Can this Tanzanian Exploration Maverick Lead AKN to Uranium Success?

We originally invested in Auking Mining Ltd (ASX:AKN) for its WA copper assets.

AKN had a proven JORC copper resource, however it needed metallurgical work to be done to see if the resource could be mineable - while those metwork results are ongoing, the share price has languished...

Until Tanzanian deal maker Mr Asimwe Kabunga came along.

AKN has just struck a deal to acquire uranium assets in Tanzania.

Sometimes in small cap investing, bringing in a new “blue sky” project in addition to existing projects can make for a more interesting journey, essentially adding an extra bet that could deliver significant returns.

We are bullish on uranium because we think it's going to be crucial as the world transitions to carbon emission free energy sources.

Africa supplies about 18% of the world’s uranium, and Tanzania itself, whilst it doesn't have any operating uranium mines yet, does host the Mkuju River uranium deposit - its previous owner was taken over for $1.16BN in 2011.

One of AKN’s new uranium assets happens to be close to that deposit.

On the surface, AKN's Tanzanian uranium acquisition should generate more interest from the market, but we will need a bit more time to dive deeper and fully understand the projects.

What we definitely DO like on first look is the vendor of the assets - Tanzanian-born entrepreneur Asimwe Kabunga, who is taking on the role of AKN Chairman as part of the transaction.

Asimwe was instrumental in bringing Tanzanian deals into three other ASX listed companies, all of which have had significant success in recent years, and are currently trading at many multiples of AKN’s market cap:

- Lindian Resources (capped at $208M),

- Volt Resources (capped at $103M) and

- Resource Mining (capped at $51M).

Of note, Lindian is up over 600% and Resource Mining is up over 500% over the past year alone.

Asmiwe retains large holdings in each of the above companies, and remains on the boards of all of them.

Management with a track record of success is very important.

We are hoping as a major shareholder and new Chairman of AKN, Asimwe can deliver the same sort of success he has brought to his other ASX listed companies.

What we don’t like - obviously acquiring this new asset has diluted current AKN shareholders (like us) who invested for the WA copper project.

However, given Asimwe’s track record, we are hoping he can deliver an outsized return for all AKN holders moving forward.

Here are the main reasons why we like the AKN deal on first glance:

- Uranium is a macro thematic that we like - Nuclear power is considered one of the lowest carbon emission, highest utility rate energy technologies currently available. Uranium is the primary fuel source for nuclear power and AKN’s acquisition increases our exposure to the sector. This has been a macro thematic that we like and have been actively looking to increase our exposure to.

- Experienced vendor/incoming chairman - Tanzanian born Asimwe Kabunga has also led new deals for Lindian Resources (capped at $208M), Volt Resources (capped at $103M) and Resource Mining (capped at $51M). All of these have market caps multiples higher than AKN and Asimwe was instrumental in bringing the companies to where they are today. Each company is up over the past year, with Lindian and Resource Mining Corp up over five-fold in that span.

- Vendor of the project being paid in AKN shares - The vendor is being paid the purchase price of 60 million AKN shares issued at 10c. We suspect a big chunk of these shares are going to entities related to the principal vendor Asimwe. Given its a 100% share based payment, the vendors will be incentivized to see AKN’s value increase over time. The shares are under escrow for 6 months.

- Historic JORC resources on the projects - One of the projects AKN is acquiring (Manyoni) had a previous resource estimate for 29mlbs of uranium, whilst another one of them partially covers a 6.1mlb uranium resource. We hope AKN can prove out a JORC compliant resource quickly based on these historic results.

So will the dilution to our shareholding be worth it? Time will tell on how well the team progresses the new projects.

This is small cap investing, and in exploration sometimes a new project and refreshed management team can breathe life into a company's share price.

For early stage explorers, many will have a couple of different projects, and each one is a roll of the dice to hopefully make a discovery and deliver a return to holders.

So while its off the “WA copper” script, AKN’s new acquisition does tie in with our general big bet of why we invest in any microcap exploration company:

Our ‘Big Bet’

AKN delivers a 10x return by discovering and defining a significant enough deposit to move into development studies for one of its projects.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our AKN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

