Krakatoa surges 40% as it expands Lachlan Fold position

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Krakatoa Resources Limited (ASX:KTA) traded more than 40% higher on Tuesday with the significant rerating occurring under record daily volumes of approximately 14 million shares.

There has been strong news flow from the group over the last week, and no doubt the rebound in the gold price overnight contributed to positive investor sentiment.

Having hit 5.7 cents, the company went close to matching the previous high of 5.8 cents that was recorded in December 2017.

However, it is more about the underlying news flow that is of most importance because the company is making a foray into one of the premier gold-copper porphyry regions in Australia.

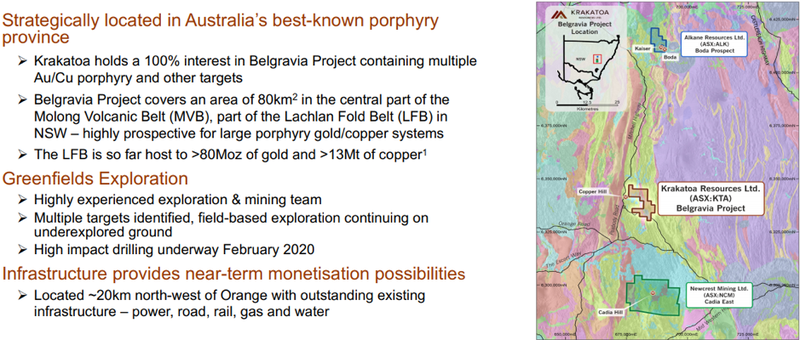

Krakatoa’s Belgravia Project covers an area of 80 square kilometres in the central part of the Molong Volcanic Belt (MVB), part of the Lachlan Fold Belt in New South Wales which is so far host to more than 80 million ounces of gold and 13 million tonnes of copper.

Newcrest Mining (ASX:NCM) has a prominent position in the region through its low-cost, long life gold-copper Cadia East Project which lies to the south of the Belgravia Project.

There has also been a recent discovery to the north of Krakatoa’s tenements made by Alkane Resources Ltd (ASX:ALK).

The MVB is predominantly a north-south trending system of gold rich porphyry mineralisation.

Krakatoa expands position in Lachlan Fold Belt

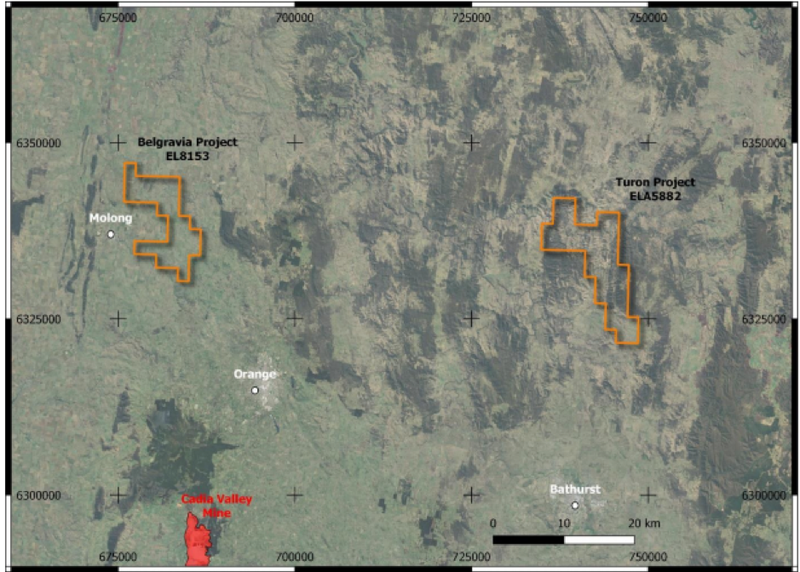

Promising news emerged on Friday when management announced that it had been granted the Turon Project (EL8942) following a direct licence application (ELA5882) in late November 2019.

The Turon Project covers an area of 120 square kilometres and is situated approximately 50 kilometres east of the company’s Belgravia Project, where it has commenced the maiden drill program.

The Belgravia Project is 60 kilometres north-east of Newcrest Mining’s, Cadia Valley Operations, and 30 kilometres north of Bathurst in the Central Tableland region of New South Wales.

The Turon Project lies within the eastern Hill End Trough, where a number of mineral deposit styles are present.

From a geological perspective, these include orogenic gold (and base metal) vein systems, as well as strata-bound base metal sulphide mineralisation.

Management’s initial focus will be on the Quartz Ridge and Turondale prospect areas where a system of quartz reefs can be traced over 1.4 kilometres and 2.4 kilometres respectively.

A number of outstanding gold results from rock chips have been historically returned from this area.

The best of these were at Dead Horse Reef where results included 1530 g/t gold and 150 g/t gold.

The Britannia mine also yielded some strong results including 60.6 g/t gold.

When the drill bits start turning in this area there will no doubt be plenty of attention surrounding upcoming results.

The program will comprise 127 aircore holes over three prospects being, Bella, Lara 1 and Lara 2.

These are part of the Copper Hill and Larras Lee Igneous Complexes, and the former is host to the Copper Hill copper-gold deposit which lies 2.7 kilometres immediately south-west of the drilling site and is the subject of a prefeasibility study.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.