Blackstone Minerals continues to intersect cobalt

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

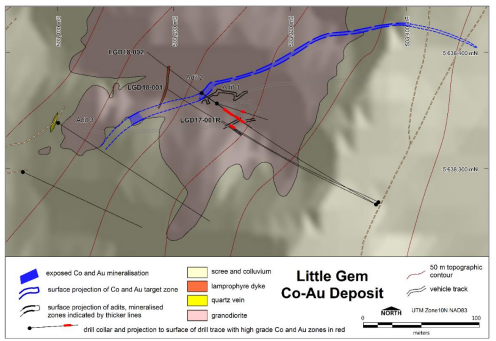

Blackstone Minerals (ASX:BSX) has provided a promising update from its high grade Little Gem Cobalt-Gold Project in British Columbia, Canada.

The company re-commenced its maiden drilling program at Little Gem in late April, with drilling to date intersecting the structure just metres within the interpreted target.

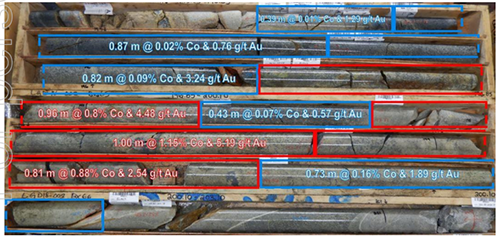

BSX has received assays from its first three drill holes (LGD17-001R, LGD18-001, LGD18-002) at the site, with results to date including:

- LGD17-001R: 1.1m at 3.0% cobalt and 44 g/t gold; within 4.3m at 1.0% cobalt and 15 g/t gold

- LGD18-002: 1.0m at 1.2% cobalt and 5 g/t gold; within 3.2m at 0.8% cobalt and 4 g/t gold

BSX believes the Little Gem alteration halo is larger than previously estimated, with the 2018 drilling to date having consistently intersected a broad alteration zone and highlighting the potential for a significant hydrothermal system on site.

However, it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Assay results are expected shortly for the next three holes from the maiden drilling program.

The company has started a geophysical survey to test for further high grade cobalt-gold prospects within the recently identified 1.8km+ strike target zone at Little Gem and nearby Jewel prospect.

The Jewel prospect is located 1.1km north-northeast of Little Gem and is situated near the (serpentinite/granodiorite) contact zone. The site is prospective for cobalt-gold mineralisation comparable to the world class Bou-Azzer primary cobalt district in Morocco.

BSX Managing Director Scott Williamson commented on the results, “Results from the first three drill holes have confirmed Little Gem has some of the world’s highest grade cobalt-gold mineralisation.

“We are looking forward to the next round of assays and results from the geophysical surveys to define the full potential of the mineralised system and the extensive alteration zone discovered at Little Gem,” he said.

About the Little Gem Project

The Little Gem Cobalt-Gold Project was discovered by prospectors in the 1930’s, who identified a pink cobalt-bloom on weather mineralisation. This discovery led to three adits being developed at the site, with a total of 1,268m of drilling being completed as a result.

Detailed channel sampling was also taken from the adits, with historical work generating the following exceptional cobalt and gold assays:

- Historic drilling: 1.8m at 2.4% cobalt and 112 g/t gold, 3.3m at 1.4% cobalt and 12 g/t gold; and 4.1m at 1.4% cobalt and 11 g/t gold

- Underground channel sampling: 1.8m at 4.4% cobalt and 73 g/t gold; and 2.0m at 3.1% cobalt and 76 g/t gold

- Surface channel sampling: 0.4m at 5.7% cobalt and 1,574 g/t gold; and 0.1m at 4.6% cobalt and 800 g/t gold

Exploration has seldom occurred at Little Gem in modern times, with the main activities being airborne geological surveys in the 1970’s and a further two drill holes completed in 1986.

The second mineral occurrence at the Little Gem site is the historic Jewel Gold Prospect, which supported gold production from 1938 to 1940.

Since BSX began working on the Little Gem Project, it has verified the mineralisation identified historically.

Global cobalt market commentary

Cobalt contributes up to 60% of the total value of lithium ion batteries, which in turn is responsible for more than 50% of global cobalt demand.

The lithium ion battery is projected to become the world’s most significant resource of power, with the adoption of electric vehicles being the key driver.

Bloomberg has forecast that 55% of vehicles sold by 2040 will be electric.

Cobalt is projected to have a significant supply shortage, as current mining activity is only just meeting demand. Cobalt prices have risen from US$10/lb to US$40/lb over the past two years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.