SGC Days Away from Potentially Company Making Drilling Event

Australian-based energy company, Sacgasco Limited (ASX:SGC) has mobilised its contracted drill rig to its Borba 1-7 Well in the Northern Sacramento Basin onshore California.

SGC is currently capped at just $38M and is on the eve of a potentially transformational drilling event.

Now as with all gas exploration plays, there is no guarantee of success here – but right now, SGC is possibly the ASX stock with the most leverage to a large gas discovery in the coming weeks.

Investors will not have long to find out the outcome here – the drill rig is being mobilised – and spudding will happen within the coming days. The drilling process is expected to take 25-35 days.

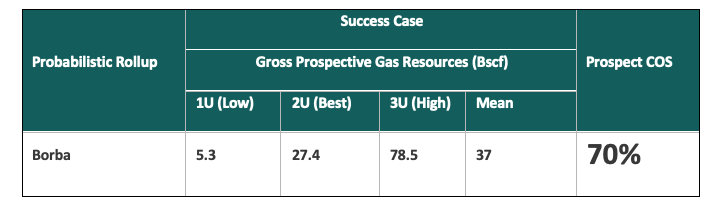

Also of note here, are results of an Independent Prospective Resources Report of the Borba Prospect, which has been completed by ERC Equipoise Pte Ltd (ERCE).

The ERCE report has assessed a Mean Unrisked Prospective Resource of 141 Bcf (Gross 100% JV) and 74 Bcf (Net SGC Entitlement Share after Royalty) of recoverable Natural Gas for the Borba Prospect.

The chance of intersecting at least one gas zone has been estimated at 70%.

This report complements SGC's own analysis of the resource potential for the broader Borba Trend SGC now controls – this could be another major catalyst in its own right.

The Borba 1-7 well will be drilled to test multiple stacked 3D seismic anomalies in the interval from 3,200 feet (975 metres) to 9,500 feet (2,800 metres) depth and will finish in Basement rocks.

The prospective interval covers around 6,300 feet (1,920 metres).

This drilling event is two years in the making, and comes after the company recently raised $5M at 6.5c per share.

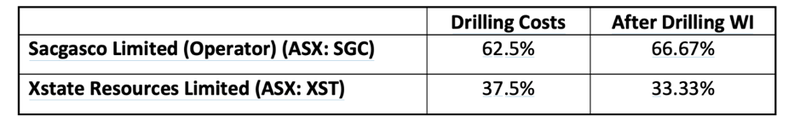

The current leverage to project for SGC investors is 67.77%, with XState Resources Limited (ASX: XST) holding 33.33%.

Borba is a technically attractive project, located in a market that is under supplied and pays a premium for Natural Gas.

In fact, the unsatiated 7 BCF/day gas market in California imports over 90% of its natural gas from Canada and other US states.

Local supply would be welcome and the size of SGC’s prospects in California have the potential to supply both domestic Californian natural gas and export LNG markets, including those in Asia.

The timing of the Borba drilling also coincides with a sustained increase in the prices of oil and gas.

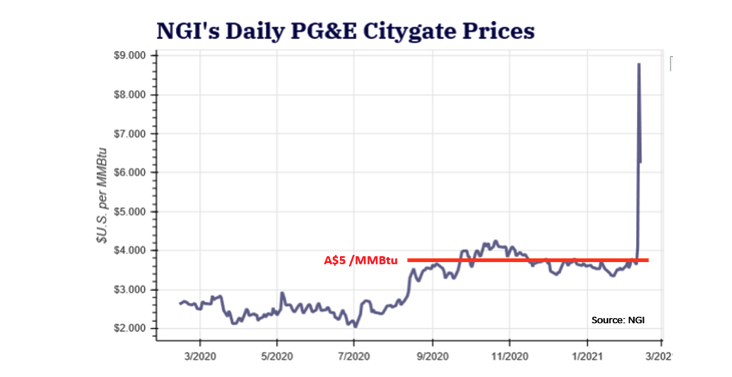

Natural gas prices in Northern California have averaged around A$5/MMBtu in recent months. There are approximately 1,000,000 MMBtu in 1 BCF of recoverable gas.

An increase in gas prices complements SGC’s recent strategy of increasing its asset base through a growing portfolio of attractive production assets.

This includes the recent 20% Working interest (WI) in oil and gas producing assets in southern Alberta, Canada and a 30% working interest in the 1,000 barrels of oil per day (bopd) Red Earth asset, consisting of six oil fields and associated infrastructure also in Alberta, Canada.

News of the Borba spud sent SGS’s share price soaring by 25% in just 10 minutes of trading last week, so the story is definitely capturing investor attention.

