Our 2023 Small Cap Pick of the Year - ASX:SLM

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 2,863,637 SLM shares. The Company has been engaged by SLM to share our commentary on the progress of our Investment in SLM over time. Some shares may be subject to shareholder approval.

Today we are announcing our new Next Investors Small Cap Pick of the Year for 2023.

A “Pick of the Year” is a label we reserve for companies that we think have the highest potential to deliver us outsized returns.

Our Picks of the Year are Investments across our Portfolios we are most confident have all the right ingredients to potentially hit our Investment goal of 1,000% plus returns over a 3+ year hold period.

Some of our past Picks of the Year at their peak from our Initial Entry price include:

- Elixir Energy: +1,208%

- Invictus Energy: +1,057%

- Province Resources: +900%

- OneView Healthcare: +858%

The Next Investors 2020 Small Cap Pick of the Year, Vulcan Energy Resources (also in lithium) was up over 8,000% at its peak.

We Invested in Vulcan at 20c, 40c, 85c and again at $6.50 - VUL traded at over $16 before coming back to ~$3.70 recently in line with 12 months of broader market weakness.

We first took a position in today's new 2023 Small Cap Pick of the Year at 20c, and have just participated in the current placement at 55c for 363,637 new shares (we bid for more but got scaled back).

IMPORTANT: The past performance of our Picks of the Year and early stage lithium Investments IS NOT an indicator that today’s new Lithium exploration Pick of the Year will perform in a similar way - remember early stage exploration is very risky and many things can go wrong - so only invest what you can afford to lose (see risks section in this note for more).

Our 2023 Next Investors Small Cap Pick Of The Year is:

Solis Minerals (ASX:SLM 🇦🇺) (TSXV: SLMN 🇨🇦 OTCQB: SLMFF 🇺🇸 FSE: 08W 🇩🇪).

We added SLM to our Next Investors portfolio last week at 20c - our first addition in nearly a year.

Since then, SLM really seemed to capture the market’s attention, with the company starting the week at ~13c (pre acquisition) and going as high as 63c.

On Monday SLM went into a trading halt, and has just come out now, raising $8M at 55c per share - a modest discount to the last close of 59c, and a 57% premium to the 10 day VWAP.

Major holder Latin Resources increased its investment to now hold 17.79% of SLM. New investors included North American institutional funds.

Today we are announcing SLM as our 2023 Small Cap Pick of the Year and launching our SLM Investment Memo.

Read our full SLM initiation note from last week, and the 11 key reasons we Invested in SLM.

In summary, last week we announced our Investment in SLM because:

- Lithium is hot, lithium in Brazil even hotter - in fact most battery metals projects in Brazil seem to be performing well right now.

- Junior explorers have had success in Brazil - Sigma went from less than $200M to $6.5BN market cap and became Brazil’s first producer in April. Our Investment Latin Resources went from $45M to $470M.

- Latin Resources success - We Invested in Latin at 1.8c and again at 3c. After Latin’s Brazil lithium discovery it is now trading at ~18.5c.

- Same team as Latin Resources (Latin 2.0?) - Latin MD Chris Gale the chairman for SLM. SLM Exec director Matt Boyes holds a country Manager role at Latin.

- Backed by Latin Resources - Latin Resources hold 14% of SLM UPDATE: Latin Resources participated in the 55c placement and now holds 17.79% of SLM.

- Original asset spinout from a well supported, successful bigger company The SLM to Latin Resources structure has some similarities to how Kuniko was spun out of Vulcan Energy Resources. KNI had an outrageous run from 20c to touch $3.60 in the peak of the bull market, and has now settled at 40c.

- SLM Executive Director built a $200m+ lithium company before - Matt Boyes oversaw Red Dirt Mining from $15M market cap to >$200M.

- Low EV and tight capital structure - SLM had 60.5m shares on issue and was capped at $8.5M - UPDATE: post today's 55c placement SLM is capped at ~$41M with at least $8M in the bank and now has ~75M share on issue

- Latin Resources has a big investor following - Latin Resources has ~12,300 shareholders who would be aware of and likely interested in “Latin 2.0” (SLM).

