2 x Production Wells Imminent

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Dual listed oil and gas company Oilex (AIM | ASX: OEX) is set to drill two unconventional gas production wells in the next quarter, providing a clear path way to positive cash flow generation: a truly transformational event that OEX can build upon for future success.

The two wells will feed into an energy starved, giant, domestic market: India.

Operating in India for nine years, these two production wells are further proof that OEX can successfully operate in this up and coming nation – where it has first mover advantage.

India is the fourth largest energy consumer in the world – but most of its hydrocarbons are imported for between $8.50 – $10 MMBtu. Demand for energy can only increase as India grows richer. OEX has positioned itself as a first mover to meet that demand – exploiting unheralded domestic energy sources and implementing North American technology that has changed the oil and gas industry paradigm since 2009.

OEX has already completed a proof of concept well in the prolific Cambay Basin in Gujarat State – India’s industrial heartland – using advanced horizontal drilling and fracking techniques, the same that fuelled the tight oil and shale gas boom in North America.

This is the first time these methods have ever been used in India, and now OEX is set to bring a further two production wells online in H1 of 2016, selling gas directly to the Indian markets at a premium price, but still cheaper compared to imported LNG.

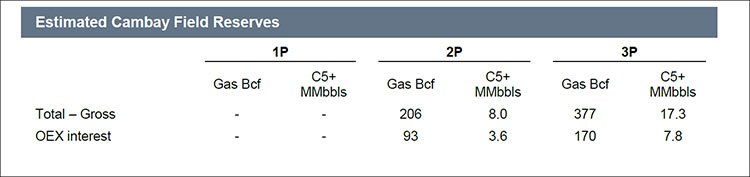

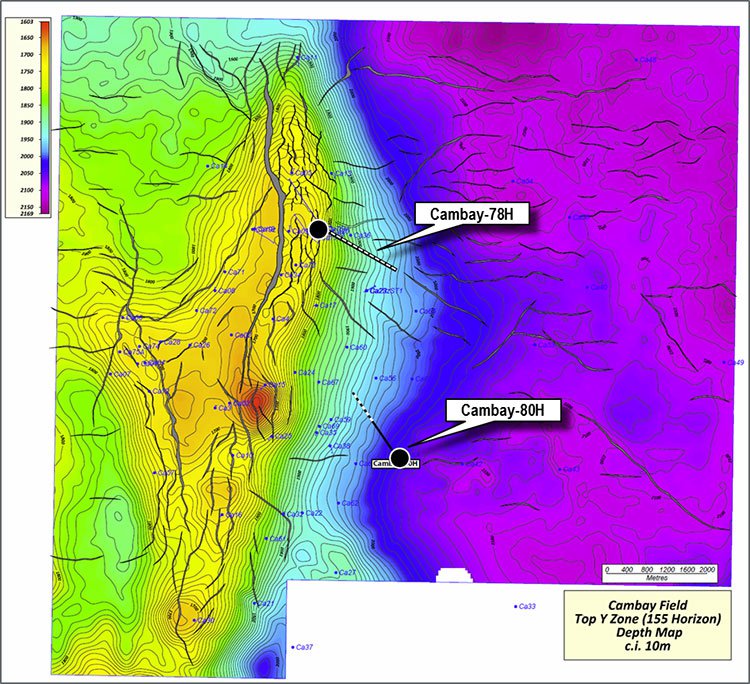

The wells are to be drilled in the Cambay Field, where OEX have a 45% stake and is the Operator. The Cambay Field has been independently assessed to hold gross 2P gas reserves 206Bcf, with 8 million barrels of condensate in just one zone of its 40,000 acres:

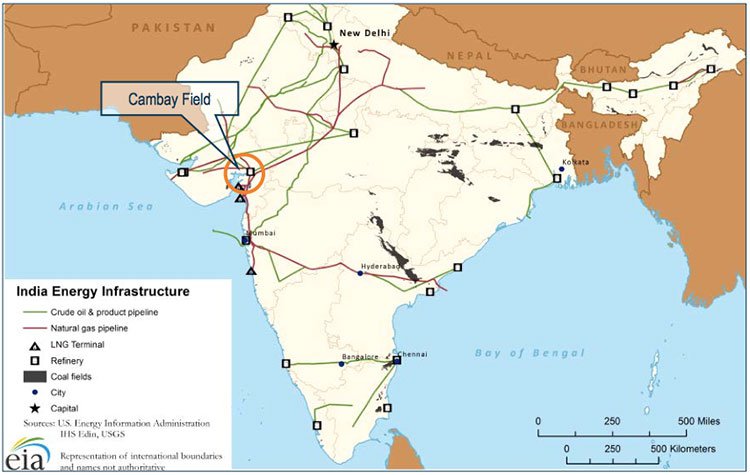

OEX enjoys strong government support and the Cambay Field is immediately adjacent to high quality infrastructure, including a network of gas pipelines owned by its partner, Gujarat State Petroleum Corporation (GSPC) which the company can supply into.

