New acquisition - Rich history but never been drilled

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and Associated Entities, own 1,250,000 TG1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by TG1 to share our commentary and opinion on the progress of our Investment in TG1 over time.

Our early stage exploration investment TechGen Metals (ASX:TG1) has just added a “walk-up, fully permitted” drill ready gold project into its portfolio of exploration projects.

Today, TG1 announced that it is acquiring a 90% interest in the “Jackadgery” gold project located in northern New South wales.

TG1 has a current market cap of just $7.3M with $2.6M in cash on hand meaning the company currently trades with a tiny enterprise value (EV) of $4.7M.

We have been holding TG1 for over a year now (hello 12 month CGT discount), in the hope that one of the drilling campaigns across TG1’s multiple projects would deliver a material result and share price re-rate.

We like that a new acquisition has added another drill campaign that increases the odds of this happening.

With drilling programs scheduled across its copper/gold projects in the Ashburton Basin in addition to the newly acquired gold project in NSW, TG1 is shaping up for a busy second half of the year full of drilling across its portfolio of projects.

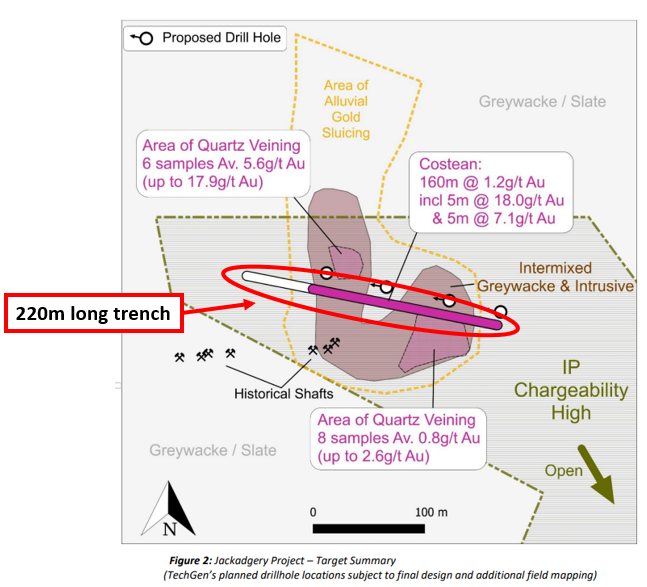

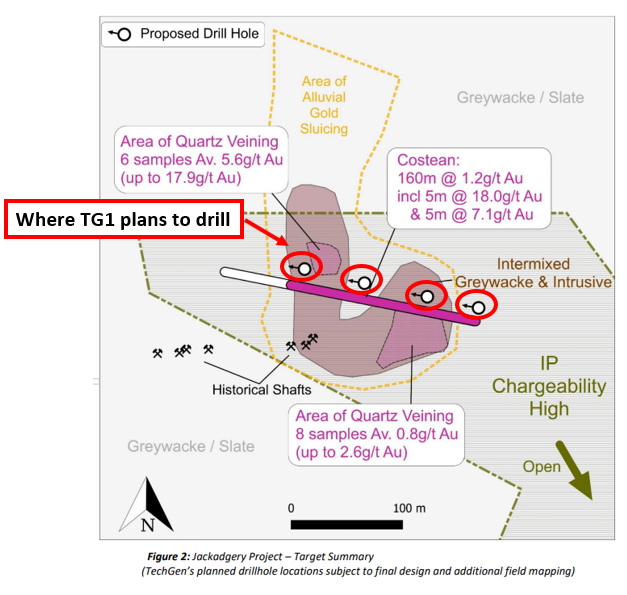

TG1’s new acquisition is an underexplored project that was last explored between 1983 and 1985. At this time, the previous owners Kennecott and Southern Goldfields Ltd dug a 220m long trench and returned 160m of gold mineralisation at grades of ~1.2g/t.

Inside that 160m of mineralisation, there were two higher grade intervals measuring 5m at 18g/t of gold and 5m at 7.1g/t of gold.