We first invested in SGC in November last year, when we alerted readers to the fact that drilling could open up a new fairway in this prolific gas basin, and we liked the upside.

We also liked how SGC compares the Sacramento Basin with our own Perth Basin, where Strike Energy (ASX: STX) and Warrego Energy (ASX: WGO) have been making their mark and in doing so experienced significant share price increases in 2020.

Strike Energy has a market capitalisation of about $511 million while Warrego Energy is capped at approximately $222 million. Strike has defined a gross contingent resource of almost 1.2 trillion cubic feet of gas at its West Erregulla Project. Any further success here, should be the catalyst for another rerating.

We are hoping SGC’s management team, which has a proven record of identifying new projects, bringing them into production and managing sustained output, can have similar success to these Perth Basin players.

SGC MD Gary Jeffery certainly thinks it can saying, "It is worthwhile comparing the recent drilling at West Erregulla in the Perth Basin (the Little Brother of the Sacramento Basin) where a similar high COS of discovery and development of 69% was predicted ahead of the successful well results, high pressure, high-rate gas flows and market excitement, albeit from significantly deeper reservoirs, while incurring higher costs and depending on a smaller gas market.

"It is also instructive to compare drilling Borba, onshore at a cost of less than A$6 million practically connected to a massive local gas market, to the recently drilled Ironbark well offshore the Northwest shelf, drilled for a single target in deep water at a cost of reportedly over $80 million.”

We think that SCG’s market capitalisation implied valuation of approximately $37 million doesn’t appear to accurately reflect the value of its existing producing wells (more on that shortly), in-ground resources and data bank, or the monetisation benefits that lie in owning its own infrastructure.

If the company is successful in making a discovery at Borba, we would expect SGC’s market cap to be multiples of its current valuation.

The catalyst – Rig mobilised, spud imminent

Sacgasco’s strategy is to find, acquire and develop undervalued and under-developed opportunities connected to materially under-supplied oil and gas markets across the world.

The near term strategy is to target the Borba 1-7 well, and the interception of good reservoirs at this location is expected to lead to further opportunities in a new play fairway in this area.

Now, SGC is just days away from spudding its Borba 1-7 well.

The company announced this week that it has signed a drilling contract that will facilitate the imminent spud of the Borba 1-7 Well in the Northern Sacramento Basin onshore California.

The rig is being mobilised to site and drilling will commence within one week.

As stated, this is a significant milestone for Sacgasco and is no doubt a contributing factor in terms of the company’s shares more than doubling in the last two months as the much-anticipated spud drew closer.

Rig 5 mobilisation involves 35 truckloads of equipment and will take 5 to 6 days to rig up and spud the well. =

Graham Drilling Rig 5 is rated to over 13,500 feet and has 750 HP mud pumps. The well will require a 10,000-psi rated control stack on the 9 5/8” casing below 6,000 feet. The well will have 3 strings of protective pipe.

The well will be drilled with a small directional component to optimise the intersection of the multiple seismic anomalies on 3D seismic. The well is expected to take some 25 - 35 days to drill.

The Working Interests (WI) in the Borba 1-7 well and Borba AMI are:

With the Borba Spud, upcoming exploration results, the release of an independent resource report and commentary on the potential for the broader Borba trend, it isn’t surprising that the company has caught the attention of investors with daily trading volumes consistently breaking new records in recent weeks – volumes on Tuesday were the second highest in the last eight years.

The well is expected to take between 25 days and 35 days to drill, and in commenting on the underlying strategy at Borba and upcoming developments managing director, Gary Jeffery said, “My view is that Sacgasco is without doubt the best ASX-listed company leveraged to a very big gas play.

“Borba is a most technically compelling, low risk, onshore prospect, located in the massively under-supplied and hence premium-priced Natural Gas Market that is California.

“The Borba well is the logical next step in evaluating the world class potential of the older sediments in the Sacramento Basin. There is plenty of room on the well site to skid the rig to drill further wells upon success.

“The Sacgasco led JV owns pipeline access equipment less than 5 miles from the Borba well site which means we can monetise a successful producing natural gas well quickly and cost effectively.”