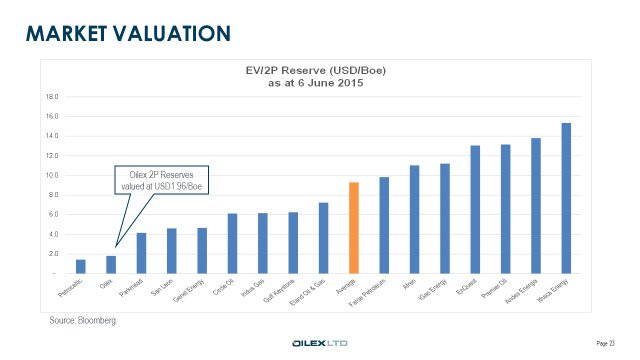

OEX is currently trading at a significant discount on a 2P Reserve/USD basis – this is likely due to perceived ‘country’ risk. This should all change once these production wells are drilled, presenting strong potential for a re-rate to OEX’s share price. There is no guarantee on OEX’s success however, and the company remains a speculative investment.

Currently raising US$23M to fund its 2015/16 work programme, and on the cusp of positive cash flow generation, MD Ron Miller recently spoke to Proactive Investors UK:

Right now, OEX is already securing long lead items for its production wells, and is moving quickly to establish an advanced asset in a proven field – just the kind of activity that catalysthunter.com looks for.

“CatalystHunter.com provides alerts when an ASX stock is close to a share price catalyst that could potentially initiate a share price movement.”

Read on for more information on OEX and its imminent re-rate potential.

OEX: Now on the cusp of solid production via 2 wells

OEX entered India in 2005, acquiring a 45% interest in Cambay Field within the prolific Cambay Basin in Gujarat State. The Gujarat State is the industrial heartland of India, supplying oil and gas to the major cities of New Delhi, Mumbai and Hyderabad:

Armed with an advanced asset in a proven field, OEX is now preparing to spud two firm wells – C-78H and C-80H – for production using advanced fracking techniques, thereby unlocking the value of the entire acreage:

The background to the imminent spudding of OEX’s two production wells is as follows:

- OEX formed the Cambay Field Joint Venture with Gujarat State Petroleum Corporation Ltd after purchasing equity interest in the field from Niko Resources Ltd;

- Since the 1950s, over 30 historic wells were sunk into the Cambay Field’s tight siltstone Eocene formations with 17 bringing oil to the surface;

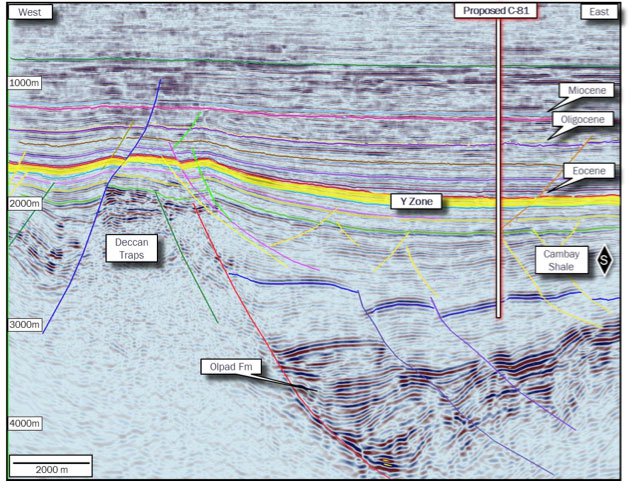

OEX and the JV conducted an extensive work programme to evaluate the application of shale gas technology to the Eocene reservoirs at the Cambay Field – dubbed the Y Zone:

- A single stage fracture simulation well, Cambay-73, was drilled in 2008 with an extended production test in 2012 showing peak production of 1MMscfd and 23.5bbls of condensate per day – a gas-sales agreement has been secured and production is underway from this well;

- OEX drilled Cambay-77H, the first horizontal multi-staged fracture stimulated well in India to be successfully production tested, completing this well in 2014. This groundbreaking well proved that North American fracking techniques can be applied to Cambay’s tight siltstone Eocene formations;

- OEX’s 2P Reserves are anticipated to support a plateau gas production rate of 50 million standard cubic feet per day (MMscfd) rising to 125-250MMscfd when combined with the Contingent Resources still to be proved up.

Once the current capital raise is complete, OEX will rapidly move to drill their production wells and consolidate their position in the emerging Indian market.