- SLM about to drill what we are calling ‘Pegmatite Grand Canyon’ - SLM is planning to drill within the next 14 days.

- SLM is already listed in the US, Canada and Germany - a bigger pool of global investors can trade SLM stock.

Today we are naming SLM our 2023 Small Cap Pick of the Year because:

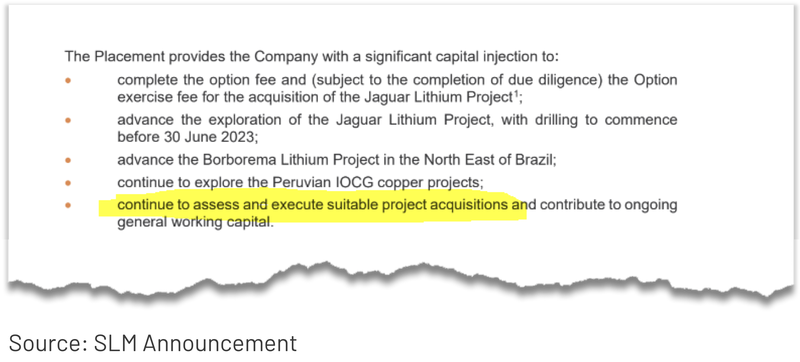

- SLM just raised $8M - SLM now has cash in the bank (~$8M) to fund drilling and option acquisition payments, and potential new acquisitions - enough cash to actually execute the strategy in the medium term.

- No major discount on the capital raise, premium to 10 day VWAP - Placement was done at near the last traded market price - strong signal, the placement was done at a 57% premium to 10 day VWAP, another strong signal.

- Latin Resources cornerstoned the raise - LRS invested in the SLM placement and has increased its SLM holding from 14% to 17.79% - very strong signal and endorsement of SLM from Latin Resources.

- SLM Board and management subscribed for 55c placement shares - collectively for $200k at 55c. We like board and management that has skin in the game and are aligned with shareholders.

- North American institutional funds now on the SLM register - SLM announced today that North American institutional funds came into the 55c raise. This strongly validates SLM’s strategy given SLM’s small market cap (from an overseas fund’s perspective).

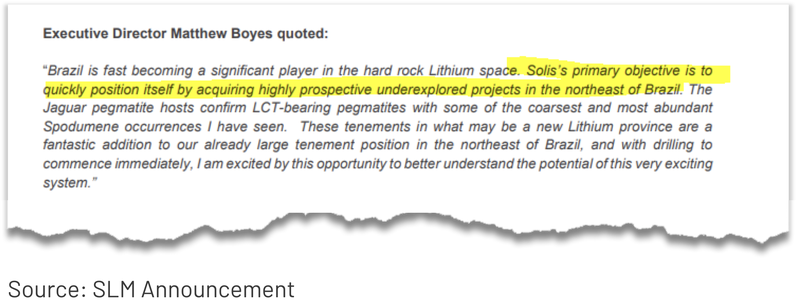

- Now funded to continue acquisition strategy - SLM Exec Director Matt Boyes confirmed in last week’s announcement that the company would be looking to continue adding to its portfolio by making more acquisitions - “Solis’ primary objective is to quickly position itself by acquiring highly prospective underexplored projects in the northeast of Brazil”.

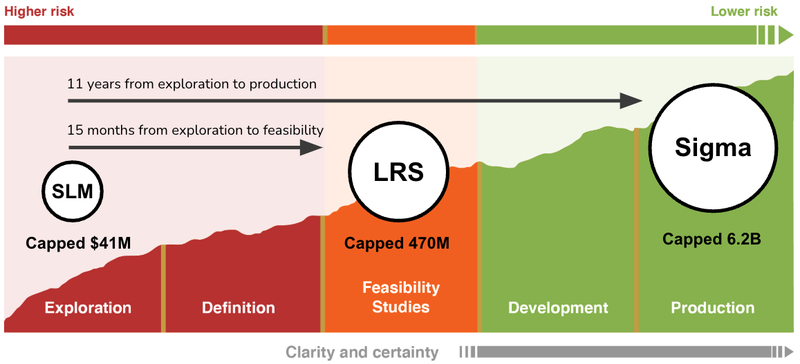

The project acquisition strategy was restated in today's placement “use of funds” announcement:

These are key reasons we have now named SLM our 2023 Small Cap Pick of the Year.

