LYN to get to work in the West Arunta - Land Access Signed

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,631,250 LYN shares and 300,000 LYN options at the time of publishing this article. The Company has been engaged by LYN to share our commentary on the progress of our Investment in LYN over time.

Our micro cap exploration Investment Lycaon Resources (ASX:LYN) now has land access agreements signed for its West Arunta project in WA.

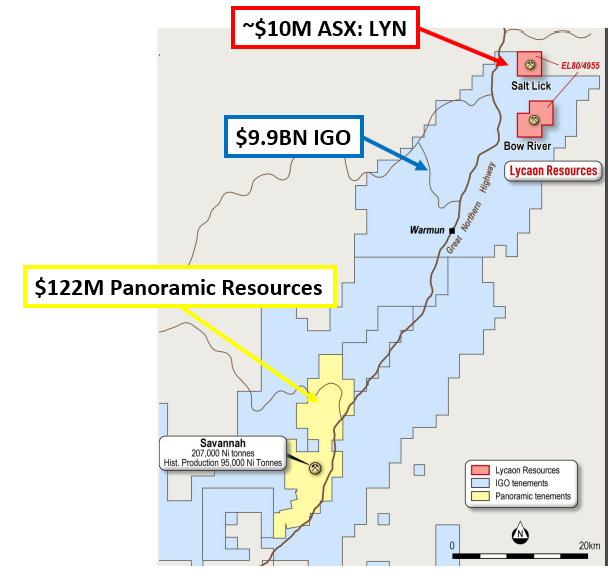

LYN is also currently drilling a nickel-copper target in WA, on ground surrounded by IGO - but LYN surprised us with the news from its West Arunta project.

This week’s news means LYN is one step closer to drilling in the same region, with similar geophysical drill targets as West Arunta superstar performer WA1 Resources.

One of the big exploration stories of 2023 was WA1’s rise from ~13.5c to a high of $7 off the back of a niobium-rare earths discovery in the West Arunta region.

LYN securing this long awaited land access agreement in the West Arunta was no easy feat and has been many months in the making.

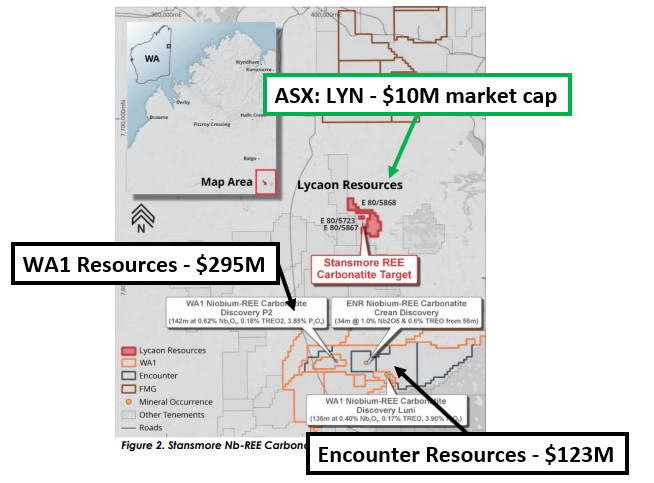

It signals that LYN can now conduct heritage surveys across its 173km^2 of ground in the same region occupied by $295M capped WA1 Resources and $123M Encounter Resources.

After heritage surveys, LYN will be able to conduct on ground exploration, including drilling.

At yesterday’s close price, LYN’s market cap is ~$10M - its much bigger regional neighbours are capped at many multiples of this:

🎓To learn more about the importance of land access agreements read: An introduction to mining permits and what is tenure?

LYN first announced its move into the West Arunta in November 2022 BUT its project was pegged way before WA1 Resources made its discovery.

LYN’s ground has the same type geophysical targets that WA1 Resources and Encounter had pre-discovery, the only difference is that LYN hasn't drilled its project yet.

Up until the WA1 Resources discovery in October 2022, the region was mostly explored for big copper-nickel deposits.

WA1 drilled in October 2022 and hit rare earths and niobium.

Off the back of its discovery, WA1’s share price went up by ~52x in under 12 months.

Pre-discovery WA1 Resources share price was ~13.5c per share, at its peak it hit ~$7.05 per share.