At the same time, rock chip sampling to the northwest of the trenching an average grade of 5.6g/t gold across 6 different samples.

These are all extremely high grade gold assays. For some context, an open pit intercept with grades of ~2g/t gold is considered high grade.

However up until now, no one has actually drill tested this project - this is the upside of this acquisition for TG1.

A drilling permit IS in place and drilling targets already identified in and around the previous trenching/sampling results. Importantly, TG1 plans to drill these targets next quarter.

This means that we won't have to wait too long to see TG1 take its first shot at a new high grade gold discovery at its newly acquired gold project.

Considering all of the target generation works done over the project area, the most interesting takeaway from today’s announcement is that the targets were never drilled before.

We think this has something to do with the price action in gold back in the 1980’s with gold seriously out of favour with investors at the time. From 1983 to 1985 (when all of the target generation work was done) the gold price halved from ~US$500 per ounce all the way down to ~US$280 per ounce.

With the gold price now trading at ~US$1,820 per ounce and the macro environment a lot more favourable, we suspect the market will start to take an interest in the project leading up to the drilling program later this year.

With TG1 trading at a market cap of just $7.3M, a high grade gold discovery from surface at this project could see the company’s share price move higher.

The new acquisition has also been structured so that the majority of the consideration is weighted towards future milestones, meaning TG1 only has to pay ~$150k in cash with the remaining ~$2.5M contingent on future milestones being achieved over the next 5 years.

This means TG1 can use its current $2.6M in cash reserves to drill out the asset before it has to make any other payments to the vendors.

We think that given there are well defined high priority drill targets at the newly acquired gold project, the new acquisition immediately goes to the top of the pile in terms of prospects we want to see TG1 drill this year.

This doesn't mean we have forgotten about the copper/gold projects in the Ashburton Basin in WA though.

Two weeks ago we covered the results of some geophysical surveys at the Ashburton Basin copper projects where two high priority IP chargeability anomalies were found right on top of high grade rock chip samples.

Those rock chips returned grades as high as 54.8% copper and 249g/t silver so we are still interested in seeing them drilled.

TG1 is still running VTEM surveys across its other Ashburton Basin project (Mt Boggola), and we expect to see the highest priority targets from both of these projects put together and then eventually drilled in the coming months.

After a relatively quiet start to 2022 (we suspect because of the gold acquisition being put together), TG1 is now moving into the end of the year with what looks like at a minimum two interesting drilling programs.

First, targeting high grade gold in NSW and then targeting copper/gold mineralisation in WA.

TG1 is currently trading at a tiny market cap of $7.3M, and had ~$2.6M in cash in the bank at the end of last quarter.

Given the company is heading into a period of intense drilling, it would be reasonable to assume that TG1 will try to raise additional capital at some stage to shore up the company’s balance sheet ahead of a busy period of drilling. In any case, at TG1’s current levels, with a market cap of less than $10M, there is plenty of room for TG1 to re-rate closer to drilling these targets.

This upside potential makes for good exploration exposure in our portfolio, on a risk reward basis.

