PUR aiming to be the 3rd lithium carbonate producer on ASX

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 51,165,999 PUR shares and the Company’s staff own 1,116,668 PUR shares at the time of publishing. The Company has been engaged by PUR to share our commentary on the progress of our Investment in PUR over time.

There’s currently only two lithium carbonate producers listed on the ASX.

The first lithium carbonate producer is currently capped at $10BN.

The second one went to a market cap of over $1BN at the start of this year.

Our Investment Pursuit Minerals (ASX:PUR) is aiming to be lithium carbonate producer “number three” in the coming months.

PUR is currently capped at ~ $40M.

PUR has 9,260 hectares of ground in South America’s Lithium Triangle - home to most of the world’s lithium reserves.

PUR recently acquired a pilot plant capable of producing 100 tonnes per annum of battery grade lithium carbonate.

PUR is aiming to demonstrate it can produce small quantities of battery grade lithium carbonate in the near term.

If PUR can show this, and then progressively scale up its production volumes, we expect an upward re-rate in its valuation to reflect its status as a “lithium producer”.

Beyond its 100 tonnes per annum pilot plant, PUR has a production target of:

- 2,000 tonnes per annum within 24 months, and;

- 20,000 tonnes per annum within 36-48 months.

It’s an aggressive strategy, and today we will unpack it.

Located in Argentina, the salar (or salt flat) on which PUR’s ground sits already has a shallow proven resource of 2.1mt at ~374mg/li from drilling down to ~100m.

This is a good first start, however PUR is going to drill deeper in the coming months to see if it can hit on an even higher concentration of lithium, and eventually declare a JORC resource of its own.

There is precedent on drilling deeper to find higher concentrations of lithium - it has happened on a few other salars in the region before.

And most importantly for PUR, a nearby company has successfully drilled deeper on the same salar as PUR and found higher concentrations of lithium - a peak result of ~925mg/li. This is a good sign for PUR as it gears up for drilling.

For PUR to achieve those ambitious production scale up targets, there are two key goals in the near term that we are looking out for:

- Objective #1: Drill deeper for higher grade lithium - PUR is now firming up drill targets (more on this below) and plans to drill in the coming months.

- Objective #2: Production testing - PUR plans to produce battery-grade lithium carbonate from its pilot processing plant.

In order to deliver the above, PUR just completed a $3M capital raise at 1.2c per share. We increased our Investment in PUR at this time as well.

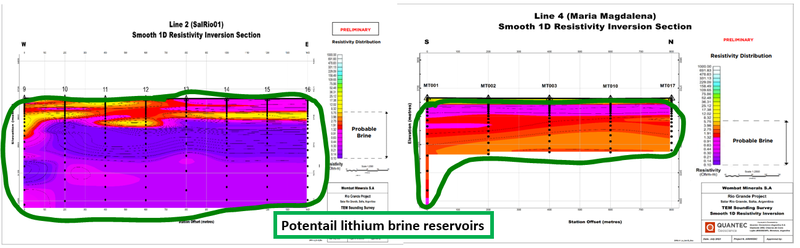

In order to prepare for drilling, PUR confirmed today that it has completed a Transient Electromagnetic (TEM) survey. Here are the key findings:

- Brine shown at depths of 250-300m and beyond, with several major low resistivity layers

- This is deeper than the Rio Grande Salar has historically been drilled.

Simple version: PUR is now firming up targets to drill at depth and hopefully finds higher grades of lithium brine that have not been previously found.

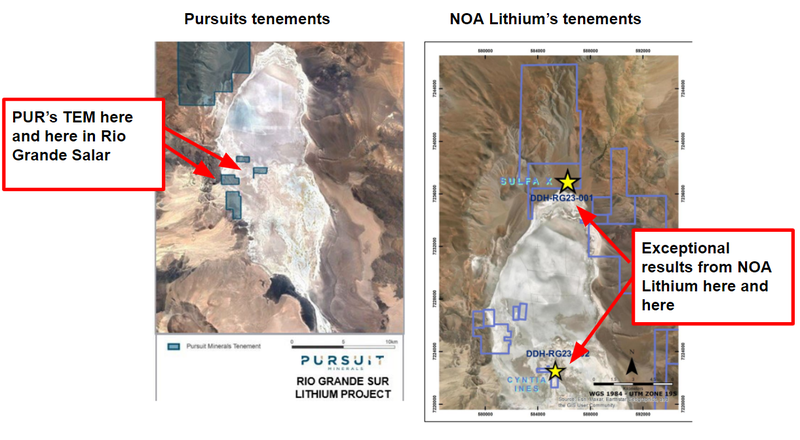

As we noted above, nearby to PUR’s project is a TSX-listed company called NOA Lithium. NOA Lithium successfully found high concentrations of lithium ~2kms away from PUR ground - we believe the proximity of NOA Lithium’s project lends itself to PUR also finding high grade lithium brines.