It's the kind of small cap exploration success story all investors invest for, but they don't happen often. For every WA1 there are hundreds of exploration projects that just don't find anything economic.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

LYN is taking the same approach to WA1 Resources

WA1’s discovery was made by running geophysical surveys, finding a big gravity target and then drilling into it to see if it was mineralised...

Lo and behold, WA1 managed to make a discovery - delivering a 52x return in the process.

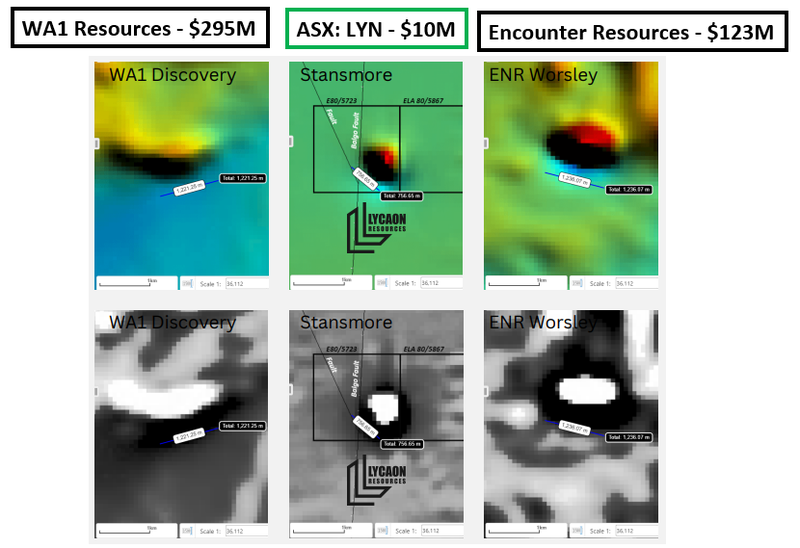

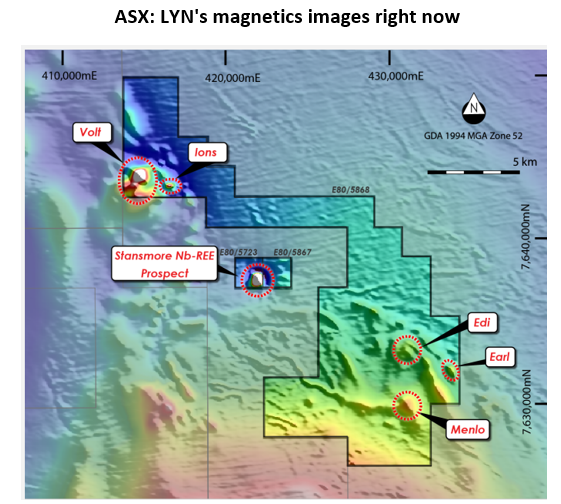

LYN is taking a similar approach to WA1 - it's in the same region and has a similar magnetic anomaly on its ground...

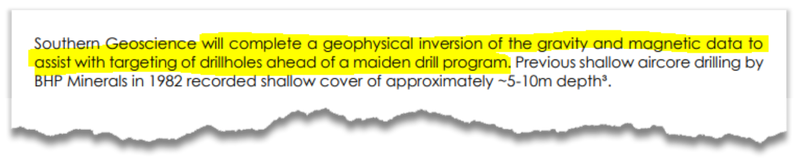

In Monday’s announcement LYN confirmed the next step for the project would be doing more geophysical works to work out the best spots to drill.

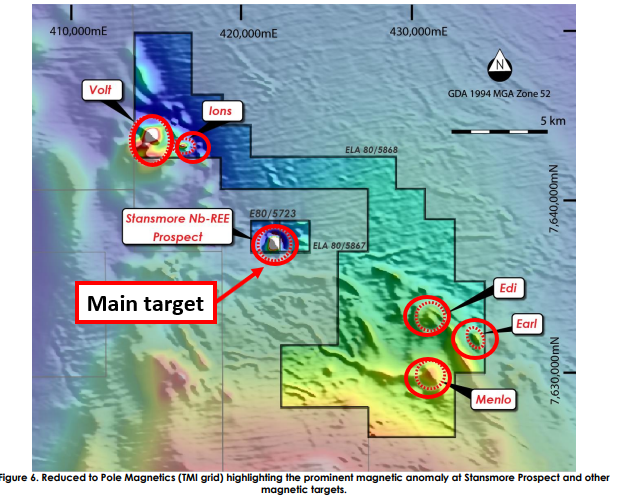

LYN already has six drill targets identified with its main target being the Stansmore prospect.