Additional SGC assets

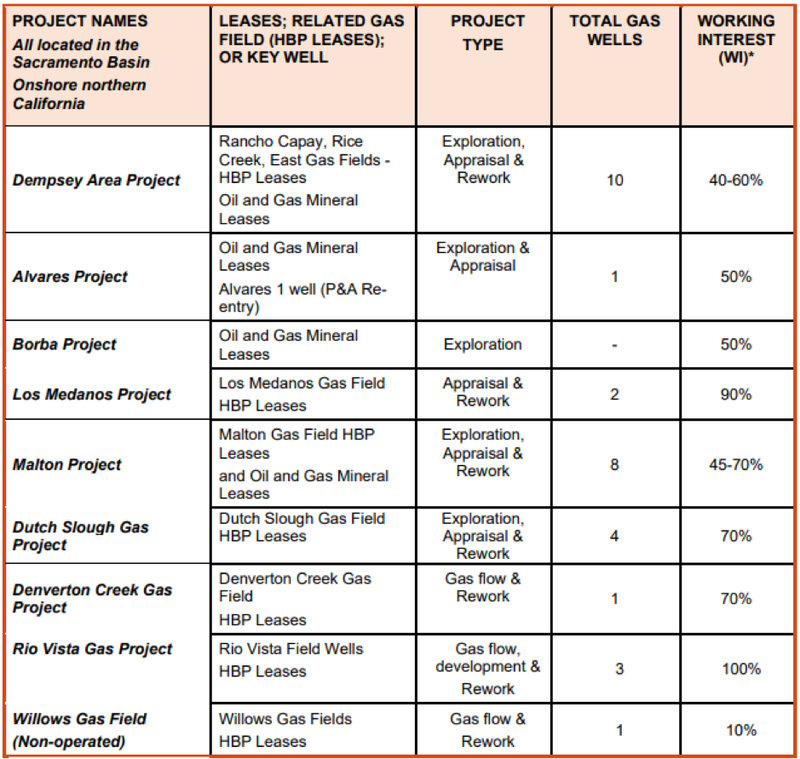

It is also worth noting that Sacgasco has working interests in a number of other wells in the Sacramento Basin.

SGC is the Operator of all but one of the following wells, highlighting management’s extensive industry experience, local knowledge and access to an operating team with unrivalled local drilling and production experience.

Importantly, the Rio Vista, Los Medanos, Malton and Dempsey Area projects, as well as the Willows Gas Field are at the production stage.

Sacgasco has full ownership and is the operator of the Rio Vista Project which has three wells.

With the addition of a 30% working interest in the 1000 barrels of oil per day (bopd) Red Earth asset, consisting of six oil fields and associated infrastructure in Alberta, Canada, it isn’t difficult to appreciate that the company is significantly undervalued.

These are long-life assets that strengthen Sacgasco’s production and development portfolio in North America. As well as having a strong production profile, the Red Earth assets have proved reserves of 4.4 million barrels with a further 2.3 million barrels potentially producible based on proved plus probable (2P) reserves of 6.7 million barrels of which SGC has 30%

Can the Sacramento Basin deliver a “Perth Basin” like event for shareholders?

