-out holes across both of these deposits.

‘In-fill’ is a specific type of drilling where a company targets the areas of a project where there is known mineralisation with an aim to either:

A) increase the resource or upgrade its classification; or

B) to obtain samples that can be used in metallurgical testing.

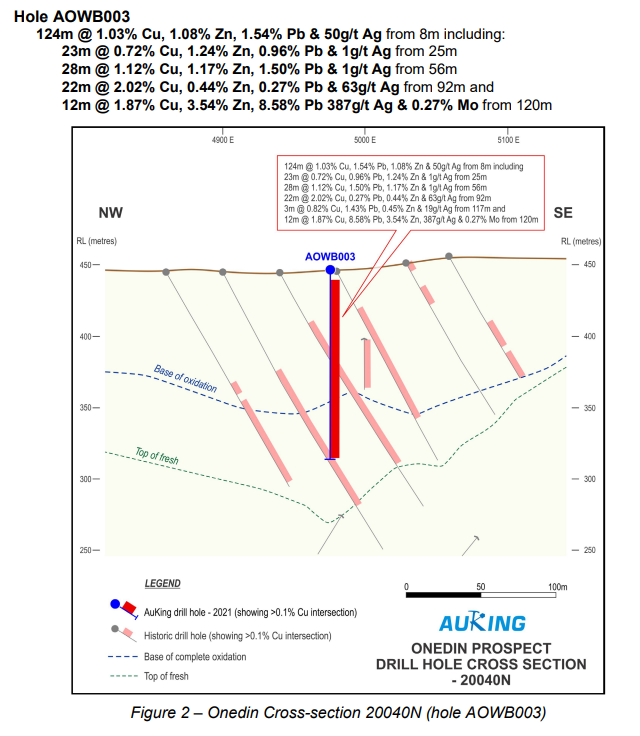

The most impressive intercept from the current round of drilling was a monster hit of up to 124m @ 1.03% Copper, 1.08% Zinc, 1.54% Lead and 50g/t Silver from 8m at the Onedin Deposit - basically mineralisation starting from surface.

Off the back of this result the share price surged from ~18¢ to a high of ~37¢, an indicator of the market interest in copper explorers. Especially those that can deliver massive copper hits like the ones achieved.

The drill hole is straight down the guts of the known ore body but this is for the reason we mentioned above.

The assays from this drilling program will be used as part of the ongoing metallurgical work.

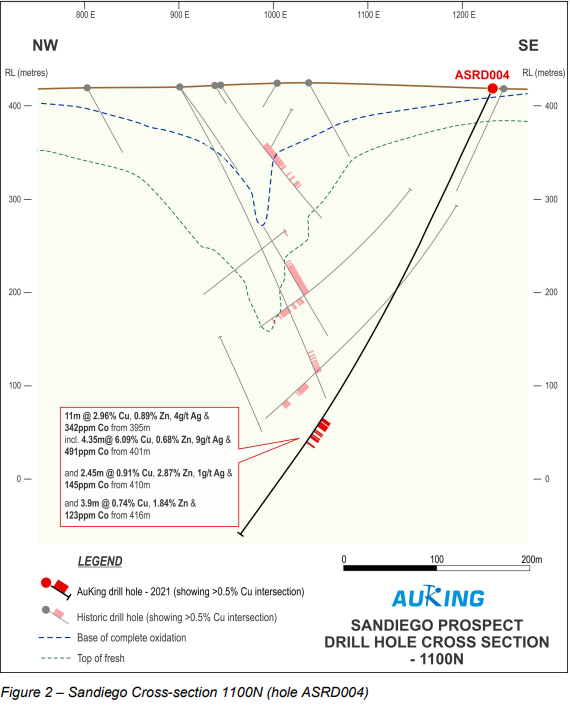

Outside of the infill drilling, AKN recently got some results back from more extensional drilling at the San Diego deposit, where the company hit 11m @ 2.96% Copper, 0.89% Zinc, 4g/t Silver from 395m.

This intercept was made below the known resource area so it could mean that mineralisation extends at depth.

This type of intercept will almost always lead to increases in the project's resource which is exactly what we want to see.