So what happens now?

SLM is now just weeks away from drilling its hard rock lithium project in Brazil.

What we really want to see in the next few weeks is a photo of a glistening spodumene core followed by high grade lithium assays. The market loves a spodumene core photo.

In the medium term, after some (hopefully) positive drill results and a lithium discovery, we would like to see the share price much higher than the placement price and another “Chris Gale special” $25M plus cap raise to fast track drilling and continue to build SLM’s Brazil land package.

We know he has the contact list to do it after the last two cap raises he did with Latin Resources.

This is what we hope to see happen, and there is no guarantee of success here. As with all micro cap stocks, this is a risky investment. The company may not find anything economic on its ground, and, because it is reliant on capital markets to fund its exploration, failed exploration activities can cause dilution at lower share prices.

At SLM, we are backing:

- Matthew Boyes who took Red Dirt from a $15M micro cap to a lithium explorer worth >$200M AND

- The Latin Resources team who took LRS from discovery to resource in under 12 months.

Compared to its Brazilian peers, SLM is at a very early stage in the mining company lifecycle, which is reflected by its market cap that we hope can grow as it delivers on some key milestones.

🎓 To learn more about the mining company lifecycle read: The mining company lifecycle explained.

We are hoping the SLM team can deliver similar success to previous Brazil lithium ventures.

The last lithium micro cap we made our Next Investors Small Cap Pick of the Year back in 2020 was:

- Vulcan Energy Resources (ASX: VUL) in 2020 - which went from 20c to ~$16 peak (a return of ~8,225% at its highest point).

As mentioned before, we Invested in Vulcan at 20c, 40c, 85c and again at $6.50 - VUL traded at over $16 before coming back to ~$3.70 recently in line with 12 months of broader market weakness.

Our Initial Entry Price for SLM was 20c per share.

Now we have added to our position at 55c.

(Important: just because Vulcan performed well does not mean SLM will do the same - small cap exploration is risky, while we always Invest hoping to emulate some of our success with Vulcan, it is unlikely to happen again to that level).

We are Invested in SLM for the long term and plan on holding most of our position for at least the next two years (see our Investment Plan section in our Investment Memo for more details).

In the short term, our focus is on the company’s upcoming drill program.

SLM is planning ~2,500m of drilling over 4-5 diamond drillholes - drilling will be starting in the coming weeks.

SLM will be following the same tried and tested playbook that has led to the discoveries of some of the world's biggest lithium deposits that have delivered billions of dollars in value.

The lithium exploration process playbook goes like this:

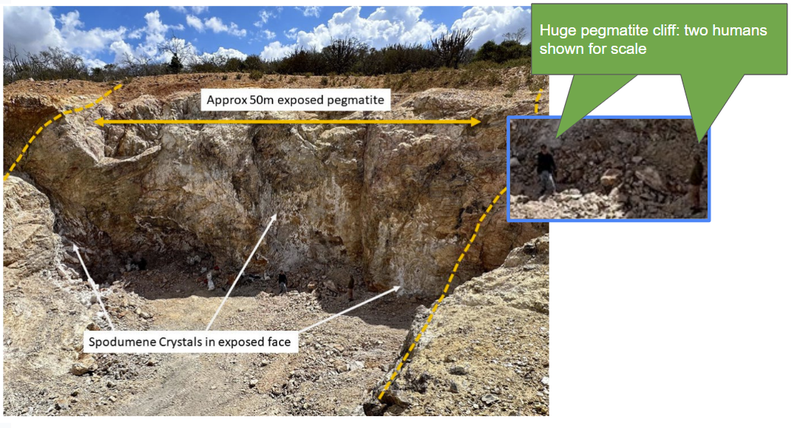

- Map outcropping pegmatites - SLM has already mapped its outcropping pegmatite over a ~1km strike with widths in excess of 50m. ✅

