Cheaper than Tesla? New Battery Technology Acquired

Published 17-AUG-2017 00:02 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A battery technology company which could significantly meet burgeoning market demand – and has the potential to disrupt the renewable battery sector at large – is the Israel-based UltraCharge (ASX:UTR).

Steadily emerging as a major player in the global battery technology market, UTR has just revealed a new development in its supercharged repertoire.

UTR has announced its acquisition of a new iron based flow battery technology intellectual property (IP), which comes as part of its recent exclusive licensing agreement with Epilsor.

Of course it is early stage of this partnership and interested investors should seek professional financial advice if considering this stock for their portfolio.

Following a comprehensive review of the IP portfolio under the licensing agreement, UTR has confirmed the leading technology is an iron based flow battery technology.

This technology can significantly reduce electricity costs for households and communities in remote or rural locations and offers unprecedentedly affordable durability.

In fact, it appears that UTR’s new technology, coming in at costs of 13c/kWh, is cheaper than Tesla’s estimate for the PowerPack, which will run at 15 to 16c/kWh by 2020.

The Energy Storage Market

As we transition into a cleaner energy climate, it’s undeniable that the rechargeable battery market is rapidly surging.

Riding the wave of the fast-growing renewable energy sector, which is poised to reach US $777 billion by 2019, is also a growing demand for durable, safe, high-performing, not to mention affordable, energy storage technologies.

The pressure for energy storage technology to balance supply and demand is set to rise globally by 47% in 2017.

A particularly ripe market within this purview is rural electrification, with the number of people without electricity access in these areas dropping from 1.4 to 1.2 billion in 2010-2030. Here, 60% of electrification tends to be off-grid with mini-grid applications. This is a market currently worth $154 billion.

Australia is predicted to be the largest market for battery storage on account of its steep electricity costs and pervasive household usage of solar panels. And UTR’s newly acquired iron flow battery technology could provide a cost-saving, durable and environmentally friendly solution.

The Catalyst: Technology Now Acquired, Research to be Fast Tracked

UTR’s newly acquired flow battery technology enables efficient use of renewable energy production, allowing for load balancing during peak demand and off-peak power storage, resulting in an uninterrupted power supply.

It’s also intriguingly economical – estimated low manufacturing and operating costs place the battery in the first quartile.

Initial analysis suggests a low installation cost of approximately $250/kwh, at a system cost of 1MW. Operating costs are estimated to be up to half the cost of diesel alternatives, and capital expenses to be $200/kw DC.

Given that there are currently no known commercially viable energy storage solutions with a cost point of $200/kwh, this technology has considerable market-busting potential.

This IP acquisition further amplifies UTR’s expanding IP portfolio and fast tracked current research programs in developing a world class nanotube anode for lithium ion batteries....

It also provides a salient opportunity for the $23 million-capped UTR to position itself as a leader in the lithium ion and flow battery technology space.

However, the stock does remain speculative and investors should take a cautious approach to any investment decision with regard to this stock.

The Technology: Unique iron based flow battery technology

UTR’s solution is a high power density flow battery based on breakthrough, patent-pending technology which could present game-changing advantages to the entire battery industry.

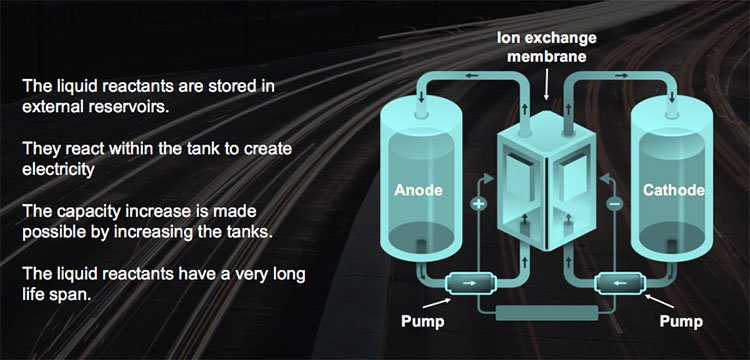

A flow battery is a type of rechargeable electrochemical cell. Flow battery technology provides energy reliability and availability when integrated with renewable energy sources, storing intermittently produced solar and wind power and dispatching the stored energy into the grid when demand is there.

The technology UTR has in its grasp is a unique anode/cathode combination with proven reliability and long-term stability. The robust battery chemistry offers a long-cycling lifetime and the ability to store excess power at off-peak hours.

The immediate advantages of this solution are its highly efficient and reliable power production, ability to produce high levels of durable power supply, and low environmental impact.

How it works:

This battery technology has very high MW capabilities, with 6MWh/1MW system planning and 70% efficiency. With its ability to supply 4-12 hours of continuous power without the need for recharging, UTR’s solution is ideal for hospitals, military bases, and other enterprises that need consistent, uninterrupted and independent power supply.

It’s also safer and more environmentally sound than traditional lithium-ion batteries.

Unparalleled cost advantages

One of the most impressive advantages of UTR’s iron flow storage solution is its low manufacturing and running costs, with life cycle costs of 13¢/kWh by 2020.

In contrast, Tesla has estimated that its Powerpack battery will run at 15 to 16c/kwh by 2020.

Installation costs for UTR’s solution are estimated to be around $250/kwh, with a system cost of 1MW. Operating costs are expected to be up to half the cost of diesel alternatives, and capital expenses are estimated at $200/kw DC.

The market growth of UTR’s energy storage technology is also expected to be exponential – according to CEO, Kobi Ben-Shabat, comparable to the growth of solar energy.

However, how much of the market UTR can attract remains to be seen and investors should take all publicly available information into account before making an investment decision.

UTR’s IP acquisition will enable its target market to expand from the electrical vehicle demographic to incorporate households and energy storage for remote communities, as well as utility-scale and grid integration applications.

On a broader scale, there are ample opportunities for flow batteries to both complement and encourage the widespread use of renewable energy, with significant economic and environmental implications – and with UTR adding to its IP arsenal, it’s in a strong position to take on a major role in this rapidly expanding renewable technology landscape.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.