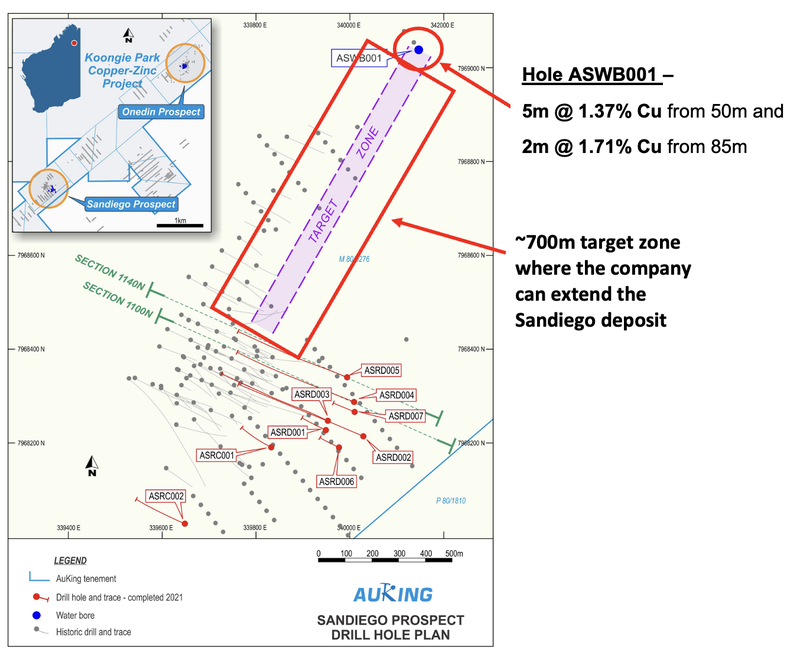

The more recent drilling results also put out an extension along-strike with a drill-hole done to the north-east of the existing resource area that produced copper hits of 5m @1.37 Copper + 2m @1.71% Copper.

This has now opened up a 700m target zone where the company can extend the San Diego deposit.

With the entire JORC resource sitting on two granted mining licenses, the Onedin deposits shallow resource offers a fast-tracked open-pit mining opportunity.

With recent drilling indicating there may also be extensions to the deposits, we think that an increase in the resource size will make the upside all that bit higher.

3. A processing solution away from production?

We mentioned earlier in the article that the key to getting the Copper/Zinc project into production quickly, was for the metallurgical issues on the near surface Onedin deposit to be resolved - this is one of the key objectives we want to see AKN tackle in 2022.

We also think this is why AKN’s market cap is where it is right now - there is simply not enough certainty in AKN being able to process commercial quantities of copper right now and the market is waiting to see how AKN approaches this problem.

Anglo Australian, the previous owners of the project, were unable to include the near surface Onedin deposit in the Pre-Feasibility Study (PFS) done in 2008 due to an inability to identify a suitable processing solution for the near-surface oxide and transitional ores.

But we’re now 14 years on from that and there could be a solution around the corner, and it comes back to ore types.

Before we delve into AKN’s oxide copper ores, it's worth understanding the difference in copper ore types.

The most common type of copper deposits are generally sulphide deposits. Copper sulphide deposits make up about 50% of copper production globally and are generally the simplest type of deposits to process.

The other type of copper deposits are oxide ore hosted. These are more commonly found, but harder to economically mine.

AKN’s oxide ores are a little more complex geologically then conventional oxide ores, making it harder to extract the copper content from the source rock.

Generally, oxide deposits like AKN’s are extracted using sulphuric acid.

The issue with AKN’s deposit is that it needs an above average amount of sulphuric acid to extract the copper because of the contaminants in its ore.

The amount of acid required is expensive and compromises copper recoveries which makes processing the project non-viable.

But... with the combination of a near-surface deposit AND a potential processing solution on the cards, AKN could quickly prove its project is viable.

You typically don't often find this grade of copper this close to the surface - so the actual operation is relatively simple, assuming the processing works out.

So how do AKN intend to get over this processing hurdle?

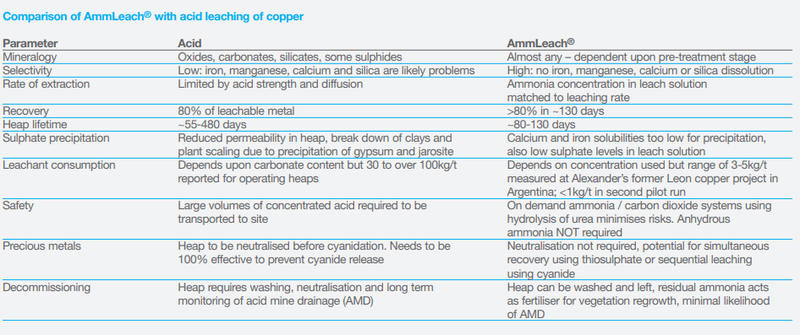

AKN, armed with in-fill drilling samples from the current round of drilling, will look to test a technology developed by London-based Metaleach called “AmmLeach”.