- Sample the outcrop to see if there is lithium - SLM has taken ~5 rock chip samples returning a peak lithium grade of ~4.95%. ✅

- Confirm the presence of spodumene - spodumene is the source rock for the majority of the world’s lithium production. SLM has confirmed mineralised spodumene bearing pegmatites. ✅

- Drill below the outcrop to see how much high grade lithium is there - SLM already has a drill rig and is preparing to drill within the next 14 days. 🔄

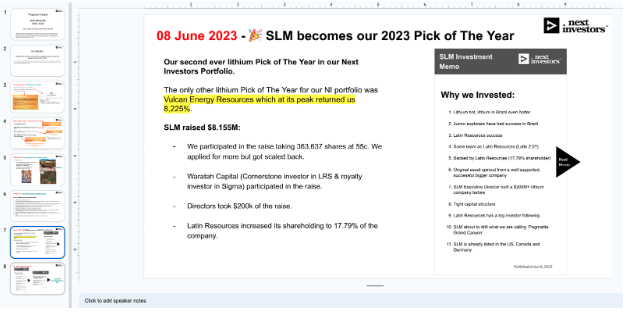

We have named SLM’s target “pegmatite grand canyon” because of how big the outcropping pegmatite is:

After the 55c capital raise is completed, SLM’s market cap will be $41M.

Even at its current valuation, SLM is trading at a market cap with plenty of room to re-rate if the company makes a material lithium discovery with its upcoming drill program.

For context - Latin Resources went from a market cap of ~$45M to a market cap of $337M less than a month after its discovery hole.

SLM already has confirmed spodumene bearing pegmatites and high lithium grades.

Interestingly, SLM’s spodumene crystals are up to 2m wide - bigger than the size of most humans.

SLM’s Matt Boyes commented on the crystals saying “I’ve not seen something like that here in WA or anywhere else”.

For context, the spodumene crystals being found at $2.1BN Patriot Battery Metals project in the James Bay region in Canada were the size of a human head and had the markets interested.

All we need now is for the company to confirm the structures extend below ground enough for a discovery to be declared.

This forms the basis for our SLM Big Bet which is as follows:

Our SLM ‘Big Bet’

“SLM discovers and defines a large resource, leading to a long term re-rate in the company’s share price by >1,000%”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - some of which we refer to earlier in today’s note. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

We look forward to following SLM’s journey over the next few years and sharing our opinions and commentary on SLM’s progress as long term Investors.

To see our deep dive on why we Invested in SLM check out our initiation note from last week:

In our initiation note we mentioned that we would be releasing our SLM Investment Memo once the company has detailed its upcoming drill plan.

SLM’s Matt Boyes outlined a rough plan in the following interview:

So within the next 14 days we expect to see SLM:

- Drill 4-5 diamond holes (~2,500m of drilling)

- Drilling to start within 14 days.

- Drilling is aiming to define the extent of lithium mineralisation.

Once drilling starts, we will be watching for the following:

- During drilling - We want to see a nice photo of visual spodumene in the drillcores. Spodumene is generally the host rock for high grade lithium, visual spodumene will be a positive first indication of potential economic lithium mineralisation.

- After drilling - This will be all about waiting for the assay result - we’ll be looking for lithium grades above a level that is considered typically economical.

We have set up expectations for the assays as follows:

- Bull case (exceptional result) = Lithium grades >1.5%

- Base case (good result) = Lithium grades 1-1.5%

- Bear case (poor result) = Lithium grades <1%

Today we are launching our SLM Investment Memo, where you can find:

- Why we Invested in SLM

- Our “Big Bet” - what we think the upside Investment case for SLM is.

