IVZ about to drill main targets - reports higher background gas, better reservoir, heavier hydrocarbons so far

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 6,261,999 IVZ shares and 2,833,212 IVZ options and the Company’s staff own 161,667 IVZ shares and 51,679 IVZ options at the time of publishing this article. The Company has been engaged by IVZ to share our commentary on the progress of our Investment in IVZ over time.

We have been waiting a long time for this one.

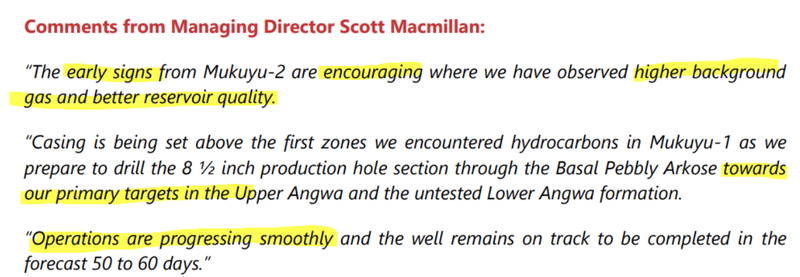

IVZ has just provided another drilling progress update.

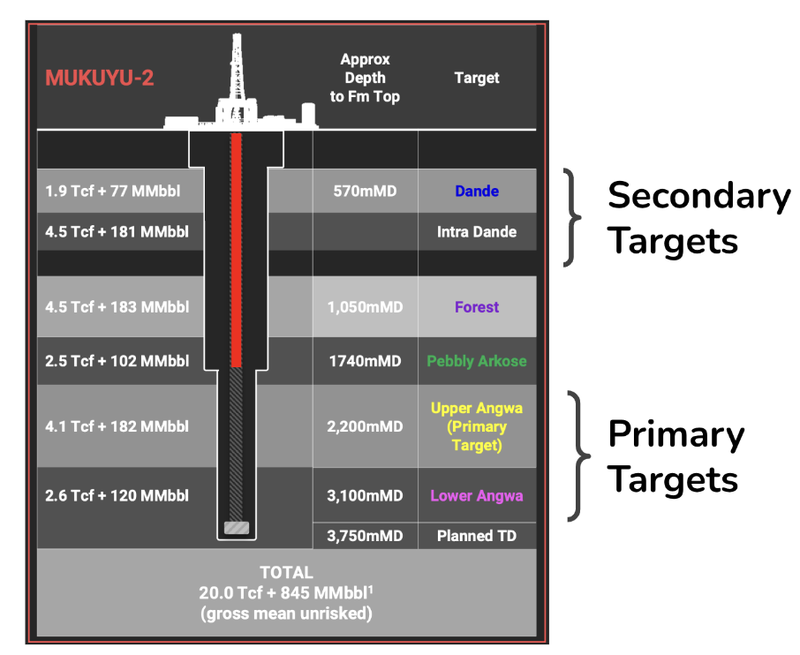

The drill is now at 1,966m depth (out of a planned depth of 3,750m).

IVZ has just announced it has now drilled through the secondary target zones and reported higher background gas and better reservoir quality so far...

IVZ could now be just a week or two away from drilling into its primary target zones.

And then the much anticipated drill results we are all waiting for....

Results of drilling like this is what small cap oil & gas investors wait years for, and often result in wild share price movements (up OR down) depending on the results.

And so far so good it seems from today’s IVZ announcement.

So far the drilling through the secondary zones has revealed higher total background gas than in IVZ’s first well.

IVZ has also announced better reservoir quality than encountered in the first well (average 15% to 20% porosity).

And importantly, so far there are no technical issues to delay the drilling progress, as happened with the first well.

Meaning that this well looks like it will be completed within the 50 to 60 day time frame by around ~ 20th November... about 6 weeks from today.

And then the results...

(Source)

IVZ is now setting drill casing and preparing to drill through the main targets:

Our quick take on the news:

- About 1/3 of the way through the drilling

- Residual hydrocarbons interpreted to be located in secondary targets

- IVZ about to penetrate primary targets

- Background gas encountered so far higher than the first well

- First word about reservoir quality - this was a key risk point from the first well and a good sign that IVZ is talking about this early.

Why we think IVZ’s Mukuyu-2 could be a company maker:

We first Invested in IVZ back in 2020, and we named it our 2020 Energy Pick of the Year.

Over the years, we have written about the different reasons why we think a discovery for IVZ could be a company-making event.

While Mukuyu-2 drill grinds towards target depth, so here is some background reading on IVZ on the days where IVZ doesn’t release any news.

- IVZ holds the key to the basin, if a discovery is made (Basin Master position) - IVZ holds ~80% of its project and if a discovery is made it gets to decide what happens with the project post-discovery.

- Oil and gas majors have paid multiples of IVZ’s current valuation for discoveries across East Africa - some transactions were done at 12x to 224x of IVZ’s implied working interest % on its project.