More on NOA Lithium later.

Furthering Objective #1 - PUR said it expects to be drilling in “Q3/Q4” of this year, which we assume means towards the end of September or some time in Q4.

Furthering Objective #2 - Next up for PUR will be getting a pilot plant up and running, which they have already acquired.

Together, this is how PUR will prove that the brines from their project can be converted into lithium carbonate and successful production from this project would likely be seen as a major de-risking event/catalyst.

All up, there should be plenty of newsflow to come and we think the recent capital raise should provide enough runway for PUR to prove it can produce lithium from its Argentinian project.

Here’s what our PUR Big Bet looks like:

Our PUR ‘Big Bet’

“PUR increases the size and scale of its lithium project to a level that warrants putting it into production. We are hoping this re-rates the company to a market cap of >$1bn (similar to what peer company Argosy achieved)”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our PUR Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For a high level update on PUR’s progress, check out our Progress Tracker for PUR:

More on today’s announcement

Today PUR completed its Transient Electromagnetic (TEM) survey to identify potential drilling targets for lithium exploration.

(Source)

Here are our key takeaways from the announcement:

- Indications of lithium brine reservoirs down to depths of ~300m - to date historical drilling in the Rio Grande Salar has been down to a maximum of ~100m, the survey results are indicating potential lithium brine reservoirs well below the historic drillhole depths.

- Confirmed lithium brine potential at shallow depths <70m.

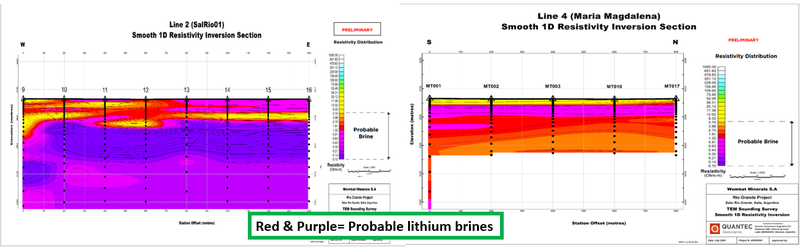

The red/purple sections in the image below are the potential brine reservoirs:

(Source)

At a very high level, the TEM survey is shooting electromagnetic currents underground looking for high conductivity readings.

The colourful blobs show the most conductive areas underground which MAY be an indication of lithium filled brines.

At this stage the results are preliminary and the final results from the program are expected to be received in the coming weeks.

Ultimately, PUR will need to drill and see whether or not these potential targets are in fact lithium brine reservoirs - drilling is expected to start later this quarter/early Q4.

Objective #1 - PUR to drill deeper to try to find higher grade lithium

In a previous note we detailed how we think PUR could go from ~$40M capped developer to hopefully a >$1BN producer.

The first step of the process was to drill down to depths of 500-600m.

With this drilling PUR is looking to try and find more high grade lithium concentrations, and define its own JORC resource.

The Rio Grande Salar overall, where PUR’s project sits in and around, has a 2.1Mt lithium carbonate equivalent resource estimate from drilling to depths of only ~100m.

