Okapi kicks off Phase 2 of copper-cobalt hunt

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

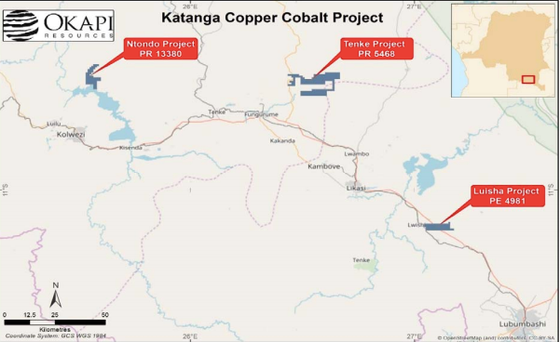

Okapi Resources (ASX:OKR) has kicked off a follow-up field program at the Tenke and Ntondo projects in the Democratic Republic of Congo (DRC) as part of its technical due diligence program across the Katanga Copper-Cobalt Project.

OKR has mobilised field teams to begin its Phase 2 exploration due diligence programs at the Ntondo and Tenke licences.

Orion Geoconsulting and Associates Sarl have been engaged as consulting geoscientists to facilitate the field work, and have significant experience in the southern DRC copper/cobalt belt.

The Phase 2 program will include detailed mapping and sampling programs of each of these license areas, targeting the Roan and Kundulungu exposed rock units identified during Phase 1 field work.

Significantly, these rocks are highly prospective for hosting world-class copper/cobalt mineralisation such as the Tenke Fungurume Copper/Cobalt Mine (Measured and Indicated – 680Mt at 2.5% copper & 0.3% cobalt) and Kamoa-Kakula (Indicated Resource 1.03 billion tonnes at 3.17% copper).

The Tenke Project sits in close proximity to many well-known copper/cobalt deposits — the Tenke Fungurume, Fwaulu, Kansalawile, Kwatebala, Pumpi and the Mambilimba deposits. It is known to have highly prospective Roan Group sediments outcrop in the license area.

Planned Phase 2 work at Tenke will consist of detailed field mapping and sampling. The plan is to cover the entire extent of the license area with mapping at a 1:50k scale.

The work which is currently underway will form the basis of future targeting work, which could include airborne geophysics, geochemical sampling and drilling.

The Ntondo Project, on the other hand, describes a series of rocks of both the Roan and Kundulungu Groups. This geological setting is extremely prospective for both traditional copper/cobalt mineralisation of the district hosted within the Roan sedimentary package (the Tondo copper/cobalt deposit is 12 kilometres east of this license) and for Kamoa-Kakula style mineralisation hosted in the Kundulungu Formation. Kamoa-Kakula is touted as one of the four largest copper deposits in the world and the highest grade copper deposit in the world’s 10 largest deposits.

The Phase 2 work program at Ntondo will be similar to that of Tenke. OKR will be engaging a second field team at Ntondo so as to run the exploration work concurrently with that of Tenke, thereby expediting outcomes.

Legal due diligence continues on the properties within the Katanga Project. Once this is completed, the option agreement with Rubamin FZC (the current owner) will formally begin, giving OKR the rights to invest and earn equity in the Tenke, Luisha and Ntondo projects, collectively known as the Katanga Copper-Cobalt Project.

Although legal due diligence is still in progress, the Phase 2 exploration program has commenced to take advantage of access to the licence areas, given the seasonal implications on field work in the Katanga region.

It should be noted that OKR is still in its early stages and investors should seek professional financial advice if considering this stock for their portfolio.

Managing director, Nigel Ferguson, commented: “We are very delighted to have commenced the Phase 2 work on the Ntondo and Tenke licences.”

“We know this work will form the foundation required to build the geological context around the properties and provide a great geological base for any airborne geophysics which we choose to pursue.”

“We have already sought quotes and commenced logistical work for an airborne EM program over the Katanga properties. This is work that probably sits beyond the scope of the due diligence program but given wet season access problems, the timing is considered appropriate,” Ferguson added.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.