- Basin Margin ‘String Of Pearls Play’ - IVZ has ~1.2Bn barrel oil equivalent prospective resources across basin margin targets. Basin Margin targets in the East African Rift System have an exploration success rate of 100% - 14 discoveries from 14 wells.

- Directors who have had success in the East African Rift System - After drilling its first well in 2022, IVZ appointed John Bentley as its chairman and Robin Sutherland as its non-executive director. John built from the ground up and sold Energy Africa to Tullow Oil for US$500M and Robin worked for both Energy Africa and Tullow Oil.

- Working conventional hydrocarbon system was declared - with its first well (Mukuyu-1) last year IVZ declared a working hydrocarbon system. Now it just needs to get a fluid sample to surface and declare a discovery.

- IVZ is looking to do what Africa Oil has done before - back in 2012, Africa Oil Corp (TSX.V:AOI) drilled a string of successful wells and delivered a 1,000% share price run and sustained re-rate. We are hoping IVZ does the same thing.

- Carbon offset projects to generate carbon credit revenues - IVZ is in the early stages of building out a carbon offset business that could generate revenues from carbon credits. IVZ is a unique small cap exposure to global carbon credit prices.

- One of the biggest conventional oil and gas prospects globally - IVZ has a gross unrisked prospective resource of ~5.5 billion barrels of oil equivalent making it one of the largest conventional oil and gas targets in the world.

- The Zimbabwe Sovereign Wealth Fund is aligned with IVZ - Back in March 2022, IVZ signed a head of agreement with the Zimbabwe Sovereign Wealth Fund which would see the fund take an interest in the project - this aligns the government and the people of Zimbabwe’s interests with IVZ.

- US$30M in work done by Mobil before IVZ acquired the project - The project had US$30M in legacy data leftover by Mobil from the 1990’s. Interestingly Mobil had never drilled the project before IVZ took control of it.

- Strategically located next to South Africa - IVZ’s project sits next to South Africa which is one of Africa’s biggest energy consumers and is expected to be structurally short of energy supplies over the next decade.

Above is really a snapshot of the many reasons we like IVZ.

Remember that small cap investments are high risk and many things can and do go wrong - we list the risks we have identified and accepted with this Investment at the end of this note and in our Investment Memo.

See the key reasons we Invested and the risks listed in our July 2023 IVZ Investment Memo.

What’s next for IVZ?

Drilling of Mukuyu-2 🔄

Drilling is expected to take 50-60 days to complete. We are now 19 days into the program so given that everything is progressing well and is on track, we expect that the program will be complete in the next ~30-40 days.

2D seismic across the eastern part of its acreage 🔄

IVZ recently completed its 2D seismic program across the eastern part of its project.

The results from the seismic program are expected in November.

Prospective resource upgrade 🔄

After the 2D seismic program’s results come in and IVZ has completed drilling Mukuyu-2, we expect to see IVZ put out an updated prospective resource estimate for its project.

Risks

In the short term, the key risk for IVZ is still exploration risk.

Mukuyu-2 well may not deliver the desired results and in that scenario, we would expect the company’s share price to drop significantly.

Now that drilling has begun, there is also “technical failure risk” where something goes wrong with the drilling that causes delays or issues.

Exploration risk

IVZ is planning two wells, the first is an appraisal well and the second is a new exploration well.

While the appraisal well is somewhat derisked (because it is targeting a known hydrocarbon system) there is still a risk that nothing commercial is found.

There is also a risk of technical failure while exploring.

Commercialisation risk

If gas is found it doesn't guarantee that it can be economically produced, there is a risk that the water content of the gas flows is too high making it uneconomic to extract.

Flow-rates will need to prove that any gas found can be economically produced.

Commodity Price Risk

Ultimately demand for gas and its price will dictate the economic viability of IVZ’s project.

Market risk

If the broader market sells off there is a chance that investors shy away from high risk investment opportunities like oil and gas explorers.

IVZ is a pre-revenue explorer and may be impacted by these market wide sell offs.

Funding risk

IVZ does not generate any revenues and so is reliant on fresh funding for its exploration programs.

This means IVZ is reliant on access to capital, if the markets are unwilling to finance IVZ’s exploration programs the company may need to go slow on its operations or offer large discounts to its share price when raising capital.

Geopolitical Risk

The project is located in Zimbabwe which has a history of political and economic instability, there is always a risk that geopolitical issues make it difficult to advance the gas project.

IVZ has a preliminary Production Sharing Agreement Finalised but the second half is not completed, there is a risk that the agreement is delayed or that IVZ gives up a portion of the project as part of the agreement.

Click here to see all of the risks we list in our IVZ Investment Memo.

Our IVZ Investment Memo

In our IVZ Investment Memo, you can find the following:

- Key objectives for IVZ

- Why we are Invested in IVZ

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.