The technology is currently licensed to Perth based “Accudo Metals” for use in Australia, and AKN will have full access to Acuddos metallurgical expertise and knowledge as-well as the Ammleach process.

The AmmLeach processing tech is TGA approved in Australia to process near-surface ore that’s been oxidised and therefore very hard to recover through standard acid leaching process.

It uses an alkaline solution instead of sulphuric acid when treating the ore and leaves the ground with less environmental damage and in a more fertile state.

A potential win-win.

This is how Ammleach stacks up against traditional acid leaching operations:

That’s a lot to take in - and we aren’t metallurgy experts, we’re investors. Which is why the risk/reward rational needs to be right here.

On the rewards - beyond unlocking AKN’s deposit, AmmLeach could also offer a more ESG friendly alternative to mining the project offering concurrent rehabilitation opportunities.

Of course there is no guarantee a solution can be found here.

Should the new processing tech work and the Onedin deposit becomes economically viable, we expect that the market will re-rate AKN significantly.

This naturally leads us to our next reason - the reason why there was never any urgency to find a solution to unlock this deposit.

4. AKN’s project was acquired when the market wasn't interested in copper

At Catalyst Hunter, we look for hidden gems - under the radar stocks that the market is sleeping on.

With AKN we have a strong hunch that investors haven't connected the macro thematic dots yet.

The AKN story started when the company signed an earn-in agreement with Anglo Australian Resources to farm-in a 75% interest in the Koongie Park Copper/Zinc Project in June 2020.

As part of the earn-in agreement, AKN committed to a $1M upfront cash payment and $3M in exploration expenditure to get to its 75% interest.

AKN has now completed this earn-in period and has an outright ownership interest of 75% of the project, with the remainder being held by Anglo Australian Resources.

AKN basically picked the asset up for $1M cash, with the rest of the cash being used to advance the project.

The significance of the earn-in agreement is that it was signed with Anglo Australian in June 2020 when the copper price was US$2.50/Lb, since then we have seen the price increase by over 100% - now sitting at US$4.47.

Basically the assets were picked up when copper was seriously unloved.

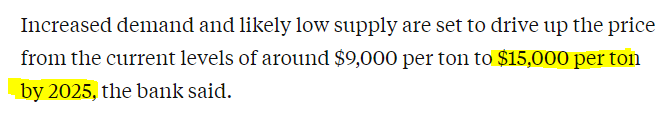

Goldman Sachs said in a recent note that “Copper is the New Oil” - and the bank has recently reiterated a US$12,000/tonne price target within the next 12 months which implies a price of ~US$5.50/lb and a price target of US$15,000 in the long-term which is ~US$6.80/lb.

This means Goldman is anticipating at least another 50%+ upside in the copper price. Almost 3x higher than where AKN made their acquisition.

Let’s not forget that AKN didn't just get a prospective tenement, they picked up a project that already has an established 6.8MT JORC resource with significant exploration upside.

Any increase in the resource around the current deposit would flow straight through to AKN’s in-ground resource. All of this just means that if/when AKN finds a processing solution for Onedin the re-rate in the share price will be that much higher.

5. Copper critical to electrification thematic

Macro thematics inform our approach to investing.

We think that when it comes to exploration companies, a lack of any macro thematic can leave even the highest quality deposits stranded due to a lack of investment appetite from investors or simply a lack of demand for that particular commodity.

This is where AKN ticks the right boxes for us, with an established JORC Copper/Zinc resource, AKN increases our exposure to the green-energy transition thematic - one of our most successful thematics.

Copper is already the 3rd most used industrial metal, which means any current demand issues are de-risked whereas other commodities in rapidly developing industries may face a sort of “ramp-up stage”. Like the lithium bear-market between 2018-2020 where investors realised that lithium demand was not developing as quickly as they expected.

With copper having the one of the highest thermal and electrical conductivity of all metals. It is essential for all electricity-related infrastructure.

This is where we think the real upside for copper comes from, as the world increasingly becomes climate conscious and is rapidly moving to a more sustainable energy mix. Electrification of industries is becoming priority number one globally.

For example electric vehicles use up to 80kgs of copper - as opposed to internal combustion engines which use up to 20kg of copper. Over a 4x increase in copper demand.

The increased demand for copper doesn't stop there though, with copper being the primary input for cabling in wind-farms and the key input for solar farms.

We think copper will become one of the most critical metals for the green-energy revolution and with BHP calling for Copper demand to multiply over the next 30-years and Citigroup predicting shortfalls in supply in the short term, we have added copper exposure to our portfolio.