- The key objectives we want to see SLM achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Our SLM Investment Memo

Memo Opened: 8-June-2023

Shares Held: 2,863,637

What does SLM do?

Solis Minerals (ASX:SLM) is a lithium explorer focused on hard rock lithium exploration in Brazil.

What is the macro theme?

Lithium is a critical material used in Electric Vehicle (EV) battery cathodes.

We believe battery metals are the most compelling investment theme of this decade. A lithium supply deficit is anticipated between 2024-2030.

SLM will be looking to replicate some of the success of Brazilian lithium companies Sigma Lithium and Latin Resources.

Brazil is already the world’s second largest producer of iron ore (second to Australia), now the Brazilian government is looking to grow its lithium production.

Our SLM Big Bet:

“SLM discovers and defines a large spodumene hosted lithium resource, leading to a re-rate in the company’s share price by >1,000%”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SLM Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

Why did we invest in SLM?

1. Lithium hot, lithium in Brazil even hotter

We have written extensively about the broader lithium market and the decade long investment thematic we are in.

Once it gets to full capacity, Sigma Lithium will be one of the world’s largest lithium producers.

Off the back of this, “Lithium Valley” was launched in the State of Minas Gerais with the ultimate view of promoting foreign investment in Brazilian lithium projects.

We think a tidal wave of capital is going to come into Brazilian lithium projects. SLM is an early stage Investment in this sector.

2. Junior explorers have had success in Brazil

Sigma has gone from a junior developer with a market cap of <$200M to now trade at $6.5BN. Latin Resources has also gone from <$40M to now trade at $470M. Exploration success in Brazil is typically rewarded with a re-rate in a company’s market cap.

3. Latin Resources success

We have had success Investing in our other Portfolio Company Latin Resources which made a hard rock lithium discovery in March 2022 and has since gone from a share price of ~3.5c to 18.5c per share. Latin is now being called “Sigma 2.0”.

In a similar way, we hope to see SLM become a “Latin 2.0” (while remembering that just because Latin performed well doesn’t mean that SLM will do the same).

4. Same team as Latin Resources (Latin 2.0?)

SLM is backed by the same team that delivered Latin Resources discovery last year.

Latin’s Managing Director Chris Gale is SLM’s non-executive Chairman.

Chris Gale has taken Latin Resources from pre-discovery to a maiden JORC resource in <12 months and managed to raise $72M along the way.

SLM Executive Director Matt Boyes also holds a country manager role at Latin Resources. He has also had previous success in early stage lithium - overseeing Red Dirt Mining as it grew from a $15M market cap to $200M.

5. Backed by Latin Resources (17.79% shareholder)

Latin Resources hold 17.79% of SLM shares - which means they are incentivised to see SLM succeed. We hope that SLM can leverage its Latin Resources connection to deliver success in Brazil for itself.

6. Original asset spinout from a well supported, successful bigger company

The SLM to Latin Resources structure has some similarities to how Kuniko was spun out of Vulcan Energy Resources. KNI had an outrageous run from 20c to touch $3.60 in the peak of the bull market, and has now settled at 40c.

We like to back a successful management team in sectors with strong momentum. We certainly aren’t expecting anything like this again, but note that the management team does play a role in the market's interest in a company.

We also have a view that a lot of the interest in Kuniko initially came from investors that had success with Vulcan, wanting to follow the Vulcan team’s new venture.

7. SLM Executive Director built a $200M+ lithium company before

SLM’s ED Matthew Boyes has been there and done it before.

Boyes was the Managing Director at Red Dirt Metals where he oversaw early development of the Mt Ida lithium project - which took Red Dirt’s market cap from ~$15M to in excess of $200M.

8. Tight capital structure

SLM has only ~75 million shares on issue with the majority held by Latin Resources (17.79%).

We note there are ~27 million options on issue too, with the majority having an exercise price of 30c.

SLM has plenty of room to re-rate if it makes a successful discovery.

