ASX Gold Explorer Days Away From Releasing JORC Resource

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Kingston Resources (ASX:KSN) will release its maiden JORC resource in November, which is expected to set a benchmark for exploration moving forward.

KSN recently merged with Canadian-listed WCB Resources (TSX-V:WCB), in a deal that gave it a multi-million ounce gold project in an underexplored corner of Papua New Guinea (PNG).

That project is the Misima project, which already comprises known mineralisation over seven kilometres of strike and a current NI 43-101 gold Resource of 2.3 million ounces.

N1 43-101 (National Instrument) is a Canadian mineral Resource classification scheme which is effectively the Canadian equivalent of JORC. The pending announcement of its JORC Resource complements the existing JORC 2004 Inferred Resource of almost 50,000 ounces at its Livingstone Gold Project in Western Australia.

The focus of this article, however, is on Misima.

With the WCB merger put away, KSN turned its focus to releasing its maiden Australian JORC resource at Misima and immediately commenced work including completing a JORC Resource, and re-establishing a field team to recommence geotechnical field work.

Importantly for KSN, historical data has enabled it to rapidly identify priority drill targets at Misima, with drilling approvals to be submitted early in the new year and the drill rig to be mobilised by Q2 2018.

A game changing merger for KSN

The significant exploration potential at Misima was too good to ignore for KSN when it first started merger talks with WCB Resources.

However, KSN remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Misima’s history is expansive.

The open pit was mined from 1989 to 2001, when a previous company managed to produce 3.7 million ounces of gold. Misima was closed down, however, when the gold price sunk to US$300 in 1999.

Times have changed. Gold is up. And there is a place for a strategic ASX explorer to try to revive the mine and bring it back to its former glory.

Here’s a look at where Misima sits:

If you look at the numbers in the map above, you can see Misima is surrounded by giants and exists in a region with massive upside potential.

The benefit here for KSN, is that its project is in an underexplored area of this region, but Misima’s history also illustrates huge potential. This is effectively a long life and low cost gold mine, driven by low strip ratio and an industry-leading low cost milling operation.

In essence there is a great deal of upside for KSN here at it looks to build on its $17.8 million market cap.

The merger in a little more detail

KSN has assumed management of the Misima Project and major shareholders are supportive. This is a tightly held stock with the Top 10 owning 55% of the stock, with the $996.8 million capped Sandfire Resources NL (ASX:SFR) holding 11.4%.

KSN currently owns 49% of this project, with earn-in expenditure of A$1.9 million remaining to reach 70% ownership by 31st March 2019. With $3.1 million cash in the bank, KSN is funded to complete this earn-in.

There is one other player in the mix here: Misima’s JV partner PPC, which is owned by JX Nippon Metals and Mining (66%), and Mitsui Mining and Smelting (34%).

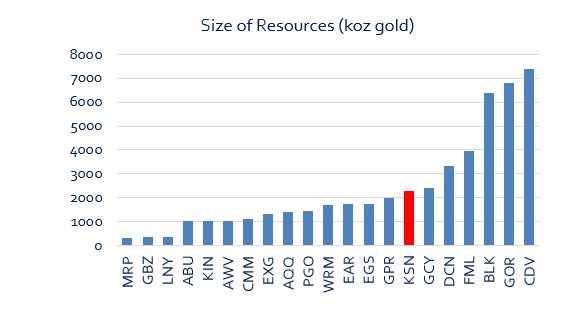

The merger makes KSN a strategic entry point into the small-cap gold exploration corridor.

Here’s a look at the size of the resource post-merger:

The Misima Project

The Misima Project is located on Misima Island, 625 kilometres east of Port Moresby in the Solomon Sea.

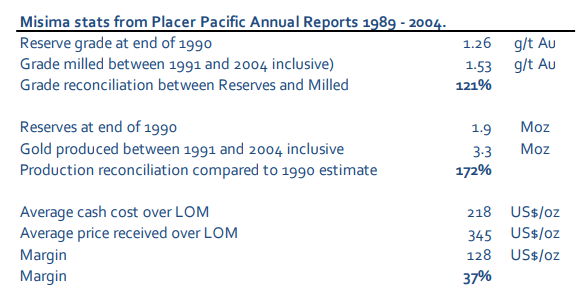

As stated, it was a long life and low cost gold mine, driven by low strip ratios (low relative amounts of waste material) and a low cost milling operation, and also delivered 72% more gold than anticipated at the start of the operation.