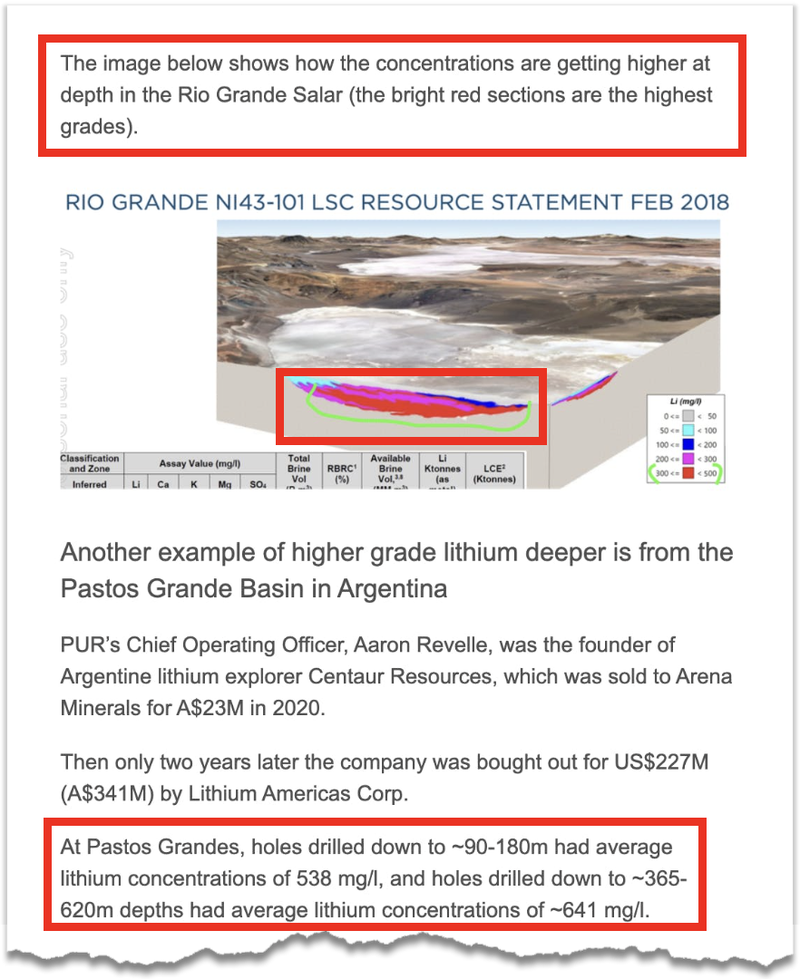

In our last note we touched on how other salars (salt lakes) across the lithium triangle have lithium grades down to depths of >800m.

We also touched on how lithium grades tend to increase at depth. Below is an excerpt from our last article, click the link below to read in full:

(Source)

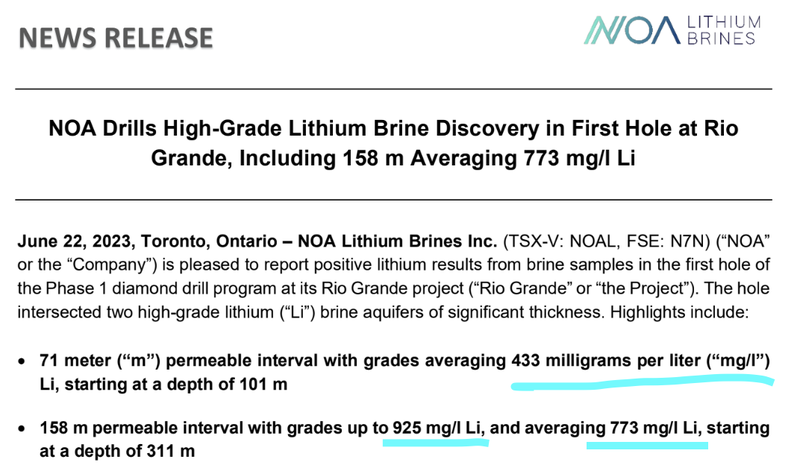

As we noted above, just a few weeks ago we noticed some drill results released from another explorer in the Rio Grande Salar to PUR’s north - the TSX-listed NOA Lithium.

NOA drilled a few holes down to depths of ~600m and hit multiple lithium bearing brine reservoirs.

More importantly though, NOA proved the theory that lithium grades are increasing with depth in the Rio Grande Salar.

NOA hit lithium grades of ~433mg/li from depths of ~101m.

From its deeper holes, NOA hit average lithium grades of ~773mg/li from depths of ~311m.

The highest grade intercept was ~925mg/li and came from depths >400m.

This is a clear indication that deeper drilling does in fact find higher lithium grades in the same part of the world PUR is planning to drill.

For context on the grades - the current Rio Grande resource has a grade of ~374mg/li from drilling down to depths of ~100m.

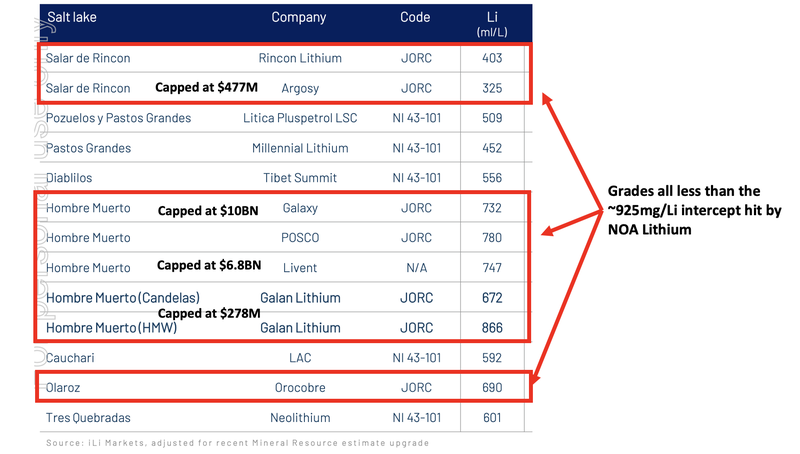

How do the grades compare to other projects in the Lithium Triangle?

So we know NOA Lithium’s hits have shown grades up to ~925mg/li in the same salar as PUR is exploring.

But how do the grades from NOA’s drilling at Rio Grande compare to the JORC resources owned by other major lithium companies?

For comparison:

- $7.3BN Livent’s Fenix project in the Hombre Muerto Salar has a resource with grades of ~740mg/li.