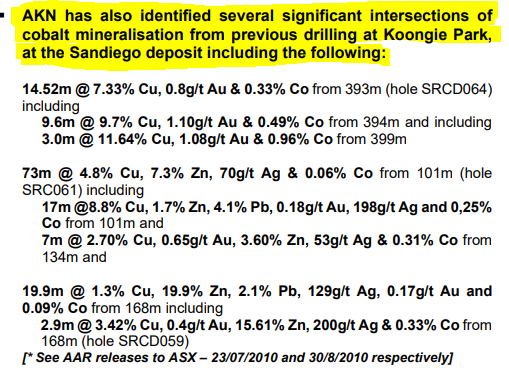

6. Latest drilling results and historical results showing Molybdenum and Cobalt grades.

Another reason we liked AKN was that we had the opportunity to buy into the established Copper/Zinc resource and also get the Molybdenum/Cobalt potential.

Drilling over the project between 2006-2009 by Anglo Australian brought back some really interesting Cobalt/Molybdenum hits. At the time there was no electrification theme and these assays would have been ignored.

At this stage it is far too early to tell how much of these hits can be added to the project's resource but any addition of these to the established JORC resource would significantly improve the economics of a producing Koongie Park project.

The best part about this is that we are getting all of this upside in addition to the established resource.

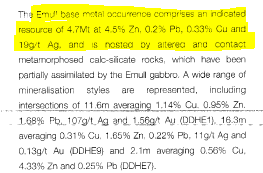

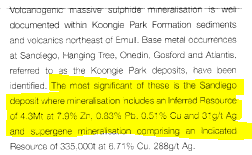

7. Interesting regional exploration prospect.

Another reason we like AKN is because of the interesting follow-up exploration opportunities.

The Koongie Park project also contains the Emull prospect which interestingly enough was one of the prospects that made up Northern Star Resources listing assets in 2003.

Northern Star, who viewed the Koongie Park zone as one of the 3 major zones in the Halls Creek Region at the time, had an indicated resource of 4.7mt @4.5% Zinc +0.33% Copper + 0.2% Lead.

Northern Star in their prospectus identified the Emull prospect as one of “at least two significant mineral occurrences within or near the Red Billabong project”. The second of these and the “most significant” was AKN’s San Diego deposit.

(sorry for the low resolution screenshots... PDF making technology apparently wasn’t that great back in 2003)

The most interesting thing to us was that at the time in 2003, Northern Star believed this area had significant Nickel-Copper-PGE potential and that advancements in exploration technology could unlock the potential of the region.

There is no current resource attributed to the Emull prospect for AKN, but exploration technology has come a long way since 2003. We think Emull provides an interesting ‘side bet’ for AKN should they look at going back and drill testing this prospect.

If they can re-classify the resource Northern Star Resources had done in the past then the project resource in total would very quickly double.

Early stage exploration is extremely risky so none of this makes up our core investment thesis, but it's always nice to have side bets like this available as they can produce unexpected surprises.

8. Nearology

The final key reason for making our investment in AKN is because of its location in the Lamboo Region.

AKN’s assets sit ~15km South-west of the Nicholsons Gold mine being operated by gold producer Pantoro Limited. Pantoro during the September quarter produced ~9,473 ounces of gold and has a resource of ~331,000 Oz.

The more interesting part of this “nearology” to us is the recent exploration activities of Pantoro.

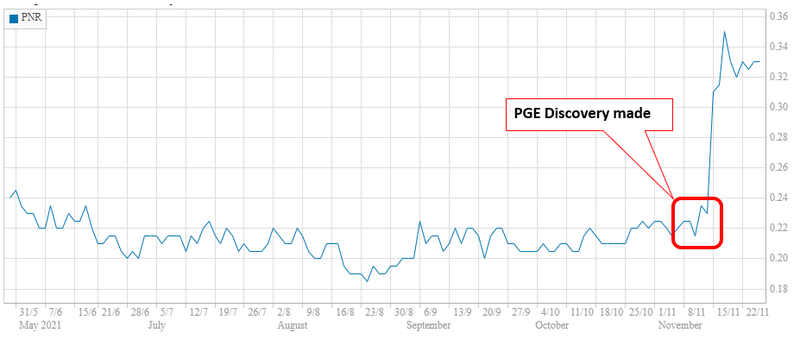

On the 15th of November Pantoro confirmed a large-scale PGE discovery at its Lamboo project and the share price moved from ~21.5¢ to a high of ~35¢.

At its peak Pantoro added $183M to its market cap.

Pantoro’s new discovery is ~5km south of the Nicholsons gold mine which is right next-door to AKN’s ground.

Pantoro has also committed to aggressively drilling here, so we can start to get a better understanding of what the potential mineralisation here looks like.