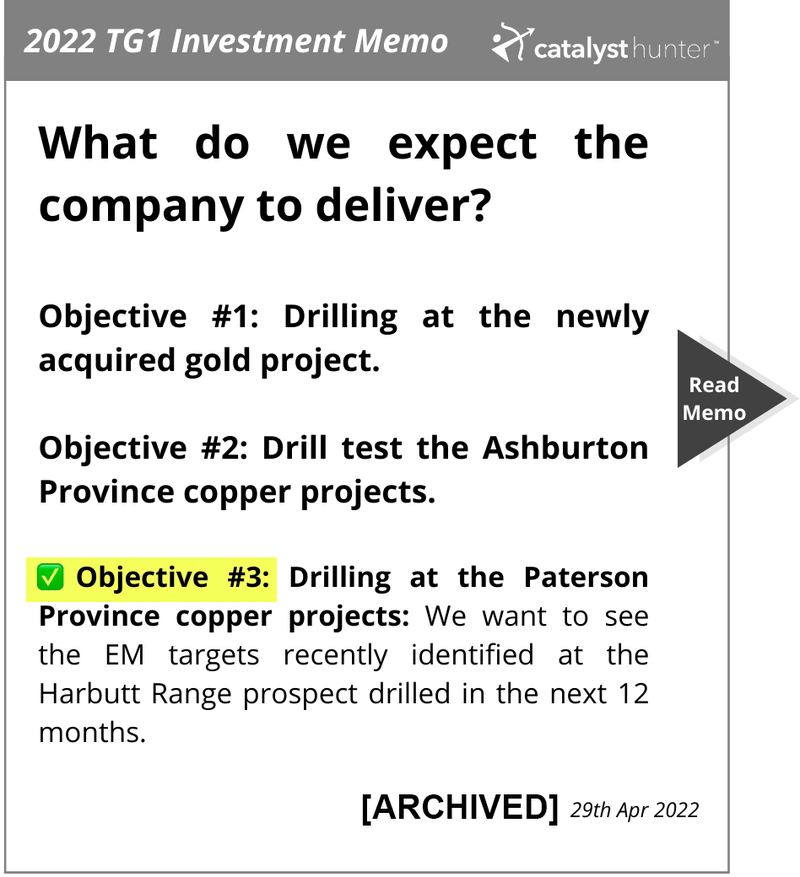

As part of our first 2022 TG1 Investment Memo, we had specifically mentioned that we wanted to see TG1 bring in more advanced exploration projects into its portfolio.

With today’s announcement, TG1 has effectively ticked off key objective #3 of our existing Investment Memo and triggered an Investment Memo revision.

🎓 = To learn more about what type of company events trigger a rethinking of our investment thesis and a subsequent update to our Investment Memo’s check out our educational article here.

With this new acquisition, we have gone back and re-written our 2022 Investment Memo taking into consideration where we think the new project ranks in terms of priority for us.

Below is a list of the things we want to see TG1 achieve for the rest of this year.

Check out our updated 2022 Investment Memo which shows all of the key reasons for our Investment in TG1, all of the key objectives we want to see achieved for the rest of the year and the key risks to our Investment thesis.

More on TG1’s new acquisition:

The announcement today now means TG1 has brought a slightly more advanced project into its portfolio, one with walk up and fully permitted drill targets.

More specifically it has brought in a gold project that is severely underexplored and has NEVER been drilled before.

The last round of exploration over the project was done by previous owners (Kennecott and Southern Goldfields Ltd) between 1983 and 1985.

This was a period of time where the gold price went from ~US$500 per ounce at the start of 1983 down all the way to ~US$280 by the start of 1985.

Effectively the last round of exploration was done at a time where sentiment in the gold sector would have been declining and appetite for new discoveries would have been lower.

Times have changed now with the gold price trading ~15% off all-time highs at US$1,850 per ounce. Gold generally tends to perform well in periods of market volatility, so TG1 has timed its gold acquisition and drilling programs well.

Coming back to the historic exploration at TG1’s new project.

Between 1983 and 1985 the previous owners dug a ~220m long trench above historic gold workings which is mostly made up of several shallow shafts that were mined in the 1870’s.

The three key takeaways from that trenching program was:

- A 160m zone of mineralisation was hit grading at an average of 1.2g/t gold.

- Inside that 160m section there were two higher grade intervals measuring 5m at 18g/t of gold and 5m at 7.1g/t of gold.

- All of this was found at the surface.

At the same time, the previous owners also did some rock chip sampling to the northwest of the trenching works and returned assays as high as 17.9g/t gold with an average grade of 5.6g/t gold across 6 different rock chip samples.

These are really high gold grades, for some context an open pit mine with a grade of 1.5g/t to 2g/t gold is considered extremely high grade.

Most open pit gold explorers today are using cut-off grades of between 0.3-0.5g/t gold, which means anything above that grade is considered economically viable to mine.

🎓 Educational Content: Check out our educational note which details what a cut-off grade is and how they are determined.

To summarise:

- TG1’s new project has already had some trenching work - intercepting ~160m at 1.2g/t gold with intervals as high as 18g/t gold.