AKN now pursuing Tanzanian uranium assets

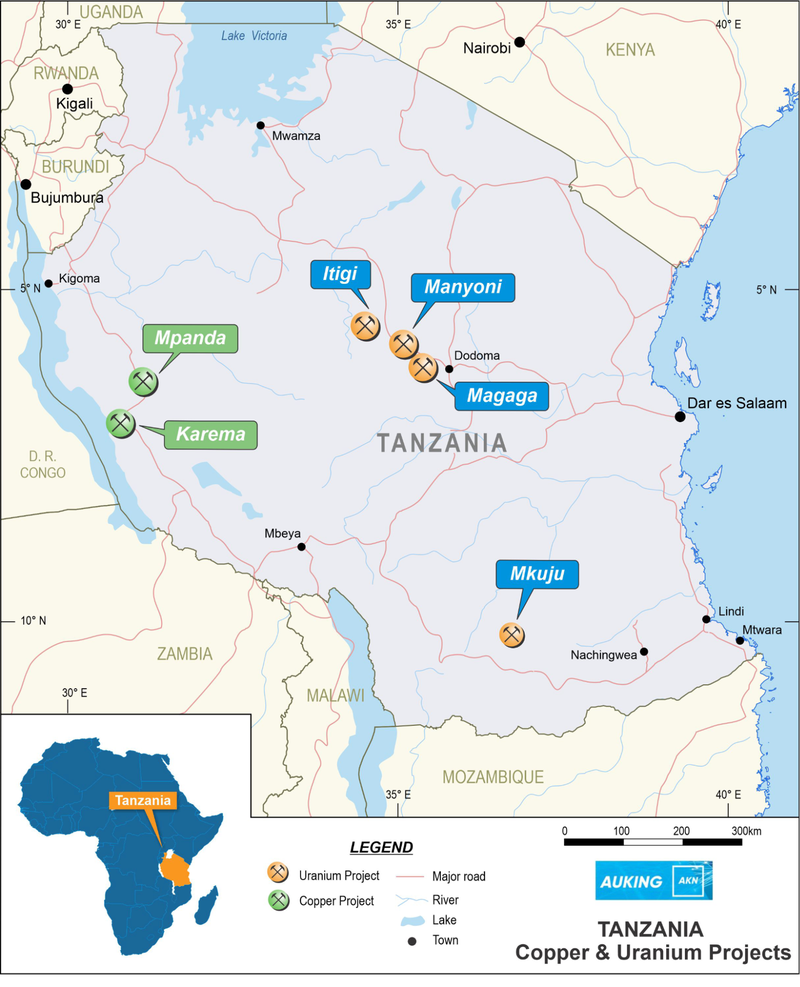

AKN has agreed to acquire 100% interest in six projects in Tanzania:

- Four prospective projects for uranium (namely Mkuju, Manyoni, Itigi and Magaga - the blue names on the map below) and

- Two prospective projects for copper (namely Mpanda and Karema - the green names on the map below).

These uranium projects are either nearby, or include, areas subject to significant prior exploration and development up until 2012/2013 including:

- Mkuju - this project is just north of the Nyota Project which hosts a non-JORC uranium resource of 108.9Mt @ 422ppm U3O8 (101.4Mlbs contained U3O8).

- Manyoni - previous owner Uranex NL, now Magnis Energy Technologies – hosts a 92Mt @ 144ppm U3O8 non-JORC resource (29Mlbs contained U3O8).

- Itigi/Magaga - geological setting potential similar to nearby Manyoni.

These projects haven’t had much progress for almost a decade now, coinciding with low commodity prices for uranium and broad pessimistic sentiment for the sector.

AKN hopes that by providing some attention and resources to these projects, it can revive them, just as a turn around in sector sentiment blossoms. If they are correct, then any exploration success will likely deliver a positive market re-rate for the company.

What is AKN paying?

AKN will be paying the equivalent of ~ $6M to acquire the uranium projects in Tanzania.

The entire purchase price will be settled via the issuing of 60 million AKN shares at 10c per share, plus the vendors will be receiving 30 million options exercisable at 20c per share, with a 30 September 2025 expiry date.

The vendor shares and options will be under an escrow for 6 months from the acquisition being completed, which means they cannot be traded.

Given the vendor fee is in shares that are escrowed for six months, and the principal vendor Asimwe is taking the AKN Chairman role, we see that as a sign of commitment to see AKN’s value grow over time.

Alongside the transaction, AKN is also completing a placement to raise ~$3.5M at 10c per share with 1:2 options also exercisable at 20c per share with a 30 September 2025 expiry date.

The placement is to be completed in two tranches as follows:

- Tranche 1 (completed) – issuing 13.75 million new shares at 10c to raise $1.37M under an existing placement capacity; and

- Tranche 2 (subject to shareholder approval) – issuing 20 million new shares at 10c to raise a further $2M.

This will all add to AKN’s current cash balance (circa ~$3M as at 30 June 2022) which should mean the company has ~$6M in cash before any spending in the September quarter is accounted for. We will get a fresh look at AKN’s quarter end cash balance when the quarterly report comes out by the end of this month.

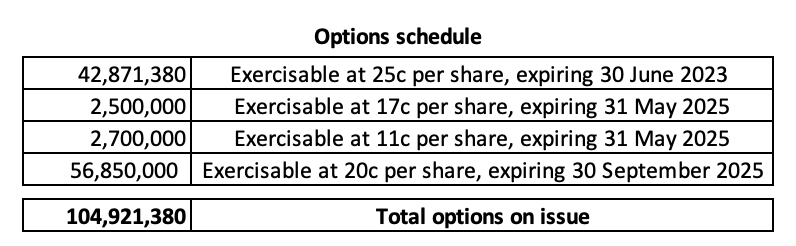

Below are tables of the AKN capital structure AFTER the placement is completed AND assuming the acquisition gets approved and completed.