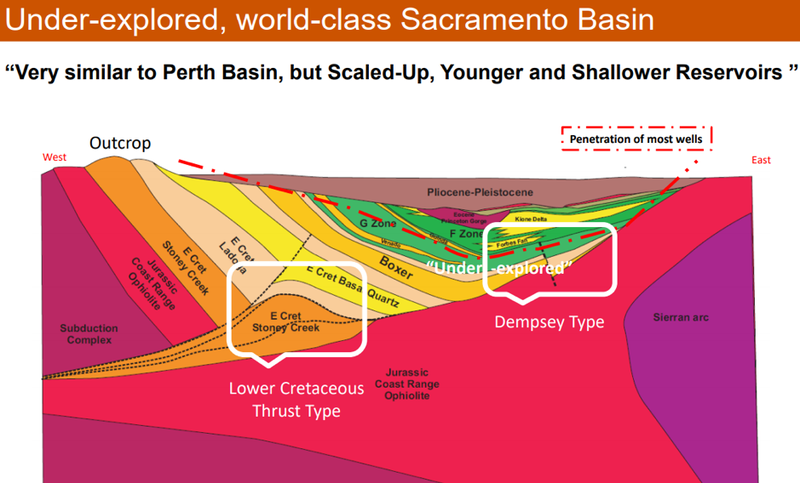

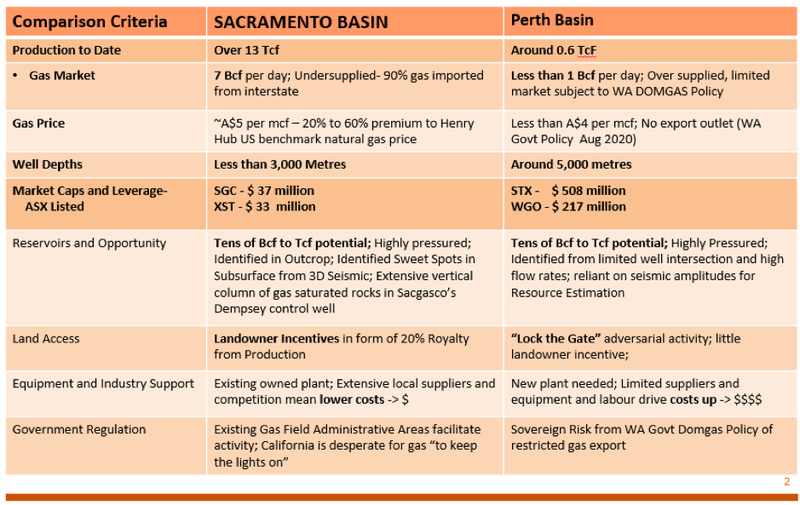

While direct peer comparisons are difficult to find, the Sacramento Basin is referred to by SGC as the Perth Basin’s “big brother”.

Both areas boast highly pressured reservoirs with production to date from the Sacramento Basin standing at 13 trillion cubic feet compared with the Perth Basin’s 0.6 trillion cubic feet.

As we stated earlier, the Perth Basin is where Strike Energy (ASX: STX) and Warrego Energy (ASX: WGO) have experienced significant share price increases in 2020 due to the work they have been doing there.

Both companies have undergone re-ratings based on the future prospect of production as they are currently not generating revenues.

Thus, it could be argued that Sacgasco’s reputation as a proven producer with cash flows from modest production at least helping to cover costs weighs up quite favourably against the other two companies, particularly given it also has strong prospects in terms of future production.

It would appear that there is a serious disconnect between the valuation being attributed to Sacgasco (market capitalisation: $37.7 million) and the potential upside demonstrated by transitional oil and gas explorers/producers in Australia such as Strike and Warrego that are operating in similar geological environments.

One important factor that differentiates the two basins is the drill depths, which in Sacramento is less than 3,000 metres compared with 5,000 metres in the Perth Basin, resulting in Sacgasco’s ability to benefit from lower cost exploration.

Sacgasco has a distinct advantage when it comes to owning supporting infrastructure (including at the Red Earth working interests), and it also benefits from better pricing with gas produced in Sacramento fetching in the order of A$5 per million cubic feet compared with approximately $4 per million cubic feet in the Perth Basin.

Acquisition strategy gains more ground

The acquisition is an astute move by Sacgasco as, at current prices, the assets are low priced and cash flow positive and are highly leveraged to increased oil prices.

Sacgasco has 20% of the acquired 3.7 million BOE of Proved and 1.4 million BOE of Probable Reserves.

All of the producing reservoirs are conventional sandstones with natural aquifer pressure support, variously enhanced by formal waterfloods and produced water re-injection.

Around 25% of the wells are drilled horizontally, and producing reservoirs are mostly shallower than 1,150 metres.

This acquisition followed the 30% working interest SGC took in the 1,000 barrels of oil per day (bopd) Red Earth asset, consisting of six oil fields and associated infrastructure also in Alberta, Canada.

These recent acquisitions provide SGC with an additional income stream as well as geographic and commodity diversification outside of the group’s traditional areas of operation. The Canadian assts also provide exposure to oil prices which are currently on a tear!

There also potential upside from the Red Earth assets, should the current recovery rate of about 12% increase to 30% – a scenario SGC sees as potentially achievable.

One to watch

The current share price of approximately 12 cents and market capitalisation of about $37.7 million offers significant blue sky potential, relative to the valuations attributed to other companies that aren’t even close to production.

However, at the end of the day, this is a high risk / high potential reward investment, and not for the faint hearted.

SGC has proven capabilities in the industry which would suggest that it can realise the value of the assets under its control through well-managed, cost-effective and astutely targeted exploration strategies – starting with Borba in the coming days.

SGC’s assets are located in proven oil and gas basins for low-cost, high return wells.

Its management team has an intimate knowledge of the region, including a proven record of identifying new wells, bringing them into production and managing sustained output.

The company-owned infrastructure taps into high demand markets and is in close proximity to planned drilling.

With the strong and growing demand for gas in California set to continue to underpin premium prices, SGC looks to have positioned itself perfectly to capitalise on the macro outlook.

Furthermore, recent diversification (Red Earth and Alberta Plains Assets) provides exposure to a new geographic region, as well as a new revenue source with the scope for exploration/well refinement upside.

There are numerous share price catalysts are on the horizon as drilling at Borba commences and results from 11 layers of hydrocarbons come to hand.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.