OEX: Production wells to be brought online in H1 of 2016

All eyes are now on OEX and their imminent drilling of two production wells:

- The Cambay JV has approved the budget for 2015/16 incorporating two firm wells, two contingent wells and up to five firm workover wells;

- The two firm wells – Cambay-78H and 80H – will work up a level of production that allows connection to a nearby high pressure gas pipeline;

- Drilling of the first firm well –likely C-78H – is expected to commence during Q4 2015, and tendering of long lead items is already in progress;

- The ramp up to the drilling events will see OEX mark off a series of milestones such as contracting, approvals and set up, which could provide material catalysts to its share price;

- There could be significant upside if significant quantities of oil and gas are demonstrated to flow as modelled in the Reserves Assessment, leading to short term price catalysts for OEX, and long term value as its discoveries are sold to the Indian markets and the company drills further wells;

- Following the drilling of the 2 upcoming wells, OEX seek the necessary approvals to drill the first of the contingent wells – Cambay-81 – that will target upgrades to the Contingent Resources at Cambay within the X and Y Zones, followed by four more contingent wells if needed.

Another Catalyst Hunter stock

Since our first article on Stonehenge Metals (ASX:SHE) Acquisition of Breakthrough Wave Energy Technology , SHE has risen over 750%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

SHE may be on the move again – for more details see our most recent article on the company: Energy Tech on the Cusp of Commercialisation?

OEX: First mover in India, the 4th largest energy consuming nation in the world

By supplying oil and gas to an energy hungry domestic Indian market, OEX have the following advantages when it comes to its project economics:

- India imports over 30% of its gas, creating a gas deficit that OEX’s Cambay Field project can readily fill;

- The cost of imported LNG is between $8.50-$10MMBtu, effectively providing a floor price for domestic gas sales;

- OEX reckons on achieving sales of over $8+/MMBtu for any gas it generates from its Cambay Field, representing a strong potential margin.

- Cambay gas is relatively hydrocarbon liquids-rich, providing increased relative profits.

OEX’s goal is to bring large oil and gas resources online at its Cambay Field in Gujarat – India’s industrial centre. It wants to use the region’s high quality infrastructure and its close relationship with the Gujarat State Petroleum Corporation Ltd to reach the vast domestic markets directly.

OEX’s production wells will be drilled close to an existing pipeline network that has spare capacity – and JV partner Gujarat State Petroleum Corporation Ltd can help negotiate sales and access agreements.

Market yet to fully recognise OEX’s 2P Reserves

Other oil and gas companies that own 2P Reserves enjoy far higher market valuations than OEX – the highest being Tullow Oil, which has developed 2P Reserves across its portfolio of assets in Africa, Europe and Asia and South America, and is valued at close to $30USD/Boe:

Despite progressively working up proven resources and advanced assets in an area of great demand, OEX has not seen great increases in its value, with its 2P Reserves valued at under US$5/Boe.

This gap in market value is likely due to perceived in-country risk – India has a reputation for being a difficult place to do business. Phillip Capital analyst Andrew Shearer theorises that a perception issue with the nature of doing business in India may be affecting OEX’s position in his recent report on OEX .

Many coal and iron ore companies have historically experienced difficulties gaining a foot hold – and although there are differences between the minerals and oil and gas sectors in that they operate under different legislative regimes, Shearer says the negative impression can bleed over.

The upcoming spudding of two production wells in the Cambay Field could then serve a dual purpose – establishing OEX as a viable energy producer in India as well as proving oil and gas investment can be successful in India.

Most importantly, once OEX drill their upcoming wells we would expect this perceived country risk to be well and truly eliminated, providing an unencumbered path to share price appreciation for OEX. At the same time, like all stocks, there is a risk the company will devalue as well – success is no guarantee.

First mover advantage gathers pace

As H1 of 2016 approaches, the coming months will see OEX ramp up toward two drilling events at its Cambay Basin project in India.

The spudding of two production wells could simultaneously unlock the value of OEX’s entire 40,000 acre project area and bring the company positive cash flow from sales to India’s energy hungry domestic markets.

In addition, the success of these wells could position OEX as a frontrunner in applying advanced fracking techniques in India to unlock new resources. This would convince the markets that energy investment in the sub-continent is viable – and profitable.

These elements position OEX for significant upside, and as it accelerates its plans toward the spudding of the production wells, a steady stream of catalysts, could flow as the company ticks off one milestone after another to bring it all about.

Oil and gas drilling has its risks, and OEX is no different – it’s a speculative stock.

However if OEX meets success, it will have cracked one of the world’s biggest energy markets, with a strong first mover advantage.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.