NOTE: the numbers below become irrelevant if the deal does not get completed or there are changes to the terms and conditions of the acquisition.

The placements and the acquisition both bring a significant number of options exercisable at 20c per share into the capital structure.

Generally these options can create some more churn as the people holding the options look to sell their shares at that level and free carry the options.

This means we expect to see some churn in AKN’s share price at around the exercise price of the options - in this case 20c per share.

On the flip side, these options also provide a future source of funding for AKN should the company’s share price re-rate significantly above the exercise price.

We are hoping as AKN finalises the acquisition, and further explores its uranium project, the market rewards it by re-rating the company’s share price well above the exercise price of the options. In that way, AKN can bring in some cash from the conversion of the options into shares.

What could stop the deal from going ahead?

Completion of the Acquisition is conditional upon the following occurring:

- AKN completing a satisfactory due diligence of the projects and related interests;

- Shareholder approval for the issue of the shares and options to complete the Acquisition, approval of the T1 and T2 share placements (see below), and approval for certain advisor shares and options associated with the Acquisition; and

- Confirmation of the formal grant of twelve of the Prospecting Licences (PLs).

More on AKN’s new chairman - Asimwe Kabunga

Asimwe Kabunga is a Tanzanian-born, Australian entrepreneur based in Perth.

He has an extensive network and a proven track record in the African resources sector, identifying quality projects and unlocking their value.

We are looking forward to seeing what he can achieve with AKN.

Asimwe retains strong relationships within the Tanzanian community, both locally and abroad. He has been central in establishing the Tanzanian Community of WA Inc., and served as its first President. He was also a founding member of Rafiki Surgical Missions and Safina Foundation, both NGO’s dedicated to helping children in Tanzania.

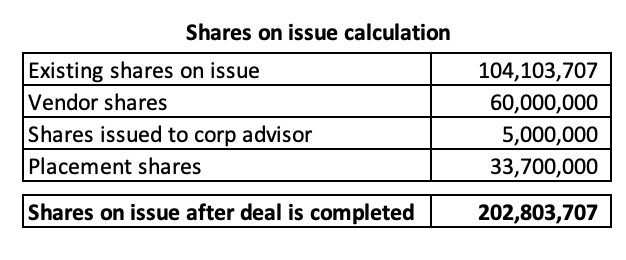

Asimwe also serves as a Chairman of Lindian Resources (ASX:LIN), Chairman of Volt Resources Limited (ASX: VRC) and Executive Chairman of Resource Mining Corporation (ASX:RMI). Here is the one year chart of these companies:

As well as sitting on the boards of all the companies, Asimwe retains significant shareholdings in all of them.

Particularly with LIN and RMI up 674% and 525% over the past year, our hope is that Mr Kabunga can replicate that success with AKN. Of course it's early days for AKN, and we will find out over time.

What’s happening at AKN’s WA base metals project?

Whilst AKN progresses due diligence in acquiring the Tanzanian assets, it is also advancing its Koongie Park project in the heart of the Halls Creek mining hub in WA.

Koongie Park already hosts a sizable resource, currently 8.9Mt containing 1.01% copper, 3.67% zinc, 0.77% lead, 0.16g/t gold, and 26g/t silver (inferred and indicated).

This is set to get bigger, with resources from another prospect (Emull) set to be incorporated.

However AKN requires significant metallurgical work (metwork for short) to find a suitable processing solution that allows extraction of the valuable commodities contained within the rocks, particularly within its shallow Onedin deposit.

If AKN can crack the metwork code to unlock extracting this resource, then it isn’t a big reach to fast-track to early production... which means cashflow.

That said, the market hasn’t really responded to AKN’s progress here. Shares in AKN have traded from our Initial Entry Price of 16.5c to start the year, to under 10c prior to today’s deal - despite AKN announcing a sizable resource upgrade and several positive drilling results.

Perhaps that's because sentiment for copper and zinc explorers has been fairly lacklustre this year as well, and even more so for those in the resource definition phase.

What’s next for AKN?

Uranium acquisition outcome

🔲 Complete due diligence on transaction

🔲 Complete acquisition

🔲 Start fieldwork sampling, review existing data

Further works at WA copper-zinc project

🔲 Revised JORC resource incorporating Emull prospect

🔲 Further resource definition drilling at Emull prospect

🔲 Drilling of two anomalies at Emull prospect

🔲 Metwork progress for Onedin prospect

Our Updated AKN Investment Memo

Below is our 2022 Investment Memo for AKN where you can find a short, high-level summary of our reasons for investing.

We’ve made a few changes to our AKN Investment Memo to reflect this pending acquisition, given its potential to significantly alter its operations.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our updated AKN Investment Memo you’ll find:

- Key objectives for AKN in 2022

- Why we invested in AKN

- What the key risks to our investment thesis are (including updated risks relevant to the potential acquisition of the uranium assets)

- Our investment plan

To access the AKN Investment Memo simply click on the button below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.