- TG1’s new project also has rock chip samples - picking up grading as high as 17.9g/t gold in and around the trenching work.

This all means that TG1 doesn't need to do any pre-drilling work looking for targets, instead it just needs to walk up and start drilling in and around the previous trenching work.

With all of the permitting in place, all TG1 needs to do is get a drill rig sorted and we get to see whether or not these high grade gold finds are pointing to a new gold discovery.

So what is TG1 paying for the project?

Today’s announcement means TG1 will be acquiring a 90% interest in the Jackadgery project.

The payment terms are split into a current and deferred component.

The upfront consideration being:

- $133,250 in TG1 shares at 20c per share (premium to the current share price).

- $20,000 in reimbursements to the vendors of the project.

The deferred consideration being split across four different milestones:

- Class A: $100,000 in cash or TG1 shares within 30 days of the definition of a 100k oz gold resource. (Must be achieved within 2 years)

- Class B: $400,000 in cash or shares within 30 days of a definition of a 400k oz gold resource. (Must be achieved within 3 years)

- Class C: $1,000,000 in cash or shares within 30 days of the Company announcing the completion of a Bankable Feasibility Study.(Must be achieved within 4 years)

- Class D: $1,000,000 in cash or shares within 30 days of commencement of any Commercial Production. (Must be achieved within 5 years)

We especially like the fact that the payments are predominantly weighted in the deferred component of the transaction. This will mean TG1 makes a modest payment to bring in the project after which it can deploy all of its capital to try and make a discovery.

After the milestones are hit, the payments relative to the value of the asset will be minimal considering TG1 can go and raise more cash at higher valuations.

For example if TG1 were to announce a 400k ounce gold resource, we suspect TG1’s market cap would be multiples of where it is today and the $400k payment would be no issue.

The same goes for the commencement of mining and a $1m payment that would come due if the “class d” milestone was met.

Effectively TG1 is only paying ~$150k to bring in the project and can drill out the targets before it has to make any additional payments.

What’s next for TG1

RC drilling at the newly acquired gold project 🔄

Given there is already enough data available for TG1 to drill out the targets across the Jackadgery project, we specifically want to see a drilling program here as soon as possible.

TG1 highlighted in today’s announcement that the project is permitted and ready to be drilled so the only thing left should be to procure a drill rig and get the program started.

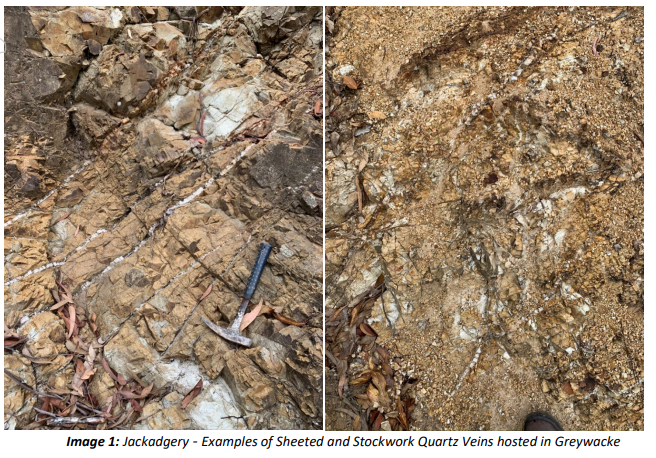

The most recent exploration activity over the project was done by the projects vendor (Who is retaining a 10% interest in the project). That work included IP surveys which defined chareability - resistivity highs and so there isnt really much TG1 has to do before it can take its first shot at a discovery over this project.

The image below shows where TG1 is planning to drill :

More target generation works at the Ashburton Basin projects 🔄

TG1 is still completing the IP surveys (geophysical surveys) at the Station Creek Project in and around the two anomalies found today.

In the company’s latest update TG1 had completed ~70% of the program.

On top of this, TG1 is running some airborne VTEM and magnetics surveys at the Mt Boggola project to firm up some drilling targets for a drilling program which we hope to see before the end of the year.