Interestingly, AKN’s new exploration manager previously worked at Pantoro so he is very familiar with this region

Although AKN doesn't own the PGE rights at the Koongie Park project, any major discovery in the area will increase overall market interest in projects close to Pantoro’s.

We expect that this interest could flow-through to AKN’s tenements.

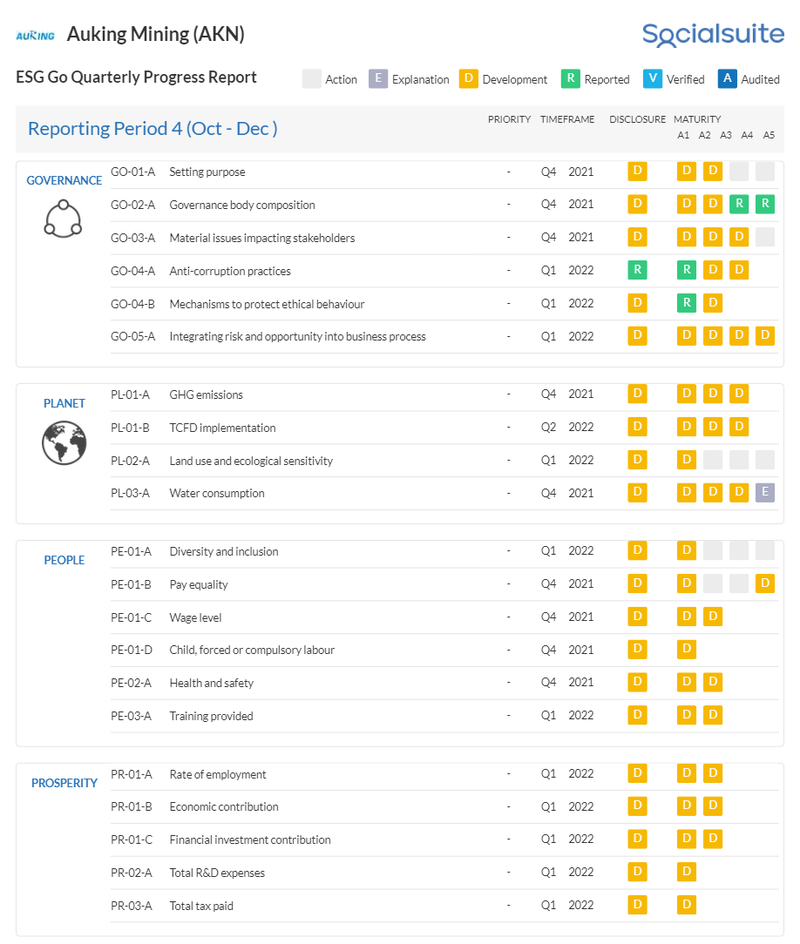

AKN is taking environmental, Social and Governance disclosures seriously

You’ve probably heard of environmental, social and governance (ESG) by now.

The world has collectively decided it wants to “go green” and also usher in a new version of capitalism that takes into account not only shareholder profit, but environmental, social and governance (ESG) considerations too.

Global funds through to the “mom and dad” retail crowd are increasingly seeking investments that help make the world a better place, and as a by-product, helps us feel better about those investments. The belief is that companies with strong ESG credentials are less risky or prone to questionable practices, more transparent, and better positioned for the long term.

The best ESG investments are now considered “bragging rights” amongst the ultra wealthy.

The appeal to ESG-centric companies is picking up steam across the globe. Research from Gartner last year indicated that “85% of investors considered ESG factors in their investments”.

ESG focussed companies are able to:

- Access ESG funds – There is currently more ESG money than there are ESG investment ready opportunities.

- Secure top tier customers – Top companies are conscious of ESG in their supply chain – think Tesla, Apple, Governments etc.

- Attract the most talented teams – Smart people do not want to work for non-ESG companies.

- Positive community perception – Doing business at all levels is just easier when the community wants you to exist.

- Shareholder returns with positive impact – Be proud they are creating a positive change in the world while providing outsized returns to shareholders.

AKN has committed to ongoing ESG reporting and disclosures, which can be tracked on in there quarterly ESG report here:

Our AKN Investment Memo for 2022

Below is our 2022 Investment memo for AKN where you can find a short, high-level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our AKN Investment Memo you’ll find:

- Key objectives for AKN in 2022

- Why we invested in AKN

- What the key risks to our investment thesis are

- Our investment plan

To access the AKN Investment Memo simply click on the button below:

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 1,515,152 AKN shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by AKN to share our commentary on the progress of our investment in AKN over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.