The next stage of work will be to do additional field work to determine which targets to drill first.

(Source)

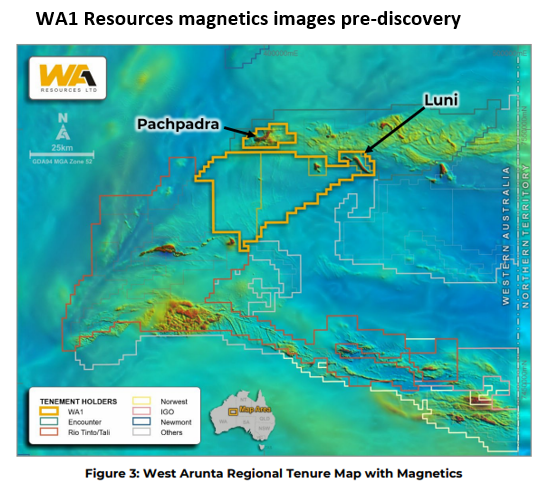

Here is a side by side of LYN’s projects compared to WA1 Resources (pre-discovery) - notice both had distinct geophysical “hot spots”.

(Source)

(Source)

What’s next for LYN’s West Arunta project?

🔄 Geophysical work - precursor to drilling.

🔄 Heritage Surveys - precursor to final permits.

LYN expects to be drilling in the West Arunta in Q2-2023.

Ultimately, we are hoping LYN drills into its targets and makes a rare earths-niobium discovery comparable to WA1 Resources.

LYN is also drilling right now

Drilling in the West Arunta is a while away BUT LYN is also drilling another project right now.

LYN already hit disseminated nickel-copper sulphides on its first hole (confirmed by XRF).

LYN is currently drilling its second hole at its Bow River nickel-copper-PGE project in the Kimberly region, WA.

Once that hole is drilled, it will run downhole EM surveys to see if it can light up any additional targets.

So far, LYN has already hit our “Base Case” expectation - with pending assay results (from both holes) to determine if our Bull Case gets hit.

- Bull Case = intercepts with nickel/copper grades >0.5%.

- Base Case = Sulphides intercepted worthy of follow-up drilling.

- Bear Case = No valuable metals are intersected.

LYN’s target at Bow River is a discovery similar to the one made by Panoramic Resources back in 2014 (Savannah North).

Off the back of that discovery Panoramic hit a market cap of ~$1BN and also managed to attract corporate interest from IGO.

IGO tried to takeover Panoramic in 2019 in a deal worth ~$319M.

Interestingly, IGO holds all of the ground surrounding LYN and Panoramic.

Clearly any major discovery in this area becomes of interest to IGO (and Panoramic) almost instantly.

With LYN trading at a $10M market cap we would hope a discovery at either of its projects are enough to re-rate the company’s share price higher.

A discovery also forms the basis for our LYN Big Bet which is as follows:

Our LYN ‘Big Bet’:

“LYN’s share price re-rates by over 1,000% off the back of a new discovery and the definition of a deposit significant enough to move into development studies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LYN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress LYN has made since we first Invested, we maintain this LYN “Progress Tracker”:

What’s next for LYN?

🔄 Drilling at Bow River Nickel-copper-cobalt/PGE project:

We want to see LYN hit more sulphides with its second drillhole.

With sulphides hit in the first hole, we are looking forward to assay results from this round of drilling.

Any grades above 0.5% nickel or copper would pass our bull case for LYN’s first pass drill program.

🔄 Permitting and approvals for rare earths/niobium project:

LYN is currently running through the land access & permitting process for the ground.

At the same time, LYN still needs to settle the acquisition of its project, which includes getting shareholder approvals for the deal.

What are the risks?

In the short term, with drilling now underway, the key risk for LYN is “exploration risk”.

As always with junior explorers, there is always a chance the company finds sub economic mineralisation and its projects are deemed stranded.

Check out the key risks to our LYN Investment Thesis in our Investment Memo here:

Our LYN Investment Memo

Below is our LYN Investment Memo, where you can find the following:

- Key objectives for LYN for the coming year

- Why we are Invested in LYN

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.