Drilling program at the Ashburton Basin projects 🔲 (pending the results from the target generation works)

Drilling program at the Paterson Province projects 🔄

TG1 holds three key tenements in the Paterson Province, the nearest term newsflow will come from the Harbutt Range project.

Earlier this year TG1 completed some geophysical surveys and identified some high priority EM/IP targets that warrant drilling.

In the latest quarterly, TG1 mentioned that it is preparing a drilling program to test the highest priority targets for this project.

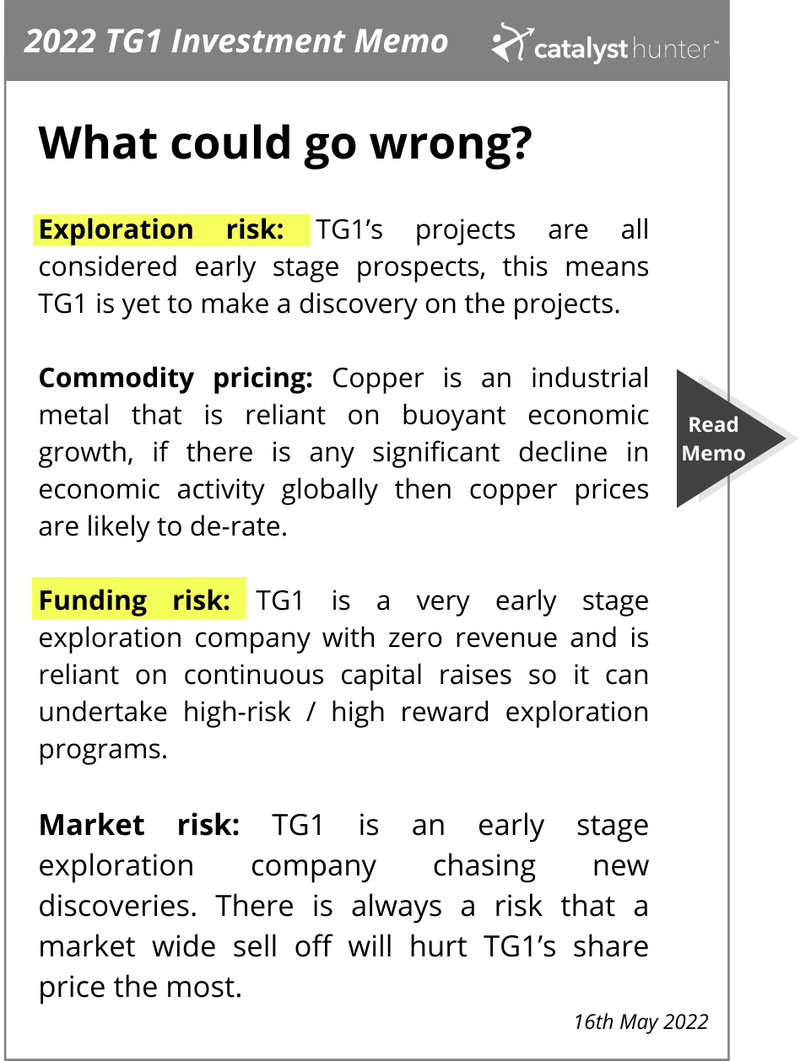

What are the risks?

TG1 is still a relatively early stage explorer, today’s acquisition brings in a new project that has more developed drill targets over it but this doesn't mean TG1 are guaranteed to make a commercial discovery.

There is always a chance that TG1 starts drilling and does not manage to return any intercepts that are indicative of a discovery.

As with any junior explorer, it generally takes several rounds of drilling before a commercial discovery is made and in some cases no discovery is ever made over different project areas.

This also means junior explorers can face funding risks as capital is spent on exploration programs with no return on investment.

TG1 currently has $2.6M in cash at the end of the March quarter but with drilling programs coming across both its Ashburton Basin projects and now at this newly acquired gold project, we think it would be prudent for TG1 to raise some funds if the market appetite for a raise is there.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.