9. Latin Resources has a big investor following

SLM should benefit from the crowd of investors that follow (and have made money from) Latin Resources (Latin Resources has ~12,300 shareholders).

SLM is following a similar style exploration process and so investors who have had success with Latin Resources may look to buy into SLM with the hope SLM becomes “Latin 2.0”.

10. SLM about to drill what we are calling ‘Pegmatite Grand Canyon’

In the photo on the acquisition announcement, you can see the exposed spodumene crystals on SLM’s project.

SLM expects to drill test this area within the 90 day due diligence period and see what kind of high grade intersections it can deliver.

11. SLM is already listed in the US, Canada and Germany

“SLM” is the ASX stock code and the primary listing, but we also note that SLM is also already listed on the following other global small cap exchanges: TSXV: SLMN 🇨🇦 OTCQB: SLMFF 🇺🇸 FSE: 08W 🇩🇪.

This means that the potential investor pool that can invest in SLM is not just limited to Australian investors, but also much larger pools of investors in the USA, Canada and Germany.

What do we expect SLM to deliver?

Objective #1: Drilling at the company’s newly acquired Lithium project (option) in Brazil.

We want to see SLM drill its new lithium project prior to the 90 day project option expiry. SLM expects to be drilling in June 2023.

Milestones:

🔲 Drilling commencement

🔲 Assay results

Once drilling starts we will be watching for the following:

- During drilling - We want to see visual spodumene in the drillcores. Spodumene is generally the host rock for high grade lithium, visual spodumene will be a positive first indication of potential economic lithium mineralisation.

- After drilling - This will be all about waiting for the assay result — we’ll be looking for lithium grades above a level that is considered typically economic.

We have set up expectations for the assays as follows:

- Bull case (exceptional result) = Lithium grades >1.5%.

- Base case (good result) = Lithium grades 1-1.5%.

- Bear case (poor result) = Lithium grades <1%.

Objective #2: Complete due diligence and acquire Brazilian lithium projects.

SLM has a 90 day due diligence period within which it can acquire its new Brazilian lithium projects.

We want to see the company run its first drill program and do enough work to justify acquiring its project.

Milestones:

🔄 Due Diligence

🔲 Acquisition completed

Objective #3: Acquire new projects in South America/Brazil.

SLM said in its 31 May 2023 announcement that ”Solis’s primary objective is to quickly position itself by acquiring highly prospective underexplored projects in the northeast of Brazil”.

We want to see the company continue to leverage its in-country experience and acquire new projects in South America/Brazil.

Milestones:

🔲 Acquire/apply for new ground across South America/Brazil.

What could go wrong?

Exploration risk

SLM is yet to have drilled its lithium project, there is always a risk that after drilling the company doesn't find any economic lithium mineralisation.

As a result exploration risk is one of the primary risks going into the upcoming drill programs. Even if SLM does hit lithium, if the result is below market expectation the share price might react negatively.

Funding risk

Like most small cap exploration stocks, SLM is not generating any revenue, and is reliant on capital markets to fuel its growth plans.

SLM just raised $8M (8th June 2023) and should be funded for at least the next few quarters, but at some point the company should look to raise more funds to cover the development of its projects.

This might be at a lower share price if initial drilling results do not meet market expectations.

Sovereign risk

Whilst Brazil is a mining friendly country, it is a developing nation, and there is always some risk with regards to investing here.

Market risk

While lithium is a popular investment theme at the moment, lithium prices have pulled back before and its possible supply/demand dynamics change and in turn impact market sentiment for junior lithium explorers like SLM.

Investment Plan

Our Initial Investment is escrowed for the next two years, so we will be holding 100% of this position until June 2025.

We just have participated in the placement at 55c, this stock is freely tradable but our plan is to hold until the company has had a chance to deliver some material progress.

If the company materially re-rates from the placement price on the back of positive news we may look to Top Slice some of the placement shares to try and claim back our Initial Investment and be Free Carried on the position.

This is our standard plan across all early stage exploration Investments.

Our SLM Progress Tracker:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.