A major reason for the low cost was the extremely soft, free-milling ore. This saw Misima milling up to 25% above nameplate during Placer (former owner) days, achieving 6.9 million tonnes per year, with life of mine recoveries of 91.7% gold and 48% silver.

The following table tracks Misima’s Placer stats from 1989 to 2004.

The mine was decommissioned in 2005, but KSN has a real chance now to not only revive the mine, but do it a time when gold is relatively strong.

The coming JORC resource announcement will also help its aims and don’t forget, Misima already has a N143-101 gold Resource of 2.3 million ounces.

Yet, this is still an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

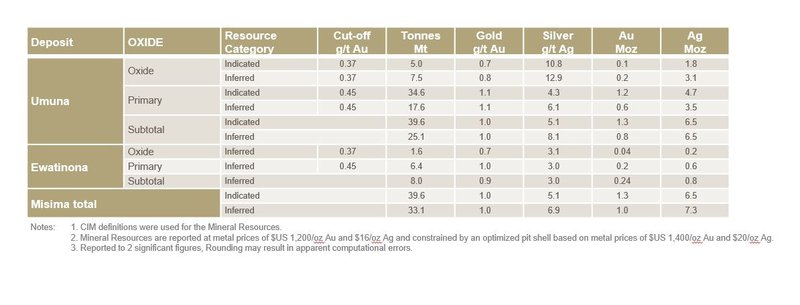

The breakdown of the current resource looks like this:

Of course this is expected to change for the better when the JORC is announced.

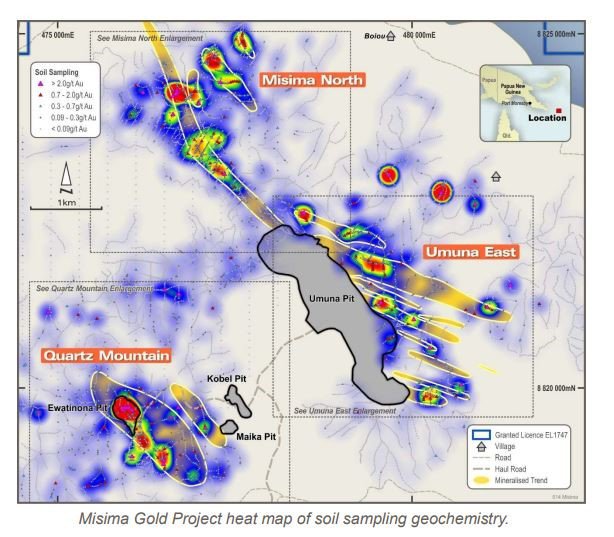

Now with the merger complete, KSN has prioritised several areas for extensional exploration, including Umuna East, which shows mineralised structures on the southeast side of Umuna – up to 1.8km in strike with evidence of high grade, shallow mineralisation.

In addition, the Umuna area which currently contains the bulk of the known mineral resource and remains open along strike and down dip, with both shear-hosted and skarn mineralisation potential

Thirdly, Misima North contains 3km untested strike open to the north, supported by historic mining and geochemistry. This area remains under-explored. Finally Quartz Mountain has an average hole depth to date of 90 metres and mineralisation remains open at depth.

The following map illustrates the upside:

Looking forward

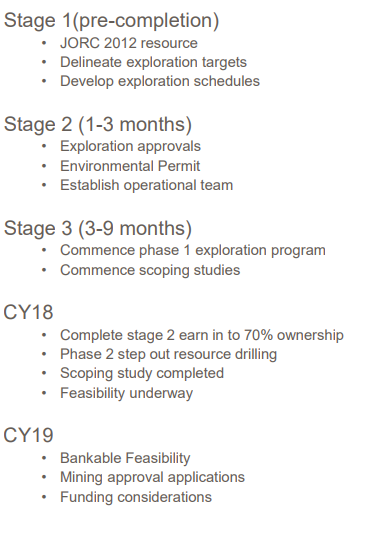

Now that the merger is complete and the JORC is imminent there is a lot of work to be done. Here’s the timeline:

As you can see, it is a pretty full schedule, meaning the potential for an enormous amount of news to come.

First and foremost amongst the news will be the release of the JORC Resource.

This will be followed by a robust exploration program that could turn KSN into a far more advanced explorer with a range of projects that could fast track its progression.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.