- $10BN Allkem’s Hombre Muerto project has a resource with grades of ~732mg/li.

- $548M Argosy Minerals Rincon project has a resource with grades of ~325mg/li.

(Source)

The current foreign resource estimate for the Rio Grande Salar hosts ~2.1mt of lithium carbonate equivalent at an average grade of ~374mg/li.

If PUR delivers high grade hits at depth then there is a chance for the Rio Grande Salar to host a resource comparable to projects owned by some of the world’s biggest lithium companies.

Today’s preliminary TEM survey results are also showing signs of lithium brine reservoirs down beyond depths of 250-300m.

(Source)

So there is potential for PUR to drill deeper and find grades almost 3x the current grade of the salar’s resource.

NOA Lithium also said that ‘these results rank among some of the highest grading salars in the region’ - which of course is part of the Lithium Triangle - one of the most prolific lithium districts in the world.

Below is a side by side comparison of where PUR’s TEM survey sits in relation to NOA’s drilling:

Clearly, the Rio Grande Salar is showing similar characteristics to other salars across the lithium triangle...

As companies drill deeper they keep finding higher grades of lithium.

Ultimately, this is what we are hoping PUR does when it drills later this quarter/early Q4.

Objective #2 - update on PUR’s pilot production plant

The second part of PUR’s strategy is to put its newly acquired pilot production plant into production - and become the third lithium carbonate producer on the ASX.

The goal of this plant is to produce marketing samples that it can send to potential offtake customers so that PUR can refine and optimise its lithium product.

(Source)

PUR recently purchased a pilot processing plant that has produced battery grade (99.5%+ purity) lithium carbonate in the past.

PUR will be paying in cash, 10% of the ~US$3.6M it cost the vendor to build the plant.

PUR had 90 days from 5 May 2023 to complete the acquisition.

PUR can now put the plant back into working condition at a much lower cost than it would have cost to build from scratch.

Part of the $3M raised last week will be used to put the plant into working condition ready to produce PUR’s first batch of lithium carbonate.

The plant has a ~750kg per day (100 tonnes per annum) production capacity which should mean PUR will be able to produce more than enough to qualify its product and send samples out to offtake partners.

Given the current lithium carbonate spot price is ~ US$42,000 per tonne, getting even some modest production up and running and sold to customers could prove to be valuable.

The pilot plant means PUR can start production testing its project a lot quicker than first expected - meaning a condensed timeline to first production.

We think this is a big de-risking event for the company, and could be a major share price catalyst.

Ultimately the production target for PUR is ~2,000 tonnes per annum within 24 months and 20,000 tonnes per annum within 36-48 months.

To scale up to this kind of production, over time PUR will need to move its pilot plant up to site, scale up the plant to increase its capacity, build evaporation ponds and start pumping its lithium brines to surface.

(Source)

But the first step is getting that pilot plant turned on and producing battery grade lithum carbonate.

What does success look like for PUR - “Argosy 2.0”?

PUR currently trades with a market cap of ~$40M.

PUR’s target is to get its project into production and become the ASX’s 3rd lithium carbonate producer.

The first company to produce was Allkem capped at $10BN.

The second was Argosy Minerals capped at $447M - at its peak it hit a ~$1.1BN market cap.

PUR is looking to become “Argosy 2.0” by doing the following:

- Drill and define a maiden JORC resource.

- Produce battery grade lithium carbonate from its pilot plant

- Scale up production to 2,000 tonnes per annum and then 20,000 tonnes per annum.

Why follow Argosry?

Well, from first resource (in 2017) through to first production (in 2022), Argosy’s share price rose from ~5c per share to a high of ~80c per share.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We think that over the next 12-24 months PUR’s project has the potential to catch up, and (we hope) exceed, the size and scale of Argosy’s.

We are Invested in PUR for the long term to see PUR deliver on its production goals, and that includes continuing to hold the majority of our position through the short-medium term volatility as per our Investment Plan.

Of course - this is no guarantee - PUR is a high risk small cap stock, and lots can still go wrong.

What are the risks?

So over the next 3-6 months PUR’s focus will be on:

- Exploration - refining drill targets then drilling later in the year.

- Production testing - looking to produce battery-grade lithium carbonate from its pilot processing plant.

As a result, in the short term the key risks to PUR are “commercialisation risk” and “resource risk”.

There is always a risk that PUR’s drilling returns low or uneconomic lithium grades AND/OR there may be technical issues trying to get the plant back online.

You can see more on the key risks in our Investment Memo:

Our PUR Investment Memo

Along with the key risks, our PUR Investment Memo provides a short, high-level summary of our reasons for Investing.

The Investment Memo details:

- Key objectives we want to see PUR achieve

- Why we Invested in PUR

- What are the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.